October 28, 2016

1. Bill Gurley: “Being ‘right’ doesn’t lead to superior performance if the consensus forecast is also right.”

Andy Rachleff elaborates on the point made by Gurley: “What most people don’t realize is if you’re right and consensus you don’t make money.” It is a bit strange that most people don’t realize this truth and yet it is common sense: you simply can’t be part of the crowd and at the same time beat the crowd.

2. Jeff Bezos: “You just have to remember that contrarians are usually wrong.”

This point made by Bezos is the reason why most people follow the crowd. Michael Mauboussin explains this tendency with a simple example:

“Being a contrarian for the sake of being a contrarian is not a good idea. In other words, when the movie theater’s on fire, run out the door, right? Don’t run in the door…. Successful contrarian investing isn’t about going against the grain per se, it’s about exploiting expectations gaps. If this assertion is true, it leads to an obvious question: how do these expectations gaps arise? Or, more basically, how and why are markets inefficient?”

Mauboussin explains why some investments get mispriced so badly:

“Because if the crowd takes something to an extreme, either on the bullish side or the bearish side, that should show up in your disconnect between fundamentals and expectations. And that is what allows you to make a good investment… Again, the goal is not to be a contrarian just to be a contrarian, but rather to feel comfortable betting against the crowd when the gap between fundamentals and expectations warrants it. This independence is difficult because the widest gap often coincides with the strongest urge to be part of the group. Independence also incorporates the notion of objectivity—an ability to assess the odds without being swayed by outside factors. After all, prices not only inform investors, they also influence investors.”

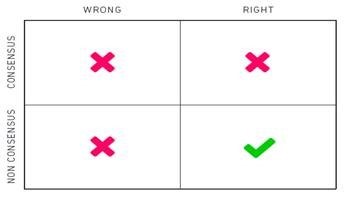

3. Andy Rachleff: “Investment can be explained with a 2×2 matrix. On one axis you can be right or wrong. And on the other axis you can be consensus or non-consensus. Now obviously if you’re wrong you don’t make money. The only way as an investor and as an entrepreneur to make outsized returns is by being right and non-consensus.”

It is the existence of a gap between expected value and market price that Mauboussin talked about above which should drive investment decision making. If you have views which reflect the consensus of the crowd you are unlikely to outperform a market since a market by definition reflects the consensus view. Buffett puts it this way: “Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well.”

Charlie Munger is more direct and colorful in his explanation: “For a security to be mispriced, someone else must be a damn fool. It may be bad for world, but not bad for Berkshire.” Sometimes waves of social proof and other dysfunctional heuristics create a significant gap between price and value. This does not happen often in areas within a person’s circle of competence, but it does happen. For some investors, spotting a gap like this happens only once or twice a year and that is just fine with them. In those instances these investors bet big and the rest of the time they do nothing. Some people, like day traders, think they can spot gaps between expected value and market price several times a day and make a profit after fees (this is almost always a triumph of hope over experience).

4. Howard Marks: “To achieve superior investment results, your insight into value has to be superior. Thus you must learn things others don’t, see things differently or do a better job of analyzing them – ideally all three.”

Being genuinely contrarian means the investor is going to be uncomfortable sometimes. Some people are good at being uncomfortable, and some are not. Peter Lynch said once: “To make money, you must find something that nobody else knows, or do something that others won’t do because they have rigid mind-sets.”

Successful investing is the search for the mistakes of other people that may create a mispriced asset (Howard Marks). In other words, one person’s mistake about the value of an asset is what can create an opportunity for another investor to outperform the market.

This search is best done by people who are curious and hard working. Great investors hustle, have a huge scuttlebutt network and read constantly. They are constantly trying to learn more about more and know that the more that they know, they more they will know that there is even more that they don’t know. If you are not getting more humble over time, you have a flawed system.

It is Mr. Market’s irrationality that creates the opportunity for investors. Markets are often wise, but they are not always wise. The best returns accrue to investors who are patient and yet aggressive when they are offered an attractive price for an asset. Seth Klarman says: “Successful investing is the marriage of a calculator and a contrarian streak.” The most effective way to get free of social proof when the time is right is to have done the homework in advance and stay within your circle of competence.

5. Jeff Bezos: “Outsized returns often come from betting against conventional wisdom, and conventional wisdom is usually right. Given a 10% chance of a 100 times payoff, you should take that bet every time. But you’re still going to be wrong nine times out of ten. We all know that if you swing for the fences, you’re going to strike out a lot, but you’re also going to hit some home runs.” “In business, every once in a while, when you step up to the plate, you can score 1,000 runs. This long-tailed distribution of returns is why it’s important to be bold. Big winners pay for so many experiments.”

It is magnitude of success and not frequency of success that matters for an investor. Bezos is talking about convexity in investments. All a founder or venture capitalist can lose is 100% of what they invest in a startup and yet what they can potentially gain is potentially many multiples of that investment.

(Icon8888 comment for item 5 : you don’t need to get all your stocks in your portfolio right. Sometime a few of them will turn bad. But if you have one or two multi-baggers, that will help to cover the losses and elevate the performance of the entire portfolio. In other words, don’t be afraid to take risk. It is ok to make some bad decisions. But try not to be too concentrated)

https://klse.i3investor.com/blogs/icon8888/192750.jsp