BSTEAD 2771

Why am i looking into this stock? I will explain this into point form for your easy understanding.

News Update :

1. 16 Sept 2019

BOUSTEAD Holdings Bhd is in talks to sell its stake in Boustead Petroleum Marketing Sdn Bhd (BPM), which operates petrol stations under the BHPetrol banner, sources familiar with the matter tell The Edge.

It is understood that talks with at least one individual buyer are ongoing, with several other parties interested in the assets or waiting on the sidelines.

A

source with knowledge of the matter says, “This (waiting on the

sidelines) is because the price tag being bandied about is more than RM1

billion … maybe even RM1.5 billion, or more. BPM is 70% controlled by

Boustead Petroleum Sdn Bhd and 30% by Lembaga Tabung Angkatan Tentera

(LTAT) or the Armed Forces Fund Board.

It

is noteworthy that LTAT has a 59.45% stake in Boustead Holdings. While

it is still unclear at press time, considering the shareholding

structure of LTAT and Boustead Holdings, it is unlikely that LTAT will

remain in BPM if Boustead Holdings exits.

Source obtain from https://www.theedgemarkets.com/article/newsbreak-boustead-holdings-exit-petrol-station-business

2. 28 Aug 2019

Boustead

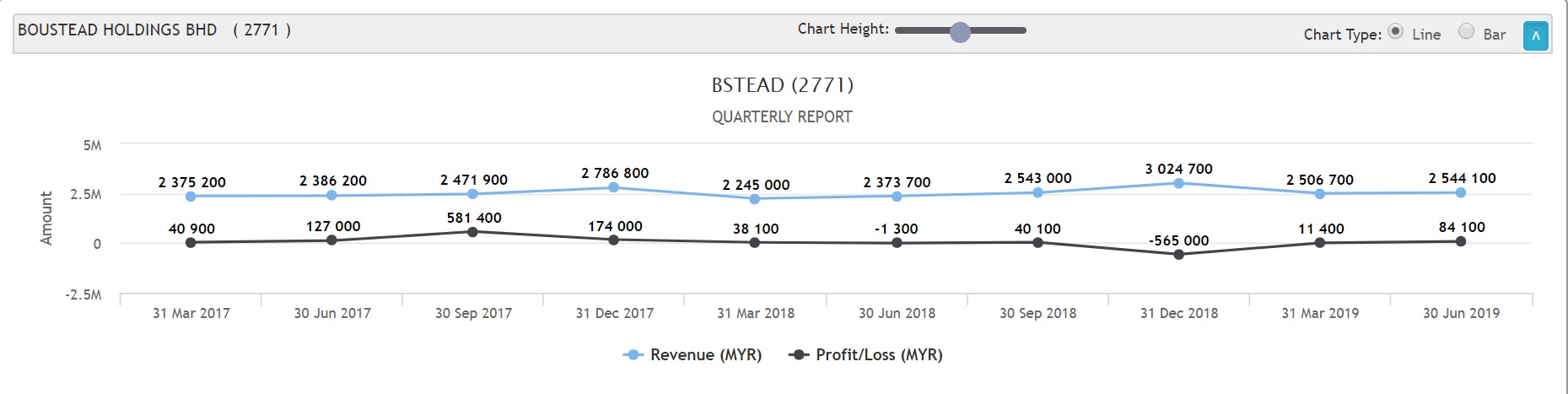

Holdings Bhd’s second quarter profits ended June 2019 turned in RM84

million in profits, reversing a RM1.3 million in net losses, a year ago.

Group

managing director Datuk Seri Amrin Awaluddin said this was mainly

driven by a RM120 million gain after plantation land sale.

“All

divisions contributed positively to the group’s bottom line, with the

exception of the heavy industries and property divisions,’ Amrin said in

a statement today.

Source obtain from https://www.nst.com.my/business/2019/08/516867/boustead-holdings-q2-turned-rm84m-profits-after-plantation-land-sale

3. 12 July 2019

Boustead Holdings Bhd (BHB) is poised to record a positive momentum

with the new appointment of new individuals to its boards, effective

July 15.

The new appointment comprising Lieutenant General Datuk Fadzil Mokhtar

(R) as independent non-executive director, Datuk Nonee Ashirin Mohd

Radzi as independent non-executive director, Abraham Verghese as

independent non-executive director and Loong Caesar as independent

non-executive director.

With this diverse and well-rounded board, BHB said the group would

certainly benefit from their backgrounds and broad experience.

Source obtain from https://www.nst.com.my/business/2019/07/503731/boustead-holdings-appoints-new-members-its-board

4. 21 Jun 2019

In

its filings, the diversified group said its subsidiary, Boustead Naval

Shipyard Sdn Bhd (BNS), would undertake the works for the military

vessel KD Terengganu.Source obtain from https://www.thestar.com.my/business/business-news/2019/06/21/boustead-unit-wins-rm96mil-job

5. 5 April 2019

Boustead

Holdings Bhd has announced the appointment of (MD) Datuk Seri Amrin

Awaluddin as the new managing director effective May 6, 2019. Amrin, who is the managing director of Sime Darby Property Bhd (SD Property), has announced that is leaving the group on May 3.

Amrin was appointed as SD Property director on July 12, 2017. He was subsequently appointed as the group MD on August 24, 2017.

He

has played a pivotal role in driving the success of leading Malaysian

companies which includes Renong Bhd, Malaysian Resources Corporation

Bhd, Sistem Televisyen Malaysia Bhd, Media Prima Bhd and most recently,

Sime Property.

He is currently a director of Taliworks Corporation Bhd and CIMB Bank Bhd.

“We

are pleased to welcome Amrin as our new MD. We are confident that his

experience and proven track record will help steer the group forward.

“Particularly

given the increasingly competitive landscape, his vast expertise and

sharp business acumen certainly augurs well for the development of the

group,” Boustead chairman Tan Sri Mohd Ghazali Che Mat said in a

statement.

Source obtain from https://www.nst.com.my/business/2019/04/476568/amrin-take-helm-boustead

Related News : https://www.malaymail.com/news/malaysia/2019/04/11/ltat-failed-to-state-rm88.9m-impairment-in-fy17-financial-report-says-audit/1742164

Fundamental Outlook

1. Improving Quarter Outlook

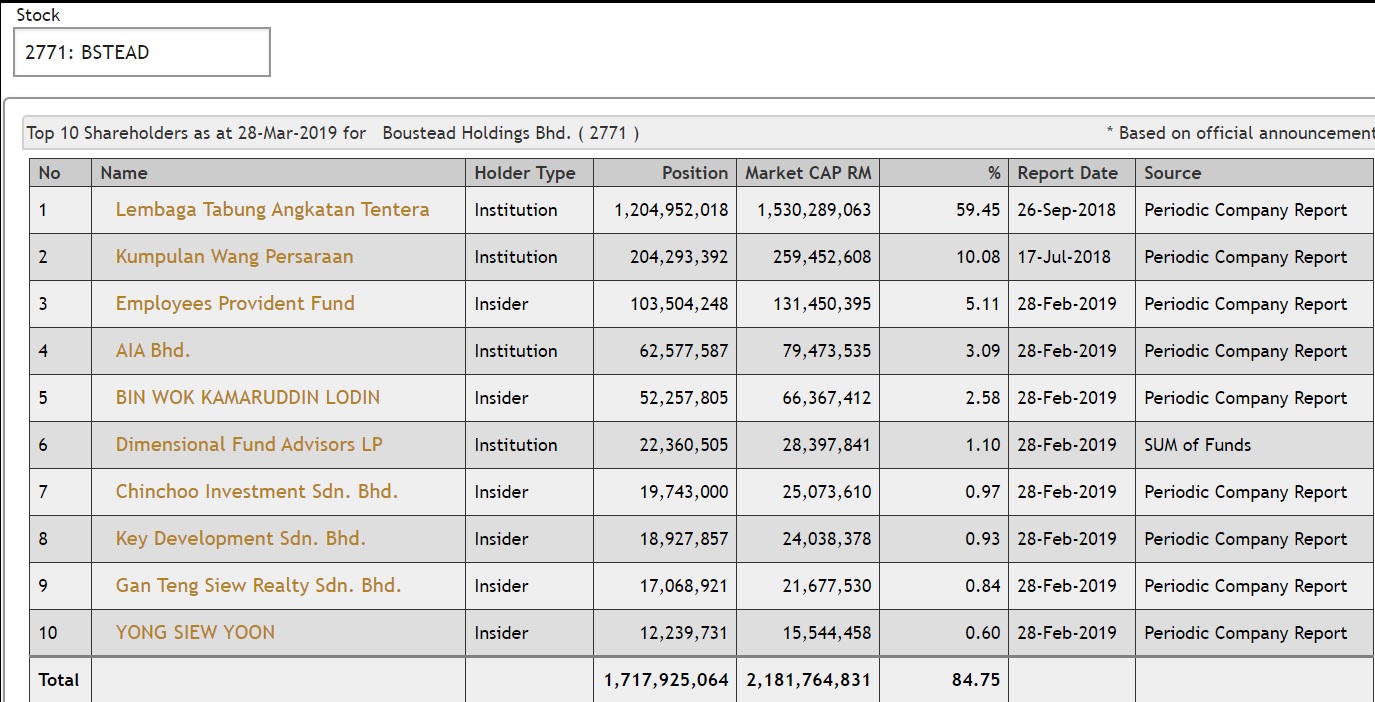

2. Top 10 Shareholder

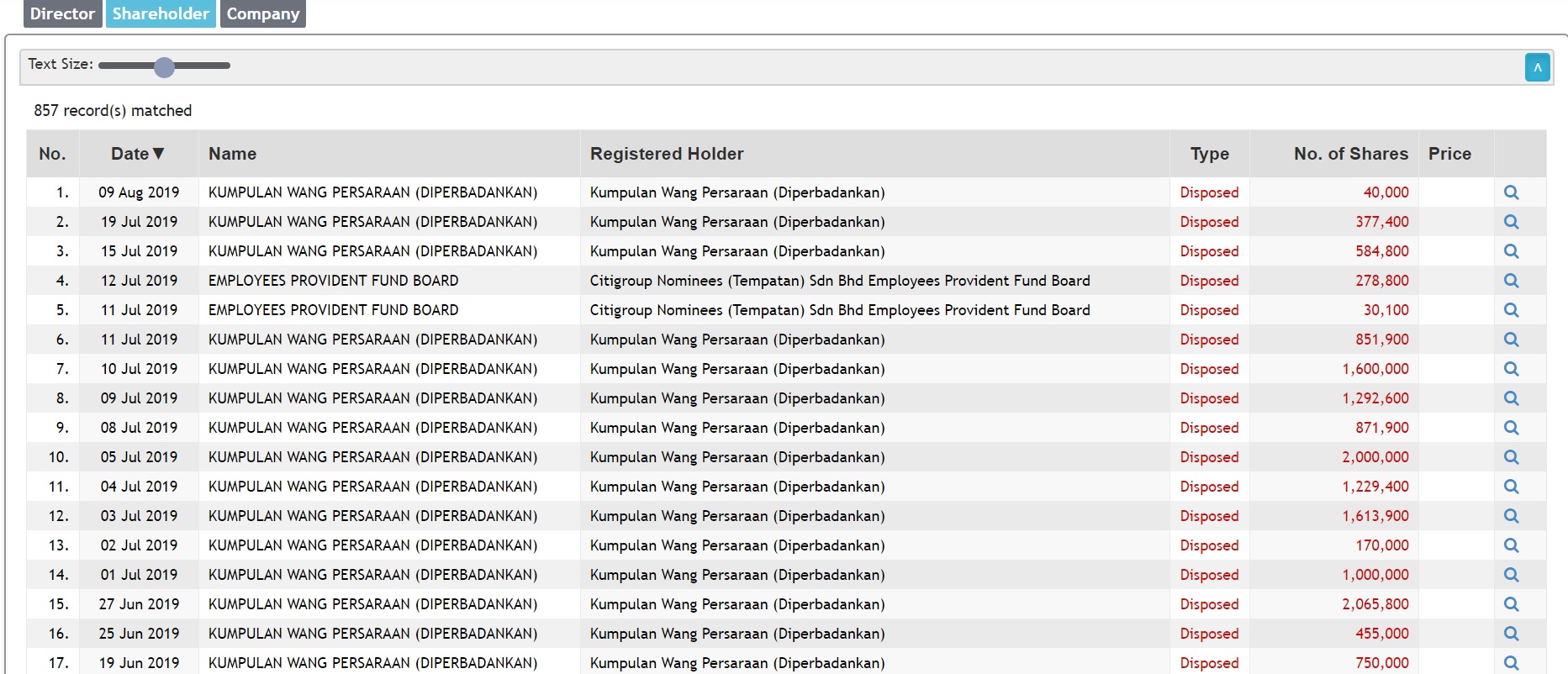

3. Change in Shareholder

4.

Bloomberg

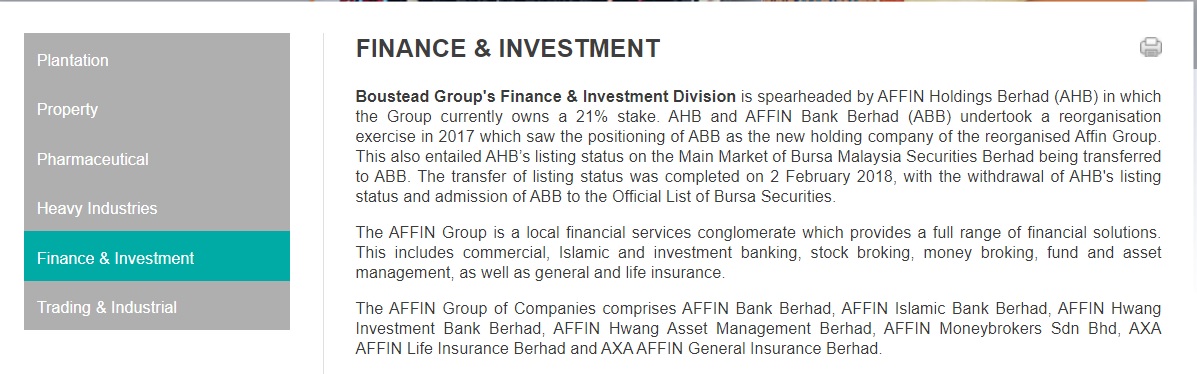

reported that the parties are looking to sell AXA Affin General

Insurance Bhd for US$500mil and AXA Affin Life Insurance Bhd for

US$150mil.Both financial institutions are in the midst of engaging with

advisers for the transaction.

Source obtain from https://www.thestar.com.my/business/business-news/2019/09/06/axa-affin-mull-selling-insurance-businesses-for-rm272bil

How does this related to Bstead?

This clearly tell the relationship of Boustead related to Affin Holding and then Affin Own AXA Affin Life Insurance.

BHP plan to sell 1billion to 1.5 billion and Boustead own 70% if able

to sell off. Assume worst case for desperate selling price at 1 billion.

Boustead should be getting approximately 700 million.

Boustead own 21% of AHB and AHB own 49,9% of AXA Insurance which plant to RM2.72 billion. 2.72/2 = 1.36

1.36 x 0.2 = 272 million

Total for above 2 exercise of dippose asset will be giving BSTEAD approxiamately 1 billion.

If this would to pay out as special dividend, LTAT being the major

shareholder who own 59% shares should be getting 594 million if there is

such special dividend to declare. Having say that, Boustead may use

some of the proceed of selling to par down their debt level as well.

Hhistorical LTAT payout 11.8% dividend. So, there is possibility LTAT

being the major shareholder of Bstead to ask to liquidate their non core

asset to please LTAT investor.

Technical Outlook

Base on the chart, it is clearly showing accumulation activity is happening at the current stage.

LAST DONE PRICE : 1.08

SUPPORT : 0.995 ; 1.05

RESISTANCE : 1.21 ; 1.26 ; 1.38 ; 1.60

Personal Opinion :

1. I think LTAT is seeking for fresh fund to payoff for their investor.

I can't find any newspaper about dividend payout for the year 2019. So,

i guess all this action of dissposing AXA Life insurance, BHP action.

Ultimately is trim down their holding company and pare down their debt

as well as pay dividend to LTAT investor.

2. Strong accumulation activity at the bottom. Good risk / reward ratio

3. Turnaround of quarterly report

4. High NTA 3.26 compare to current price 1.08 which meaning to match

with NTA value there is 200% upside. Due to poor market sentiment, we

give 30% discount of NTA 3.26 = 2.28. That also translate to a upside

111%.

5. Good Connection between Non Executive Director due to his background as you can see it from the link which i post

FB LINK : https://www.facebook.com/Steventheeinvestment/

TELEGRAM LINK : https://t.me/steventhee628

Subcribe Stevent Hee Youtube Channel :

https://www.youtube.com/channel/UCYm446mSdNPaxlSVDCVj7bA

DISCLAIMER : Trade at your own risk. Above article is merely for educational sharing purpose, it does not solicit any buy/sell recommendation. Kindly consult your dealer/remisier for any investment decision. Writer does not hold any liabilities if any financial losses occur due to your investment you have make.

https://klse.i3investor.com/blogs/SICStockPick/225376.jsp