Harnessing the Nature for a Better Tomorrow

Malaysia is essentially blessed with a good generation mix of energy

resources varying from conventional sources such as oil, natural gas,

and coal to renewable energy resources from the likes of solar

installations, hydropower plants and biomass. Currently, Malaysia’s gas

component makes up about 35 % of the total energy mix in 2018 with coal

holding steady at 57 % in the coming years, while relatively smaller

share of Renewable Energy (RE) sources which includes the fraction

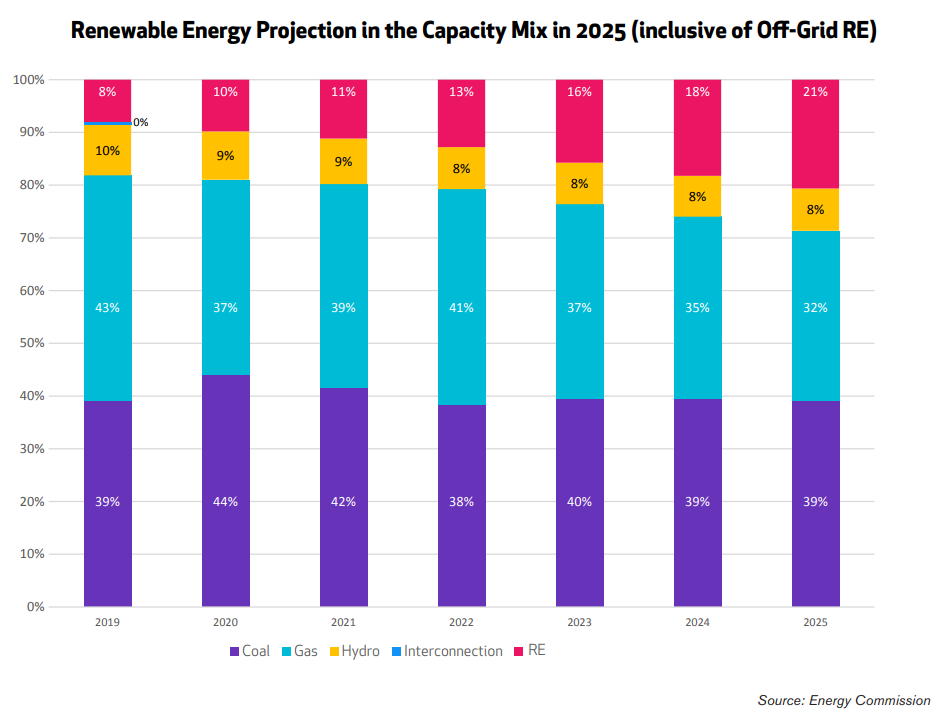

combination of hydropower and also solar power. Malaysian Government has

set an ambitious target to achieve a higher penetration of Renewable

Energy (RE) in the Malaysian energy mix. To date, Malaysia has

approximately 5% of its energy coming from RE generation sources

compared to the total generation mix and on its trajectory to achieve

20% penetration by 2025.The key objective is to transform our current

energy mix into one that comprises more RE sources, not only for the

continuity of supply but for the pressing environmental concerns.

The Cost Volatility of the Conventional Generation

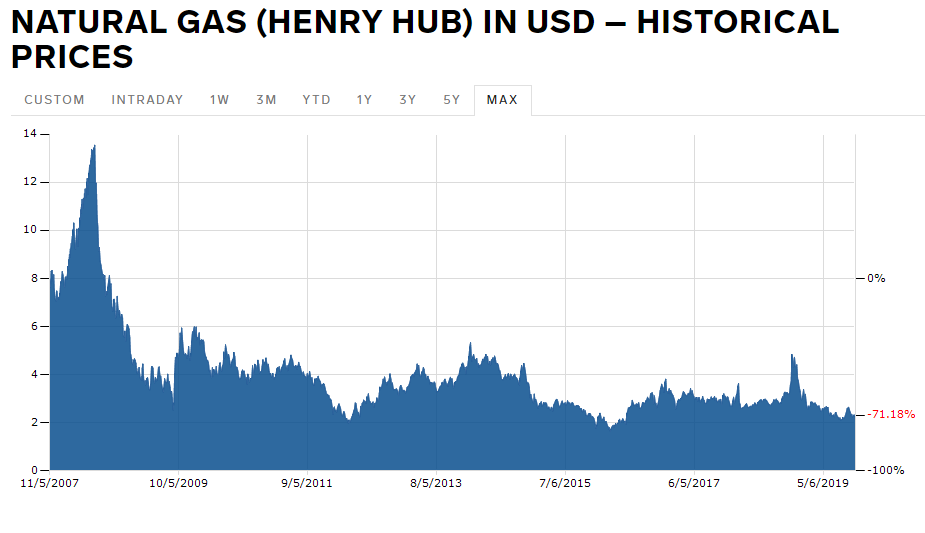

The current scenario which seen a drastic decline in domestic fossil

fuel reserves will consequently push Malaysia to resort to importing

fossil fuel at a marginally higher market price which comes with the

hazard of purchasing energy resources in a volatile and foreign fuel

market. As domestic fossil fuel depletion threatens the development of

the country, it becomes imperative now to overcome the nation’s

over-zealous reliance on fossil fuel. In terms of power generation,

concerns are centred towards the energy supply security of fuels at the

power plants. A large percentage of electricity generation were produced

by coal and natural gas. However, current trend shows a decline in

domestic coal and natural gas production with the supply system that is

stretched to its limits. Dependency on fossil fuels is expected to

continue until full-fledged renewables plus storage technologies can be

fully integrated into the system, thus we can conclude that the

production cost thus earnings will be vulnerable and proportional to the

movement of the price of fuel fossil.

Solar; Delivering Uncompromising Value at Inexpensive Cost

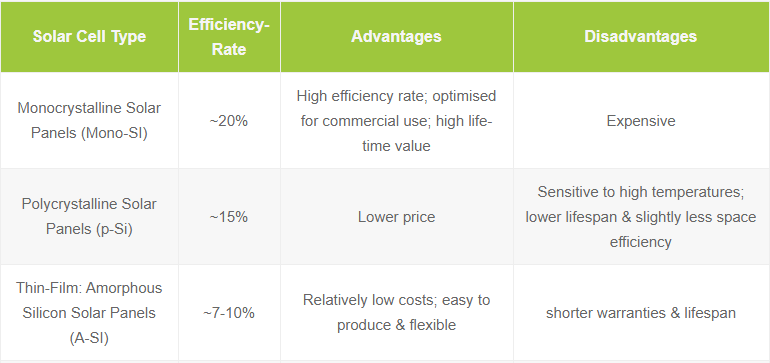

Generally, there are 3 types of solar panels that are being widely used in Malaysia, namely monocrystalline, polycrystalline, and thin-film panels.

Each type has its own unique advantages and disadvantages, and the

solar panel type best suited for your installation will depend on

factors specific to your own property and desired system

characteristics. To produce electricity, solar cells are made from a

semiconducting material that converts light into electricity. The most

common material used as a semiconductor during the solar cell

manufacturing process is silicon.Monocrystalline and Polycrystalline Solar Panels

Both monocrystalline and polycrystalline solar panels have cells made of silicon wafers. To build a monocrystalline or polycrystalline panel, wafers are assembled into rows and columns to form a rectangle, covered with a glass sheet, and framed together. While both of these types of solar panels have cells made from silicon, monocrystalline and polycrystalline panels vary in the composition of the silicon itself. Monocrystalline solar cells are cut from a single, pure crystal of silicon. Alternatively, polycrystalline solar cells are composed of fragments of silicon crystals that are melted together in a mold before being cut into wafers.

Thin-Film Solar Panels

Unlike monocrystalline and polycrystalline solar panels, thin-film panels are made from variety of materials the most prevalent type of thin-film solar panel is made from cadmium telluride (CdTe). To make this type of thin-film panel, manufacturers place a layer of CdTe between transparent conducting layers that help capture sunlight. This type of thin-film technology also has a glass layer on the top for protection.

Thin-film solar panels can also be made from amorphous silicon (a-Si), which is similar to the composition of monocrystalline and polycrystalline panels. Though these thin-film panels use silicon in their composition, they are not made up of solid silicon wafers. Rather, they’re composed of non-crystalline silicon placed on top of glass, plastic, or metal.

Lastly, Copper Indium Gallium Selenide (CIGS) panels are another popular type of thin-film technology. CIGS panels have all four elements placed between two conductive layers (glass, plastic, aluminium, or steel), and electrodes are placed on the front and the back of the material to capture electrical currents.

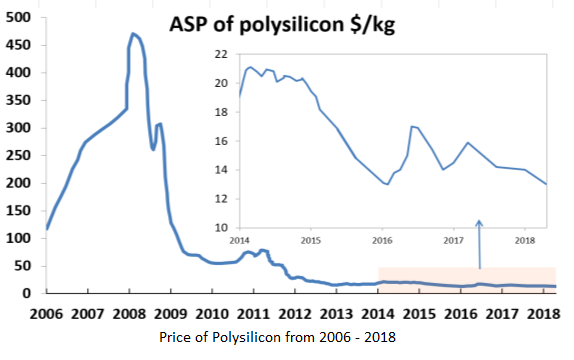

Raw polycrystalline silicon, commonly referred to as polysilicon, is a high-purity form of silicon which serves as an essential material component in the solar photovoltaic (PV) manufacturing industry. It is the primary feedstock material used for the production of solar cells today. Polysilicon feedstock generally consists of large rods which are broken into chunks or chips of various size, then cast into multi-crystalline ingots. The ingot materials are subsequently sliced into silicon wafer suitable for solar cell production.

Bottomline, since the price of raw polycrystalline silicon has been trending down ever since the peak of 2008, user tend to enjoy a lower end price of the modules regardless of tier which on another tone signifies the affordability and also shorter payback period.

Cost Comparison of Conventional Generation versus Solar Generation

|

Component

|

Charges

|

|

Single Buyer Generation (69.5%)

|

26.76 cents / kwh

|

|

Transmission (9.5%)

|

3.66 cents / kwh

|

|

Distribution Network & Customer Service (20.04%)

|

7.87 cents / kwh

|

|

Single Buyer Operation (0.5%)

|

0.19 cents / kwh

|

|

Grid System Operation (0.1%)

|

0.05 cents / kwh

|

|

|

|

|

Net Total Charges Per/ kwh (Excluding Imbalance Cost Past Through ICPT every 6month)

|

38.53 cents / kwh

|

SUBMISSION OF BIDS - LARGE SCALE SOLAR (LSS) PHOTOVOLTAIC PLANT

FOR COMMISSIONING IN 2021

(Request For Proposal (RFP) : ST (IP/JPPI/RE) 12/2/2 JLD IV (1)

OFFERS RECEIVED FROM BIDDERS AS RECORDED DURING BID OPENING

The prices listed below are as submitted in the bids received by

Suruhanjaya Tenaga by 5.00pm on 19th August 2019, which were opened on

21st August 2019. The submissions will be subjected to detailed

evaluation based on the RFP requirements.

Shortlisted bidders will be notified after detailed evaluation.

|

No.

|

Offered Export Capacity (MWac)

|

‘Raw' Offer Price (RM/kWh)

|

|

1

|

100

|

0.17777

|

|

2

|

75

|

0.2297

|

|

3

|

100

|

0.2297

|

|

4

|

90.88

|

0.2318

|

|

5

|

29.9

|

0.2339

|

|

6

|

50

|

0.2340

|

|

7

|

100

|

0.2368

|

|

8

|

100

|

0.2379

|

|

9

|

100

|

0.2396

|

|

10

|

100

|

0.2439

|

- The above sets a comparison between the cost of conventional generation versus the top 10 prices (inclusive of margin) offered by Large Scale Solar 3 bidder.

- Clear indication that solar has way surpass the conventional generation in term of cost efficiency.

Solar; Sunrise or Sunset?

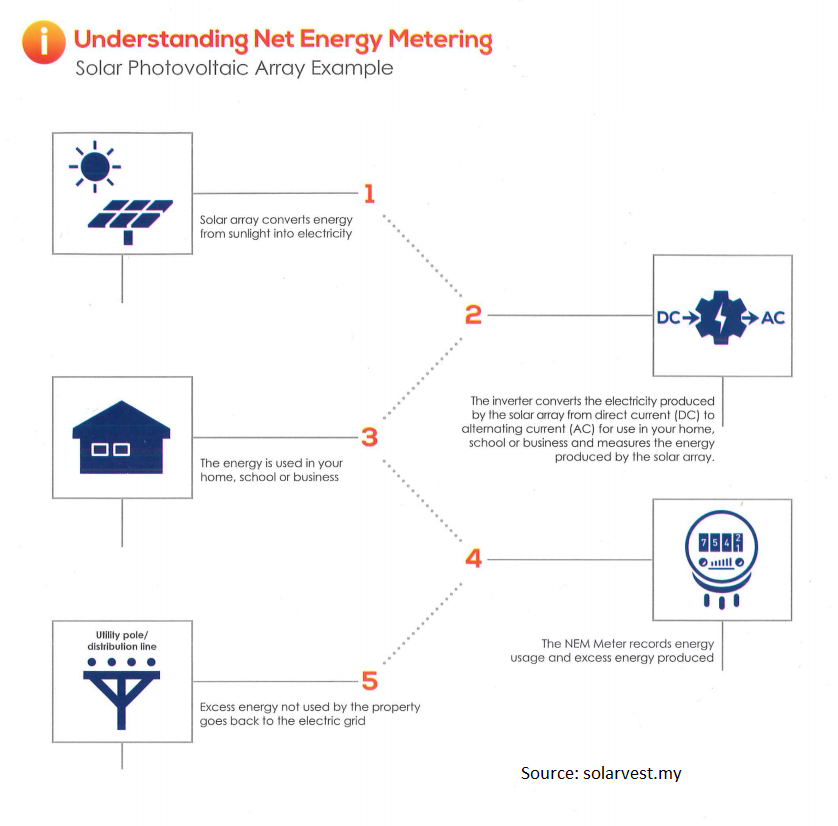

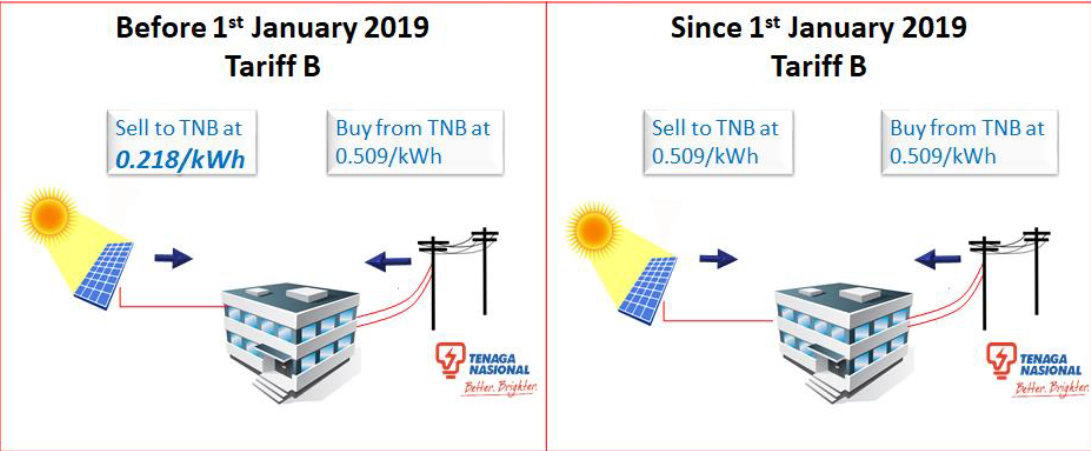

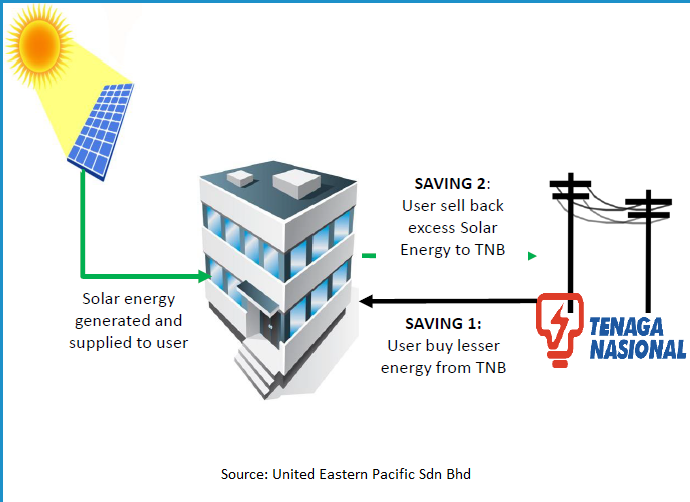

The introduction of Net Energy Metering (NEM) scheme for electricity

customers in Malaysia is seen as an improvement from the previous

Feed-In Tariff (FIT). Effective 1st January 2019, Malaysian

household set to enjoy the enhancement of NEM scheme which adopt the

true net energy metering concept which now allow excess solar PV

generated energy to be exported back to the grid on a “one-on-one”

offset basis. Net energy metering (NEM) has been introduced in the US

since 1983. Different from FIT where all generated energy is sold to the

grid, NEM allows consumers to generate, use and sell only the excess

energy to the grid. The main objective of NEM is for self-consumption to

reduce demand from the grid. The policy requires the consumer to

install a bidirectional meter. This net meter is able to show the users

whether they are having excess or shortage of energy. Any excess

generation after billing period will be given credits, which is used to

offset the consumers’ electricity bill. The maximum roll over credits

period will be 24 months thus, the remaining credits will be set to zero

deem surplus of generation. Indirectly, the policy has made the grid to

act as a huge energy storage. A well-designed NEM policy provides a

simple, low cost, and easily administered way to deal with PV system

which in another words, covers many weaknesses of the FIT policy. NEM on

the other hand also act as a perfect hedge against electricity price

rise comparing to FIT, factoring in the future increase of electricity

tariff rate over time but fixed FIT rate paid to them over the period.

Other than that, NEM policy able to reduce the power losses by allowing

the consumers to consume the generated energy first and only export the

excess instead of exporting all generated energy.

Solarvest; Crouching Tiger Hidden Dragon

Solarvest is a solar EPCC contractor that specialises in solar PV

systems for residential, commercial industrial properties, and LSSPV

plants. Its end-to-end solution covers the initial consultancy and

feasibility to in-depth system designs and installation, procurement,

project commissioning to project handover and supplemented by operations

and maintenance services that caters to all types of solar PV projects.The solar value chain consists of Upstream players, including large companies who engage in research and development, product manufacturing, and distribution which includes silicon refiners, wafer, cell manufacturers and panel manufacturers. While Downstream players consist of product distributor and EPCC / Solar System installer. Below are the popular Upstream and Downstream solar industry players in Malaysia.

|

Upstream Solar Company

|

|

Downstream Solar Company

|

Types of Downstream Solar Player

Generally, there are 3 types of downstream players in Malaysia, described in the table below. Solarvest is basically a turnkey EPCC contractor for resident, commercial, industrial properties and LSSPV plants. In addition, Solarvest also provide operations and maintenance to solar PV system project owner.

|

EPCC Sub Contractor

|

Hired by main contractor and participates in EPCC project by

providing specific task that are part of the overall project, for eg;

labour, construction, cabling, installation. |

|

EPCC Contractor

|

Turnkey or main contractor hired to provide EPCC and is usually

responsible for the overall project. It may also engage the expertise of

subcontractors to perform specific task in a project. |

|

Project Owner

|

A party that starts a new solar project which usually seek long

term investment either via self-consumption or sale to distribution

licensees for a pre-determined period. Owner usually engage EPCC

contractors to build solar PV plants. |

Types of Solar PV System

|

Solar PV System

|

Description

|

|

Rooftop Solar PV System

|

Solar PV that are installed on rooftop and basically available in

two forms which is BIPV (Building Integrated PV) and Retrofitted Solar

PV System. BIPV generally utilising solar PV panels as the roofing

material while retrofitted system is the system that requires mounting

structure and support bracket to be added to the existing rooftops

before placing panels on top. |

|

Ground-Mounted Solar PV System

|

Solar PV system where ground-mounted racks are used to hold solar PV panels. |

|

Floating Solar PV System

|

Solar PV system where solar PV panels are mounted on a moored

floating structure and are usually installed on lakes and ponds. |

Generally, in Malaysia, there are 3 types of popular Solar PV System. Solarvest positioned itself as a one stop centre of solution for all the above PV systems ranging from A to Z.

Key Activities & Stages Performed Under Solarvest EPCC Segment

|

Stage

|

Description

|

|

Stage 1: Design & Engineering

|

Solar EPCC projects generally begin with a feasibility study which

includes several assessments inclusive of the orientation of PV panels,

topography and soil test to achieve maximum amount of solar irradiation.

Deem satisfactory, engineers will propose a suitable design which

includes civil, mechanical, solar PV structural, and electrical and

interconnection design. Engineers will then design the suitable solar PV

panel mounting / support system and seek validation to determine the

validity of support structure on intended loading amount. The solar

system’s electrical diagrams, solar panel arrangement drawing and

structural drawings will be completed before the identification of

project materials / equipment. |

|

Stage 2: Financial Feasibility and Financing Option

|

Assisting clients to perform preliminary financial feasibility

study on project which includes connecting them to the financial

institutions or solar leasing service provider. |

|

Stage 3: Application to Authorities

|

Assisting clients with necessary application to the authorities

including SEDA (for NEM), MIDA (for GITA) and Energy Commission (public

generation & distribution license for LSSPV). |

|

Stage 4: Procurement

|

Procurement including the acquisition of necessary equipment,

component and materials. Delivery and logistic of equipment and

component from vendor and subcontractors (SI) to ensure smooth work flow

on the given timeframe. Testing on major equipment such as solar PV

panels, inverter, structure, switch gear and transformer to ensure

quality of the delivered equipment are all on par. |

|

Stage 5: Construction

|

Rooftop inspection inclusive of repair, repaint, or replacement if

needed for rooftop PV system. Ground preparation such as land and

vegetation clearance for ground mounted PV system. Installation of

mounting structure, PV panel, inverter, optimiser (if needed) and

cabling system. Turnkey contractor will normally subcontract the

installation to the qualified subcontractor (SI). |

|

Stage 6: Project Management

|

Manage and supervise all activities on site including those who

carried by subcontractors to ensure smooth and timely implementation on

projects. |

|

Stage 7: Testing & Commissioning

|

The final part before handover is to verify the installed solar PV

system to ensure it meet client’s and authority’s requirement.

Procedures including system performance ratio test to check on the

performance ratio guarantee and also verification on specific intervals

during construction and commissioning process. |

|

Stage 8: Handover

|

Engineers will perform final checking on the major parts of solar

PV system to ensure system working precisely according to specification

before handling over to client. |

Solarvest; The Most Anticipated IPO in 2019

Solarvest is the first ever solar EPCC company to be listed in bursa

and has been identified as among the most anticipated IPO in 2019 due to

“one of a kind” nature of business. Being a pure Solar downstream

player, Solarvest has always been seen as a formidable, aggressive;

hungry for business company and peers. To make things more interesting,

Solarvest is suprisingly a Net Cash company prior to

listing and has recorded a stable operating cash flow over the past

audited years despite aggressive expansion. Facts on, company will be

allocating most of its IPO proceed towards aggressive expansion which

also implies better earning visibility.

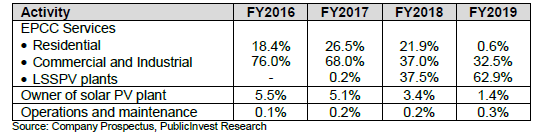

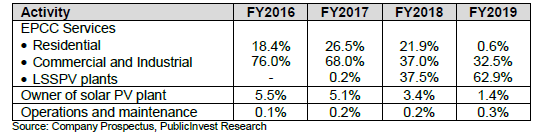

Clear Earning Visibility Despite Gross Profit Margin Depletion

Solarvest Gross Profit Margin seen a drastic decline from over 30% in

FY17 & FY18 to 20% in FY19 primarily due to a shift from residential

projects to LSSPV projects as well as pricing reduction to secure two

major commercial and industrial projects. Moving forward, investors

should be mindful that contribution from the LSSPV segment could

increase further should the group manage to secure more jobs from the

third phase of the LSSPV programme. Typically, LSSPV projects carry

lower profit margins as they require more site preparation and

infrastructure works in which the group will need to engage the services

of specialised subcontractors. Thus, all the factor above explains the

thinner gross profit margin achieved in FY19.

Facts of IPO Proceeds Utilisation

|

Business Expansion – RM3.0m (8.7%) |

|

|

Capital Expenditure – RM4.0m (11.5%) |

|

|

Working Capital – RM19.19m (55.5%) |

|

|

Repayment of Bank Borrowings – RM5.0m (14.5%) |

|

|

Estimated Listing Expenses – RM3.4m (9.8%) |

|

Solarvest; Formidable yet Reputable

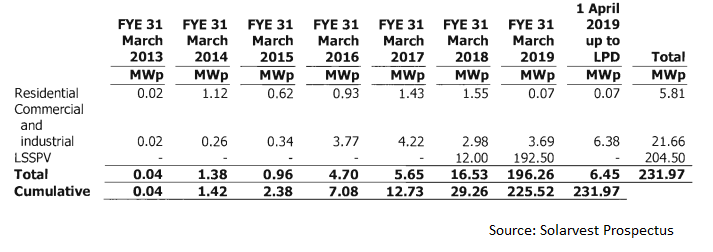

Solarvest has already completed a total of 231.97 MWp worth of project

since its inception in 2012 and will continue to strive for a year on

year better performance as its plans to penetrate Vietnam and Taiwan

market were already in line. Vietnam currently relies mainly on

hydropower to generate energy and the country targets to achieve 8.1GW

of renewable energy from solar PV by 2025. Meanwhile, Taiwan is

encouraging renewable energy development as it reduces dependency on

nuclear power. Both contributing factor from the aforementioned country

will provide liquidity besides promoting leap and bound growth in the

green energy sector.As of 31 August 2019, the group has an unbilled order book of RM200.1mn, (RM100.8mn for residential, commercial and industrial projects, RM83.1mn for LSSPV projects and the remaining RM16.2mn for others). All of these unbilled order book could provide earnings visibility to the group and will keep them busy for the next 12 months.

Green Energy; Will it Thrive?

Budget 2020: Will the Extension of GITA and GITE Spare the Future of Solar?

For those who are not familiar with GITA and GITE. Malaysia Government will provide tax incentives for the purchase of green technology equipment, besides giving tax exemption on the use of green technology services. With these tax incentives, it will allow small and medium enterprises to grow the Renewable Energy market. The main purpose of the Malaysia Government is to attract potential investors and industry players to invest in Renewable Energy. Green Investment Tax Allowance (GITA) allow 100% of qualifying capital expenditure incurred on approved green technology assets to be offset against 70% of statutory income in the year of assessment. Unutilised allowances can be carried forward until they are fully absorbed. Bottomline, all of these allowances including Capital Expenditure Allowance (CA) will shorten the payback period of Solar PV investment. Since GITA and GITE will be receiving extension till the year 2023, we can expect the demand of solar PV system will continue to grow leap and bounds.

Budget 2020 also introduced a new scheme (Framework should be out early next year) which allow 70% income tax exemption of up to 10 years for companies undertaking solar leasing activities. With all these attractions to resist, it’s nearly impossible to not jump to the bandwagon.

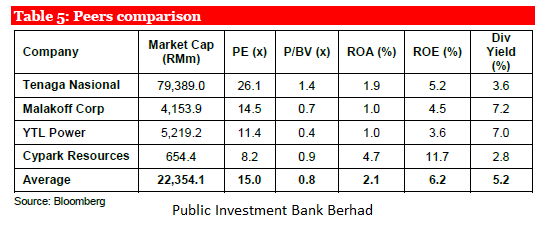

Should I Invest in Solarvest, and What is the Outlook?

As for the valuation part, the author is leaving it to investors to decide. 12.3x PE is neither cheap nor expensive given the glittering future of the company. As for comparison purposes, the average PE for this industry is pegged at 15.0x, hence the author believes that there is still potential upside for Solarvest IPO. With all the tip top management, the author believe that the company will continue to thrive up to its trajectory.

Think Green, Think Solarvest, Turning Sunlight into investment.

Author: Equitic

Recap

Solarvest Holdings Berhad

IPO Rating (4.5 out of 5.0 Stars)

Market Cap: RM136.718 mil

Total Shares: 390.623 mil shares

- The Most Anticipated IPO in 2019; First Pure Play Solar EPCC to be listed in Bursa

- One-stop centre of solution for all available PV systems & model ranging from A to Z in Malaysia.

- Net Cash company prior to listing with good gross margin, Return on Equity (ROE) and stable cash-flow despite aggressive expansion

- Organic growth and expansion beyond local geographical location (Vietnam & Taiwan)

- Most allocation of IPO fund will cater for expansion and project tender / bidding

- Positive initiative and support from the government to introduce / encourage industry player and user to go green which includes tax benefit (GITA & CA) and attractive scheme (NEM 1 to 1 offset basis)

- Large potential of market in future since the government target is to achieve 20% Renewable Energy penetration of total generation mix by 2025 from the current 5%

Fair Value from Research House Coverage

TA Securities : RM0.505 (+44.03%)

Public Investment Bank Berhad : RM0.590 (+68.57%)

Interpac Research: RM0.490 (+40.57%)

JFApex Research: 0.480 (+37.14%)

Author: Equitic

Disclaimer

This presentation is not to be reproduced or distributed to other persons, and is intended solely for internal use only.

https://klse.i3investor.com/blogs/EquiticCapital/2019-11-21-story238618-Solarvest_The_Most_Anticipated_IPO_in_2019.jsp