Just sharing for study propose. No call buy, Take your own risk in investment ><"

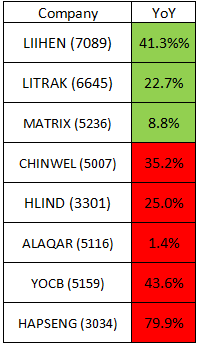

Update 8 company due to new quarter report.

3 get good YoY results and 5 get bad YoY results. Update simple result. 37.5% YoY improve only =.=....

YOCB, HAPSENG(1 week only in Top 20 list =.=..) and HLIND "All Points" drop and kick from top 20 list.

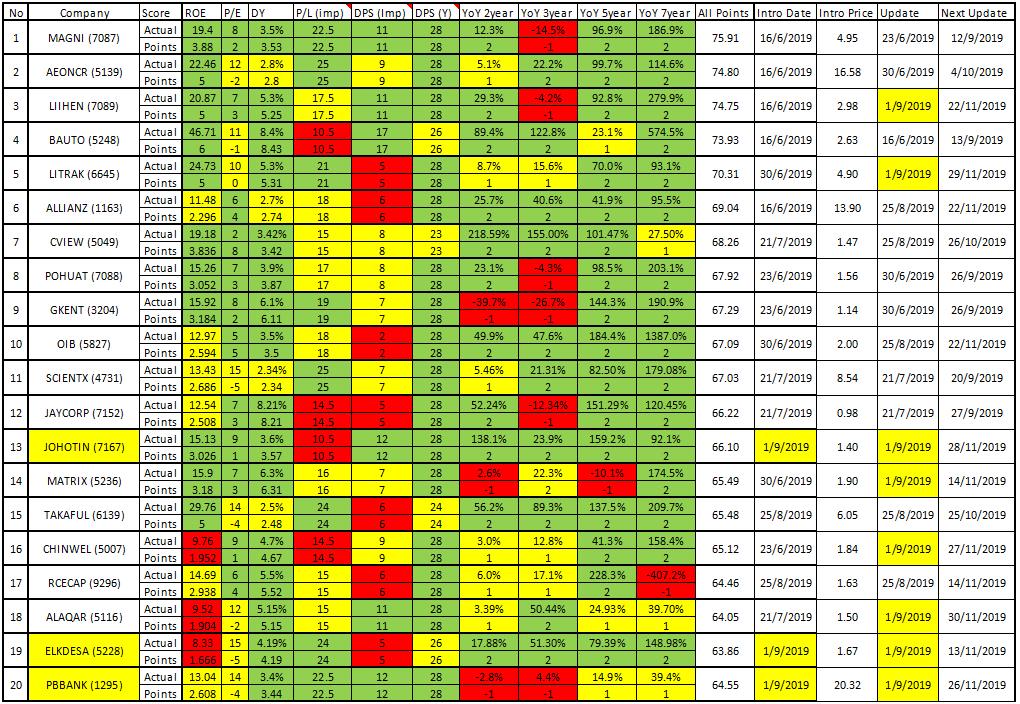

It replace by JOHOTIN (7167), ELKDESA (5228) and PBBANK (1295)

Previous post refer -->https://klse.i3investor.com/blogs/WahLau/221341.jsp

NO.13 JOHOTIN (7167)

Good

-Low P/E

-High ROE

-High YoY improve 2years until 7 years

-DPS improve

Bad

-2019Q1 and Q2 QoQ drop

-Before 2018 Q3 result not so consistant

For more information about Johotin in I3 ->https://klse.i3investor.com/servlets/stk/7167.jsp

If I think if I plan to buy Johotin for luck. I will go to plan as below:

(not buy call, just study case.)

buy 1.40

Stop Loss 1.36 or below

Risk 4/140=2.85% or more

NO.19 ELKDESA (5228)

Good

-High P/L improve

-High YoY improve 2years until 7 years

Bad

-High PE

-Low ROE

*Low DPS improve due to capital changes

For more information about this share in I3 ->https://klse.i3investor.com/servlets/stk/5228.jsp

If I think if I plan to buy Johotin for luck. I will go to plan as below:

(not buy call, just study case.)

buy 1.67

Stop Loss 1.63 or below

Risk 4/167=2.40% or more

NO.20 PBBANK (1295)

Good

-High P/L improve (this year results no good)

-High DPS improve

Bad

-High PE

-YoY 2 and 3 years no good.

For more information about this share in I3 ->https://klse.i3investor.com/servlets/stk/1295.jsp

This share back to TOP 20 again.With current PE and YoY improve no my cup of tea yet =.=...

Next project change 7 years P/E improve and DPS improve change to 3 years ^^?

https://klse.i3investor.com/blogs/WahLau/222741.jsp