For a copy with better formatting, go here, its alot easier on the eyes.

AEON Credit Service (M) Berhad (AEONCR: 5139): Much Ado About Accounting Standards

===================================================================

Well, it’s been awhile. There are a few reasons, but I’m not here to talk about that.

Disclaimers: Refer here.

AEON Credit Service (M) Berhad (AEONCR: 5139): Much Ado About Accounting Standards

===================================================================

Well, it’s been awhile. There are a few reasons, but I’m not here to talk about that.

One

of the companies I’ve always admired was AEON Credit Service (M) Berhad

(“AEONCR”). I have never done too deep an analysis on this company

before, however, its performance and the economics of the business

always impressed me.

I remember when I first read the accounts in 2016, my first thought was:

“This company is probably a scam”

Yes, i was that stupid.

It

was the first time I had read the “Statement of Cashflows” of a Non

Deposit Taking Financial Institution, or that of a financial

institution, period. And the constant drawdown of borrowings made me

think this company was borrowing money to pay dividends.

I could not have been more wrong.

After

a couple hours, I’ve understood it better, and it became the first

stock I made a profit of more than 10% on. Unfortunately, due to a

temporary suspension of intelligence, I did not hold for long, and

instead constantly bought and sold it at increasingly higher prices and

paid the transaction fees along the way.

From

2018 onward, due to my deeper understanding of value investing (or

perhaps, just my sheer incompetence and lack of talent when it comes to

trading), I bought a small position of 1.3% to hold as the valuation was

just a bit too rich for me compared to what was available (for the

record, it wasn’t really), however, I wanted to keep it around to remind

myself to never forget to check again.

A

month back, a friend told me the current price of AEONCR and I was

quite happily surprised. I did some research, and given my immaculate

timing, increased my position to 2% on 25 September 2019, the day before

the release of the Q2.

Thank god I knew enough of my own weakness, that I learnt how to size my investments purchases.

I’m

writing and sharing this because, I’m currently considering making

AEONCR a significant portion of my portfolio. However, this is one of

those companies, where despite reading every single annual report,

investor presentation and recent analyst pieces, I just can’t seem to

shake the feeling that there is something I don’t quite understand about

the company.

As

an intelligent, honest but abrasive friend told me recently when I

asked him about this company, “I’m now certain that you know absolutely

nothing about financial institutions or AEONCR”.

Well, I hope to be educated by the people here.

Enough Grandmother story, lets begin.

AEON Credit Services (M) Berhad (AEONCR: 5139)

Introduction

Just for a bit of background, 2 years back, I’ve written a little on how to value financial institutions,

I’m sharing the link, so that those who are interested, can understand a portion of the perspective I will be analyzing from.

AEONCR

is a non-deposit taking financial institution (“NBFC”), that focuses

mainly on various forms of personal lending. They consist of the

following divisions:

- Personal Financing (Personal Loans)

- Car Financing

- Motorcycle Financing (Both Kapchais and Superbikes)

- General Easy Payment (But a TV on installment plan for example)

- SME Financing (Quite Small)

- Credit Cards

They

have the third highest “Return On Asset” among all the financial

institutions, at around 5.5% before tax. The highest is Elk-Desa

Resources Sdn Bhd at roughly 6.2% and the second, RCE Capital Berhad at

around 5.7%-5.8%. Most banks have ROA around 1%-1.3% with the best bank

in Malaysia (and probably South East Asia), Public Bank, having ROA of

around 1.7%.

Having

said that, as most banks typically aim for much “safer” lending, and

are able to take deposits, and on average, leverage up around 10 times.

While for NBFC’s, due to the fact they cannot take deposits, and will

typically face impairment rates triple that of most banks during a

recession, can usually only leverage up 5 times or so safely.

As

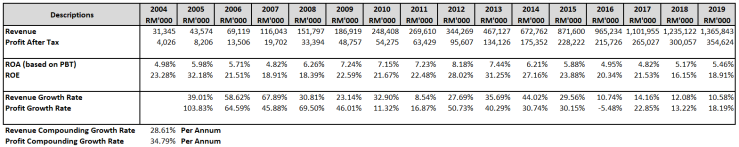

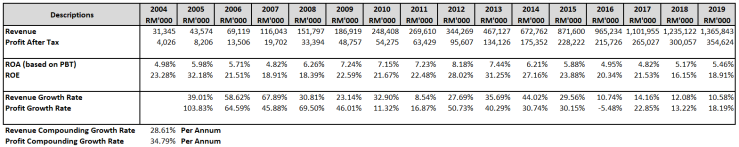

most are likely aware, the financial performance of this company since

its listing on 2008, have been nothing short than extraordinary, as we

can see in the table below.

The Business

AEONCR

started with “General Easy Payment” or as they now call it “Objective

Financing” as its bread and butter. This consist of things like

installment payments for television, electrical appliances etc.

However,

the growth rate (it actually registered a decline from 2016 to 2019) of

this segment lagged far behind those of “Personal Financing/ Personal

Loans”, “Car Easy Payments”, “Motorcycle Easy Payments” and to some

extent Consumer Products/Credit Cards, resulting it in going from 30% of

the portfolio in 2009 to only 4% of the portfolio in 2019.

On a compounding basis, these divisions have grown at,

From 2009 to 2019

Personal Financing: 43.53% Per Annum

Vehicle (Cars and Bikes) Easy Payment: 28.93% Per Annum

Consumer Products: 16.89% Per Annum

From 2013 to 2019

Car Easy Payment: 55.56% Per Annum

Motorcycle Easy Payment: 22.53% Per Annum

And this is with profitability increasing roughly in line. So why is this the case?

The first reason is structural gains.

Secondhand cars and motorcycles are an under-served market segment.

Most

banks do not offer financing for motorcycles beyond personal loans,

whose rates can go as high as 18%. In addition, motorcycles are quite

simply by far the cheapest mode of travel. A Honda EX5 can travel 100km

on just 1.8 liters, compared to the best-selling budget car Proton Saga,

which requires 5.6 liters.

In

addition, an EX5 cost less than RM5,000, while a Proton Saga cost more

than RM32,800. To top it off, when travelling via motorcycles, you have

no need whatsoever to pay tolls.

A

recent Khazanah study showed that, on average, the B40 (Bottom 40%

income earners in Malaysia by Household) of Malaysia are able to save

just RM76 per month, a fall from RM124 in 2014.

Given

such a tiny margin of safety, it’s a no brainer that motorcycles have

become the only economically viable mode of transport for the B40 and

parts of the M40.

This

has resulted in motorcycle sales increasing by 20% YOY for 2019. In

addition, in terms of motorcycles sales in the world, Malaysia is ranked

number 13, despite a small population of less than 30 million.

As

for secondhand cars, many banks have stopped providing hire purchase

financing for cars older than 3-4 years. However, it is not as great as a

business as the motorcycle loans, as they are still many competitors in

it. Having said that, this is mostly due to how amazing the motorcycle

loan business is in comparison.

As

you can see based on the above chart, their “Car Easy Payment” records a

negative Differential (“Share of Income %” – “Share of Receivable %”),

ie its share of income is negatively disproportional to the size of the

receivables. However, income yields are is still around 12%, and with

interest cost of around 4.9%, its still one hell of a business.

Of

course, it also helps that AEONCR typically targets B40 and lower half

of M40 loans. According to a study, in terms of financial literacy,

Malaysia ranks number 66 in with a score of 36/100, slightly below the

global average score of 36.58.

However, as many would be aware, the above are all industry economics, that say very little about AEONCR’s edge.

So what is their edge?

The AEONCR Edge

AEONCR’s

real edge lies in the sheer quality of their credit assessment and

discipline in ensuring good quality assets, the management and their

incredible collection processes.

Over

the years, despite the large increase in revenue and receivables size,

asset quality has largely maintained even or improved with

Non-Performing Loan (“NPL”) ratio still holding steady at 2% and have in

fact improved over the last 5 years. Since 2007, their NPL have

averaged a mere 2.1%.

For

the record, Maybank’s NPL is 1.75%, and RCE Capital’s (which obtain

repayments via direct salary deduction) is about 4%. As for ELK Desa’s

insane NPL of a mere 1%, well, if someone would care to enlighten me as

to the reason why this is even possible, i would be incredibly grateful.

In addition, collections ratio of receivables past due for 2-3 months have also increased from 62.73% in 2014 to 71.24% 2019.

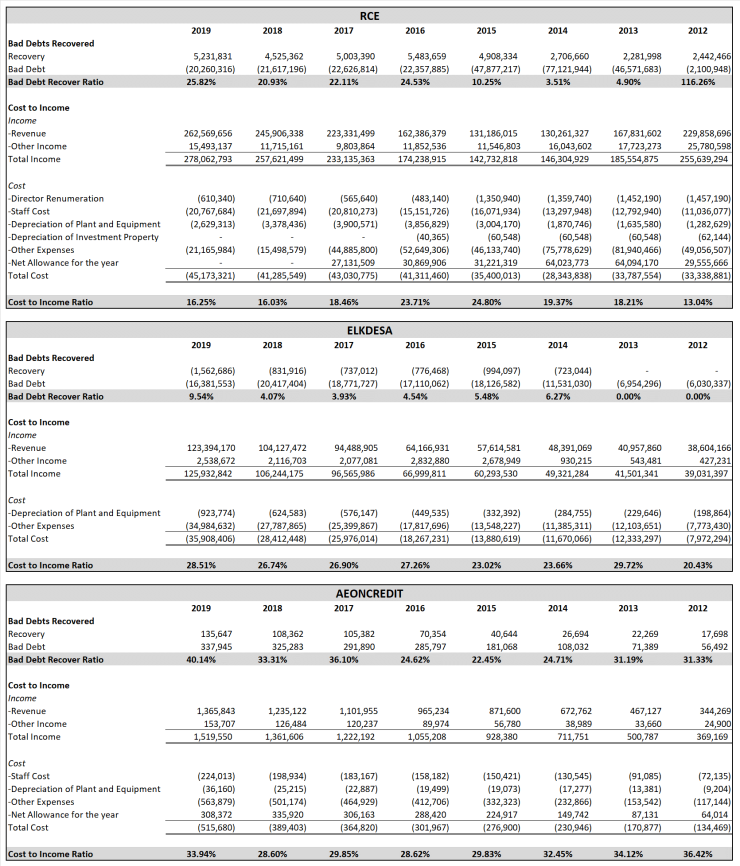

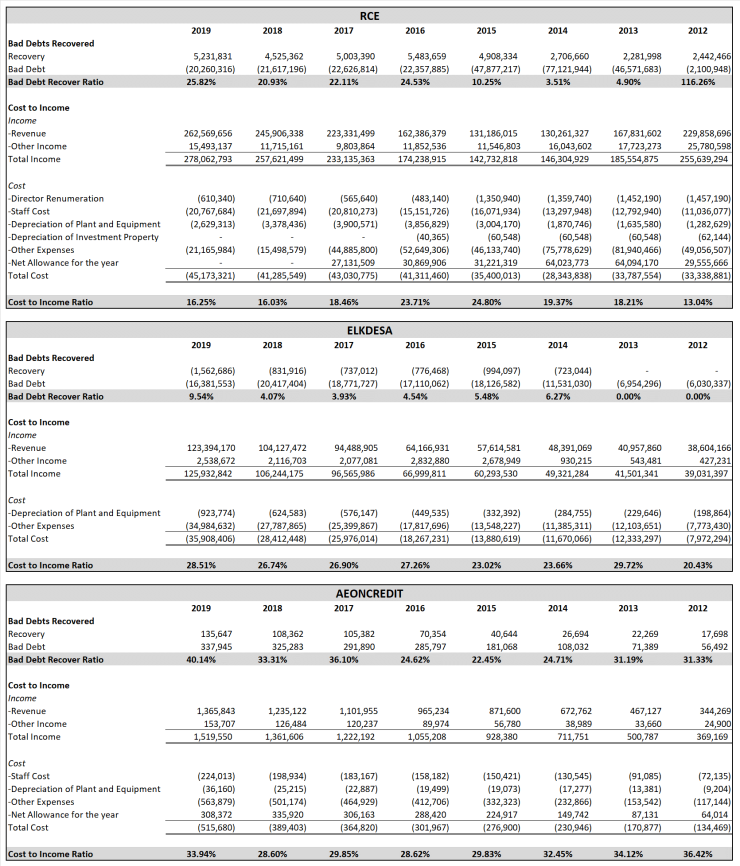

The most eye catching of these statistics is their Bad Debts Recovery % (a

ratio I derived in order to judge the effectiveness of the collections

teams, it’s not perfect, if you have a better one, I’m all ears). This

consist of (Bad Debt Recovered / Bad Debt Written Off During The Year).

Thinking

about it, it might be better for it to be, (Bad Debt Recovered / Bad

Debt Written Off In The Previous Year), but well, i’m a little lazy, and

i don’t think it affects the essence of the point i’m trying to make

(except make AEONCR’s numbers look a little better and more consistent).

Their Bad Debts Recovery %, has increased steadily over the years from 6.81% in 2007 to 40.14% in 2019.

This

is honestly quite an incredible statistic, considering that these are

all mostly unsecured loans given to low income earners.

Much of this is due to the sheer quality of the management and their collections team.

And

thus, the big question, how do they compare against their competitors,

ie other non-deposit taking financial institutes, such as RCECAP and

ELKDESA?

As

you can see from the numbers above, AEONCR’s Bad Debt Ratio of (40.14%)

in 2019, far exceeds that of RCE Capital (25.82%) and ELK Desa (9.54%).

And this is despite companies like RCE Capital having the benefits such

as guarantor requirements and direct deductions. Utterly incredible.

And

interestingly, this does not come at the cost of overly high cost to

income ratio. AEONCR’s cost to income ratio is like that of ELKDESA

despite having multiple product lines and far more outlets, with

normalized percentage being roughly 29%.

The

increase in 2019 to 34% is mainly due to additional marketing expenses

for the credit card business and to improve cross selling.

RCECAP

has an extremely low Cost to Income ratio of 16% or so, due to the fact

they only have one product line, and very little outlets, with most

sales done through agents.

If

one were to visit the Glassdoor and Jobstreet, and look at the comments

by both current and resigned members of the collections team, we can

comments by them complaining how the targets are always to high, as well

as their bonus being satisfactory. Well, you get what you incentivize

for.

Interesting, non profit making cost centers such as accounting etc, complain about the lack of bonuses for the past few years.

Quite

interesting, does not sound like the place i want to work at (since i’m

in financial reporting), but definitely sounds like the kind of company

whose stock i want to purchase.

Much Ado About Accounting

As many would have noticed by now, for the last 2-3 quarters, AEONCR have been reporting relatively lackluster results.

Before we talk about it, we first need to understand the new accounting standards being implemented.

Previously

the loan book held by AEONCR was recognized based on the accounting

standard called IFRS 139. This has been replaced with IFRS 9 for the

most recent financial year ended 28 February 2019.

The difference between these two accounting standards are as follows,

| IFRS 139 | IFRS 9 | |

| Nature | Incurred | Expected |

| Timing of Allowance | Upon Trigger Point | At Inception |

| Type of Allowance | One Off | Stage 1, 2 & 3

(12 month and lifetime Expected Credit Loss)

|

IFRS

9 was a new method of recognizing Financial Instruments that was born

after the 2008 Financial Crisis. One of the biggest complaints about the

crisis then, was that the recognition of credit losses was too little

too late.

The

previous accounting standard, IFRS 139 used for recognizing credit

losses is commonly referred to as an “incurred loss model” as it

requires the recording of credit losses that have been incurred as of

the balance sheet date, rather than of probable future losses.

This

did not allow banks and financial institutions to provision

appropriately for credit losses likely to arise from emerging risks

prior to the crisis, as it required a trigger point.

And

this lack of provisioning effected regulatory capital levels, thus

contributing to pro-cyclicality by spurring excessive lending during the

boom and forcing a sharp reduction in the subsequent bust.

The

reason for this was that loss identification IFRS139 requires a

“triggering” events supported by observable evidence (eg borrower loss

of employment, decrease in collateral values, past-due status) combined

with expert judgment, ie a “Trigger Point” before an allowance or

provision can be made.

Under IFRS139, upon the occurrence of a triggering event, the allowance is calculated as such,

Allowance: “Exposure at Default” X “Loss at Default %”

IFRS

9 on the other hand replaces this with a more forward-looking approach

that emphasizes shifts to the probability of future credit losses, even

if no such triggering events have yet occurred.

Therefore,

under IFRS 9, an “Expected Credit Loss” is made upon inception of the

financial instrument, as and classified “Stage 1”. And upon any

deterioration of the quality of the asset, it is further classified as

“Stage 2” and “Stage 3”, and is calculated as such upon inception.

Expected Credit Losses = “Exposure At Default” X “Probability Of Default %” X “Loss Given Default %”

Now,

do note that the ”Probability Of Default %” and “Loss Given Default %”

changes depending if 12 months is used (Stage 1) or Lifetime is used

(Stage 2 & 3).

So, for example,

AEONCR

borrows out RM100,000. The probability of default events in the next 12

months is 3%. And in the event of default, they will lose 50%.

Therefore

ECL= RM100,000 X 3% X 50%

ECL= RM1,500

ECL= RM1,500

Now,

the interesting thing to note here is, the “Probability of Default”

involves very significant assumptions, one of which is forward looking

macroeconomic data.

So,

for example, if AEONCR thinks that an economic slowdown is going to

occur in the next twelve months, the “Probability of Default” and “Loss

Given Default” may very well increase to 5% and 70%, despite no drop in

the quality of the loans, resulting in higher allowances.

ECL= RM100,000 X 5% X 70%

ECL= RM3,500

ECL= RM3,500

Case in point, in the 2018 accounts, for receivables not past due of RM6.5 billion, an allowance of RM8 million was provided.

While

for 2019, for receivables not past due of RM7.8 billion, an allowance

of RM203 million was provided. This is despite there being a DECREASE in Non-Performing Loan % from 2.33% to 2.04%.

When

investing, one of the things we have to be aware of, is that what is

“True and Fair” under the accounting standards, does not necessarily

reflect the real economic reality of the company.

For

example, Nestle have to spend a huge amount of marketing expenses this

year, one can argue that this a capital expenditure for the sake of

their Brand name, but this does not change the fact that under

accounting standards, it cannot be capitalized, and that the value of

their brand, as recorded in the financial statements have not changed

since god knows when.

And for good reason, if we could, the numbers would be far worse.

When

it comes to accounting standards, it needs to be unfair and inaccurate

for a few people, for the betterment of the majority.

As investors, we need to be aware of these differences.

Risk and Downsides

-

Defaults during Recessions.

For

unsecured loans (I don’t consider cars, motorcycles and fridges an

asset), defaults during recessions are typically significantly higher

than secured loans. The question is if the higher interest rates charged

(reward) is higher than the cost of the risk assumed.

I would think so.

Looking

at their numbers from 2007 to 2009, AEONCR were not affected by the

crisis and in fact grew and made more money each year.

And

since then, their operations have seen a massive improvement of loan

quality, and collections processes. I think they would be able to handle

any recessions very well.

Of course, past performance is no indicator of future performance.

-

Bullet Loans

For

AEONCR, their loans are structured by way of bullet payments. Ie, the

principal needs to paid in full during the end of the tenure with no

principal payments in between. Typically, they don’t repay it but

instead roll it forward.

In

times of crisis, if the loan were to mature during that same year, it

may make it difficult to roll it forward then. Things would be quite

interesting in that case.

This would be the case for most banks as they usually use the same structure.

Having said it, unless your loan book is rubbish (which its not), you should be fine.

-

Big Banks Giving Loans For Secondhand Cars and Motorcycles etc

Well,

they can, and i’m sure that AEONCR will not longer be as profitable.

However, Banks typically have rubbish collections teams, or outsource

them. Thus AEONCR’s edge should still largely prevail.

As long as one did not overpay, it should be fine.

Conclusion

Personally,

I’m quite unsatisfied with this article, and I think it may be due to

the fact I don’t understand the business as well as I would like. In

addition, the words do not flow as easily, or as well as I would like,

probably due to the fact I stopped writing for quite a few months.

My

main worry now is if the lower savings rate of the B40 going to affect

repayments (it will) in the event of a crisis, and how much?

What is the exact model used to calculate their ECL allowances, and how much of it differs from their previous ones?

Having

said that, given the competence and longevity of the senior management

(beyond the MD that changes every 5 years or so, as they are not local),

such as Ms Lee Tyan Jen who went from Head Of Credit Assessment to

Chief Operating Officer.

The

focused way of which the management of AEONCR go about in allocating

capital (while paying out any excess) efficiently and in a focused

manner, without straying far from their circle of competence gives me

confidence.

To buy or not to buy?

You decide lah, judge it against the current opportunities you have at hand make your own decision.

In

addition, do note that prices and accounting profit may continue to

fall for another 2-3 quarters, resulting in potentially more discounts.

Fair

value of the company? Currently, its probably somewhat below fair

value. However the real value in this company, is that its a great

business, and i love business that let me forget about thinking about

when to sell.

As always, do let me know if you think differently or feel I have missed out elsewhere.

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Website: www.choivocapital.com

Email: choivocapital@gmail.com