KYY’s credit as an investor is rapidly diminishing. The most recent

target of his is none other than Carimin Petroleum. With its share price

up 300% in 2.5 months, alarm bells should be ringing in the head of any

competent investor. This report will aim to discredit KYY’s

recommendation as stupidity at best and straight-up misleading at

worst.

From his post ‘Carimin - As I See It’, one finds the following quote:

In the post ‘Waiting for Correction Strategy’, KYY pegged FY EPS of RM0.2 and P/E of 10x to arrive at a price per share of RM2. The investment thesis and rationale behind this is apparently:

No investor of a sound mind will recommend and investment because of an upwards movement of share price – what is even more insane is the attributing of the movement not to speculation but to apparent insider information.

The above is an unedited quote by KYY. Even Warren Buffet and Charlie Munger, at the ripe old age of 88 and 95 respectively, are not senile enough to make investment decisions based on what is a baseless and frankly ridiculously rationale.

The nail in the coffin for me is the pro-rating of EPS for the next 3 Quarters based on 1Q19 and then pegging a PE of 10x. This is absolutely outrageous stuff for a company that has barely even been profitable and is exposed to a highly volatile and risky O&G sector, while paying no dividend. In contrast, Apple currently trades at 14x P/E even with its high margins, strong branding, resilient businesses and dividends.

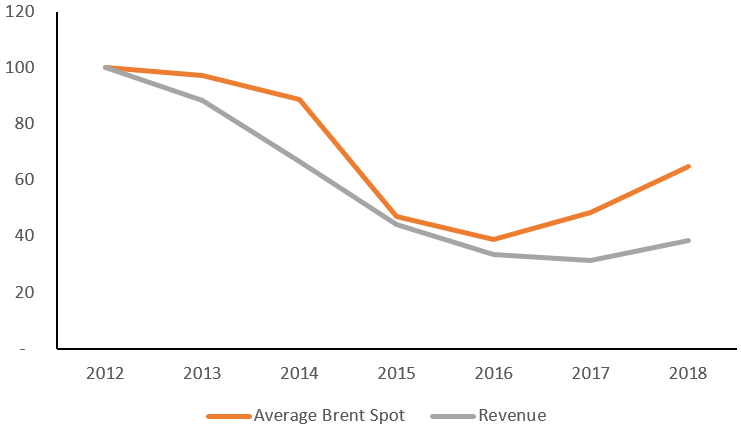

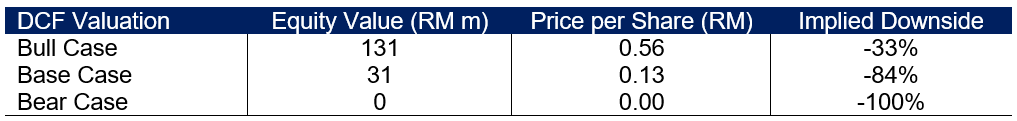

Lastly, the chart below with Carimin’s revenue and Brent spot price indexed to 2012 shows that Carimin’s revenue dipped much more than the brent crude and hasn’t exhibited as strong of a recovery. Carimin is solely exposed to the Malaysian O&G industry and any notion that there will be a massive recovery in both the industry and Carimin’s business is unfounded. More evidence of this will be presented later.

What does Carimin actually do?

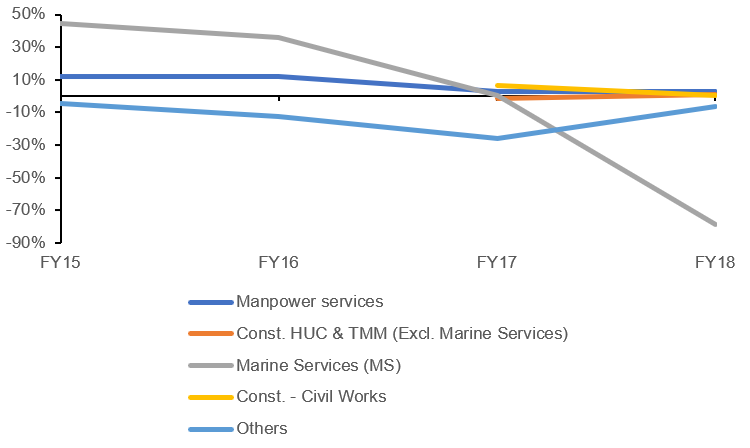

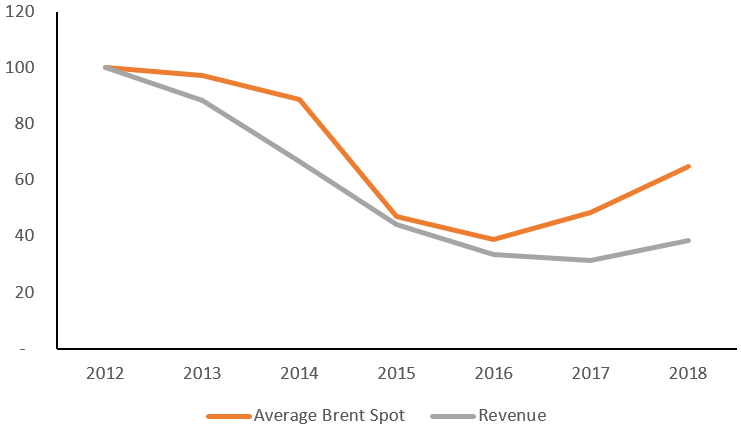

KYY called Carimin a renowned company, what renowned company has a market cap of US$45M? The actual business model for Carimin leaves a lot to be desired. Even after recent acquisitions in an attempt to diversify its business, we see that only the manpower services and const. HUC & TMM segments are profitable. In fact, Carimin is badly struggling to find any consistency in terms of profitability. While we commend that it has at least pare down its debt, we remain sceptical as to whether it has the management has the actual expertise to turn around many of the company’s floundering businesses. The track record of said management has been nothing to be proud of so far.

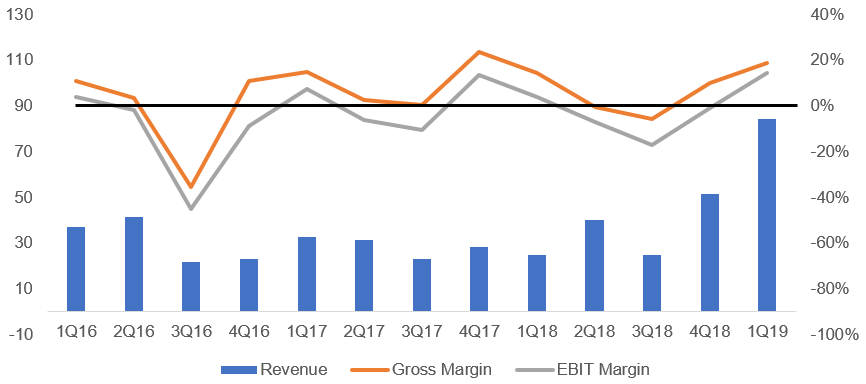

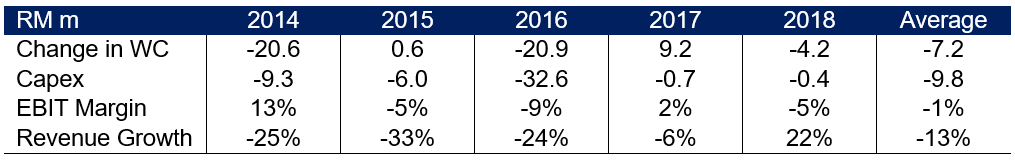

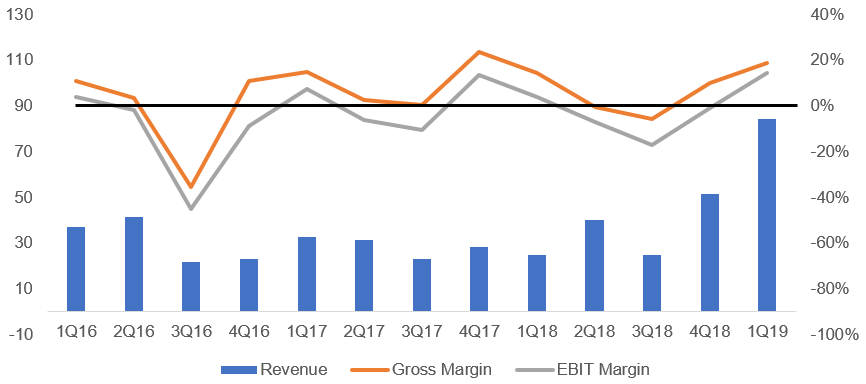

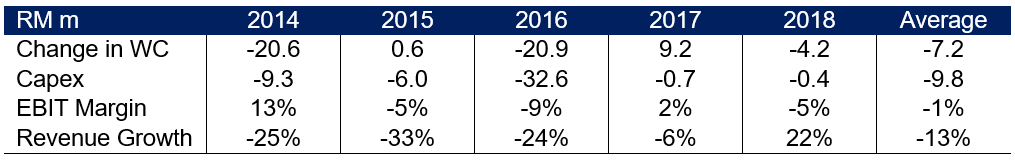

Highly volatile margins for what seems to be a simple business

Moreover, the type of businesses Carimin is engaged in low in value, as indicated by its margin. Furthermore, their overall margins have proven to be incredibly volatile and EBIT margins have usually been -ve between the second to fourth quarters, based on historical data.

No Further Upside

It is no secret that 100% of Carimin revenues are dependent on Malaysia’s O&G sector. In particular, Petronas provides the majority of their business. Contrary to what KYY and the management would like you to believe much of that revenue potential has already been recognised.

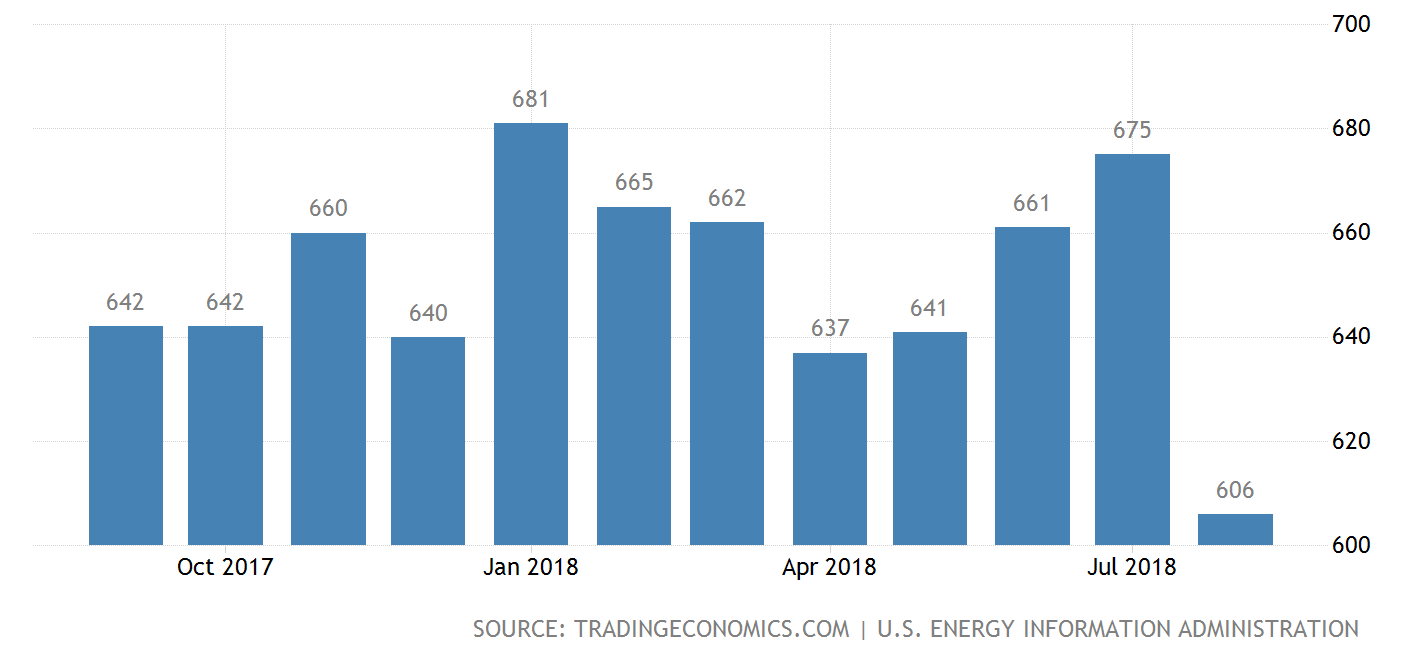

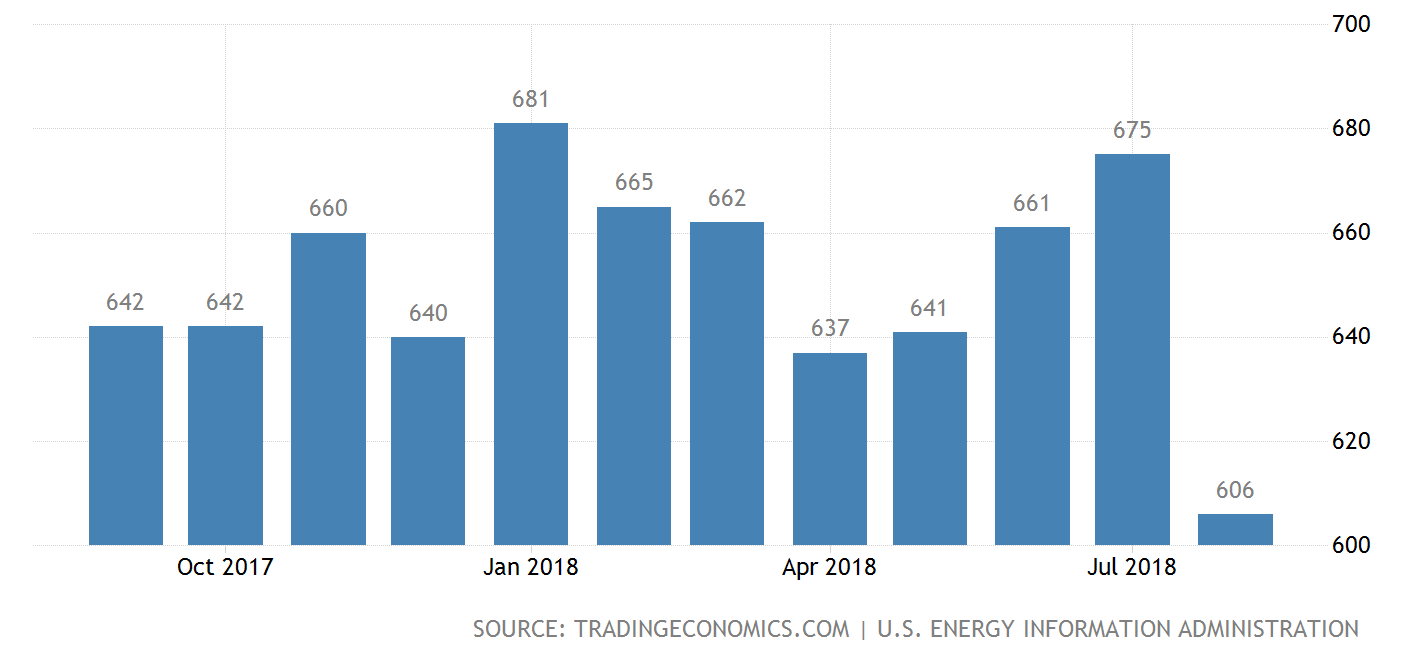

Firstly, Crude oil production in Malaysia has been relatively stable in the past few years. However, the total production levels are down from the highs of 704kbpd in 2006. Going forward, we do not expect much changes in output level, as pressures from shale producers and opec will lead to compressed output levels in an effort to profit from the inelasticity of O&G demand. With renewables expected to take flight in the next 3-5 years, our long term outlook for O&G prices is rather bearish. If oil prices remain in the current range, OPEC will continue to put a lid on output.

The current proven crude reserves in Malaysia is 3,600 million barrels. Assuming an output of 650kbpd, we have approximately 15 years of crude remaining.

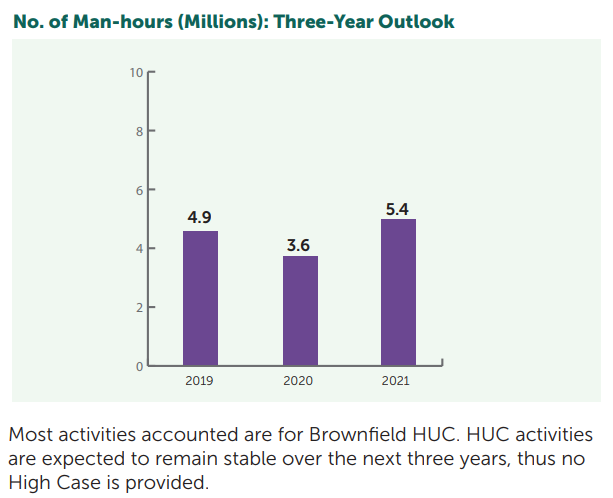

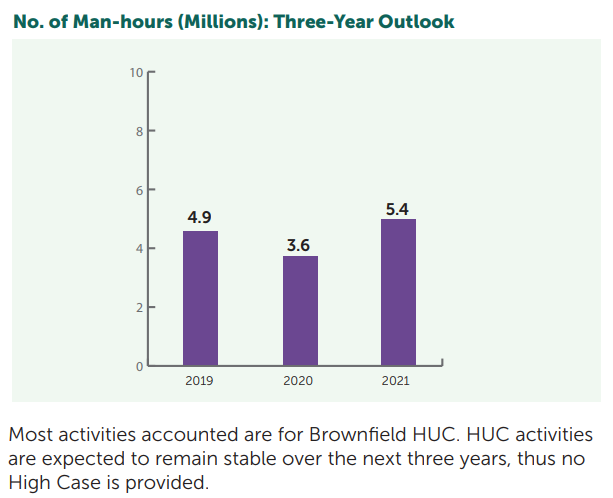

Secondly, Petronas expects man-hours to range between 3.6 – 5.4 million hours. This does not bode-well for the thesis that Carimin will benefit in the surge in O&G projects that at this point, doesn’t seem to be materialising.

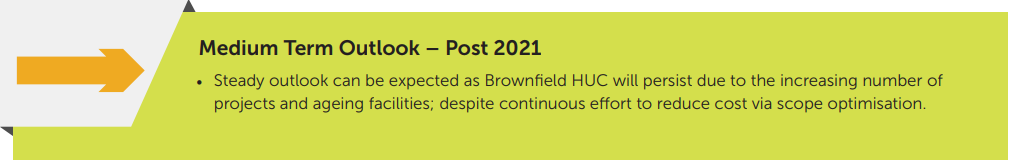

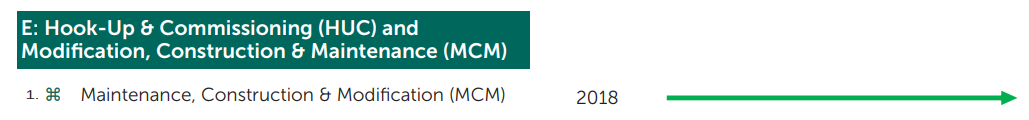

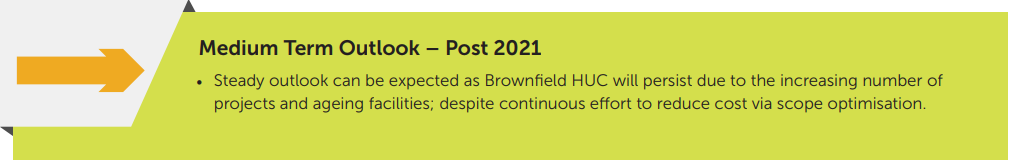

Thirdly, Petronas’ forecast for HUC and MCM indicates that all contracts for the next 3 years have been fully given out. This implies zero new revenue contribution from Petronas in this segment for Carimin over the next few years. Moreover, the outlook for post 2021 is neutral, and thus we expect no medium or long-term upside for Carimin.

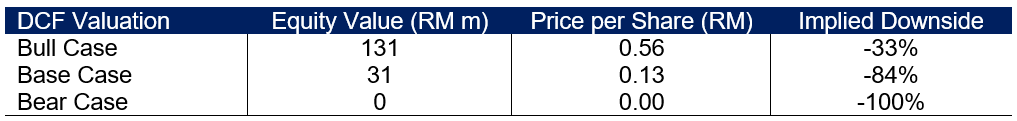

Our Valuation: Base Share Price of RM0.84

To summarise our key theses:

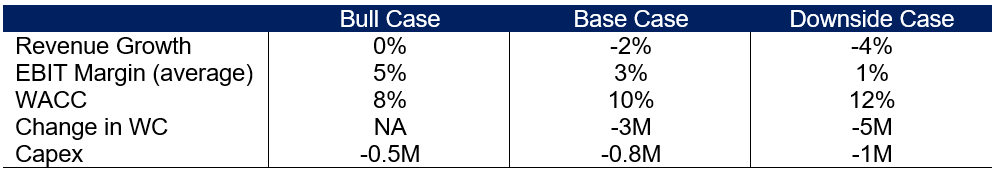

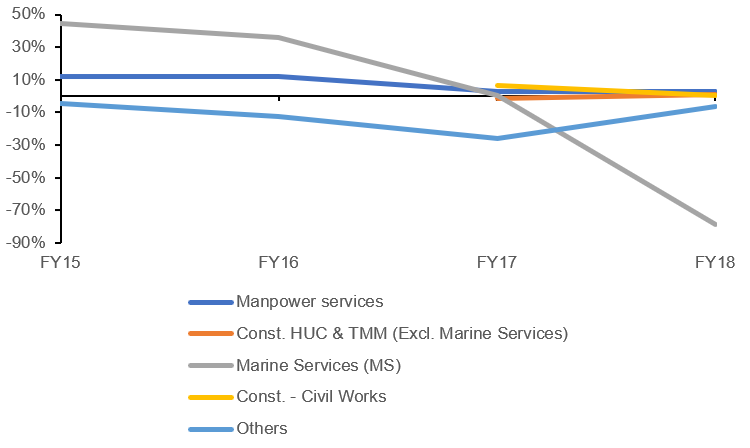

Tabulated Assumptions:

DCF Valuation: Ran for over 20 years to err on the conservative side

https://klse.i3investor.com/blogs/batuhitam/194541.jsp

From his post ‘Carimin - As I See It’, one finds the following quote:

Just based on its strong earning, the company must be very efficient

and most likely the company can secure more contracts from Petronas. As a

result, the company will have a very good profit growth prospect which

is the most powerful catalyst to move share price.

This is utter bullshit. This article will attempt to show that:

- Earnings are not strong

- Company is the exact opposite of efficient

- No more upside from Petronas, who is their largest client

- Thus, little to no profit growth prospects

- Our valuation at the end will show that this company is highly overvalued, and we recommend those who own this stock to SELL

In the post ‘Waiting for Correction Strategy’, KYY pegged FY EPS of RM0.2 and P/E of 10x to arrive at a price per share of RM2. The investment thesis and rationale behind this is apparently:

‘I believe the big buyers who were not afraid to buy so aggressively,

must have inside information that the Q2 EPS is 5 or more sen.’

No investor of a sound mind will recommend and investment because of an upwards movement of share price – what is even more insane is the attributing of the movement not to speculation but to apparent insider information.

Many people are involved in the calculation of the profit or EPS, such

as the company directors, accountants, book keepers, clerks etc. As a

result, many people already knew the 2Q EPS and likely they would have

leaked out the information to their friends and relatives.

The above is an unedited quote by KYY. Even Warren Buffet and Charlie Munger, at the ripe old age of 88 and 95 respectively, are not senile enough to make investment decisions based on what is a baseless and frankly ridiculously rationale.

The nail in the coffin for me is the pro-rating of EPS for the next 3 Quarters based on 1Q19 and then pegging a PE of 10x. This is absolutely outrageous stuff for a company that has barely even been profitable and is exposed to a highly volatile and risky O&G sector, while paying no dividend. In contrast, Apple currently trades at 14x P/E even with its high margins, strong branding, resilient businesses and dividends.

Lastly, the chart below with Carimin’s revenue and Brent spot price indexed to 2012 shows that Carimin’s revenue dipped much more than the brent crude and hasn’t exhibited as strong of a recovery. Carimin is solely exposed to the Malaysian O&G industry and any notion that there will be a massive recovery in both the industry and Carimin’s business is unfounded. More evidence of this will be presented later.

What does Carimin actually do?

KYY called Carimin a renowned company, what renowned company has a market cap of US$45M? The actual business model for Carimin leaves a lot to be desired. Even after recent acquisitions in an attempt to diversify its business, we see that only the manpower services and const. HUC & TMM segments are profitable. In fact, Carimin is badly struggling to find any consistency in terms of profitability. While we commend that it has at least pare down its debt, we remain sceptical as to whether it has the management has the actual expertise to turn around many of the company’s floundering businesses. The track record of said management has been nothing to be proud of so far.

Highly volatile margins for what seems to be a simple business

Moreover, the type of businesses Carimin is engaged in low in value, as indicated by its margin. Furthermore, their overall margins have proven to be incredibly volatile and EBIT margins have usually been -ve between the second to fourth quarters, based on historical data.

No Further Upside

It is no secret that 100% of Carimin revenues are dependent on Malaysia’s O&G sector. In particular, Petronas provides the majority of their business. Contrary to what KYY and the management would like you to believe much of that revenue potential has already been recognised.

Firstly, Crude oil production in Malaysia has been relatively stable in the past few years. However, the total production levels are down from the highs of 704kbpd in 2006. Going forward, we do not expect much changes in output level, as pressures from shale producers and opec will lead to compressed output levels in an effort to profit from the inelasticity of O&G demand. With renewables expected to take flight in the next 3-5 years, our long term outlook for O&G prices is rather bearish. If oil prices remain in the current range, OPEC will continue to put a lid on output.

The current proven crude reserves in Malaysia is 3,600 million barrels. Assuming an output of 650kbpd, we have approximately 15 years of crude remaining.

Secondly, Petronas expects man-hours to range between 3.6 – 5.4 million hours. This does not bode-well for the thesis that Carimin will benefit in the surge in O&G projects that at this point, doesn’t seem to be materialising.

Thirdly, Petronas’ forecast for HUC and MCM indicates that all contracts for the next 3 years have been fully given out. This implies zero new revenue contribution from Petronas in this segment for Carimin over the next few years. Moreover, the outlook for post 2021 is neutral, and thus we expect no medium or long-term upside for Carimin.

Our Valuation: Base Share Price of RM0.84

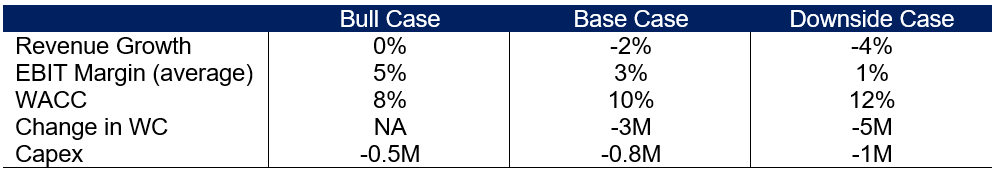

To summarise our key theses:

- Top-line expansion will be highly unlikely, our bull case assumes that orderbook replenishment maintains the revenue run rate implied by 1Q19 (which is very bullish)

- Margin volatility implies some form of contraction going into the next 3 quarters. Q4 and Q1 historically constitute the periods with highest margins

- Long term outlook is bearish due to the onset of renewable energy and an estimated 15 years of remaining proven reserve – thus we are projecting a 20Y DCF with no terminal value

Tabulated Assumptions:

DCF Valuation: Ran for over 20 years to err on the conservative side

https://klse.i3investor.com/blogs/batuhitam/194541.jsp