KYY's comments about the broking firms/analysts who might be deliberately pushing down Dayang's prices were uncalled for, over the top, childish, naive and petulant.

1) You may attack a research report, BUT on merits, please. You may dissect their assumptions and projections - if you find fault with them, call them out as weak research. To jump to "pushing down prices" is WAY, WAY, BELOW THE BELT. It is like your own kid who comes home past the 10pm curfew, say 1am, and immediately you jump to the conclusion that he must prove that he has not been doing drugs.

2) Why must all research agree with your market position? If all research analysts must follow KYY's golden principles, then no need to have other opinions. And yet when the negative research reports came out, there was only one point argument made by KYY as to why the analysts must be weak to not see the lofty and positive projections by KYY as being close to prophetic.

3) Why write to SC??? If an investor felt that he/she has been wronged or cheated, then he/she may have a case. This is like a kid crying running back to mummy cause his ice cream fell to the ground.

4) To buy at lower prices??? We ALL want to buy at lower prices. So what if all brokers buy at lower prices? If they think RM1.70 was too high, and it falls down to RM1.20... maybe I will buy then. What is wrong to buy lower? The insinuation was that they acted maybe collusively to shock the market down for Dayang. That may or may not be true but you cannot seriously SAY that out loud that you SUSPECT they may be depressing Dayang's prices UNLESS you have solid evidence.

Even then, what kind of evidence do you think you can have? That they bought 100m together from RM0.90 sen to RM1.30, and sold at RM1.60... and being clean of slate they proceeded to issue sell reports? Is this the kind of evidence you are seeking? If you are, sorry man, even if you find that to be true, it is willing-buyer willing-seller.

Firstly, to determine that the company bought, ... which account or accounts are you referring to - remisier, proprietary, fund management?? You can't attack remisiers' accounts as they act for their clients. You cannot whack prop traders as they act on their own behalf, only that they share their gains with the company. Hence if you want to target your complaint properly, it should be to look for transactions by "in house, broker owned fund management transactions" - I think I said too much.

Then you have to link the analyst to the said buyer/seller of shares - how, how did the analyst benefited... I think easier to convict Jho Low la.

5) ... and my dear friend, why say you have 30m shares???!!!... if you are writing to SC, THEY KNOW ALL YOUR TRANSACTIONS la. Is it for the "readers" to read that? Your reaction to that statement as a writer and your underlying assumptions and motives will be very revealing for your goodself.

The same goes for all readers when we read that statement: jealous ah, good for him ah, none of our biz, a bit ego ah??, its just a stock trade ... How we react internally tell ourselves a lot about our own prejudices, biases and character.

6) What I found "jumping to conclusions" too much was the statement that the brokers were depressing to buy at lower levels. KYY cannot accept the fact that there might be other learned people who may not feel the same way. To KYY, all learned people in the industry MUST FEEL THE SAME WAY about the stock, everyone is positive, only that some chowkar wanted to buy cheaper. I mean, come on la.

7) Plus ah... when did Malaysian research reports become so influential??? Just look at the production rate of all analysts - they issue notes and reports at least a few times a week - how influential are their reports. Go find the correlation. Monkey throw darts also sometimes hit bullseyes, and to me, that was largely what happened. The closest approximation to some kind of misdeed may come from (if any) the "fund management" side (size) ... look into that area. Because largely all that barking KYY was up against the wrong pokok.

8) While I say most analyst reports locally are not influential, they do matter a bit more when the stocks have been very volatile. Any stock that has surged or dropped perceptibly over a short period of time (1-2 weeks) are bound to be highly sensitive to any kind of newsflow. Not just Dayang... look at Prestariang and MY EG (on the way up and down)... there were just as many negative reports on MYEG and Prestariang on the way down... why no calls of collusion to depress prices to buy cheaper?

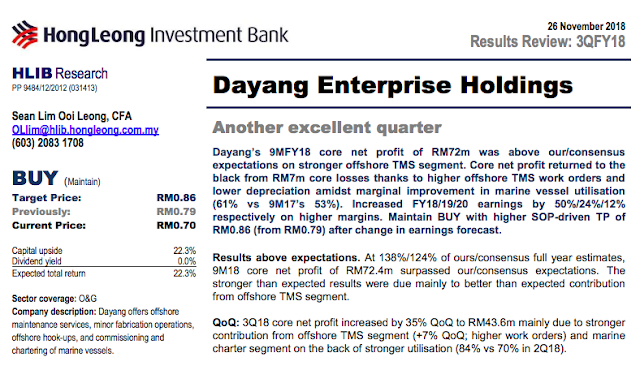

9) Look at the November 2018 report, a BUY at around RM0.70... target RM0.86. Subsequent to that, I think he upgraded the target price to RM1.15. Now KYY is whacking an analyst who has called a 40% gain in a stock correctly. To be fair to the analyst, he did not call for an immediate SELL when it went past his target price of RM1.15 ... while waiting to speak to the management of Dayang, the stock went even higher to RM1.70. To call a SELL on a stock that has surged past your target price of RM1.15 within a week or two to RM1.70 is called PRUDENT. On March 12, he can only call a BUY, SELL at RM1.70. Imagine your last target 10 days ago was RM1.15... how to follow up with another report for a higher target price than RM1.70?

The analysts have sufficient reasons to call for whatever target price they feel comfortable. This is my most important point, if the analysts had been working with in house funds or in-house fund management units - wouldn't they have all ISSUED A BUY REPORT much earlier with EVEN MUCH HIGHER TARGET PRICES??? If I bought a huge position and I want to exit at higher levels, I would call the analyst to issue a lofty report. So there was none of that.

Because KYY couldn't use that Occom 's Razor explanation, he had to go for the more difficult explanation of depressing prices TO COLLECT CHEAPER. Bollocks.

10) If KYY believes his target price of RM3.00 is achievable by 2020, why the petulant behaviour over short term gyrations? Some more, KYY thinks these brokers-analysts might be colluding to BUY cheaper, so they are still long term buyers. So don't worry la... cannot kick up a fuss everytime don't kena 4D.

11) KYY's second para above: .. "big institutional investors are responsible ..I have seen 150m shares changed hands .."

That statement might shed light on a naive understanding of volume traded in any stock. If a stock had 150m volume, largely 30-60% of the volume would have been churned by certain day traders and prop traders (who may or may not be acting in concert with certain people). Having that as a backdrop, it is easy to see how some day traders or prop traders could accelerate a stock's rise or fall by sheer momentum: e.g. buy 10m sell 8m Day 1, buy 15m sell 10m Day 2, buy 10m sell 12 m Day 3, etc... that kind of activity (momentum build up in volume and price upticks) will be highly successful when the planets are aligned (good sentiment, right sector play, strong catalysts ... all in Dayang's favour). Thus you will find more than a few of these bigwigs besides KYY holding 5m-20m position each and basically encouraging more participants as they go along. Any sign of bad news, real or fake, will trigger a landslide.

But as in most things, they will revert to the mean. If Dayang's prospects are really great the mean will be on an uptrend anyway, why bother about the noise?

In my view, that's what happened to Dayang.

https://malaysiafinance.blogspot.com/2019/03/kyy-jabs-with-analysts-commentary.html

1) You may attack a research report, BUT on merits, please. You may dissect their assumptions and projections - if you find fault with them, call them out as weak research. To jump to "pushing down prices" is WAY, WAY, BELOW THE BELT. It is like your own kid who comes home past the 10pm curfew, say 1am, and immediately you jump to the conclusion that he must prove that he has not been doing drugs.

2) Why must all research agree with your market position? If all research analysts must follow KYY's golden principles, then no need to have other opinions. And yet when the negative research reports came out, there was only one point argument made by KYY as to why the analysts must be weak to not see the lofty and positive projections by KYY as being close to prophetic.

3) Why write to SC??? If an investor felt that he/she has been wronged or cheated, then he/she may have a case. This is like a kid crying running back to mummy cause his ice cream fell to the ground.

4) To buy at lower prices??? We ALL want to buy at lower prices. So what if all brokers buy at lower prices? If they think RM1.70 was too high, and it falls down to RM1.20... maybe I will buy then. What is wrong to buy lower? The insinuation was that they acted maybe collusively to shock the market down for Dayang. That may or may not be true but you cannot seriously SAY that out loud that you SUSPECT they may be depressing Dayang's prices UNLESS you have solid evidence.

Even then, what kind of evidence do you think you can have? That they bought 100m together from RM0.90 sen to RM1.30, and sold at RM1.60... and being clean of slate they proceeded to issue sell reports? Is this the kind of evidence you are seeking? If you are, sorry man, even if you find that to be true, it is willing-buyer willing-seller.

Firstly, to determine that the company bought, ... which account or accounts are you referring to - remisier, proprietary, fund management?? You can't attack remisiers' accounts as they act for their clients. You cannot whack prop traders as they act on their own behalf, only that they share their gains with the company. Hence if you want to target your complaint properly, it should be to look for transactions by "in house, broker owned fund management transactions" - I think I said too much.

Then you have to link the analyst to the said buyer/seller of shares - how, how did the analyst benefited... I think easier to convict Jho Low la.

5) ... and my dear friend, why say you have 30m shares???!!!... if you are writing to SC, THEY KNOW ALL YOUR TRANSACTIONS la. Is it for the "readers" to read that? Your reaction to that statement as a writer and your underlying assumptions and motives will be very revealing for your goodself.

The same goes for all readers when we read that statement: jealous ah, good for him ah, none of our biz, a bit ego ah??, its just a stock trade ... How we react internally tell ourselves a lot about our own prejudices, biases and character.

6) What I found "jumping to conclusions" too much was the statement that the brokers were depressing to buy at lower levels. KYY cannot accept the fact that there might be other learned people who may not feel the same way. To KYY, all learned people in the industry MUST FEEL THE SAME WAY about the stock, everyone is positive, only that some chowkar wanted to buy cheaper. I mean, come on la.

7) Plus ah... when did Malaysian research reports become so influential??? Just look at the production rate of all analysts - they issue notes and reports at least a few times a week - how influential are their reports. Go find the correlation. Monkey throw darts also sometimes hit bullseyes, and to me, that was largely what happened. The closest approximation to some kind of misdeed may come from (if any) the "fund management" side (size) ... look into that area. Because largely all that barking KYY was up against the wrong pokok.

8) While I say most analyst reports locally are not influential, they do matter a bit more when the stocks have been very volatile. Any stock that has surged or dropped perceptibly over a short period of time (1-2 weeks) are bound to be highly sensitive to any kind of newsflow. Not just Dayang... look at Prestariang and MY EG (on the way up and down)... there were just as many negative reports on MYEG and Prestariang on the way down... why no calls of collusion to depress prices to buy cheaper?

9) Look at the November 2018 report, a BUY at around RM0.70... target RM0.86. Subsequent to that, I think he upgraded the target price to RM1.15. Now KYY is whacking an analyst who has called a 40% gain in a stock correctly. To be fair to the analyst, he did not call for an immediate SELL when it went past his target price of RM1.15 ... while waiting to speak to the management of Dayang, the stock went even higher to RM1.70. To call a SELL on a stock that has surged past your target price of RM1.15 within a week or two to RM1.70 is called PRUDENT. On March 12, he can only call a BUY, SELL at RM1.70. Imagine your last target 10 days ago was RM1.15... how to follow up with another report for a higher target price than RM1.70?

The analysts have sufficient reasons to call for whatever target price they feel comfortable. This is my most important point, if the analysts had been working with in house funds or in-house fund management units - wouldn't they have all ISSUED A BUY REPORT much earlier with EVEN MUCH HIGHER TARGET PRICES??? If I bought a huge position and I want to exit at higher levels, I would call the analyst to issue a lofty report. So there was none of that.

Because KYY couldn't use that Occom 's Razor explanation, he had to go for the more difficult explanation of depressing prices TO COLLECT CHEAPER. Bollocks.

10) If KYY believes his target price of RM3.00 is achievable by 2020, why the petulant behaviour over short term gyrations? Some more, KYY thinks these brokers-analysts might be colluding to BUY cheaper, so they are still long term buyers. So don't worry la... cannot kick up a fuss everytime don't kena 4D.

11) KYY's second para above: .. "big institutional investors are responsible ..I have seen 150m shares changed hands .."

That statement might shed light on a naive understanding of volume traded in any stock. If a stock had 150m volume, largely 30-60% of the volume would have been churned by certain day traders and prop traders (who may or may not be acting in concert with certain people). Having that as a backdrop, it is easy to see how some day traders or prop traders could accelerate a stock's rise or fall by sheer momentum: e.g. buy 10m sell 8m Day 1, buy 15m sell 10m Day 2, buy 10m sell 12 m Day 3, etc... that kind of activity (momentum build up in volume and price upticks) will be highly successful when the planets are aligned (good sentiment, right sector play, strong catalysts ... all in Dayang's favour). Thus you will find more than a few of these bigwigs besides KYY holding 5m-20m position each and basically encouraging more participants as they go along. Any sign of bad news, real or fake, will trigger a landslide.

But as in most things, they will revert to the mean. If Dayang's prospects are really great the mean will be on an uptrend anyway, why bother about the noise?

In my view, that's what happened to Dayang.

https://malaysiafinance.blogspot.com/2019/03/kyy-jabs-with-analysts-commentary.html