Hi to all fellow investors and traders !

Today I would like to highlight a stock which has been underlooked by

many, as the price remains low and in accumulation mode. That stock is SMRT HOLDINGS BERHAD or SMRT (Code 0117, ACE, Technology).

SMRT (BSKL Code 0117)

Personal TP Short To Mid Term : 20c, Long Term : 30c

Here are my thoughts :

1. Major Shareholding Changes Recently - A Possible Takeover Situation ??

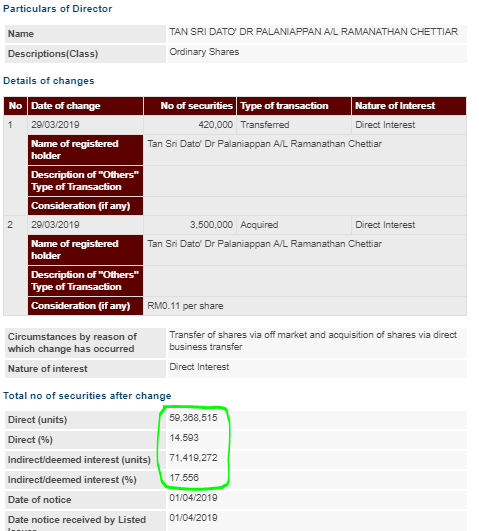

a. Addition by Director - TAN SRI DATO' DR PALANIAPPAN A/L RAMANATHAN CHETTIAR

Refer below screenshot of his latest shareholdings in SMRT. The above

director had been accumulating shares since last year 2018 until

recently in March 2019. His total shareholding now is brought up to

130.8 million shares (32.149%) which is considered rather significant

and indicating plans to make major moves in this company.

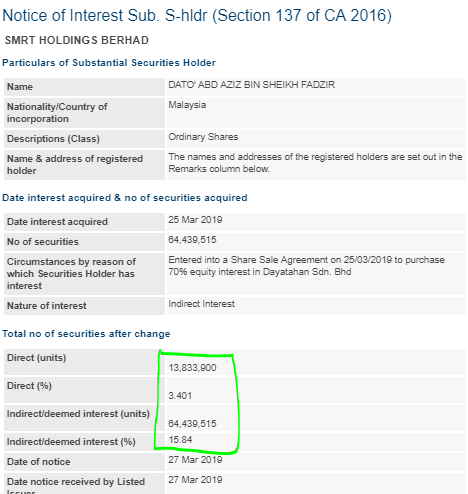

b. Addition by Substantial Shareholder - Dato' Abd Aziz Bin Sheikh Fadzir

Refer screenshot below. Dato' Abd Aziz Bin Sheikh Fadzir is not one of

the company directors. But recently, his total shareholdings stood at

78.3 million shares (19.241%).

Combined with above director, these 2 individuals already hold about 51.3% of the company. We should be on the look out for further shareholding movements in anticipation of a major event.

2. Financial Analysis - Undervalued As Now Trading about 2 X Forward PE

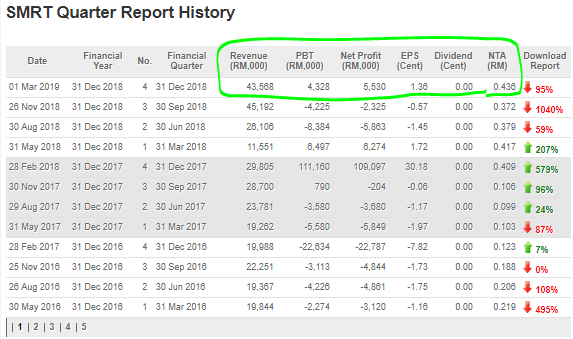

Refer below latest Quarter Report released by company on 1 March 2019.

I would like to highlight the result of latest March 2019 quarter

report, which the company had reported earnings per share (EPS) of 1.36

cents. Should this earning be consistent through out the whole year,

full year forward EPS should be at 5.44 cents. With the current price os

11.5 cents, this means that it is currently trading at a mere 2.11 X

Forward PE.

The company also has strong assets with NTA at 43.6 cents.

As commented in the QR, this improvement is primarily attributable the

inclusion of revenue from Asia Metropolitan University, Asia

Metropolitan Colleges and Asia Metropolitan International School

following the consolidation of Minda Global financial results from 1

February 2018.

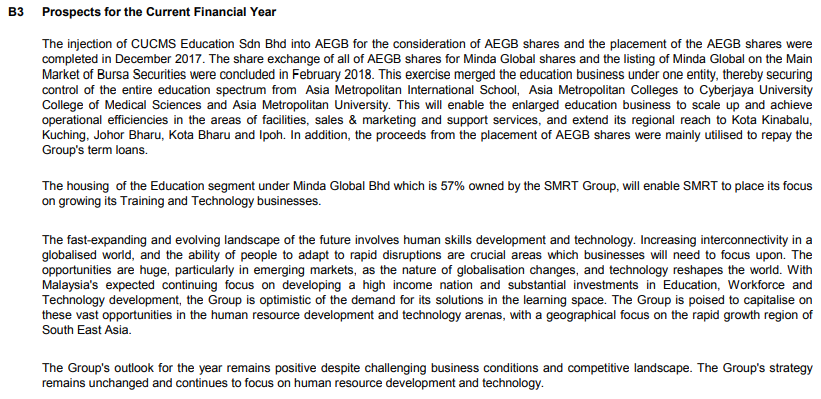

Also refer below prospects of company taken from QR. Basically, the

Group's outlook for the year remains positive despite challenging

business conditions and competitive landscape. The Group's strategy

remains unchanged and continues to focus on human resource development

and technology.

3. Technical Analysis - A Good Entry in Accumulation Stage

Refer below monthly chart of SMRT. As you can see, the current downside

on this stock is very low as it had peaked at 93 cts in Nov 2014 and

has been on downtrend since then.

The recent low was 9.5 cts in December 2018, which was when the market

sentiment was very negative and most stocks had touched lows.

With the diminishing volumes being transacted at current prices and

with the company financials turning around, I foresee that accumulation

period will be ending soon and the stock shall start to uptrend towards

first resistance of 20 cts and second resistance of 30 cts.

Therefore current entry, is considered a low downside, but high upside potential returns.

CONCLUSION

Based on my opinion, SMRT should be soon be going on uptrend mode, based on below:

a. Shareholding Changes - More Acqusitions by Director and Substantial Shareholders

b. Financial Analysis - Latest QR results had turnaround from loss to profit

c. Technical Analysis - Low Downside, High Upside Potential towards R1 20 cts , R2 30 cts

Thanks for reading and see you in the next post.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/204116.jsp