This article was prepared 1 week plus ago when the share price was at 34 sen. The share price has rallied quite a lot. This

writing is based on my own assumptions and estimations. It is strictly

for sharing purpose, not a buy or sell call of the company.

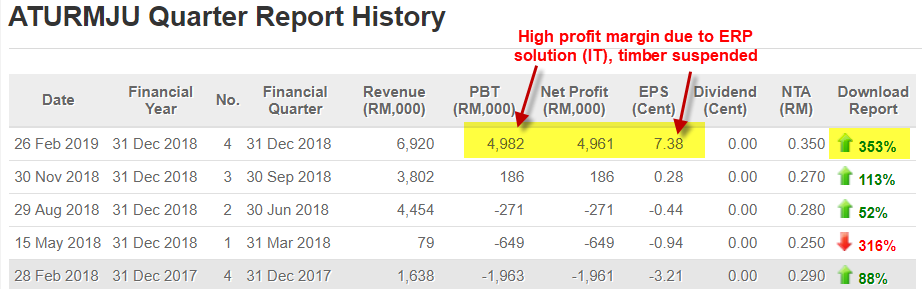

1. ATURMAJU original core business is in timber activities of both

upstream and downstream operations (this biz suspended) through Aturmaju

(Sabah) Holding Sdn Bhd, but recently they made a strategic move by diversifying its timber-related business into information technology (IT) business solutions (mainly ERP), where it has started to make profit in Q3 and Q4 2018 (4.98mil).

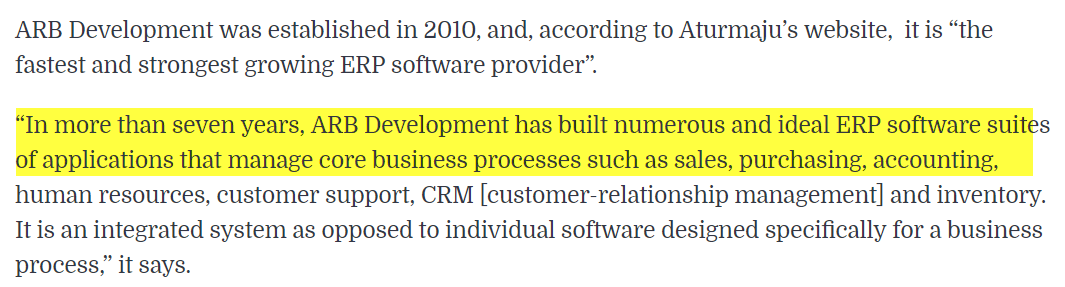

2. ERP stands for Enterprise Resource Planning. One of

the leading ERP software is SAP, from Germany but SAP is very costly

and mostly used by Multinational companies. A highly efficient company

needs optimization in inventory, order management, accounting, human resources, customer relationship management (CRM) etc. ERP software integrates these various functions (inventory etc) into one complete system to streamline processes and information across the entire organization. The main feature of all ERP systems is a shared database

that supports multiple functions used by different business units,

where multiple units of a company can use the same system with updated synced database that normally can bridge MUCH better for their sales orders and their inventory, thus higher revenue, better profit and cost saving can be achieved.3. As ERP is an integrated system in between supply chain from Sales to procurement, from production to inventory, data would be able to be stored in the database uniformly across the branches/subsidiaries, and this enable management team to make business decision faster and plan the way-forward business strategy effectively.

4. FY2018 is a turnaround year for Aturmaju as its revenue increasing and profit improve substantially (FY18 15.3mil vs FY17 11.4mil revenue, FY18 4.2mil vs FY17 -3.6mil profit) The FY2018 EPS improve to 6.4 sen (diluted about 3.8 sen based on latest 111 mil shares base).

5. Aturmaju has secured four ERP projects with the total project value of RM3.52 million in 2018 and it has completed in December 2018. Subsequently, in 3Q18, the company has secured another three projects for the total project value of RM6.9 million.

6. Aturmaju has only RM0.13mil debt company with cash in hand of RM2.53mil (up to 31 Dec 2018). What attract my eye is its high net profit margin of its IT division which contributes 99% of their 4th quarter profit (also majority of 3rd quarter profit).

7. Some may ask why Aturmaju 4Q18 profit margin so high. My guess is software development cost mainly lies on programmer salary (develop source code of ERP) and maybe already recognized in previous quarter. I like its business due to it will not subject to raw material price fluctuation and the selling price of the ERP software can be varied depends on customization and level of optimization level achieved. The snapshot of 4Q18 result as below:

8. Aturmaju had commenced its ERP business in mid of 2018 through the award and completion of an IT project to design, develop, install and support ERP solutions with a project value of RM20k. As at Oct 3 2018, the group has secured another three ERP projects, worth a combined RM5.6 million (refer to appendix).

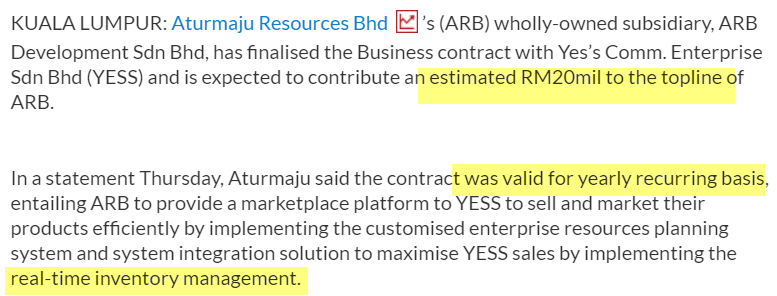

9. This super high net profit margin of ERP solution is sustainable or not? Many may assume not sustainable over long term but they company already secured a 20 mil longer term and recurring contract with Yes’s Comm. Enterprise Sdn Bhd (YESS) in Feb 2018. (source: https://www.thestar.com.my/business/business-news/2019/01/24/aturmaju-secures-rm20mil-per-year-contract/#zC0DsbRgfryVq62g.99) An excerpt of the news on this YESS contract:

11. According to company announcement, the contract from YESS provide a longer term recurring income and expected to generate up to 20 mil revenue in 2019 (provide customized ERP solution). I expect lower margin from YESS’s contract but it is recurring as the contract valid for 1 year (renewable subject to negotiation).

12. The revenue from ERP solution is 8 mil in FY2018 and they are targeting to secure more customer in FY2019 with several customers in free trial of their solution. Their target customers include retailers, E-commerce owners, manufacturers and traders which optimization of their business processes can be achieved by adoption of ERP system.

13. In a highly competition business environment today, business processes optimization is critical for company to drive higher revenue. In this case, SME companies may need a customized ERP solution for their business and this provide opportunity for Aturmaju which they provide a free ERP trial before adoption. Let see a news below from Theedge (Nov 2018) for Malaysia IT spending Trend as below:

(source:https://www.theedgemarkets.com/article/malaysia-it-spending-grow-46-2019-rm652-billion-says-gartner)

(source:https://www.theedgemarkets.com/article/malaysia-it-spending-grow-46-2019-rm652-billion-says-gartner)

This is a positive news as it will allow Aturmaju to gain exposure to a high-growth IT segment with a lot of future ERP revenue potential.

14. First IoT (Internet of Thing) development project announcement in March 2019 with contract value of 78 mil (3

years) and Aturmaju acts as SEPCM (System, Engineering, Procurement,

commissioning & Management). The project is from Perkasa Selalu Sdn.

Bhd. (PSSB) for a development of an Intelligence Modern Lifestyle (unique selling point) of a Service Apartment in Kuala Selangor.15. Aturmaju is the sole project manager & consultant for the IoT development project and all construction and related jobs will be outsourced to third party with consent from PSSB. Its function is to manage the integration of the whole system into the IoT SEPCM Project, which about 35% of the contract value is for IoT systems and the remaining 65% of the contract value will be for project management and construction works.

16. The project is expected to commence once Aturmaju obtained their financing of 40 mil by charging the development land to banks and required authorities approval (obtained by PSSB) and may contribute positively to Aturmaju in 2019-2022 revenue and results.

17. Aturmaju also express its interest to venture into renewable energy which is efficient rooftop solar panel. (refer to announcement from this link: http://malaysiastock.biz/Company-Announcement.aspx?id=1128351)

18. Main future profit driver should be come from ERP solutions supported by IoT and project management. It is an asset-light business with high profit margin from ERP where we can observe its inventory value just stand at RM10k (as they have close to zero raw material cost as their product is ERP software).

19. Valuation: Show growing profit for past 2 quarters results when they started to venture to ERP solution in 2018. If the ERP profit in 4Q18 can be sustainable (based on their YESS’s orderbook), possible annualized profit = ~18-20 mil, discount 25%, discounted annualized profit = 15mil --> Estimated FY19 EPS = 13.4 sen. Fair value of Aturmaju can be summarized in the table below:

|

PEx (EPS 13.4 sen, 15 mil) |

Fair value |

|

4x |

53.6 sen |

|

5x |

67.0 sen |

|

6x |

80.4 sen |

The justifications of Aturmaju should worth PE of 4x-6x are as below:

- It is an asset light company with nearly zero debt which they require a very low capex investment on their existing ERP solution business (Dato Larry Liew’s team has developed their ERP solution for 7 years before joining Aturmaju)

- High Margin of its ERP solution - Average net Profit margin of above 20% in Q4 2018

- Not subject to raw material price fluctuation as its core product is ERP software (more stable profit).

- Venture into a growing IoT solution where the IoT segment is well-supported by future smart home, AI and 5G communication in coming 2-3 years.

20. Risk

- Lower profit margin due to competition from other ERP solution providers

- Loss of its big customer of its ERP solution.

- Execution and project delay risk from its IoT project as slower property market in Malaysia.

- IFCAMSC – high profit margin, just 0.55mil debt, PEx 23, market cap 282 mil

- Orion – high profit margin, zero debt, PEx not applicable as full year not yet profitable (market cap 107 mil)

- Rexit – high profit margin, zero debt, PEx 17, market cap 132 mil

- N2N – low to moderate profit margin, PEx 35.6, market cap 466 mil

- Eforce – Moderate profit margin (revenue about the same with aturmaju), PEx 30, market cap 201 mil

- Aturmaju (ARBB new name on 2 May) – high profit margin, near to zero debt, PEx 8.8 (based on FY18 result where timber still losing & now suspended), market cap 37mil (based on 34 sen).

- ERP still have big market in Malaysia as it can optimize business processes (Not for public).

-

Top benefit of implementing ERP software

- Why have a dormant company?

- Aturmaju-PA share conversion and dilution analysis (still look cheap based on my analysis), This analysis is Not for public

- Simple Comparison of ERP market leaders. This part is Not for public.

- Aturmaju’s Auditor background:

RSM Malaysia (formerly known as RSM Robert Teo, Kuan & Co.) is a

member firm of RSM International. RSM is the 6th largest worldwide

network of independent audit, tax and advisory firms, encompassing over

120 countries, 800 offices and 43,000 people internationally on hand to

serve your needs.

Founded in 1978, RSM Malaysia is now one of the leading and

fastest-growing providers of audit, assurance, accounting and tax

services to companies in Malaysia. Our affiliates also provide a diverse

range of business solutions and consulting services, including

corporate finance and transaction support, cross-border tax, risk

assurance service, business restructuring, outsourcing and general

management consultancy.

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

https://klse.i3investor.com/blogs/lionind/204439.jsp