Comment what stock you like us to cover below for the next article....

Bumi Armada Bhd (5210.KL) listed in the Bursa Malaysia.

Background of Bumi Armada

Bumi Armada Bhd is an international offshore services provider to the oil and gas industry in Malaysia and other countries in Asia. Founded in 1995 with two main business units, Bumi Armada Navigation (BAN) and Haven, with a predominantly domestic focus. Bumi Armada was listed on the Main Board of the Kuala Lumpur Stock Exchange on June 1997 or Bursa Malaysia but delisted on April 2003. Bumi Armada was once again listed on Bursa Malaysia on July 2011, in an IPO which was the largest in the country for that year.Currently, Bumi Armada is a Malaysia based fully integrated offshore solutions provider that operates across the globe operating via two business units:

- Floating Production and Operation (FPO) of oil and gas solutions and

- Offshore Marine Services (OMS) which comprises of Offshore Support Vessel (OSV) and Subsea Construction (SC) services.

Bumi Armada's firm order book stood at RM20.2 b (2017: RM22.25 b) by the end of December 2019.

The Bumi Armada company listed in Bursa Malaysia, its revenue fell by 18.1% yoy to RM1027.2 m in 1H19, operating profit before impairments rose 20.9% yoy to RM345.7 m. The fell in revenue was mainly attributed to the Offshore Marine Services (OMS) segment (-54.5% yoy to RM158.1 m) in December 2018. OSV vessel utilisation has improved to 51% in 2Q19 from 39% in 1Q19, due to higher demand in Malaysia.

Recent Insider Report for Bumi Armada (Bursa Malaysia)

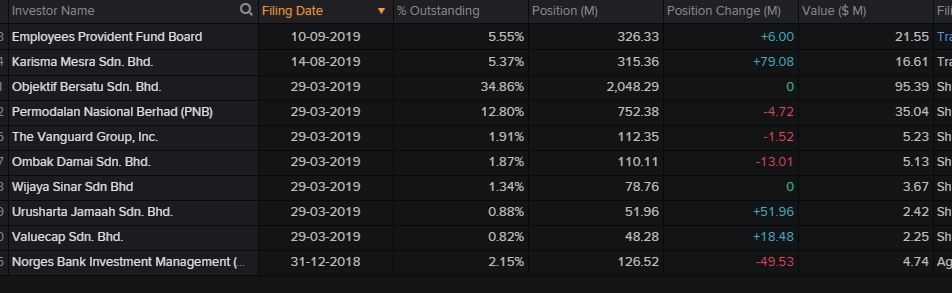

Notice in the TradeVSAChart, the two major purchase by EPF and Karisma Mesra respectively and Pentagon Green Buy to support the insider buying evident. Clearly insider report has influence to overall price movement. Investor can use Pentagon Guider to help them in their timing.In this Insider Report, Karisma S.B increased position a lot to almost 80% or 5.4% outstanding. Reader should google out who’s Karisma Mesra S.B as this recent purchase was in 14 Aug 2019 and EPF is also increasing its position. Good things usually come when we see big institution like EPF’s buying in the insider report.

Known Insiders in Insider Report

8.56 %, Amanah Saham Bumiputera

7.10 %, Employees Provident Fund Board

34.89 %, Objektif Bersatu Sdn Bhd

+Note: + Ananda Krishnan & family have interest in this.

Profitability Analysis of Bumi Armada

We see a large drop in profitability for 2018 and latest number suggested improvement in losing less money. The bottom may be here already. The worst has passed hopefully in the insider report.

Weekly & Daily Chart VSA (Volume Spread Analysis) Review

Based on weekly TradeVSA chart, we do spot a clear change of trend with high volume. High volume started to appear on end of November 2018. This shown activities by Smart Money as they started to do accumulation after the mark-down stage.

Another signal appeared in the TradeVSA chart at the end of April 2019 with pentagon bullish high volume. Again, this shown Smart Money are ready and trying to mark-up by testing the resistance. The latest weekly bar successful closed above all the Up-Thrust bar at resistance. Price likely to move and test the previous support around RM0.66. Take note if any Up-Thrust or TradeVSA Red Pentagon appear as price will have pullback soon.

Daily TradeVSA chart shows the similar trading setup with long period of accumulation after mark-down stage. In the daily chart, we do notice the shakeout on the weak hand holders towards the end of the mark-down stage. With the recent TradeVSA Pentagon buy* signal and Line Change, the price managed to break higher than resistance and previous false breakout area.

*Pentagon Guider System has Buy or Sell Indicator indicated by Green Pentagon Icon and Red Pentagon Guider Icon in the field of Volume Spread Analysis. However, we advised reader that not all pentagons are buy or sell taken literally 100% of the time in Volume Spread Analysis method.

Contact us via: email at support@tradevsa.com or Call/WhatsApp at +6010 266 9761 if you have any queries about this Bumi Armada and its Insider Report article or opinion to clarify.

Interested to learn more “How to put Simple Fundamental Analysis with Volume Spread Analysis (VSA) in 3 easy steps”

TradeVSA System, a Volume Spread Analysis (VSA) Malaysia Premier Education Provider in Malaysia· Free Workshop, 21 September 2019 (Sat), Petaling Jaya, 2pm: http://bit.ly/2kHvCij

· FREE Education via Telegram Channel: https://t.me/tradevsatradingideas

https://klse.i3investor.com/blogs/tradevsa_case_study/224970.jsp