Pan-International Electronics (Malaysia) Sdn Bhd (PIESB) was

established in 1989. Currently, PIESB principally provides integrated

'one-stop' CEM service for the computer, electronics and

telecommunication industries, including assembly of various cables.

When PIESB was first established, it started off with general PC

products such as keyboard cable assembly and serial mouse cable

assembly. Subsequently, it has expanded and moved on to network PC

products such as high precision network cable assembly, PC card assembly

and GSM cable assembly. The company then ventured into contract

electronic manufacturing for hand-held laser bar-code scanner devices.

Most of the sales are either directly or indirectly exported to the

overseas market, mainly to the USA, Europe and the Asia Pacific region.

The operations of PIESB are strategically located in Seberang Jaya Industrial Estate, with a workforce of around 700.

The operations of PIESB are strategically located in Seberang Jaya Industrial Estate, with a workforce of around 700.

WHY PIE?

According

to PIE group managing director Alvin Mui(pic), some of these projects

came to PIE as a result of the US-China trade war.

PIE

has confident to secure five electronic manufacturing projects that

would generate a collective revenue of more than RM50mil a year.

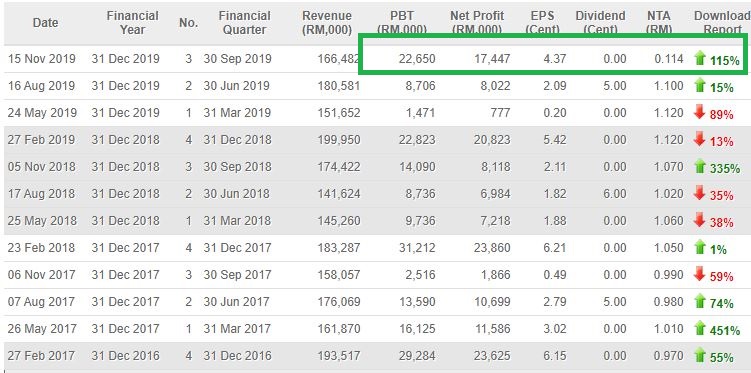

For the recently announced quarter, PIE recorded core net profit of RM16.8mil, which was 115% higher quarter-on-quarter (q-o-q).

Huge Quaterly sequential improvement from Q1 2019 to Q3 2019 as shown below

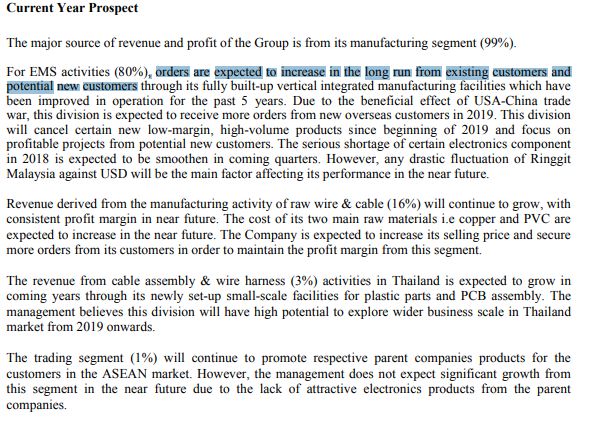

From current year prospect, we are expecting company will deliever even better Quarter result compare to current Q3

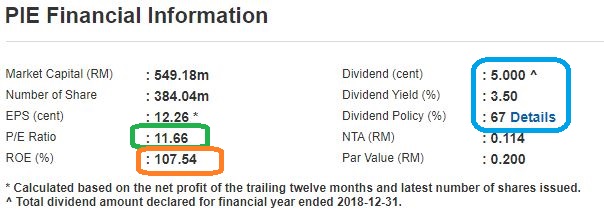

We think that PIE will be able to achieve growth in the coming year due

to the improvement in operational efficiency while the company

continues to work with existing and new customers on projects to further

grow its topline. Valuation is considerably attractive at the moment,

which is lower than other EMS players that trade at 14x-16x. Moreover,

the company’s balance sheet remains heathy with a net cash of RM115.8m.

This will enable the continuation of its decent dividend yield that is

expected at 4.1%.

Based on FA and TA, we foreseen PIE has more than 100% potential gain or at least RM3

We

wish to tell you that we are holding PIE because last quarter result

is super good and from technical Analysis, We will buy more at RM1.6

BREAKOUT level !!

Disclaimer

At this point of time the writer has a position in P.I.E . This

article is purely meant for educational purposes only and it’s not

BUY/SELL recommendation. Please consult your remisier /dealer before

making any decision

https://klse.i3investor.com/blogs/PiePie/247812.jsp

https://klse.i3investor.com/blogs/PiePie/247812.jsp