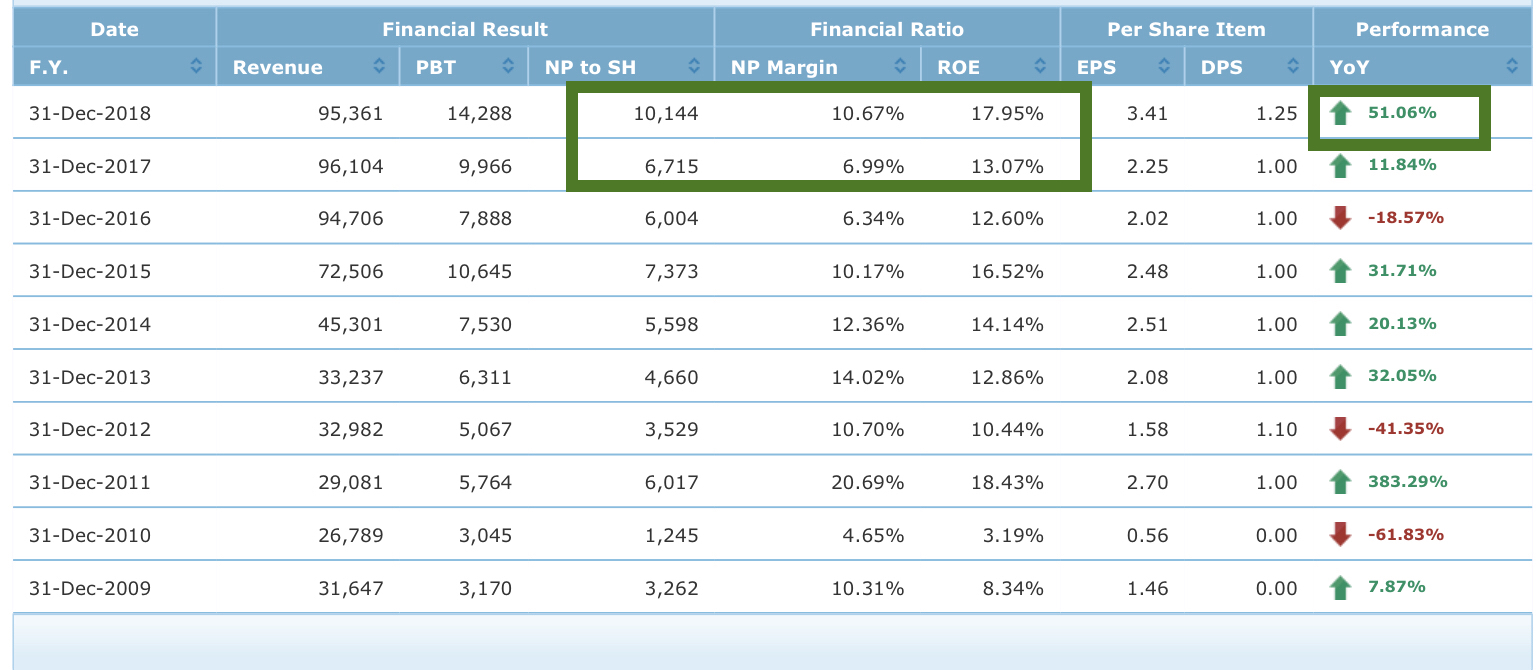

Opensys just released its latest financial results today.

For

the year ended 31 December 2018, Opensys’s net profit surged 51% to

RM10.1 million as compared to RM6.7 million in the preceding year

despite a slight decline in revenue.

The

better performance in 2018 was mainly driven by higher gross margins

achieved from the roll-out of the CRM due to the stronger ringgit

against foreign currencies.

OpenSys

expects that, barring any unforeseen circumstances, the performance of

the Group will continue to be satisfactory in the financial year ending

31 December 2019.

(Click/zoom to enlarge)

Mismatch between share performance and profit growth

For

the year ended 31 December 2018, Opensys’s net profit surged 51% to

RM10.1 million as compared to RM6.7 million in the preceding year.

However,

it’s share price performance was flat for the last 1 year. Share price

opened at 34 sen on 2 January 2017 and closed at 34.5 sen today. The

stock was very active starting 2016 after famous investor Cold eye

recommended the stock. His comments below

21. 傲奔系統(OPENSYS,0040,創業板)Publish date: Sun, 6 Nov 2016

-做CRM&ATM,或是銀行提款機。

-拿到日本OKI版權,提款機(ATM)和存款機(Deposit)合為一體,可以為銀行節省25%費用。

- 目前,我国自动提款机和现金存款机年增长率是5%,意味着生意空间大。

-大馬擁有1萬6000臺ATM,如果銀行逐步採用,生意空間大,可做8到10年的生意。

-現在股價不是很便宜需要1至2年,等成績出來,將有潛在力。(2016年11月:36仙. PE Ratio: 20)

-凈現金公司。

-今年首季業績滑落,但是今年訂單已超過上財政年全年,營收賬款(Acc. Receivable)所以出奇的高

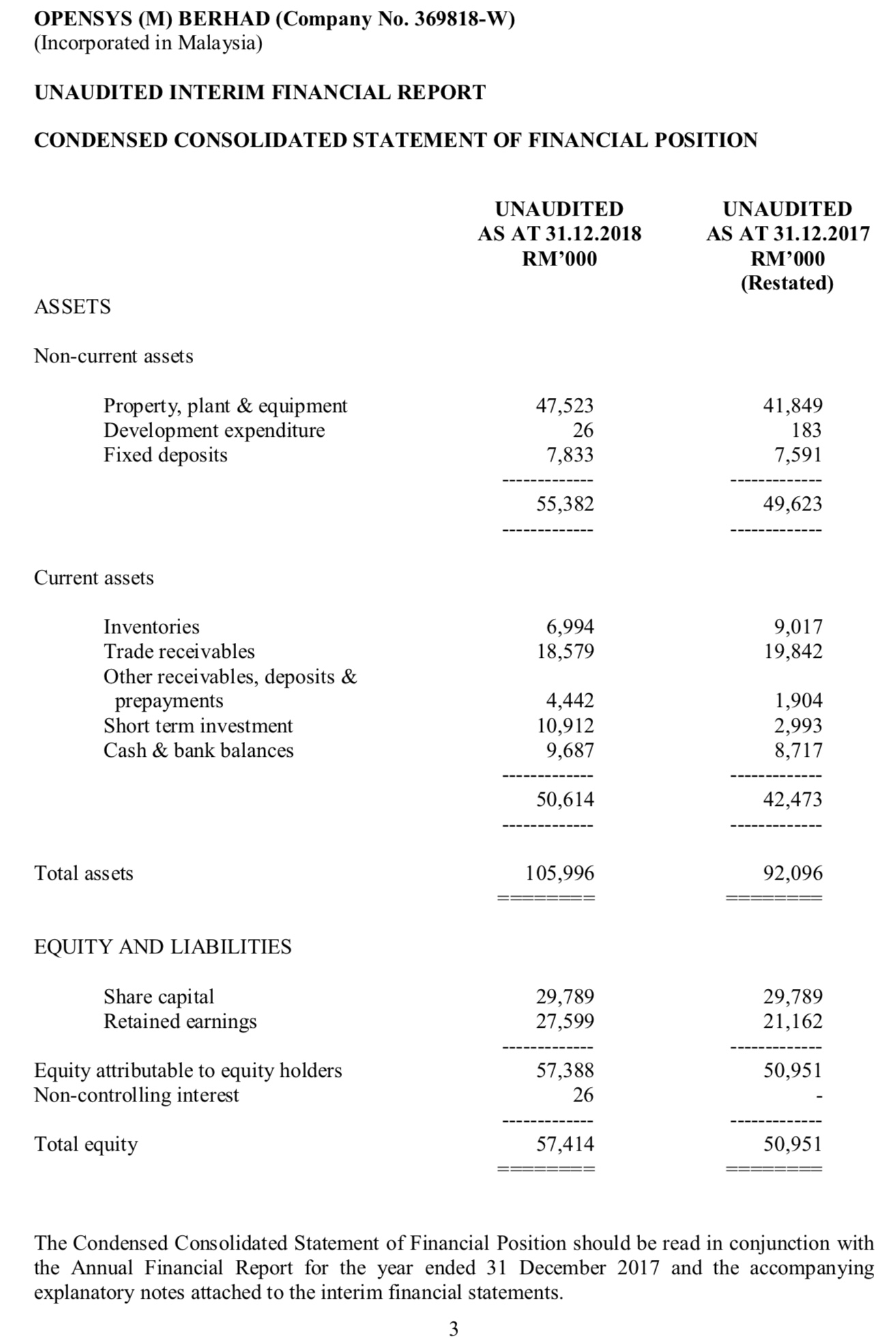

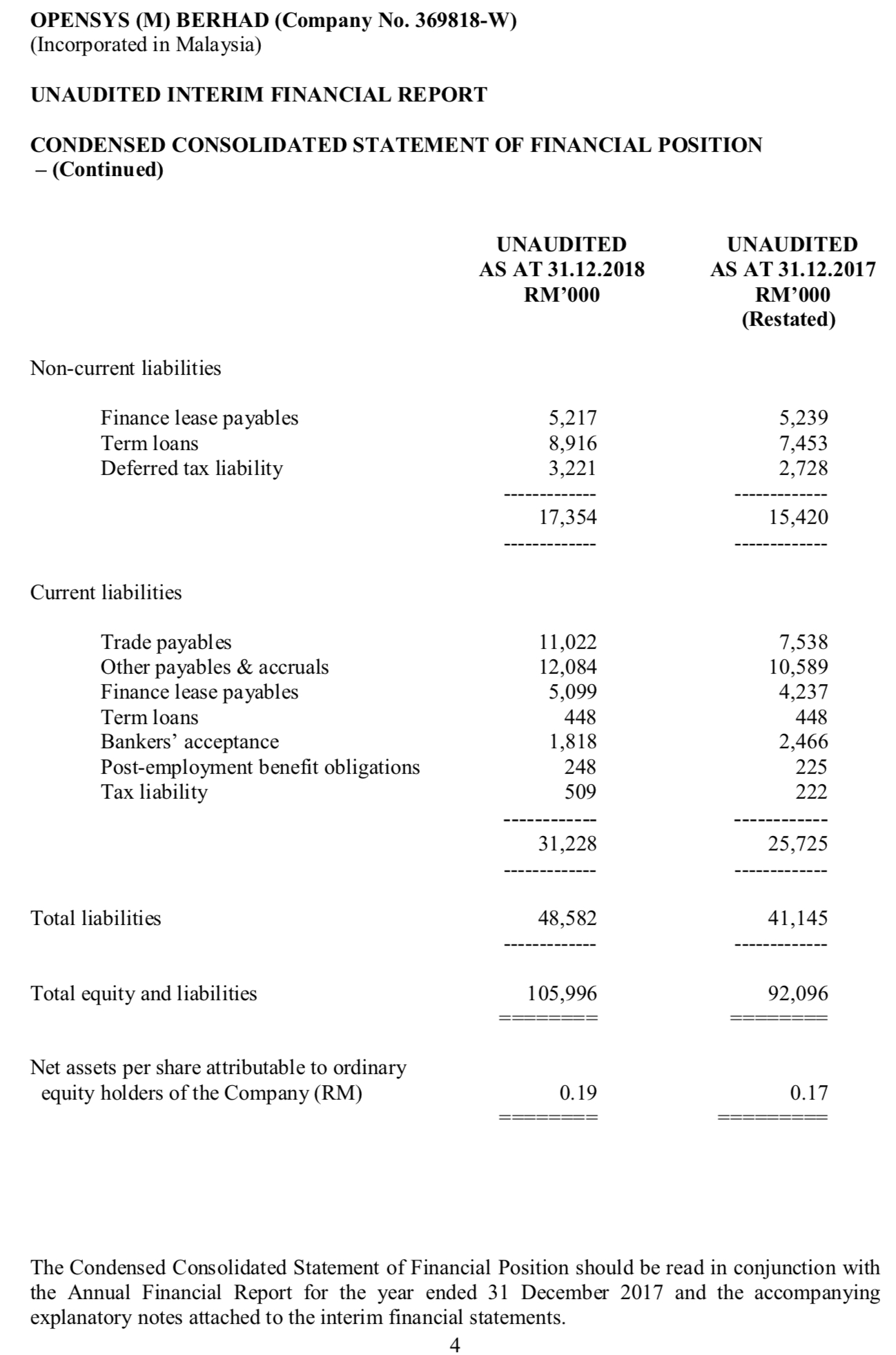

Opensys Financial position

Today,

Opensys’s valuations are much cheaper than in 2016 when Cold Eye

recommended the stock, at 20x PE. It’s fundamentals have also improved

over the years.

Cash and equivalent: RM 28.43 million

Total borrowings: RM21.5 million

Net cash and equivalent: RM6.93 million

Market capitalisation: RM102.77 million

ex-cash PE: 9.45x

Dividend yield: 3.62%

Opensys balance sheet

Future prospects

The

future looks exciting for Opensys. In 2017 annual report, Opensys

mentioned that it had installed over 2,500 CRMs in Malaysia since 2014

and became the industry leader with 80% market share.

Moving

forward, there is a huge patent demand for CRMs in Malaysia. Most banks

are replacing their ATMs and CDMs with CRMs. Currently, the number of

ATMs and CDMs is 17,500 units with annual growth of 5%. Only 20% of bank

machines are CRMs today. Opensys is optimistic of winning more market

share considering its excellent track record.

Source

Disclaimer: The article above does not represent a recommendation to buy or sell.

https://klse.i3investor.com/blogs/Amazinggrowth/195023.jsp

https://klse.i3investor.com/blogs/Amazinggrowth/195023.jsp