MCT Berhad: A Lowly Geared Developer with a TP of RM0.90

1) What MCT does?

MCT Berhad, an investment holding company headquartered in Subang Jaya, operates as an integrated property development company in Malaysia. The group's operating divisions include the development of residential and commercial properties, construction activities, providing civil and mechanical engineering services, investment holding. The company also trades in construction materials; rents plant and machinery; operates hotels, fitness centers, and cinema and seminar facilities; and provides utility services, as well as leases properties.

2) Background of MCT Berhad

Back in 1999, MCT started their operations as Modular Construction Technology Sdn Bhd, with a total paid-up share capital of RM250,000 when started, and today, they are one of the larger property counters listed on the Malaysian stock exchange.

MCT existing landbank comprises over 540.2 acres of which only 20.4 acres have been fully developed. On-going and soon-to-be launched projects with a combined gross development value (GDV) of approximately RM8 billion account for another 209.9 acres, leaving 309.9 acres for future projects with a conservatively estimated GDV of approximately RM5 billion.

3) Strong backup support from the Property Giant - Ayala Land

In April 2015, Ayala Land emerged in MCT Berhad via a private placement during IPO, six months later it bumped up its shareholdings in MCT to 32.95%.

In early January 2016, Ayala Land emerged as a major shareholder of MCT, buying the stake from MCT’s founders. This brought Ayala Land’s holdings to 50.19% and firmly indicated its control of the local property developer. As per MCT 2018 Annual Report, Ayala Land indirectly owns 66.25% of MCT Stake, which makes them the largest shareholder for MCT Berhad.

Ayala Land is part of the oldest conglomerate in the Philippines’ Ayala Corp with a rich history that can be traced back to the 1800s. It is the biggest property developer in the Philippines with market capitalisation of RM53.69bil. The value of approximately RM54bil also means that Ayala Land is even larger than top 10 property developer in Malaysia combined.

Two weeks ago, Tan Sri Barry Goh has resigned from his non-independent, non-executive directorship with the company.

With the strong ownership structure, it certainly assume an implicit support from the parental company in various aspects (financial and expertise).

4) Tan Sri Barry Goh left the board of MCT

Two weeks ago, Tan Sri Barry Goh has resigned from his non-independent, non-executive directorship with the company. In a filing with Bursa Malaysia on 15 April 2019, MCT said Goh quit due to "personal matters". His direct stake in the company has been pared down from 10.46% as at April 4 last year to 5.86% as at April 4 this year.

In my view, it makes sense for Tan Sri Barry Goh to make the move to exit the board as Ayala Land has been extending its control over the company significantly over the past few years. This move will grant Ayala Land the full control over the future direction and strategic positioning of MCT in the Malaysian property market. I see no personnel risk from Tan Sri Barry Goh’s resignation from the board.

5) How was MCT doing financially?

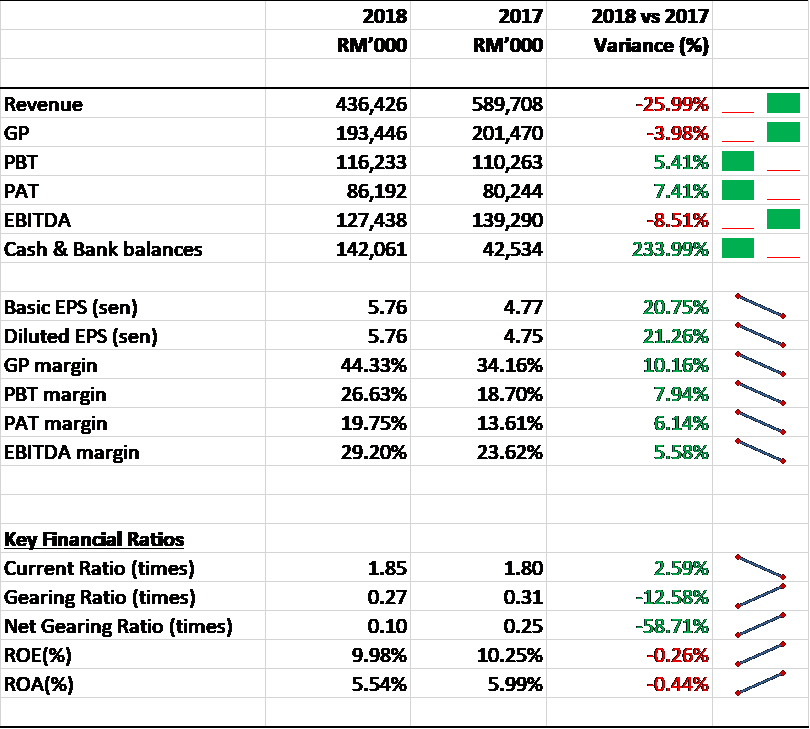

Despite the current weak market sentiment of property sector and oversupply concerns, profit consistency by MCT in contributing >10% over the past 5 years has shown that the company was able deliver great margins on top of proficient cost saving management in their property development in line with the government budget initiatives for FY2019 in supporting the 1st time house buyer range between RM300k to RM700k.

For YoY profitability, MCT has registered a PAT of RM86 million with an approximate margin of 20% in FY2018 compared to RM80 million with an approximate margin of 14% in FY2017. The main revenue driver in 2018 was mainly due to profit contribution from newly-launched project launched in May 2018, Casawood @ Cybersouth. With existing landmark in Subang Jaya, Cyber Jaya & Dengkil owned by MCT, it is considerably a strategic location for property buyer as there are linkage to several new announced public transport such as LRT3 & MRT2 which could gave a heads up for MCT future property planning. On the other hand, we can expect there are at least two 2 projects at Tropicana Metropark and Tropicana Grande to be launched by this year which in turns to be new unbilled sales for MCT.

6) Conservative Balance Sheet

On top of that, MCT was able to generate a net cash of RM100 million from its operational activities which gave them a boost of their cash management. Besides that, MCT has a historical low net gearing ratio of 0.10x where credit concerns are off the bucket list during this challenging environment.

Overall, MCT has been proactively manage their balance sheet and profitability in a cautious manner while government initiatives on affordable housing could further build up MCT profitability as the company have the margins to cater for affordable property structure. Although affordable housing will impact MCT’s business cost, but there will be extra volumes for them to consistently perform throughout the year.

7) Target Price of MR0.90

Credit profile should be an important factor for investors to look into when they want to make their investment decision. The slumping property market in the past years weighted financial burden on the developers’ balance sheet. Developers like Mah Sing, IJMLand and Ecoworld International have been raising debt via issuance of corporate bonds as they are facing reducing credit facilities from the banks. The tightening of bank funds pushed the developers to bear a higher interest rate to issue corporate bonds. It is not the case for MCT.

We are projecting a 3-year net profit CAGR of 8.7% to MYR120m in FY22, taking into account of the recovery of property market in Malaysia amid the supports of government initiatives. MCT could be valued at RM0.90 assuming 10x P/E on 2022F EPS. We believe the stock deserves to trade on par with the Bursa Malaysia Property Index P/E average of 10x, given its high margin business model, supported by a strong balance sheet.

https://klse.i3investor.com/blogs/kokokai/204260.jsp