Just sharing for study propose. No call buy, Take your own risk in investment ><"

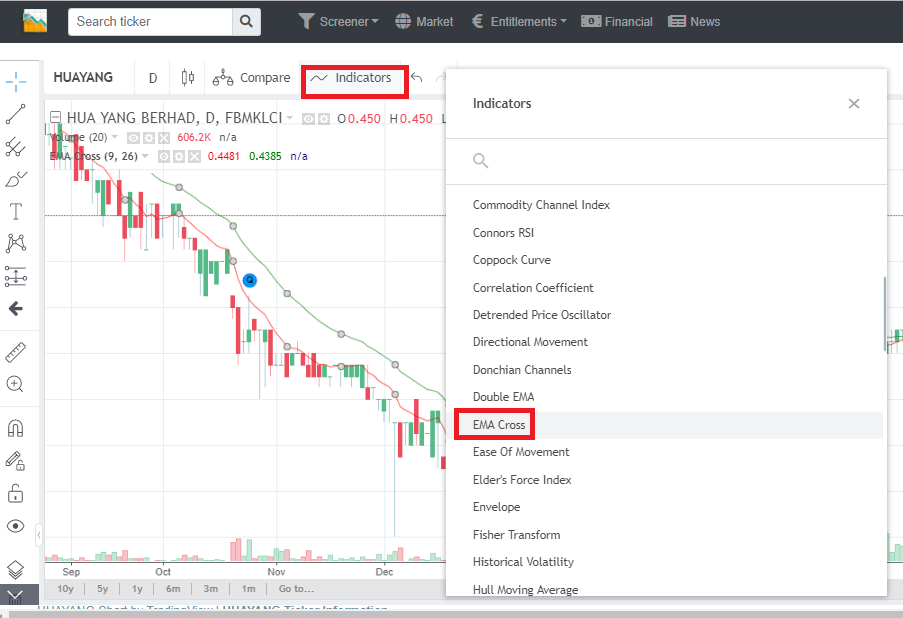

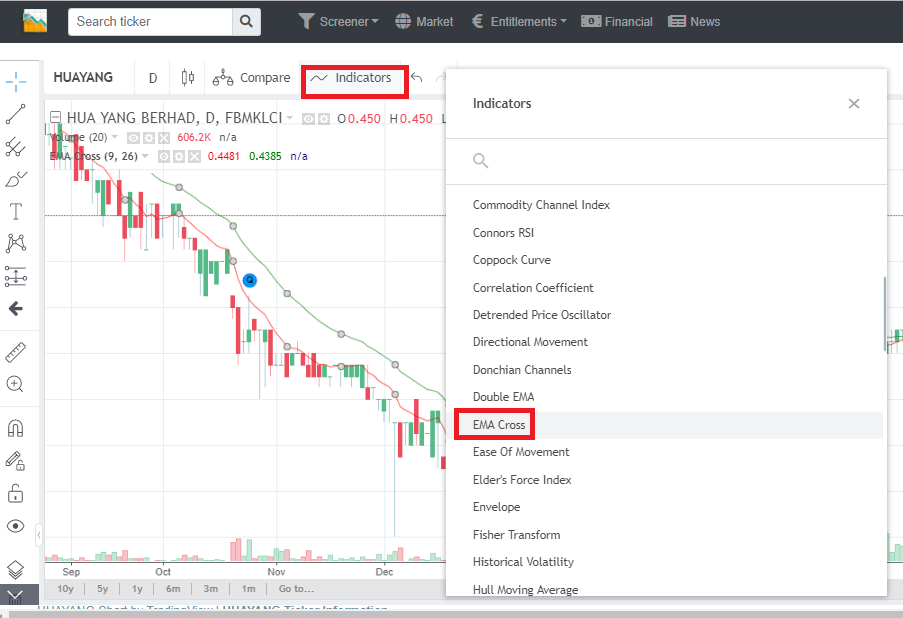

1 of popular technical indicator is EMA. We can consider it function like moving average with closer to price.

Want to learn more please refer link as below:

https://www.babypips.com/learn/forex/exponential-moving-average

How to use?

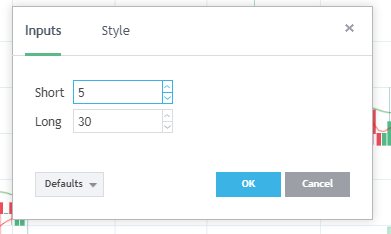

EMA 5 line upper EMA 30 -> buy

EMA 5 line below EMA 30 -> sell

Advantage of EMA

1.) Easy understand, follow and free of charge

*Huayang as example no buy call =.=....

MQ Trader : https://klse.i3investor.com/mqtrader/sf/chart/stk/5062

klsescreener : https://klse.i3investor.com/mqtrader/sf/chart/stk/5062

*by this article I found klsescreener have many indicator to choose. ^^V

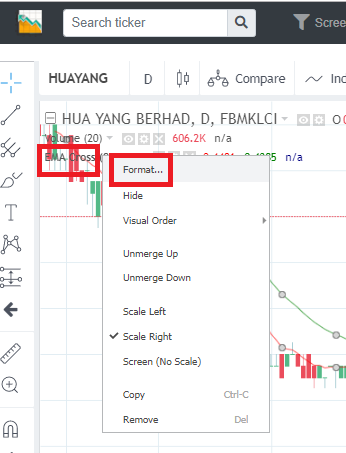

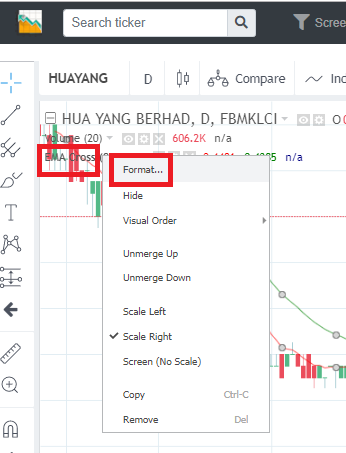

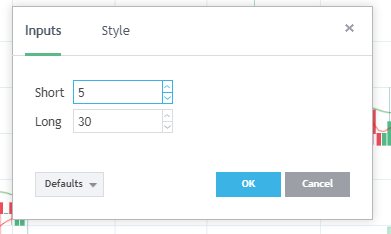

Click EMA and select format can change EMA format

2.) It suitable for uptrend stock

3.) Follow rule "cut losses short let profit run"

4.) Follow trend (big shark run, we follow run)

Disadvantage

1.) Not suitable for side way chart (loss "water fee".)

2.) Gap up or gap down.

Gap up, price up and price become expensive. Hard to buy =.=...(Gap down, too cheap to sell)

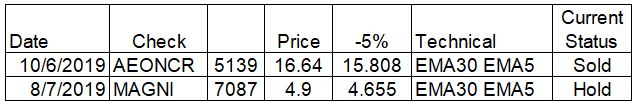

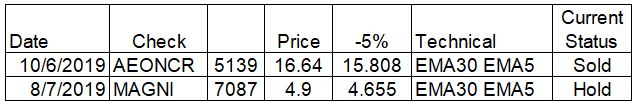

Practical Test:

*not buy at EMA cross

1.) AEONCR

Reason I select it :

a.) https://klse.i3investor.com/blogs/WahLau/216056.jsp

b,) not bad news

c.) Stable uptrend

d.) Back test good results in EMA

Sold 16.54-16.20 (31/7/2019) Reason EMA cross

Temporary not buy due to bad news :https://klse.i3investor.com/blogs/sinchew_company_story/214598.jsp

2.) Magni

a.) https://klse.i3investor.com/blogs/WahLau/216056.jsp

b.) Olympic

c.) Back test good result in EMA

d.) 1/8/2019 no yet sell =.=V than gap up (much sell within 3 days if EMA cross no come back)

Conclusion:

1.) EMA suitable stable share to buy (less gap up or down)

2.) Share too low price and high variation not so suitable EMA, (increase short EMA to reduce variation)

3.) EMA suitable for uptrend or cycle share

4.) Not buy share have bad news but share price not yet gap down

5.) Better buy when start buy signal. Now put the share plan to buy in watch list and manual check. If you have free software can alert function when have buy signal please intro.

1 of popular technical indicator is EMA. We can consider it function like moving average with closer to price.

Want to learn more please refer link as below:

https://www.babypips.com/learn/forex/exponential-moving-average

How to use?

EMA 5 line upper EMA 30 -> buy

EMA 5 line below EMA 30 -> sell

Advantage of EMA

1.) Easy understand, follow and free of charge

*Huayang as example no buy call =.=....

MQ Trader : https://klse.i3investor.com/mqtrader/sf/chart/stk/5062

klsescreener : https://klse.i3investor.com/mqtrader/sf/chart/stk/5062

*by this article I found klsescreener have many indicator to choose. ^^V

Click EMA and select format can change EMA format

2.) It suitable for uptrend stock

3.) Follow rule "cut losses short let profit run"

4.) Follow trend (big shark run, we follow run)

Disadvantage

1.) Not suitable for side way chart (loss "water fee".)

2.) Gap up or gap down.

Gap up, price up and price become expensive. Hard to buy =.=...(Gap down, too cheap to sell)

Practical Test:

*not buy at EMA cross

1.) AEONCR

Reason I select it :

a.) https://klse.i3investor.com/blogs/WahLau/216056.jsp

b,) not bad news

c.) Stable uptrend

d.) Back test good results in EMA

Sold 16.54-16.20 (31/7/2019) Reason EMA cross

Temporary not buy due to bad news :https://klse.i3investor.com/blogs/sinchew_company_story/214598.jsp

2.) Magni

a.) https://klse.i3investor.com/blogs/WahLau/216056.jsp

b.) Olympic

c.) Back test good result in EMA

d.) 1/8/2019 no yet sell =.=V than gap up (much sell within 3 days if EMA cross no come back)

Conclusion:

1.) EMA suitable stable share to buy (less gap up or down)

2.) Share too low price and high variation not so suitable EMA, (increase short EMA to reduce variation)

3.) EMA suitable for uptrend or cycle share

4.) Not buy share have bad news but share price not yet gap down

5.) Better buy when start buy signal. Now put the share plan to buy in watch list and manual check. If you have free software can alert function when have buy signal please intro.

https://klse.i3investor.com/blogs/WahLau/218996.jsp