I took this weekend to conduct research for those company plunged more than 80% within 3 years. One of them is Sasbadi.

I identify three main reasons to invest in this company.

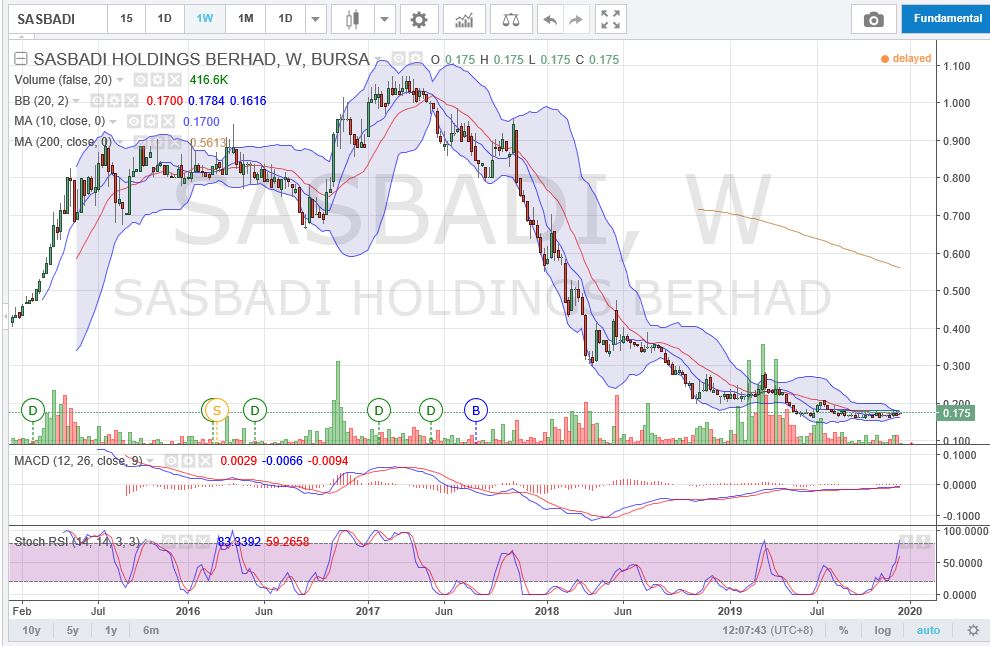

- After GE14, the stock has plunged more than 80% from its peak. Imagine how many investors have caught up at the peak. The current chart is pending for a breakout. The chart found a bottom at 0.17.

- Calculate of Your Margin of Safety and Risk of Rewards.

The margin of safety is quite high. The margin of safety (safety margin) is the difference between the intrinsic value of a stock and its market price. In this case, I will use accounting book value instead of intrinsic value to fair to my student. The NTA is around 37 cents and now the company traded at the price of RM0.175 (16/12/2019). Risk of reward. Target price of RM0.3cents with recoverable of profit with the current price of RM0.175. Cut loss point at 0.16. You are having a good return on the risk of rewards ratio.

- RM5 Million Contract Awarded In their Pipeline. Just do your own homework by sump up the latest contract awarded in hand announced in BURSA website. You will find some information where the Company will tell you when they will recognize the profit in FY2020.

|

Date |

Duration Contract |

Value Awarded (RM) |

|

4-Dec-18

|

3 December 2018 to 2 December 2021 |

892,680.00

|

|

18-Sep-18

|

13 September 2018 to 31 December 2020 |

990,050.00

|

|

7-Mar-19

|

5 March 2019 to 4 March 2022 |

746,460.00

|

|

28-Mar-19

|

26 March 2019 to 25 March 2022 |

826,140.00

|

|

9-Aug-19

|

5 August 2019 to 4 August 2020 |

371,723.80

|

|

30-Aug-19

|

29 August 2019 to 28 August 2022 |

335,720.00

|

|

24-Sep-19

|

23 September 2019 to 22 September 2022 |

444,540.00

|

|

6-Nov-19

|

25 October 2019 to 24 October 2020 |

392,000.00

|

|

|

Total |

4,999,313.80

|

https://klse.i3investor.com/blogs/SASBADI5252/2019-12-16-story248229-SASBADI_5252_Bags_RM5Mil_Contract_for_FY2020_Expected_Strong_Start_FY2020.jsp