For a copy with better formatting, go here, its alot easier on the eyes,espeacially since im very lohsoh!

My Speech on 2 March 2019: My experience and Identifying a wonderful company.

Today, i delivered a speech at the I3 Investment Blogger Forum.

Due to time constraints, i was not able to deliver the full version.

I even opened the wrong slides which did not contain my contact information!

After the event, i had a few request to post up the speech and slides in full. Well, i was planning to do it to begin with. Warning, its very lohsoh!

===================================================================

Introduction

Good afternoon,

By

way of introduction, my name is Jonathan Choi. Some of the more active

members of the I3 forums here may know me as Choivo Capital or Jon

Choivo, also known as that arrogant sounding young fella who is not

adventurous at all.

When

I first got the invite to speak at this forum, I instantly thought,

“Wah, must be really cannot find anyone, until me also want”. In

addition, I was also given 45 minutes, the longest time slot. They must

really know I very lohsoh.

I

wasn’t sure if I should accept the invite, considering how many people I

may have inadvertently offended online, but I decided to do it for the

reference experience.

It

was then that I realized that I didn’t really know what to say or

present, to our typical I3 Investor audience. As many of them are likely

to be older than me, further up in their careers or as I notice in this

room, retirees and are thus likely to have life experience that is far

more comprehensive than mine.

There

is a Chinese saying I really like, “I’ve eaten more salt than you have

eaten rice”, among the Chinese community, this is a saying often used by

the elders against the younger member who are no big no small. I’ve

gotten it a few times, and definitely deserved it most of the time.

And

I think there is a lot of truth in that saying, even if the elder

person is sometimes wrong. As whatever he is wrong about, it is based

off a lot more real-life experience than what the younger member may be

right about, his viewpoint is therefore much more nuanced, even if it’s

erroneous. At times his wrong, may even be righter that your rightness.

Therefore,

I did not think it would be right for me, to arrogantly think I am

worthy of standing up here and spend 45 minutes lecturing my betters. I

have therefore decided to spend this time sharing my experience in

investing thus far and what I have learnt from it. I hope you find some

value out of it.

My Experience

I

was very lucky to have been exposed to Warren Buffet, Charlie Munger

and Benjamin Graham as a child. My father had a copy of “The Intelligent

Investor” lying around, and I think I was around 9 or 10 years old when

I picked it up and read it. Parts of it didn’t make sense to me then, I

was 10 years old, but the concepts of value investing stuck in my young

mind very clearly. Especially those about Mr Market and Margin of

Safety.

Shortly

after, I found out about Warren Buffet, who had an incredible ability

to explain value investing in a manner a 10-year-old can understand. I

went on to read his biography and a few books on him. It was around then

that I could start talking about investments with my parents and give

minor input on their portfolios. Do note, I was 10 years old, so most of

the time, it was just my parents being patient and encouraging with me.

Now

you would think, with this kind of investment education background, I

must have saved all that stock market tuition money that most people pay

and went straight to buying wonderful companies at fair prices and

making a lot of money. Well that wasn’t the case, as you will shortly

see, one way or another, I still found a way to be stupid and foolish.

It

wasn’t until more than 15 years later, in the later half 2016, having

worked for around 2 years, that I took out my savings of around RM50k

(my salary and some small business and trading I used to do) and started

investing it. Despite having an education in investing that many would

envy, I was still incredibly foolish and made mistakes the likes of

which I still couldn’t believe.

One

of the first stocks I remember buying was GAMUDA-WE. I bought my first

batch at RM1.35 and averaged down at RM1.30. The main reason I choose

this back then was because it was recommended by a very famous trader in

I3 and looking at his results for the past 5 years, I got greedy. Do

note I’m not a subscriber, so my experience is likely to be very

different than if I was.

During

the entire period I owned it, despite studying it for a long time, I

just couldn’t see why GAMUDA should be worth the RM5 or, so it was

selling then, however, as that famous trader had it, and had such a

wonderful track record, I thought it must be good.

I

kept thinking, I must be stupid, his track record is so amazing. If

this genius looking fellow buys it, and I can’t see why its worth it, I

must be wrong. Better buy first and just keep studying.

As

I was stupid and did not know how to size my investments, that tuition

lesson, which is to do your own research from the bottom up and to only

do what makes sense to yourself, cost me around RM3,000. As it turns

out, me and the famous trader are fundamentally extremely different in

terms of our philosophy when it comes to the stock market. What works

for him will not work for me.

And

back then I was an incredibly frugal person, who will think very long

and hard if I should pay RM1 for an egg when ordering rice. But despite

that, I could somehow spend the RM8 plus the stamp duties etc to buy and

sell a stock a few times in a day, a fundamentally stupid thing to do.

In

just a few months, I managed to rack up transaction cost of roughly

RM3,500 on a cash only account portfolio of a mere RM50,000 and falling.

And only had an additional pointless losses of RM4,000 to show.

One

of my most vivid memory of the time back then was, when I told a very

close friend and a current investor in my fund that, “If only I had a

margin account and a higher trading limit, I would be able to average

down and make money”. I sounded like a pure-bred delusional gambling

addict, just unbelievably stupid.

Thankfully,

despite all that, the initial teachings of Warren Buffet and Benjamin

Graham still lingered on my mind and managed to convince me otherwise

and limited my future losses.

I

can’t help but shiver thinking of the many other new market

participants like me, who unlike me , were not lucky enough to have had a

decent education on investing by Warren Buffet etc at a young age. I

remember a colleague of mine, who borrowed RM100k from his parents, his

father is a broker by the way, to trade in the market. He lost almost

80% of it.

Charlie

Munger is right, in this modern world, where people are trying to get

you trade actively in the stock market, actions like that is the

equivalent trying to induce a bunch of young people and retirees to

start off on heroin. To be fair, brokerages etc need these kind of

people, they also need to eat, but i feel there is a better way of

making money.

And

if someone becomes rich doing stock trading, do you think they will

feel a need to write a book, go around to these talks to encourage you

get rich by trading? They say things like I have a trading or investment

system to teach you how to make 300 percent a year and all you must do

is sign up for a 3-hour course that cost RM8,000 and I will teach you.

Its very easy to make money in the market.

How

likely is it a person who suddenly found a way to make 300 percent a

year will be trying to sell books or teaching you how to do the same for

just RM8,000? It doesn’t make sense.

In

addition, in the KLSE we also have a bunch of very confident people

writing articles on I3 telling you to buy this or that stock as if they

they’ve got an endless supply of wonderful opportunities. These people

are the equivalent of those tow truck drivers who wait for people who

get into accidents by trying to extort them into using an expensive

workshop.

Investing

is a game of reading a lot, constantly learning and sitting there all

the time and recognizing the rare opportunity when it comes and

recognizing that a normal human life does not have very many. And when

they do come, you need to back up the truck into it.

Anyway,

back to topic, it was around that moment, which is six months in and

RM10,000 or so worth of tuition fees paid, that I thought something is

completely wrong.

Do I even know what I’m doing?

Do I even understand what I’m buying and how it compares to the rest of the companies in the KLSE?

I said I was a value investor, but I sure don’t feel, act or think like one.

Do I even understand value investing?

And I was lucky, some people were unfortunate enough to pay millions in tuition fees.

I

decided there and then I was going to study properly. The first

question I had was, investing is all about putting money in the best

opportunity, but how do you know which is the best opportunity in the

market?

Well,

I asked that question to Warren Buffet. Or at least in a proxy manner,

where an interviewer asked him that same question. He told him to read

the annual reports of every single public listed company in the

exchange. The interviewer said, there are more than 15,000! Warren

replied, Start from A.

And

so, I did that, and as the KLSE was a much smaller market than the

American one, there was only 950-960 or so companies. It took me around 3

months or so to finish it. Do note I was not married and single, I had a

lot of time.

The

next question I asked was do you even know what value investing really

is? Why are some value investors so different from another? Some

diversify a lot, some concentrate very highly, and yet both had great

points

I

decided then to read everything about value investing. One of my

favorites were from Warren Buffet and Charlie Munger. the complete

annual letters of Berkshire Hathaway, his old partnership letters,

transcripts for the Annual General Meetings, every single speech he ever

made etc. Compared to the previous question, this took a longer time to

answer, just the few items above were around 10,000 – 11,000 pages.

I

just want to make clear here, that I’m not saying this to sound

impressive or that it is an impressive achievement. If they were

difficult and boring to read, like the IFRS Accounting standards book,

it would be. But these books were very easy to consume.

Why?

When someone who is very wise and smart, takes the time to answer every

single one of your questions of a topic you are very interested in, in a

patient, detailed, comprehensive, humorous (they are quite funny at

times) and most importantly, honestly and sincerely, that feeling is

incomparable at times.

I’m

confident that if you had a copy as well, you wouldn’t be able to put

it down. It was after I had built my base of knowledge from the greats,

that I could now build on it and solidify my investment philosophy.

One

of the most important and insightful things I’ve learnt during from

reading those tens of thousands of pages and would like to share with

you is this.

Identifying a Wonderful Company

This also happens to be title of my presentation. I also feel this is one of the hardest thing to find and understand.

Now do note I mean WONDERFUL business, not “Normal”, “Good”, or “Great” business, but a capital W, “WONDERFUL” business.

In

order to know what an all CAPS “WONDERFUL” business is, we need to know

what is a “Bad”, “Normal”, “Good”, “Great” and “Wonderful” business.

A

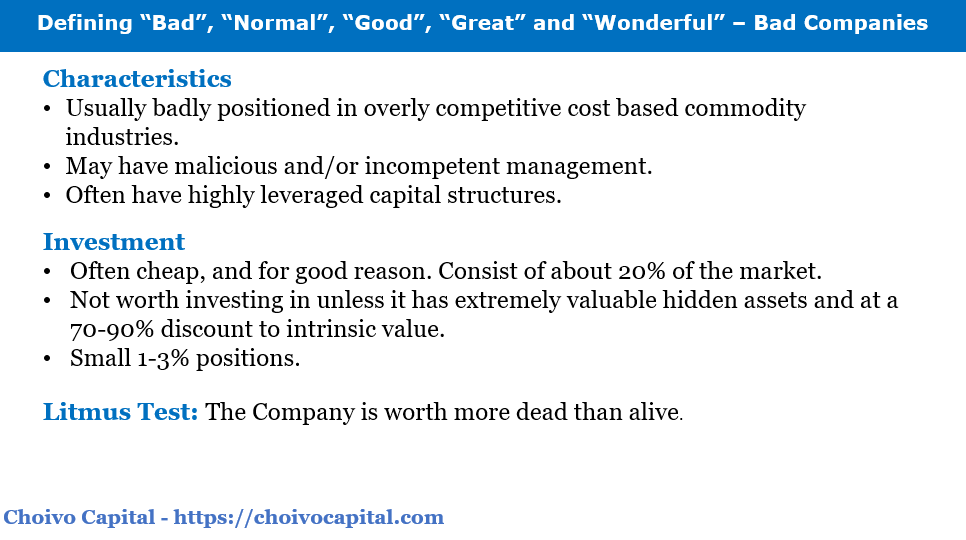

“Bad” business, well, we all know what they look like. They are usually

in overly competitive cost based commodity industries, in a bad

position with higher than average cost than the competitor, may also

include incompetent and malicious owners or management, coupled with

horrible capital structures.

These

companies are also often cheap, and for good reason. Buy a bad business

for a cheap price, and another 5 quarters of losses will turn that into

an expensive price.

Unless

they have hidden assets that are extremely valuable and selling at

minimum a 65-90% discount to Revalued Net Asset Value, and even then you

should only put a small amount like 1-3% in it and diversify unless you

know a catalyst event is coming. These are your Talamt, Facbind, MUI,

BJCORP etc

How do you know it’s a bad business? The litmus test is this, “The company is worth more dead than alive”.

It

should be noted that they are plenty of bad businesses that “appear” to

be worth more alive than dead, but this is mostly illusory. From my

study of the KLSE, they consist of about 25% of the KLSE.

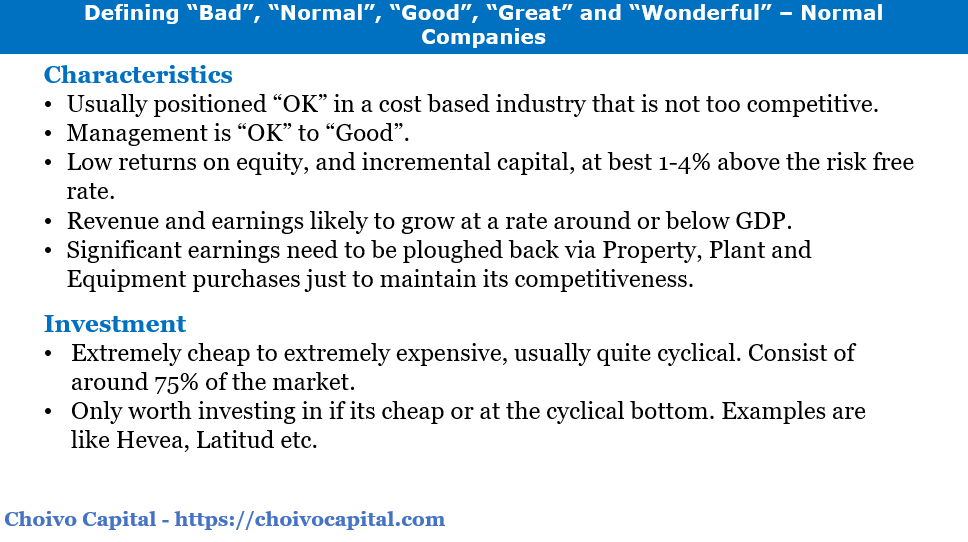

How about a “Normal” business. Well, in all sense of the word, they are well, “Normal”.

They

are usually in a cost-based industry that is not stupidly competitive,

management is “OK” to “Good” and somewhat shareholder-centric.

The

earnings often need to plowed back to the company to maintain its

competitiveness and current earnings via Property, Plant and Equipment

purchases.

These

companies often say they are buying new machinery to be more efficient,

save cost and thus make more money and increase market share. Except

they are selling a commodity and have no pricing power.

All

their competitors also buy the same machine, everyone cut cost and

everyone cut price, and in the end all that extra profit pass on to the

customers. But not buying is also not a solution.

There is a saying, “Even if you have not bought the new machinery, you are already paying for it”

Low

returns on equity and incremental capital, at best 1-4% above risk-free

rate. Revenue and earnings likely to grow below country GDP.

Only

worth buying is they become very cheap at the bottom of the cycle, all

industries got boom and bust. You better make sure its not a permanent

downturn though.

This consist of about 70% of the KLSE market. These are your HEVEA, LATITUD etc.

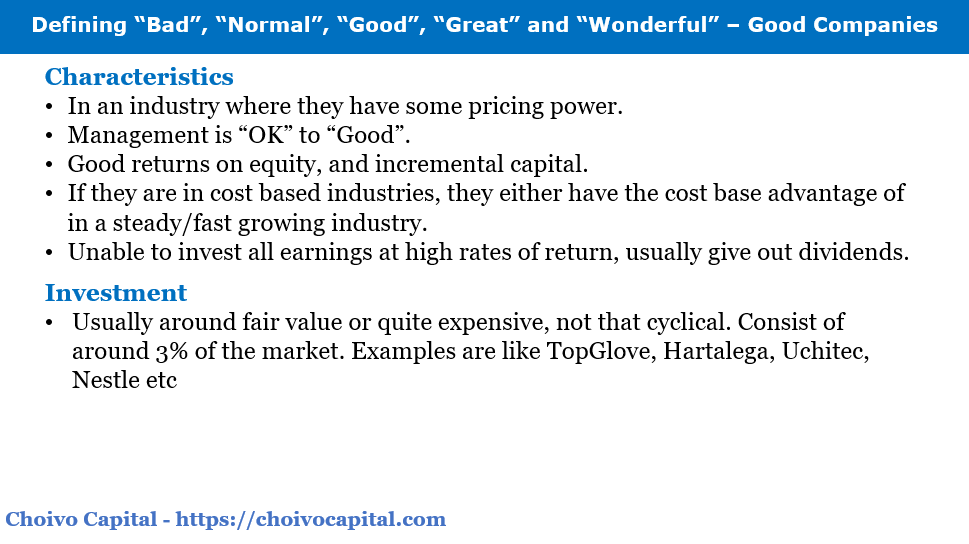

What

about a “Good Business” then? These businesses are usually not in a

cost centric (or at least more quality or brand centric) business, and

thus have some leeway is charging higher prices.

Management is Ok to Good, these companies often have good return on equity and incremental capital.

They

can also be in a cost based business, where due to various reasons,

they have the cost base advantage, a little pricing power and/or is part

of a fast growing industry. A rising tide lift all boats after all.

The

problem with good businesses, is that they are unable to scale up, and

reinvest the earnings at a high rate of return. However, if they have

“Ok” to “Good” management, that do not have empire building tendencies,

(If they do, you have companies like Berjaya Corporation) they will pay

them out as dividends.

Having

to find new ways to invest the dividends is a problem I’m sure most

investors would be happy to have. This consist of about 3% of the KLSE

market.

In

our last two descriptions of “Normal” and “Good” businesses, you may

have noticed that in both scenarios, i said that management is “Ok” to

“Good”. Why do I say this? This is because whether a manager is “Ok” or

“Good” in the eyes of the public, depends on the industry they are in.

If you get into a horrible industry, not even the best management can

save you.

For

example, Tan Sri Willian Cheng is a good, hardworking and conscientious

businessman, however, the industries he is in, have both had their

economics destroyed in the last few years, and its almost impossible to

make money. Just because PARKSON make money in the early 2000’s and to

an extend 2010-2012, does that mean he was a genius then and bad

business man now? I don’t think so.

Does

this mean that Tan Sri Leong Hoy Kum of Mahsing or Tan Sri Jeffrey

Cheah of Sunway is better than him? I don’t think so, they just happened

to get into the right industry.

Is

Tan Sri Ananda Krishnan and Tan Sri The Hong Piow being better than the

previous 2? Or if Mark Zuckerberg, Jeff Bezos Bill Gates is better than

Tan Sri Teh Hong Piow etc?

I

don’t think so, it is the industry that is key, some industries are so

good, that if you’re hardworking and a little smart, and get a dominant

position in it and be a tycoon. That’s assuming you can find one.

There

are some industries where its almost impossible to make money, if i had

Tan Sri Teh Hong Piow to start a textile company in Malaysia tomorrow,

the company will open on Day 1 and go bankrupt on Day 2.

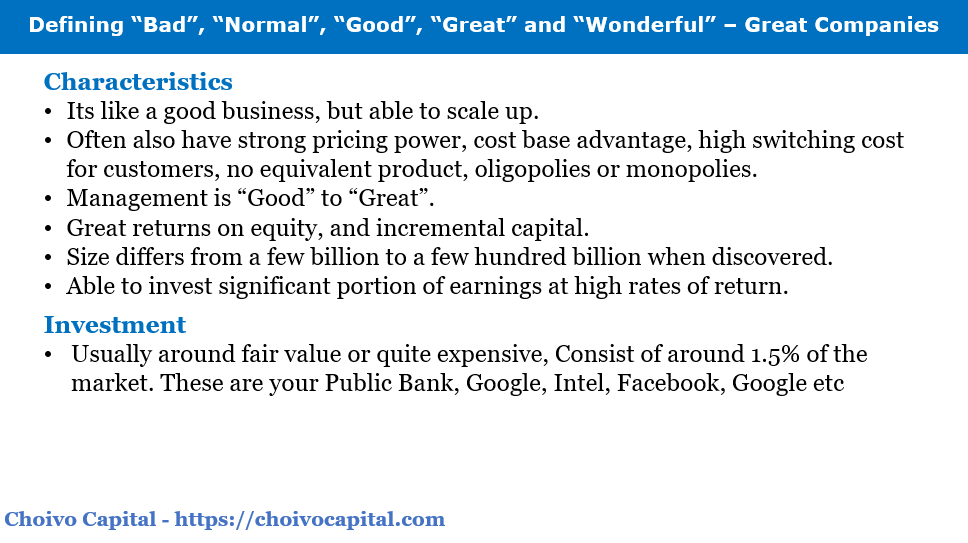

So, what is a “Great” business then? It is a good business, but with a good to great management that can scale up!

These

companies can make high returns on equity and incremental capital,

churn out a lot of cash, and take this money to make more at higher

returns.

They

vary in greatness, some can be a few billion in size, others hundreds

of billion in size. In Malaysia, they consist of companies like Public

Bank, Hong Leong Bank etc, overseas they are companies like Intel,

Facebook, Google, Alibaba etc.

Now, you may think, those businesses are that you consider to be just “Great” seem incredible to me already.

Waseh,

you telling me you so picky until even Google is not considered “Great”

in your book ah? What is the difference between “Great” and “Wonderful”

then?

The difference is this. A wonderful company is good for humanity.

For

every single dollar extra, this business, it provides at minimum an

extra dollar worth of benefit to humanity and society. This kind of

company, both the Public and the Government want them to make more

money. If they made 1 billion today, and with the same business model

made 10 billion tomorrow, the world would be better off.

Now

you may think, “Make money is make money”, why is the second important,

is this some kind of odd modern millennial thinking etc? Not really.

Let

me give you some examples of “Great” but not “Wonderful” businesses,

and why this “Wonderful/Good for Humanity” factor was important. We will

start off with a foreign company first, and then we will move on to

local examples.

Mainly

because the foreign one is one where they were making a lot of money,

and if they made more money, humanity will be even more miserable.

The Rise and Fall of Valeant Pharmaceuticals.

The

name of the company is formerly called “Valeant Pharmaceuticals

International Inc”. After its downfall, the company changed its name to

“Bausch Health Companies Inc”.

This

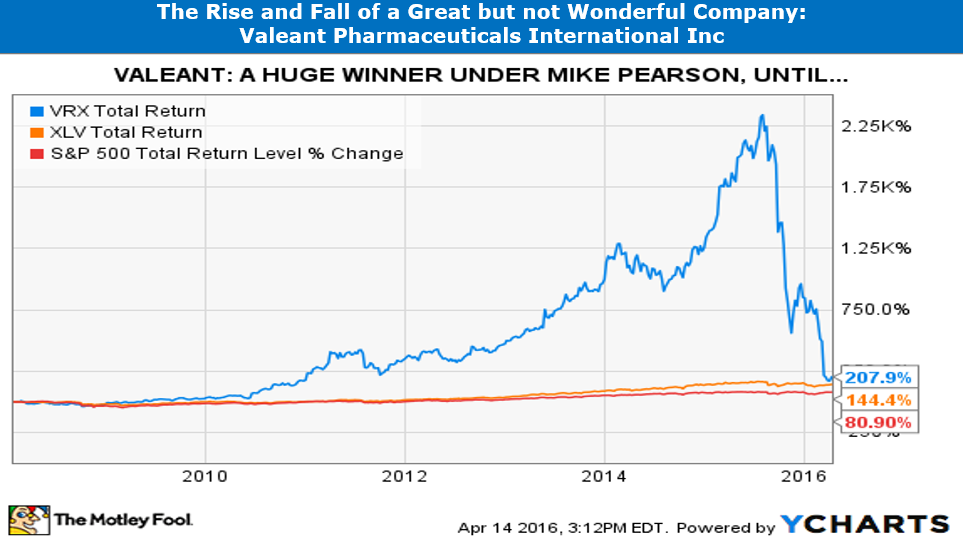

was a pharmaceutical company listed on the Toronto Exchange. In 2008,

when its then new CEO Micheal Pearson, an ex McKinsey Director with deep

pharmaceutical experience, took charge. The market capitalization was

less than USD2billion in 2008.

With

mergers and acquisitions and soaring stock prices, it rose to a high of

USD90 billion, before falling back down to a low of USD2.9 billion in

2017. A 96.7% drop from peak to trough. Its currently at USD8.2 billion.

They

are a few things to note, when Micheal Pearson was hired, his was

incentivized as if he joined a private equity firm. He was required

personally to buy USD3 million worth of stock (he bought USD5 million).

And

his compensation mainly consists of a form of restricted equity that

would pay him USD4 for every USD100 in value created (measured via stock

price increase), with a hurdle rate of 15%. In addition, if he hit 30%,

his rewards will be doubled, and if he hit 45%, it would be tripled.

For

example: Lets say Valeant was at USD2bil market capitalization, they

bought another company with USD2 bil market capitalization. Total is

USD4 billion capitalization. No compensation on this.

Lets

say the price of the stock then went up to USD8 billion in a year. That

is a 200% increase, above the 45% hurdle rate. His restricted equity

at USD4 per USD100 value is now tripled to USD12. So, the difference of

USD4 billion, he gets USD480 million salary that year.

Why

is it important to know this, because incentives are the iron law of

nature, at the end of the day you get what you incentivize for. If you

put out honey, you get ants. If you put out salt, what eats salt ah? No

idea.

This

example also illustrates why incentivizing a CEO on share price

increases is usually a stupid idea in the long term. An increase in

share price does not mean the company is improving. Its better to do it

via incentives on Return on Incremental Capital/ Retained Earnings not

paid out.

Micheal

Pearson being an ex-Mckinsey Director who had deep experience in the

pharmaceutical industry, did things differently from most Pharmaceutical

Companies.

For

most pharmaceutical companies, they way they do business, is by using

the profitability of the current biopharmaceutical portfolio, to do

doing research and development for new drugs.

Typically, most pharmaceutical companies spend 20% of their annual on R&D. Valeant spends 6-2% or 3 to 10 times less.

And

it makes sense, according to a McKinsey Report, the return on

investment in a typical biopharmaceutical portfolio often fails to cover

its cost of capital, and so naturally the logical thing to do is to do

less research on new drugs.

Someone

once asked the CEO Michael Pearson what he thought of cancer research.

He famously replied, “I think it’s a losing proposition. I don’t know

any pharmaceutical company who has generated positive returns on it.”

Basically, screw cancer research, i want my money.

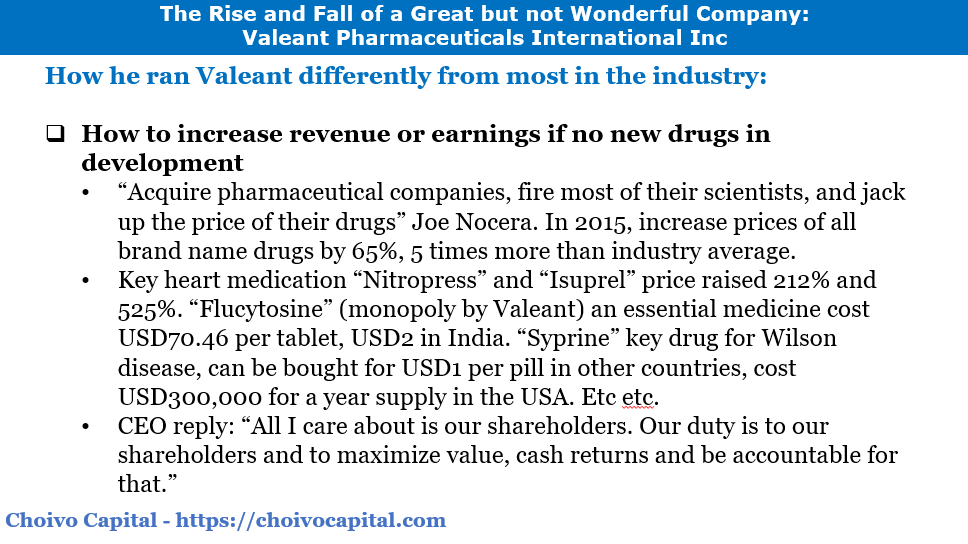

So how do they increase their revenue and profitability if they don’t have new drugs from research? It’s simple.

They

bought over companies with drugs that have no easy replacements nor

have generics sold in the United States. Cut their R&D cost by 80%

or so, and then massively increase the prices of these drugs.

The

logic is simple, like it or not, no matter the price I charge, you or

the insurance company must pay for these drugs. This is one of the

reasons why insurance cost in the US is one of the highest in the world.

In

2015, they raised the prices of all their brand name drugs by 65%, 5

times more than their peers. The prices of two key heart medications

“Nitropress” and “Isuprel” had prices raised by 212% and 525% upon the

acquisition of the right to sell these drugs.

The

cost of “Flucytosine” by Valeant was 10,000% higher in the United

States than in Europe, and those sold in Europe was simply not allowed

to be sold in US. And here is the funniest thing, the drug was not even

developed by them. It was developed in 1957, considered an essential

medicine by World Health Organization’s List of Essential Medicines

(therefore considered key in an effective healthcare system), and was no

longer patented. However, as they were the only FDA certified generic

producer, they could essentially price it as if they held the patent for

it

The

price of “Syprine” a key drug for Wilson’s disease, which can result

in, among other things, fatal liver failure and which can be bought for

USD 1 per pill in some countries, cost around USD300,000 for a year

supply.

For

“Syprine”, Valeant bought a pharmaceutical company called, Aton who

owned the rights to sell that drug for $318 million. Despite the tiny

patient base for Syprine, Valeant raised the price so strongly that they

made back 2.5 times its cost in less than two years.

When Valeant acquired Salix Pharmaceuticals, the price of the diabetic drug, “Glumetza” increased by about 800%.

When

asked to justify these price increases, the CEO replied, “All I care

about is our shareholders. Our duty is to our shareholders and to

maximize value, cash returns and be accountable for that.”

What a wonderful CEO and management.

A captive market, highly inelastic demands. Essentially, your money or your life.

What a great business.

In addition, he also took advantage of lower tax rates abroad, by making tax “inversion” purchases of foreign companies.

In

2010, Valeant purchased Biovail, a Canadian Pharmaceutical company at a

15% premium. However, post-acquisition, the shareholders of Valeant

held only 49.5% of the combined entity. Why?

Well,

the operating subsidiary of Biovail is based in the Barbados, and to

preserve its low tax rate, Biovail needed to be the company doing the

acquiring.

Why was this particularly important? With the lower tax rates, Valeant could offer better prices as an acquirer.

A

pharmaceutical company could be they purchased, could have a tax rate

of say 38.9% (the US combined corporate tax rate) will now have a tax

rate of 25%. Top that off with a couple hundred million in savings by

firing your scientist and cutting your R&D budget. That’s a lot of

money.

Indirectly

owning a specialty pharmacy called Philidor (they created an option to

buy the company that had a price of USD100million and strike price of

USD0, enabling them to treat the company as if it was a third party,

when the reality was anything but if) whose main business was dispensing

Valeant’s drugs to consumers and getting insurers to pay for them.

Well,

what happened then? Couple great business economics with a highly

motivated and intelligent CEO with a lack of morality, and you get share

prices rising from USD8.55 to a peak of USD257.53, or 3000% gain.

At

one point, Valeant even exceeded the market capitalization of the Royal

Bank of Scotland to be the company with the highest market

capitalization on the Toronto Stock Exchange.

It

was around the peak years of 2013, that it started becoming the darling

of hedge funds and investment managers around the world. Even famous

value investors like Bill Ackman (whom if you’ve read the Berkshire AGM

Transcripts, you would have noticed him asking questions every other

year) were investors, along with Sequoia Capital, Paulson & Co

(famous for shorting mortgage bonds during the 2008 Crisis and made

USD15billion in 2007, on capital of USD12.5 billion) and ValueAct whose

president, Mason Morfit was quoted saying “Micheal Pearson is the best

CEO I’ve ever worked with”.

Even

companies with friendly links to Warren Buffet such as Ruane, Cunniff

& Goldfarb and personal friends and business partners such as Jorge

Paolo Lemann of 3G Capital were investors.

One

could scarcely find a fund manager who disagreed with Valeant or

thought they were a bad investment. Except for short sellers, Warren

Buffet and especially Charlie Munger who said that “Sewer is too light a

word for Valeant” and that the company was deeply immoral.

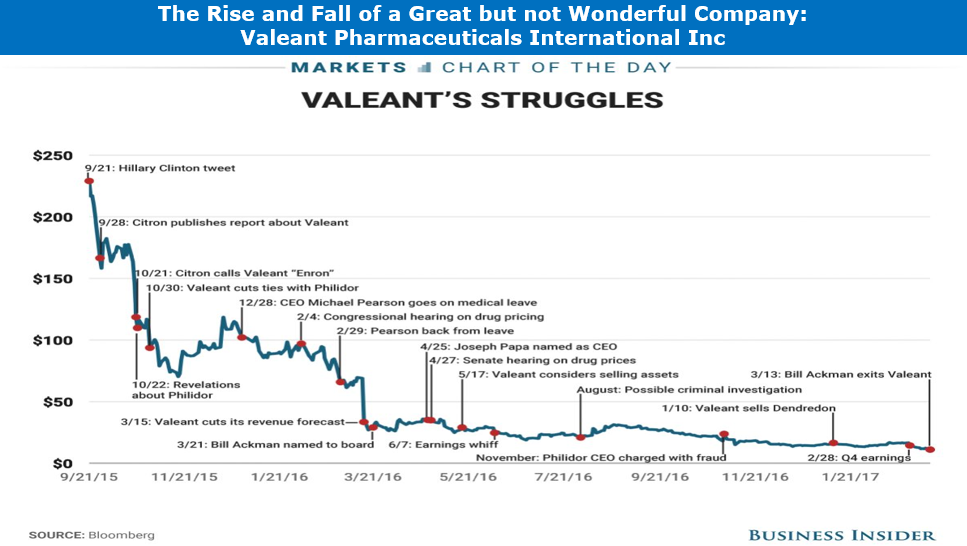

We will now see how a great business, falls due to immorality. It started slowly.

First,

their public failure in acquiring Allergan, which raised the Company’s

Public profile, in addition to an insider trading lawsuit, as Bill

Ackman of Pershing Square bought options on the shares of Allegan to

help fund the acquisition and intimidate the company into selling. The

fund made a profit of USD2 billion despite the failed acquisition.

During

the fight, Valeant was compared very publicly to TYCO, a huge

conglomerate company with a similar business model that imploded in a

wave of accounting scandals in the early 2000’s. This failed acquisition

was particularly painful for Valeant as their acquisition and business

model required them to issue their shares, like TYCO. And with that

public comparison, no board of directors will dare to sign. They will

technically go to jail if found guilty.

In

addition, the former of CEO of Biovail Eugene Melnyk, filed a filed a

whistle-blower complaint with U.S. regulatory agencies over Valeant’s

tax structure.

But

things really took pace on 20th September 2015, when “The New York

Times” wrote an article about a Martin Shkreli, a pharmaceutical CEO who

hiked the price of a life saving drug by 5000% overnight.

The

article mentioned Valeant, and its hiking of Nitropress and Isuprel by

525 percent and 212 percent, the day they acquired the right to sell.

The

then democratic presidential candidate Hillary Clinton tweeted, “Price

gouging like this in the specialty drug market is outrageous.”.

In

short order, Valeant admitted that it was being investigated by both

the House and the Senate, and had received subpoenas from the U.S.

Attorney’s Offices, in the Southern District of New York and Boston,

over its pricing of drugs and its programs to assist patients.

Its amazing how fast politicians can work, when their interest are exactly aligned with the public.

It

was also around this time, that Charlie Munger made his comments on the

company and research reports from various investment banks and short

selling houses appeared, stating that any revenue growth was due to

price increases.

The share price have now fallen to USD90 from USD257.53, in 2-3 months.

It

was currently, that the final blow came, newspaper had found out about

the specialty pharmacy company Philidor, and they published pieces

quoting former Philidor employees who said they were told to do things

such as change codes on doctors’ prescriptions to Valeant’s brand, even

when much cheaper generics were available, and re-submit rejected claims

by using another pharmacy’s identification number.

In

addition, due to the auditors now finding out about Philidor, Valeant

was not unable to file previous year’s financial report and disclosed

that the S.E.C. was investigating it. In addition, the company missed

its projection on a key metric by a wide margin.

On

April 27 2016, Bill Ackman (Fund Manager), the CEO and CFO were forced

to appear before the United States Senate Special Committee on Ageing to

answer to concerns about the repercussions for patients and the health

care system faced with Valeant’s business model.

After the meeting, the Senate Special Committee ordered the firing of the CEO.

It was around this time that sales started to drop as even doctors started to boycott their products whenever possible.

The

share price is now USD33.36. It fell down to a low of USD8.51 on April

21 2017, amid doubts that the company will be able to service its loans.

It had USD1 billion in cash and USD30 billion in loans.

Now that we’ve seen a great but not wonderful company with a lack of morality, lets look at a wonderful company.

The Wonderful Company called Costco

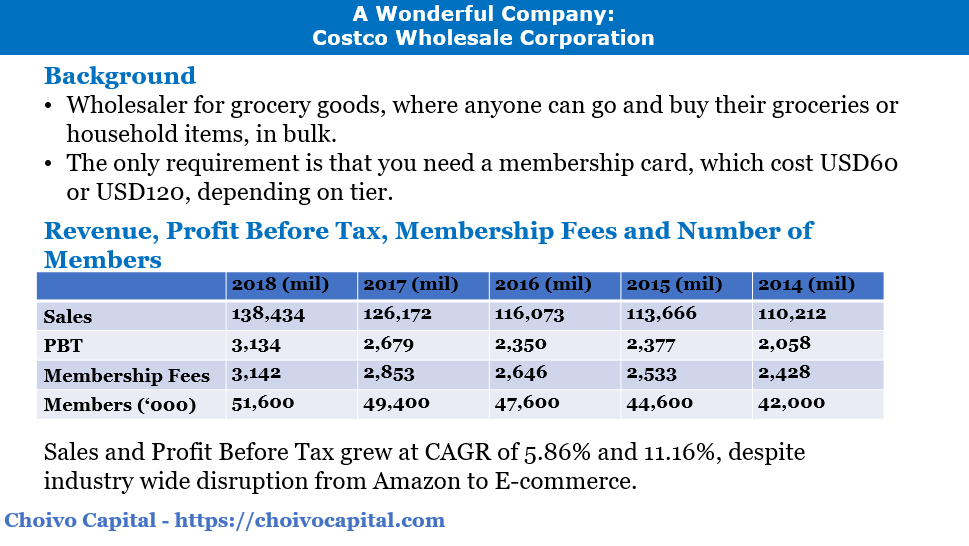

Costco

Wholesale Corporation (COST) is wholesaler for grocery goods, where

anyone can go and buy their groceries or household items, in bulk. The

only requirement is that you need a membership card, which cost USD60 or

USD120.

Here is their Revenue, Profit Before Tax, Membership Fees and Number of Members from 2014 to 2018.

Now,

some of you may have noticed that unlike retail, grocery stores were

not as effect by the rise of e-commerce. This is due to their margins

being a lot thinner to begin with and thus more efficient and harder to

run. Despite that, we still see falling sales in companies like Whole

Foods etc.

Despite this, Costco have still managed to grow sales at CAGR of 5.86% and PAT at 11.16%.

How

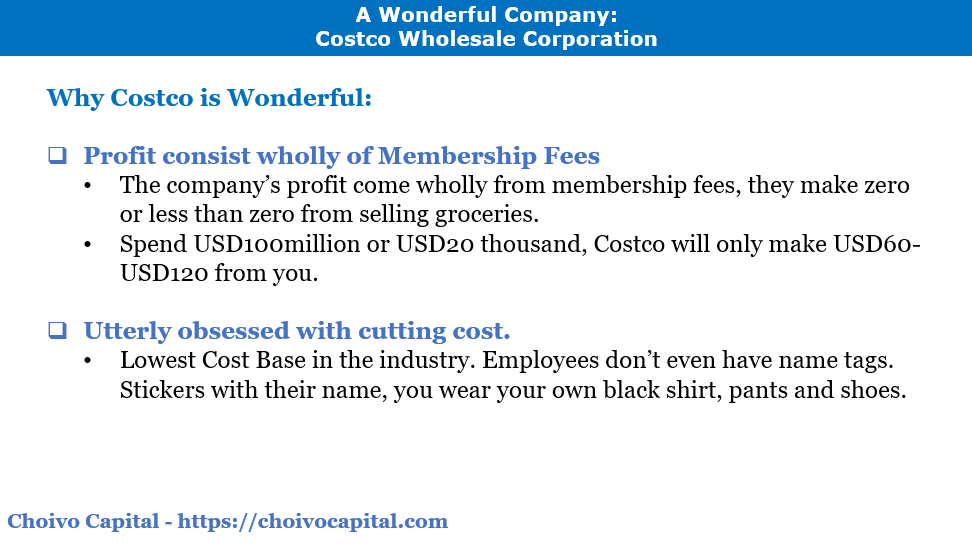

did it do this? If you look closer, you would notice that the profit

after tax of the company consist almost wholly of membership fees. They

literally make around or less than zero from customers.

Here

is what COSTCO are telling their customers. Every year, we will only

make USD60-USD120 dollars in profit from you, regardless of how much you

buy. You own a restaurant and spend USD20k a month? We earned USD60

from you this year. You are a big business and spent USD10 million with

us? We only make a profit of USD60.

And

this company by being absolutely obsessed with cutting cost, has the

lowest cost base in the industry. They don’t even have name tags for the

employees. They just pass you a sticker with your name, and have you

wear a black shirt, pants and shoes. Buy your own.

In

2009, Coca-cola tried to increase the selling price by 3 cents per

bottle, they completely refuse to stock coca cola, telling their

customers,

“Costco

is committed to carrying name brand merchandise at the best possible

prices. At this time, Coca-Cola has not provided Costco with competitive

pricing so that we may pass along the value our members deserve.”

Coca cola buckled and didn’t increase the price.

Unlike

Valeant, if Costco maintained their business model and profits next

year doubled from USD3.1bil to USD6.2bil. America would be rejoicing, as

that would mean 51.6 million more people get to buy their daily goods

and groceries for far cheaper prices.

This definitely be value accretive for the American people. The same cannot be said for Valeant.

Other Examples

This

“Good for humanity” factor which results in both the Public and

Government cheering for increased profits for you, is especially key.

Almost

every great company that have fallen since the start of time has been

due to it not being “Good for humanity”. “Good for Humanity” is as good

as a moat you are ever going to get. Others fall due to fundamental

technological disruption.

Why

is PARKSON and SEARS etc, formerly amazingly profitable retail

companies either on the verge of bankruptcy, or loss making with no end

in sight?

Its

simple. Back in the day PARKSON and SEARS sold household and clothing

items with an extremely fat net profit margin of 20-30%, and gross

margins of 50-70%

Would

humanity be better of from them doubling their profits? Would humanity

be better from paying double to triple for household items when it can

be had for around half or a third of the price? I doubt it.

Extremely

fat profit margins of great companies are opportunities for wonderful

companies who kill the margins and make it up with volume, increasing

the value, productivity and efficiency per dollar and per head of

society.

Wonderful companies are essentially companies that increase the value of each ringgit exponentially other companies include,

Interactive Brokers

– The cheapest international stock broker in the world, you can trade

across most major stock markets in the world, with fees of 0.5 cents per

share or a minimum of 1 dollar and a maximum of 1% of trade value.

Volume discount available. For the record, this is in most cases far

cheaper than what Malaysian brokers charge for buying Malaysian Stock.

There is a reason why this company is not allowed to operate in KLSE.

Berkshire Energy

– Unlike other energy companies with high dividend payout ratios,

Warren Buffet does not require a dividend if money can be reinvested at a

good rate of return. And since in America’s utility industry, the

government basically guarantee you an IRR of 8-10% (most who go bankrupt

here do so because they took up debt to pay dividends), the company can

basically pour all their money into building the best utility plants

and pipelines with no debt.

Whenever Berkshire Energy takes over another energy company or goes into a new area, energy prices drop by around 15%.

TTI

– This is a global electronics parts distribution company. This is an

enormously complex business where you need to manage inventories with

millions of types of parts, and you make a profit of less than one tenth

of a cent per part. An unbelievably hard business system to set up with

close to a thousand suppliers, and the millions of data sheets for

parts. Just a wonderful business.

There

are some companies that appear great now, whose business is currently

deteriorating due to it not being a wonderful business.

Coca Cola/Pepsi/F&N –

In the last 3 years, sales volumes of soft drinks have been falling.

Why is this the case? Studies have shown that sugar is almost as

addictive as heroin, and it is a very refreshing drink.

Well,

its not healthy and therefore not good for humanity. Would humanity be

better off if they sold 2x more next year? I don’t think so.

And

with the current drive to be healthier, the soft drink market is really

suffering. I personally don’t really know anyone around my age group

who still drinks soft drinks.

Even

for our local champion F&N, sales of soft drinks have been falling,

except for those of 100 PLUS, which for some reason, Malaysians think

drinking 100PLUS is good for health.

I personally remember my doctor recommending me to drink it when I was younger when I had fever or stomach-ache.

Other companies such as General Mills, Kelloggs, Kraft Heinz etc is also facing falling sales.

So

how many of these wonderful companies are there in KLSE. Maybe 2 or 3.

There is a good chance it’s because I’m not smart enough to identify

more. But it appears in line considering the size of our markets.

TIMECOM

Having gone through all the annual report of companies listed Malaysia, I managed to identify only 2 wonderful companies.

One

of them had a real moat, the other appears to have a decent one. The

first is around fair value or a little above fair value, the other is

cheap-ish maybe.

I’m

not a fan of sharing my best ideas to strangers, however, as I’ve

already built up my position for the first one, and they are better

opportunities in the market, and will therefore be unlikely to top up

soon, I don’t particularly mind sharing this, as it will not affect

myself and my fund investors much.

The

main reason i gave it out back then, was because the valuation i paid

was quite expensive at 25 times earnings, and as i wasn’t sure, i wanted

a second opinion and for people to criticize it in order for me to find

out the strength of my research.

Currently

the earnings have almost doubled, without a change in the price.

Personally, i’m quite happy to be paying the same price for a much

improved company!

The name of the company is TIMECOM. I wrote a post on it in my website back in 2017,

However, allow me to give you just a brief overview.

The

thing about wonderful companies is that when the insight comes, they

are often already expensive and TIMECOM was about 10-15% above my fair

value when I bought it.

I

first found and understood it around April 2017, and being so excited,

after thinking very deeply for 3 weeks, I sold half my portfolio and put

it into TIMECOM, a little foolish.

But

to be fair, I was younger, and everything else was a lot more

expensive. I’ve only topped up once since then, and as my portfolio is a

lot bigger now, despite not selling a share, it has fallen to around

15% of portfolio.

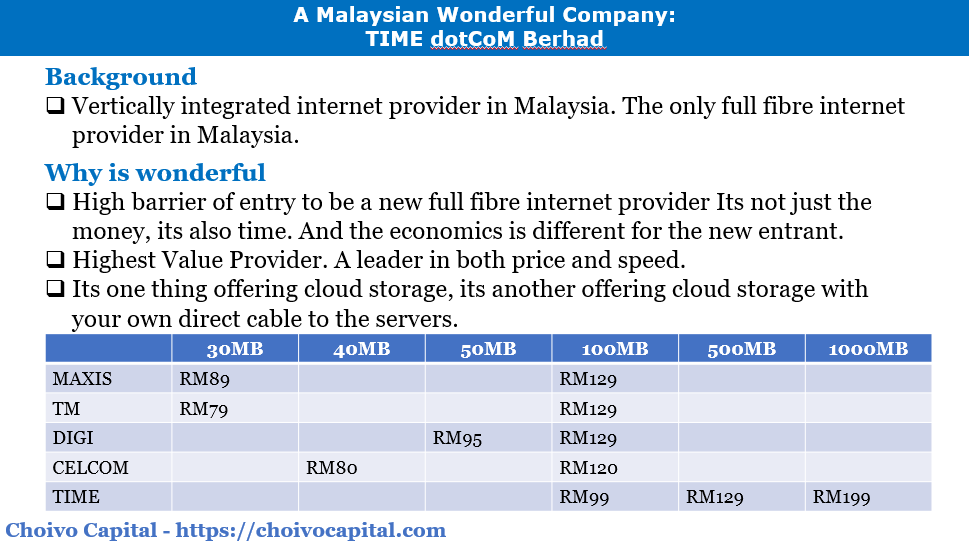

TIMECOM

is the only full fibre internet provider in Malaysia and is vertically

integrated with their own data centre business and shares of

international underwater fibre optic cables.

Pre-2008,

TIMECOM was a mediocre telecommunications company. Late 2008, they

hired their new CEO Afzal. His turnaround plan was to turn TIME into a

telecommunications company that connected Malaysia internally and

externally with a pure fibre optic network.

They

first started laying down the main backbone of the fibre network from

Thailand/Penang to Johor/ Singapore in 2010, and since then, mainly

provided their network services to enterprises and business such as

Astro which require very high speeds and bandwidths. And in 2016, the

network was finally dense enough to launch to the Retail market.

Now,

why does having a full fibre network matter? Its simple, copper is

inherently slower, and its signals degrade over long distances, this is

not the case for fibre optic cables, as long as there is a single

stretch of copper in your network line, it won’t be as fast.

And

TM, has a Fibre /Copper Hybrid network, which is also why they have so

many Streamyx users, who are on copper lines. This is also why TM turned

extremely quiet on their TURBO plan which came out 3 days after

elections. If they could sell 10x speed, they would, but they can’t,

which is why 100MB is their fastest plan now.

And

as we can see from the table above, they are way ahead. And if you go

to my article, which was written in 2017, the gap is value is far

bigger. While TM and AXIATA etc struggle with the Gorbind Singh’s pledge

of double the speed at half the price, with impairments coming left

right centre.

What about TIMECOM? Profits hits an all-time high, this is what you call a moat!

Now

you might ask, why don’t TM or Maxis etc just build a pure fibre optic

line and compete? Well, time and money. I said money second but let’s

talk about that first.

TM

has net borrowings of about RM15 billion, and they have a legacy copper

fibre network which spans hundreds of thousands of kilometres long of

km long and built over decades, replacing that is going to be expensive,

especially since they still have hundreds of thousands of Streamyx

users to upgrade.

It’s going to be very difficult, and TIME is net cash, and growing 18% per annum while TM sorts that out.

As

for our mobile telco’s. They could, but their stocks are all very

overvalued with support of a 90-100% dividend payout policy. If they

drop the payout, the share price will drop like a stone, I don’t think

EPF etc would find that acceptable.

In

addition, they still need to buy spectrums, and build new towers,

especially with 5G coming up, which already take up most of their

borrowing capacity.

And

to top it off, you need time. Starting in 2010, it took them 3-4 years

to connect Penang to Singapore and offer to commercial users. And

another 2 more years before they could start with retail customers,

imagine a blood vessel, its kind of like that.

Network

effects just take time, even if you have a lot of money to pour into

it, it’s a little like having children, you cannot have a baby in one

month by getting 9 women pregnant.

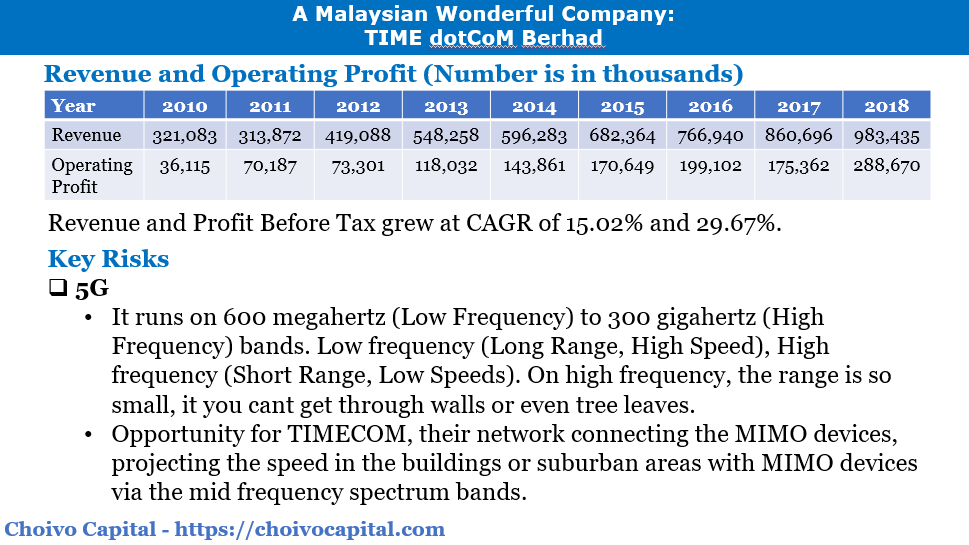

And as we can see from this table here, which strips out any one-off income, that is the effect of their moat.

When

I first bought it in 2017, I expected the retail business to grow at

70-100% per annum, which translates to 15-18% growth per annum. The

income and revenue did not grow at that speed in 2017, when one off

depreciations, forex losses hitting the books, as well as lower IRU

sales. But I could see very clearly that the recurring revenue and

earnings was increasing at the pace I thought it would.

The

growth and demand for their service was obvious especially if you went

to their Facebook page, where people ask two questions.

1) Why your installer not yet arrive!

2) When you want to connect to my area

What wonderful complains to have!

It

started showing the increased in earnings later mid to late 2018. The

focus of the company now is in connecting condominiums. Why? Connect to

one condo, you will instantly steal 200 customers from TM or Maxis.

I

expanded on a few things a lot more in my article, but due to time

constraints, I better skip it and go straight to the most important part

risk and valuation. Feel free to read the article enclosed.

The biggest risk to this company is 5G.

Let

me just give a brief layman introduction on what it is. It is the 5th

generation wireless connection that runs on low frequencies and high

frequency bands and is expected to be up to 100 times faster than

current 4G speeds.

Now, despite how loudly people talk about the wonders of 5G, we need to note this.

4G

is not even properly implemented worldwide, not in even in the US or

Malaysia. Do you see the LTE sign on your phone, that stands for “Long

Term Evolution”, or basically as how BN ministers use to say ”Akan cuba

lah”. LTE is what you put when its not yet full 4G. You notice how they

even say “Long Term”, this means few years also can mah!

Now

let’s say they roll out 5G, the thing you need to know is this, it will

take a long time for nationwide rollout. Because the key weakness of

5G, is that if you want to get those extremely high speeds, you need

MIMO devices every 50-100m, or basically everywhere.

Those

articles you read about where 5G had speed of 10-30GB per second, it’s

the 5G device directly facing the MIMO device 50 meters away on the

highest frequency bands. If someone walk in between, putus straight!

If

they want better range, they need to use the low to mid frequency

bands. SPRINT, a US company is aiming to release 5G in parts of the

nation, the minimum speed they are aiming for is 2-4mb, even our “akan

cuba” 4G is faster.

Now,

even if they do take off in a big way, TIMECOM stands to benefit in a

big way. These MIMO devices need to be connected by a fibre optic

backbone, and TIMECOM is well positioned for it. And if people start

using 5G for their connections, it would save TIMECOM cost when it comes

to connecting to suburban areas.

When

it comes to suburban areas, the reason TIMECOM does not connect to them

is firstly cost, its just more profitable to connect to condo’s and

secondly, because they can’t.

TM

previously did not allow the use of their poles, and government does

not allow above air fibre optic cables as they look ugly. And so, if

TIME wanted to connect, they need to dig new tunnels to all the houses.

But

if 5G took off, they can very easily just install a few MIMO devices,

connected to their fibre network, near suburban areas and use the

mid-spectrum bands to offer high internet speeds to homeowners.

Valuation

wise, its currently 16 times earnings. A company growing earnings and

revenue at 16-18% and selling at that price, translates to about 11%-12%

yield. FD’s currently yield 4.6%. And to top it off, this company can

really scale up with the profits they earn at good rates of return. ROE

is 11%.

Up to you. Make up your own mind.

Choivo Capital

From

the speech thus far, some of you may have correctly deduced that I

intend to enter fund management. However, I consider it immoral for

someone to manage another’s money for a fee, unless you have a high

confidence level backed by a decently long track record, of your ability

to obtain higher than average results.

And

like a fibre optic cable network, this takes time. And so, until I get a

good 5-year track record (and if I do get it), i do not do any fund

management in an official capacity.

Having

said that, I consider the mere act of investing to be a zero value add

activity to society. A life spent getting rich by getting increasingly

shrewd at buying and selling pieces of paper is a life wasted.

My

main goal now therefore, is to create my own course online on

investing. I intend for it to cover everything you need to know on

investing and the mental models, and I also intend for it to be free.

Currently,

I’ve not yet started on it, but if you go to my site and the page, I’ve

listed down the list of books I believe will teach you far better than I

can, and you will find my articles there, which may be interesting and

of use.

At

the end of the day, investing is the last real liberal art. Its about

understanding human beings, business, psychology, maths, physics,

economics, biology and life itself. The older you are, the more you know

about life and the better you are likely to be. I’m certain that if the

people in this room were as lucky as me, in being given such a good

investment education, you guys are likely to be way better.

If

I could help young people like me, and retirees or people advanced in

their careers, understand money and investing properly, and save their

tuition money, which can often exceed hundreds of thousands to millions,

I think I would have lived a decent life.

Now,

In the event you feel like having me manage your investments, whether

due to lack of time, not your interest, or you believe in me and my

ability, the conditions are as below.

You need to sign a commitment to keep the money and reinvest the dividends into the specified trading account for 3 years.

After

3 years, I will charge fees of 0% annually, 30% of whatever gains above

the return given by EPF, and a highwater mark. Which means, next year I

need to beat EPF rate, as well as the fees I took last year. If I can’t

beat it, no fees, go eat economy rice.

Due

to time constraints, the minimum is RM150,000. However, the most

important thing for me, is that we have similar investment philosophy,

if we have the same values when it comes to investments, I’m willing to

relax on the above.

If

you’re looking for a chartist, trader, momentum investor etc. I’m not

your guy. As an investment manager, the only thing I can really control

is the clients I take, and I’m quite picky on this.

Quite

weird right, fund manager tells you they don’t want you because you

have different philosophy. I wonder if Public Mutual got turn down

customers before or not.

Now

for some of you, you may prefer someone sit with you and walk you

through the concepts and mental models instead of reading a bunch of

books. Or you just want someone to discuss your investment ideas with or

walk through your portfolio.

In

this case, I charge RM1,000 for 3 hours. Or RM 5000 for 2 hours every

month for a year. If you’re in Selangor, we can meet up, otherwise, we

can skype, or if you cover transport cost and I have time, I can visit

you wherever you are.

And I’m done, say hello if you see me afterwards! This conversation is free! Haha

=====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Website: www.choivocapital.com

Email: choivocapital@gmail.com

https://klse.i3investor.com/blogs/PilosopoCapital/196087.jsp