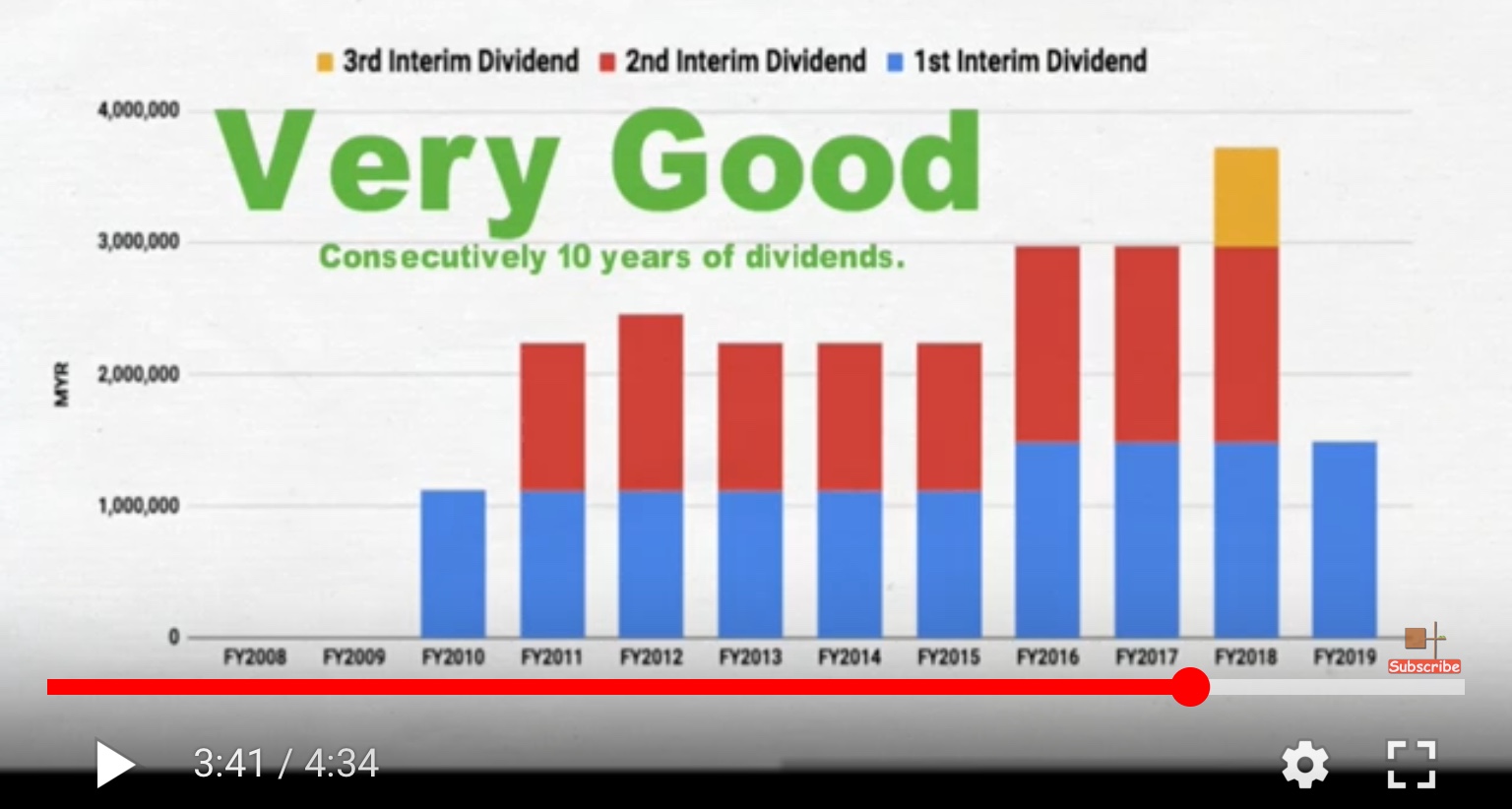

This is a great video on fundamentals of Opensys done by YAPSS

Which I think is a waste if not shared with many smart i3 investors.

https://www.youtube.com/watch?v=Uu-lDarLOI0

If you are too lazy to watch the whole video, here’s the snapshots of the key points

Which I think is a waste if not shared with many smart i3 investors.

https://www.youtube.com/watch?v=Uu-lDarLOI0

If you are too lazy to watch the whole video, here’s the snapshots of the key points

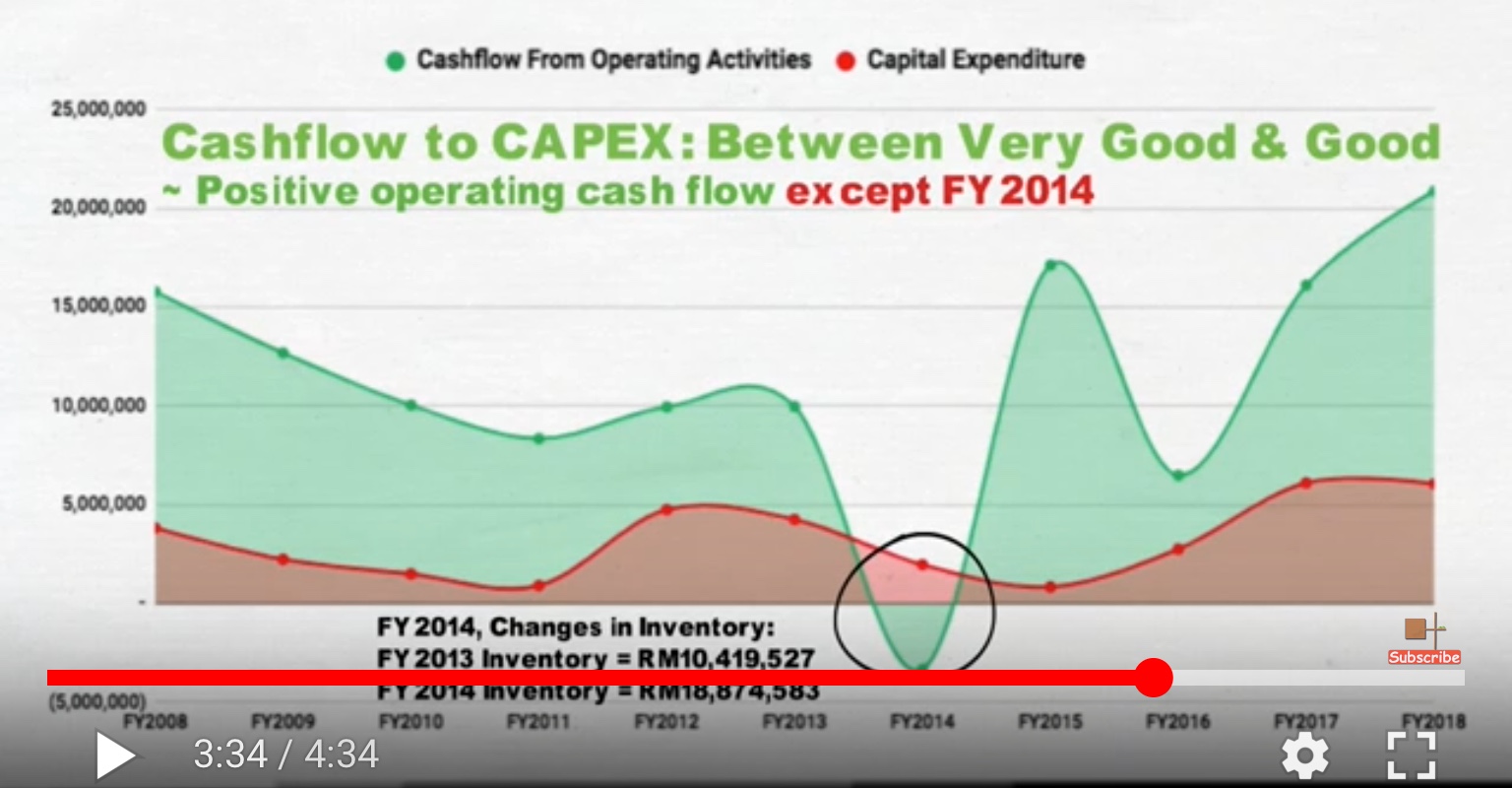

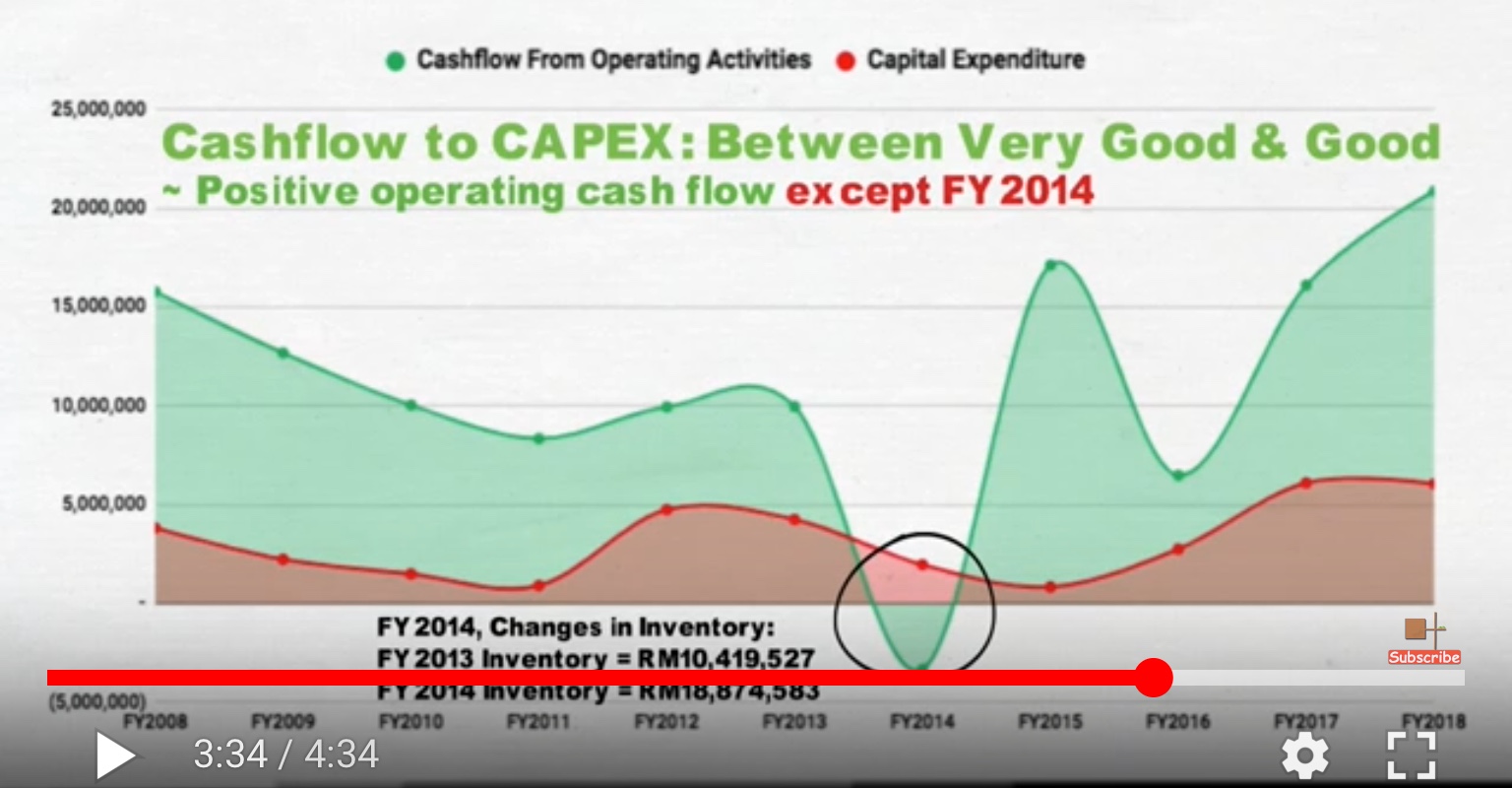

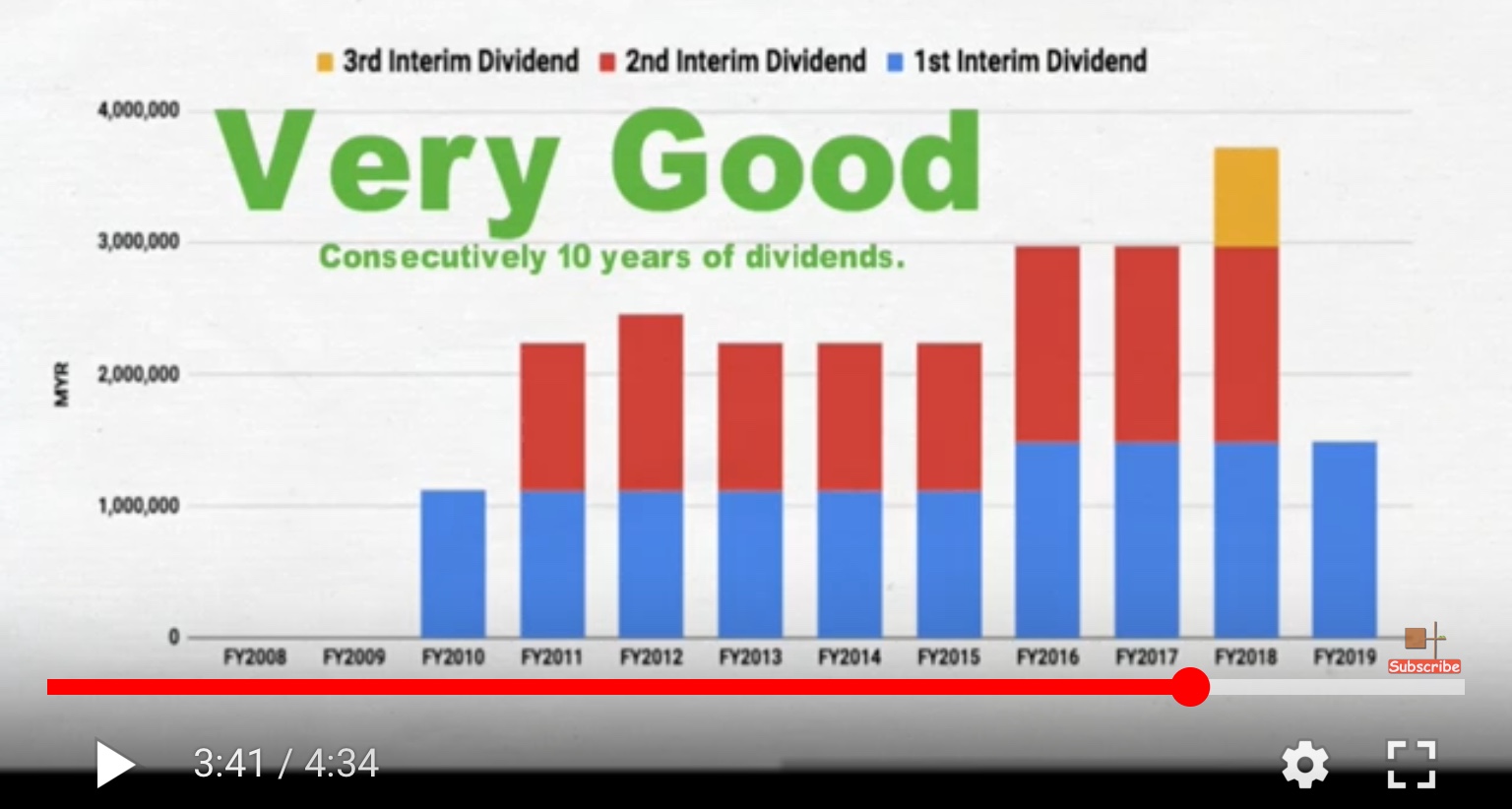

Opensys’ free cash flow and cash yield

FCF = CFFO – Net Capex

Cash flows from operations (CFFO) was

RM20.9 million last year, way much higher than the net profit of RM10

million. Net capex remained the same at RM6 million.

CY = Free cash flow (FCF) / Price

FCF for Opensys surged 48% to RM14.8

million last year as compared to RM10 million in the previous year. At

34 sen, the cash yield (CY) is 15%.

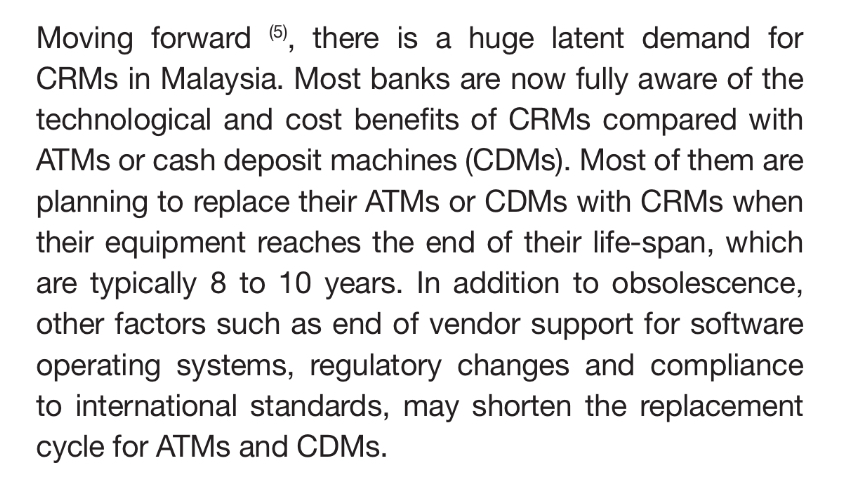

Is cashless society a threat?

“In tech-savvy Singapore, where

almost everyone has a mobile phone, nine out of 10 people, still prefer

to pay for everyday transactions the old-fashioned way – with cash.

According to interviews conducted by Bloomberg in September 2017, some

of the reasons why Singaporeans prefer cash are because it is more

convenient than swiping a bank card or in case when they can use digital

devices, machines sometimes break down and cannot process a payment.”

Read what the management had to say (Warning: You will change your mind after reading)

Cash cow

“In

maintenance services, the banks pay us an annual maintenance fee of

10-12 percent based on the selling price of the machines that we sold

them. In return, we service and repair the machines to ensure high

availability and optimum uptime.” Opensys annual report

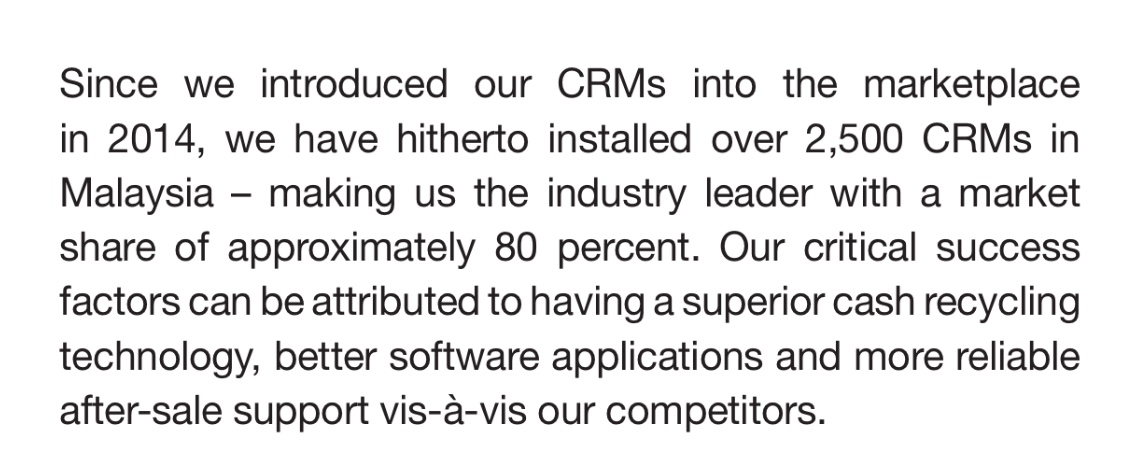

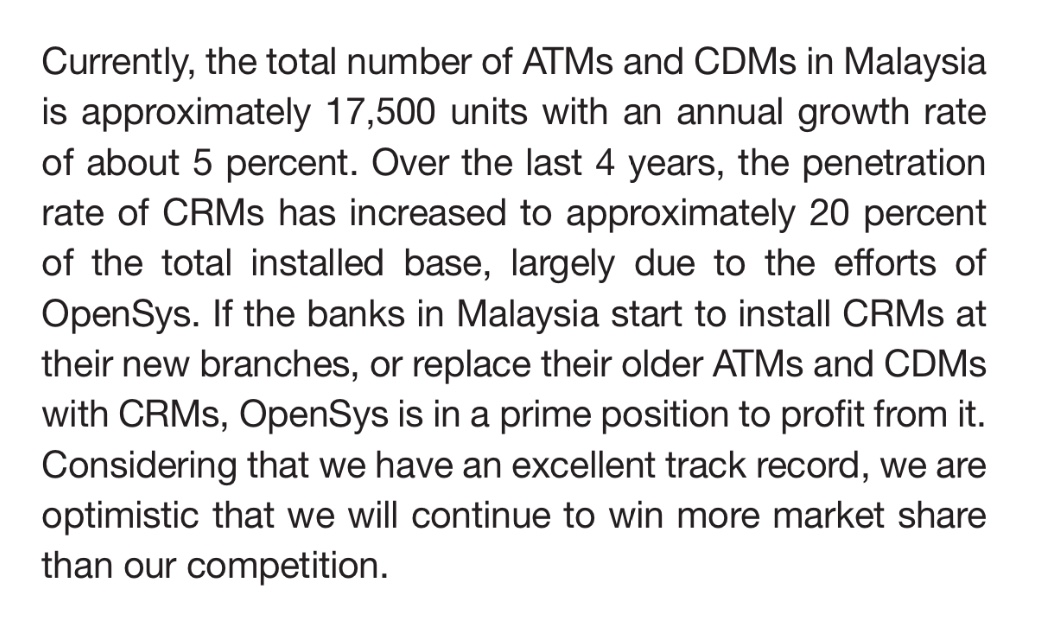

Opensys

mentioned that it had installed over 2,500 CRMs in Malaysia since 2014.

Maintenance fee is recurring after 2-3 years free warranty period.

Lifespan of machines is 8-10 years. What is total profit for 2,600

machines? Recurring for the next 5-7 years? Nobody seem to realise

Opensys is a cash cow in the making!

Disclaimer: The article above does not represent a recommendation to buy or sell.

https://klse.i3investor.com/blogs/Amazinggrowth/204254.jsp