Watch Market Uncertainties with Crispy London Biscuits: TP RM 1.08 - An upside of 96% you don’t want to miss!

Company Background

London Biscuits Berhad (LONBISC 7126), founded in 1981, which engages in manufacture and trading confectionery and related foodstuffs, in both Malaysia and internationally. Key products including Swiss roll, pie cakes, layer cakes, sweets and potato chips.

1) Stronger than Expected Result in FY18

During last quarter, which is 4QFY18, LONBISC recorded a RM6.65mil net profit, resulting a RM13.9mil net profit in entire FY2018, which exceed public expectation with a strong end in FY18.

The key boost towards a stronger-than-expected quarter result mainly due to lower material cost and improved cost efficiency. Better profit margins from its mix product also provide a hand to create delightful quarter result.

In coming 1QFY19, we foresee an even stronger performance from LONBISC as demand of its mix products remains high due to year end season festival.

2) Sustained Earnings through Long-time Products & New Production Lines for Potatoes Chips

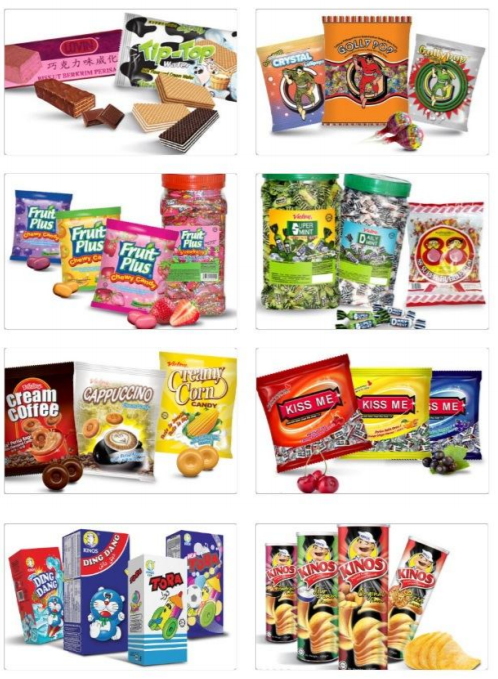

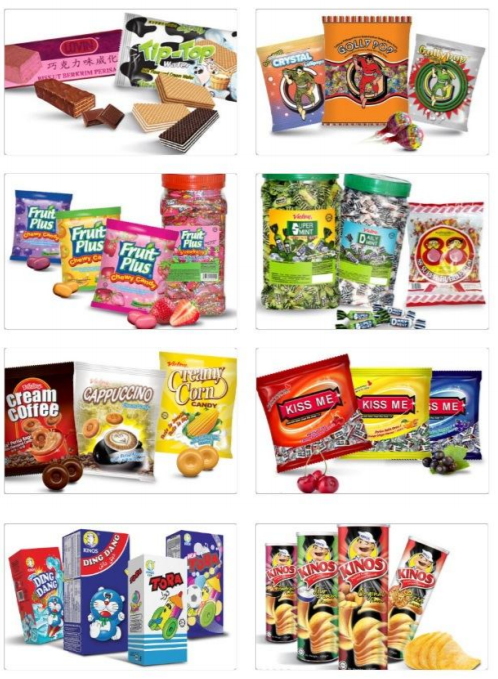

Looking at its product portfolio closely, we will begin to recall and realize that at one point we did consume (or are still consuming) at least a few of its sugary goodies. This illustrates the edge LBB possesses in meeting consumers‟ preferences, seeing as that its products have been able to sustain well over the years.

Building on that, we believe that the company has set a solid base and will continue to flourish even further with its recently upgraded capacity.

One of the growth catalysts for LONBISC is their additional capacity in its potato chips production which yield extra revenue line. In two years, potato chips segment has been expected to double up current revenue to 30% supported by two additional production line. As per future business planning, extra potato chips that produced are planned to enter into Japan and Korea market, which potentially expand their business to even wider international distribution.

3) Lower Finance Costs as LONBISC Deleverages

By issuing more shares via private placements, the company plans to utilize the fund to repay part of its borrowing to deleverage. The management of the company mentioned a potential saving of RM1.3 million after the de-gearing of balance sheet. RM1.3 million interest expense is equivalent to 9% of LONBISC’s current net profit. Lowering its finance costs will be helpful to improve the company’s margin in the future.

We believe the management will continue putting in more efforts in controlling their gearing level, which will eventually help in lowering LBB‟s annual finance costs and correspondingly bump earnings higher. Dilution of EPS should not be a big concern from our view as the company is putting out good earnings growth.

Valuation

Looking at the sustainability over the years coupled with long term promising growth, hence we opine that valuing the stock using a PER approach is the most reflective of its potentials.

Among LBB’s listed peers, the closest comparison is Apollo and Oriental Food, both trading at 24.5x and 17x respectively. LBB, on the other hand, is trading at an undemanding valuation of 10.15x.

Pegging LBB’s rolling 4 quarters EPS of 5.42 cents to 20x PER (average of its listed peers) translates to our target price of RM1.08, which implies to an upside of 96%.

We believe our forecast is justified and sustainable, mainly attributed to a) diversified and sustainable products range within the confectionery business, b) steady improvement in net gearing c) wide distribution network across different markets and d) recently upgraded overall production line.

Company Background

London Biscuits Berhad (LONBISC 7126), founded in 1981, which engages in manufacture and trading confectionery and related foodstuffs, in both Malaysia and internationally. Key products including Swiss roll, pie cakes, layer cakes, sweets and potato chips.

1) Stronger than Expected Result in FY18

During last quarter, which is 4QFY18, LONBISC recorded a RM6.65mil net profit, resulting a RM13.9mil net profit in entire FY2018, which exceed public expectation with a strong end in FY18.

The key boost towards a stronger-than-expected quarter result mainly due to lower material cost and improved cost efficiency. Better profit margins from its mix product also provide a hand to create delightful quarter result.

In coming 1QFY19, we foresee an even stronger performance from LONBISC as demand of its mix products remains high due to year end season festival.

2) Sustained Earnings through Long-time Products & New Production Lines for Potatoes Chips

Looking at its product portfolio closely, we will begin to recall and realize that at one point we did consume (or are still consuming) at least a few of its sugary goodies. This illustrates the edge LBB possesses in meeting consumers‟ preferences, seeing as that its products have been able to sustain well over the years.

Building on that, we believe that the company has set a solid base and will continue to flourish even further with its recently upgraded capacity.

One of the growth catalysts for LONBISC is their additional capacity in its potato chips production which yield extra revenue line. In two years, potato chips segment has been expected to double up current revenue to 30% supported by two additional production line. As per future business planning, extra potato chips that produced are planned to enter into Japan and Korea market, which potentially expand their business to even wider international distribution.

3) Lower Finance Costs as LONBISC Deleverages

By issuing more shares via private placements, the company plans to utilize the fund to repay part of its borrowing to deleverage. The management of the company mentioned a potential saving of RM1.3 million after the de-gearing of balance sheet. RM1.3 million interest expense is equivalent to 9% of LONBISC’s current net profit. Lowering its finance costs will be helpful to improve the company’s margin in the future.

We believe the management will continue putting in more efforts in controlling their gearing level, which will eventually help in lowering LBB‟s annual finance costs and correspondingly bump earnings higher. Dilution of EPS should not be a big concern from our view as the company is putting out good earnings growth.

Looking at the sustainability over the years coupled with long term promising growth, hence we opine that valuing the stock using a PER approach is the most reflective of its potentials.

Among LBB’s listed peers, the closest comparison is Apollo and Oriental Food, both trading at 24.5x and 17x respectively. LBB, on the other hand, is trading at an undemanding valuation of 10.15x.

Pegging LBB’s rolling 4 quarters EPS of 5.42 cents to 20x PER (average of its listed peers) translates to our target price of RM1.08, which implies to an upside of 96%.

We believe our forecast is justified and sustainable, mainly attributed to a) diversified and sustainable products range within the confectionery business, b) steady improvement in net gearing c) wide distribution network across different markets and d) recently upgraded overall production line.

https://klse.i3investor.com/blogs/kokokai/194673.jsp