SEDANIA (0178)

Technical BUY:

Entry price: Buy on breakout above 18sen

Price target: 23sen (28%) / 31sen (72%)

Stop-loss: 14.5sen

Shariah: Yes

Duration: Intra-day/Contra

Confirmation:

-

The stock has been trading above short-term simple moving average (SMA) 20-day, 50-day and long-term SMA 200-day.

-

It

has also now broken above Ichimoku Cloud, signifying continuation

bullish trend and will see further rally in the share price.

-

The

share price is expected to rally further given stronger bullish signals

in MACD (panel 3) and RSI (panel 4) indicators. MACD histogram been in

positive territory and started to resume its expansion. This indicates

that there will be more upside in the share price.

-

Buying

is expected to accelerate further as DMI+ (panel 2; blue line) has

shown momentum is picking up, where it has been hovering above DMI-

(yellow line) and ADX (red line). More stronger momentum to come as ADX

line is still below DMI+, which could see huge push up in the share

price.

-

This is supported by stronger volume as compared to last few days.

-

Evidently, money

flow index indicator (last panel) shows aggresive inflow of money/funds

into the stock, which could indicate stronger rally ahead.

Key Catalysts:

-

New earnings growth: Sedania is venturing into the electronic sports or e-sports space via a special-purpose vehicle (SPV) with iCandy Interactive Ltd and the former chief of eSports.com AG, Michael Broda to launch a global e-sports tournament and media network.

-

According to Statista, the eSports market is experiencing a rapid growth, despite being in its formative stage. In 2016, worldwide revenues generated in the eSports market amounted to USD492.7 million.

By 2020, the market is expected to generate over USD1.48 billion in

revenues, which indicates a compound annual growth rate of 32%. These revenues came from betting, prize pools and tournaments, but overwhelmingly from sponsorship and advertising, which brought in almost USD661 million in 2016. In terms of revenue, Asia was the biggest eSports market overall, followed by North America and Europe.

-

In

Budget 2020, the Pakatan Harapan government recognises the growing

potential of eSports and will provide an increased allocation of RM20

million for 2020.

-

Current earnings base growth: It would be supported by continuous contribution from fintech segment and new innovations are expected to contribute to company earnings in FY 2019. Internet of Things (IoT) segment prospects are expected to improve this year and making good progress in green tech segment in FY 2019.

-

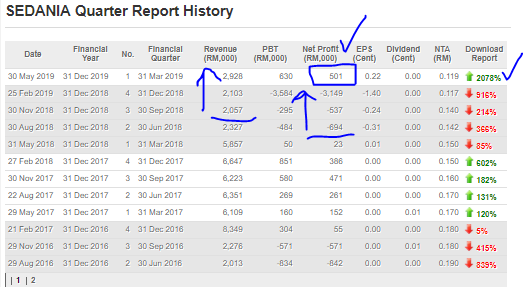

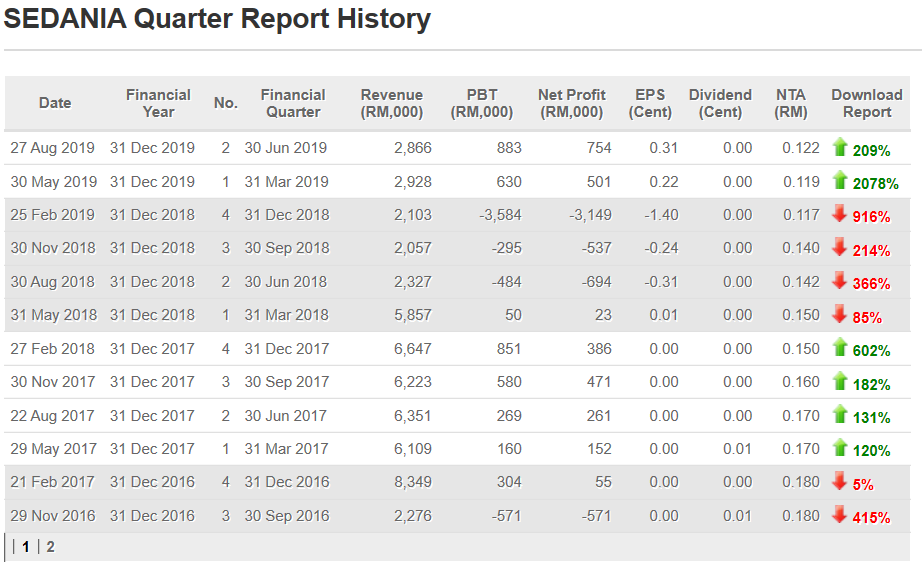

In recent quarters, Sedania shows improving net profit and for 2 straight quarterly profit after 3 straight quarterly losses. The worst is over and will continue to chalk more earnings growth.

https://klse.i3investor.com/blogs/smartinvestment2030/231415.jsp