IPO - LEONG HUP HOLDINGS BHD - MAIN BOARD, CONSUMER

PRODUCTS/SERVICES - MY VIEW

First of all I would like to share all the latest fair value reports

which I had come accross in the news / internet for everybody's

reference (below also the links and images source of the target). Those

who maybe have coverages from other brokers, please do share at the

comment section below.

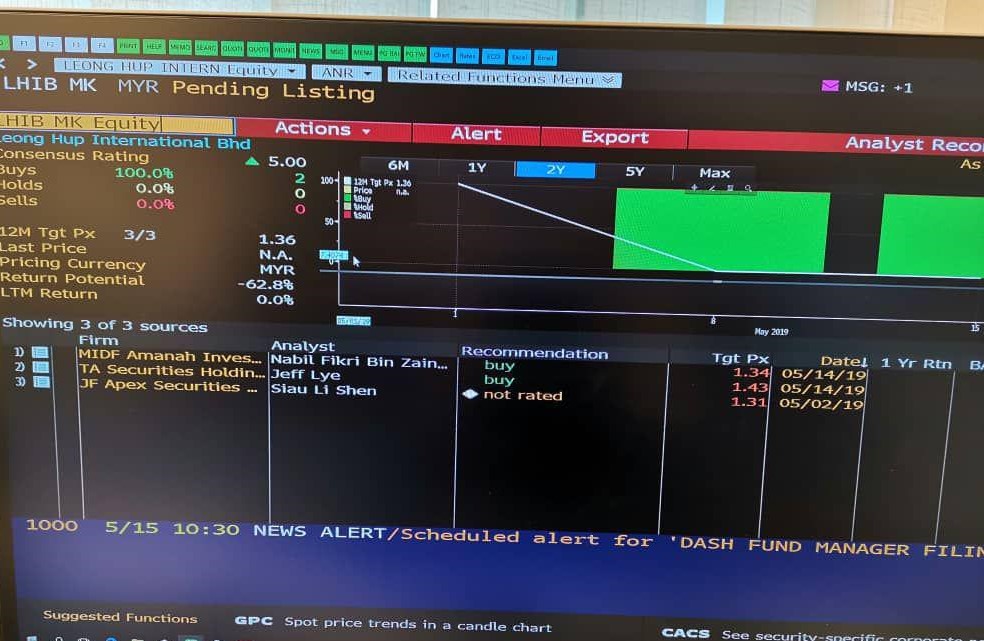

1. PUBLIC INVEST - RM 1.26

2. INTERPAC SECURITIES - RM 1.27

3. MIDF AMANAH INVESTMENT - RM 1.34

4. JF APEX - RM 1.43

5. TA SECURITIES - RM 1.43

From the above, the range of fair value is from lowest of 1.26 to 1.43.

To me, taking a middle price approach would be conservative at the

moment, therefore, I am looking at a personal TP of around RM 1.35.

A few factors to look at which make this counter a positive sentiment for tomorrow listing:

1. Q1 Earnings Up 15% to RM 60.58 million

Ahead of its listing tomorrow, the company reported an increase in earnings of 15% compared to last year same quarter.

2. Louis Dreyfus as Cornerstone Investor

Louis

Dreyfus is one of the world's biggest traders of animal feed, rice,

oilseeds, sugar and coffee and employs about 17,000 people worldwide. It

is also a familiar investor in Malaysia's agriculture industry.

As commented by Louis Dreyfus CEO on 25th April 2019, "LDC's cornerstone investment in LHI's IPO is in line with our strategy

to diversify further downstream and strengthen our footprint in growth

markets by partnering with key players in the feed, food and nutrition

value chain,"

Other big names mentioned to have garnered

keen interests from billionaire Tan Sri Quek Leng Chan, Employees

Provident Fund, the AIA Group, Maybank Asset Management, RHB Asset

Management and prominent investor Chua Ma Yu.

ALTERNATIVE COUNTERS WHICH MIGHT SEE ACTION DUE TO

SENTIMENT FROM LEONGHUP

All poultry counters should be seeing interest ahead of LEONGHUP

listing. However, 2 that I am particularly interested at are TEOSENG and

MFLOUR.

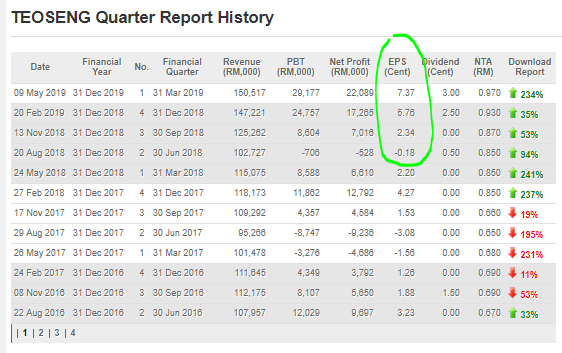

1. TEOSENG - Superb Quarter Result & LEONG HUP 53.7% Ownership

Recently, TEOSENG had posted a superb QR as below.

We see that EPS is improving each quarter. If the recent EPS of 7.37c

can be maintained for 4 quarters, we get full year EPS of around 29.48c.

Therefore. taking a conservatie PE ratio around 8-10 will yield target

price around RM 2.36 - 2.95 for longer term.

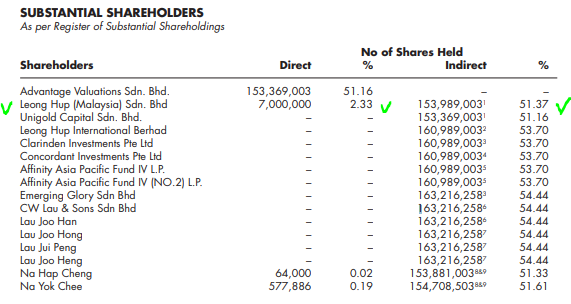

Also, refer below major shareholder list for TEOSENG as of latest 2018

Annual Report. LEONG HUP is a 2.3% direct shareholder and 51.37%

indirect shareholder of TEOSENG. Therefore, any price action in LEONG

HUP tomorrow should be reflected in TEOSENG.

2. MFLOUR - Superb QR and Rapid Expansion

Recently, MFLOUR had posted a superb QR as below.

We see that EPS is 3.02c compared to previous quarter loss. Should the

company maintain performance of 3c per quarter EPS, full year EPS will

be 12c. Taking a conservative PE Ratio of 8-10 will yield a target price

of RM 0.96 - 1.20 in long term.

MFLOUR has been rapidly expanding its capacity recently. You may refer below blog write up on this matter.

CONCLUSION

Considering all the above, I will be monitoring closely LEONGHUP, TEOSENG and MFLOUR for tomorrow 16/5/2019.

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/206613.jsp

https://klse.i3investor.com/blogs/Bursa_Master/206613.jsp