Aturmaju Resources Berhad (“ARB”)

Company Summary and Prospects

ARB’s core business is in timber activities of both upstream and downstream operations through Aturmaju (Sabah) Holding Sdn Bhd. Through its subsidiary, they integrated timber complex processing sawn timber, veneer, plywood, blockboard, wooden flooring board, and multiple plywoods.

Despite they are a proud owner of a fully integrated timber complex sited at Kalabakan, District of Tawau, yet they had made a consecutive loss for a long 10 years. Over the years, ARB faced major challenges in stabilizing its revenue stream due to instability in the supply chain. A few years back, they made a strategic move by diversifying its timber-related business into IT business solutions. Anyhow, the group remains in losses.

However, recently the RM 20 million ERP business contract per year between Aturmaju and Yes’s Communication Enterprise caught my attention. “You must be kidding me!”, a listed company with a RM 21 million market capital secures nearly the same amount of its market cap’s project. Even though the contract is yearly renewable and subjected to review, but I got a few very big “question marks” in my brain, why Aturmaju? with such a big contract? What so special on theirs that can compete in the markets? There are many ERP solution providers in the market, right? Why not Microsoft Dynamics, Oracle, SAGE, SAP…

Datuk Larry Liew, CEO (Investment & Technology) said in the statement that “this contract is to provide a marketplace platform to YESS to sell and market their products efficiently by implementing the customized ERP system and System Integration solution to maximize YESS sales by implementing the real-time inventory management. The SIS features include real-time sales tracking, real-time sales, and inventory sales interlinking, inventory management, assortment selection and forecast, warehousing and logistics optimization. The intention is to assist YESS to accurately map inventory assortments against customer preferences and seasonal trends across YESS’ operations/ outlets. This ultimately provides better customer service with an improved, more real-time understanding of what is selling and what is not.”

I learned and managed to use ERP software before, yet we did not come across with local products. Basically, ERP is an acronym for Enterprise Resource Planning, but even its full name doesn't shed much light on what ERP is or what it does. For that, you need to take a step back and think about all of the various processes that are essential to running a business, including inventory and order management, accounting, human resources, customer relationship management (CRM), and beyond. At its most basic level, ERP software integrates these various functions into one complete system to streamline processes and information across the entire organization. The central feature of all ERP systems is a shared database that supports multiple functions used by different business units. In practice, this means that employees in different divisions—for example, accounting and sales—can rely on the same information for their specific needs.

In a nutshell, the ERP software market is a high growth segment with a lot of revenue and profit potential. This might be a game changer for ARB and bring them back to green!

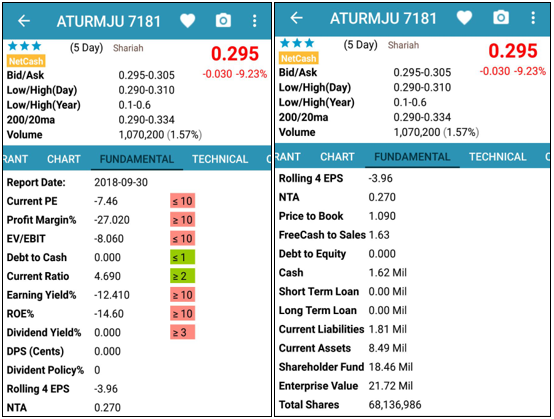

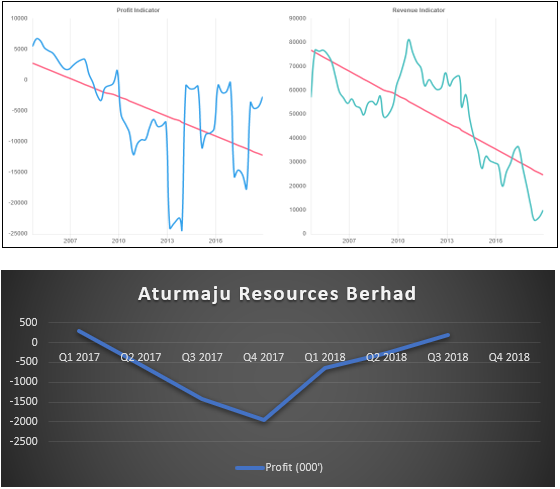

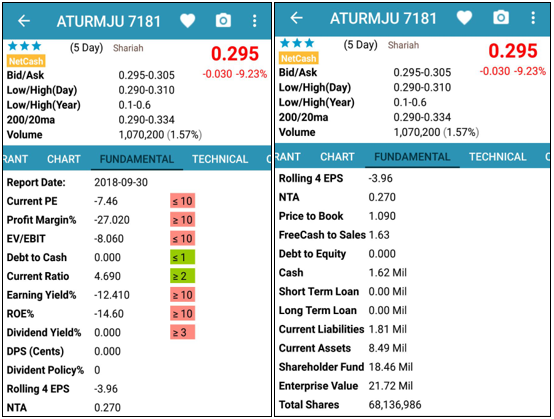

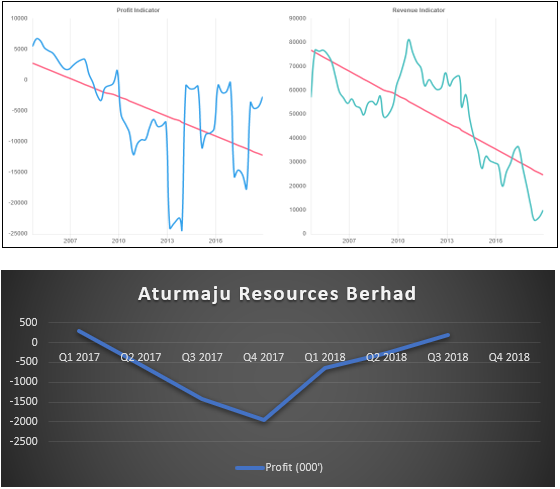

Fundamental Analysis

Revenue and Profit are in a downward trend (long run). However, if you make it in the short period of time (i.e. 2 years timeframe), you might see the company’s yearly profit is likely back to green and in an upward trend. In the long run, Aturmaju is a good opportunity to be invested as the group had executed an excellent diversification strategy into ERP software market!

Technical Analysis

The stock price is likely to move beyond RM 0.50 per share, as the share price is:

1. Buy mother – riskier due to illiquidity and conversion risk (arbitraging gap).

2. Buy preference shares (son) – safer because investors can convert into mother with another 19sen anytime even though you might see any paper loss in your pa. After the conversion is done, you can take profit anytime or hold it at a price that below the market.

Disclaimer: Sometimes the smallest step in the right direction ends up being the biggest step of our life. This is not a buy/ sell call, it is just for education purposes.

https://klse.i3investor.com/blogs/Aturmaju/194765.jsp

Company Summary and Prospects

ARB’s core business is in timber activities of both upstream and downstream operations through Aturmaju (Sabah) Holding Sdn Bhd. Through its subsidiary, they integrated timber complex processing sawn timber, veneer, plywood, blockboard, wooden flooring board, and multiple plywoods.

Despite they are a proud owner of a fully integrated timber complex sited at Kalabakan, District of Tawau, yet they had made a consecutive loss for a long 10 years. Over the years, ARB faced major challenges in stabilizing its revenue stream due to instability in the supply chain. A few years back, they made a strategic move by diversifying its timber-related business into IT business solutions. Anyhow, the group remains in losses.

However, recently the RM 20 million ERP business contract per year between Aturmaju and Yes’s Communication Enterprise caught my attention. “You must be kidding me!”, a listed company with a RM 21 million market capital secures nearly the same amount of its market cap’s project. Even though the contract is yearly renewable and subjected to review, but I got a few very big “question marks” in my brain, why Aturmaju? with such a big contract? What so special on theirs that can compete in the markets? There are many ERP solution providers in the market, right? Why not Microsoft Dynamics, Oracle, SAGE, SAP…

Datuk Larry Liew, CEO (Investment & Technology) said in the statement that “this contract is to provide a marketplace platform to YESS to sell and market their products efficiently by implementing the customized ERP system and System Integration solution to maximize YESS sales by implementing the real-time inventory management. The SIS features include real-time sales tracking, real-time sales, and inventory sales interlinking, inventory management, assortment selection and forecast, warehousing and logistics optimization. The intention is to assist YESS to accurately map inventory assortments against customer preferences and seasonal trends across YESS’ operations/ outlets. This ultimately provides better customer service with an improved, more real-time understanding of what is selling and what is not.”

I learned and managed to use ERP software before, yet we did not come across with local products. Basically, ERP is an acronym for Enterprise Resource Planning, but even its full name doesn't shed much light on what ERP is or what it does. For that, you need to take a step back and think about all of the various processes that are essential to running a business, including inventory and order management, accounting, human resources, customer relationship management (CRM), and beyond. At its most basic level, ERP software integrates these various functions into one complete system to streamline processes and information across the entire organization. The central feature of all ERP systems is a shared database that supports multiple functions used by different business units. In practice, this means that employees in different divisions—for example, accounting and sales—can rely on the same information for their specific needs.

In a nutshell, the ERP software market is a high growth segment with a lot of revenue and profit potential. This might be a game changer for ARB and bring them back to green!

Fundamental Analysis

Revenue and Profit are in a downward trend (long run). However, if you make it in the short period of time (i.e. 2 years timeframe), you might see the company’s yearly profit is likely back to green and in an upward trend. In the long run, Aturmaju is a good opportunity to be invested as the group had executed an excellent diversification strategy into ERP software market!

Technical Analysis

The stock price is likely to move beyond RM 0.50 per share, as the share price is:

a. supported by SMA 200;

b. likely to break out from symmetrical triangle;

c. likely to move in a round bottom shape (3 main areas fulfilled –

share price declining, bottom, share price recovering).

Aturmaju vs Aturmaju-pa1. Buy mother – riskier due to illiquidity and conversion risk (arbitraging gap).

2. Buy preference shares (son) – safer because investors can convert into mother with another 19sen anytime even though you might see any paper loss in your pa. After the conversion is done, you can take profit anytime or hold it at a price that below the market.

Disclaimer: Sometimes the smallest step in the right direction ends up being the biggest step of our life. This is not a buy/ sell call, it is just for education purposes.

https://klse.i3investor.com/blogs/Aturmaju/194765.jsp