This is my first article in 2019, a real tough company to study, too many data, too many factors. But a SUPER POTENTIAL one!

Tony has uploaded his message in twitter earlier,

And today he shoot another one!

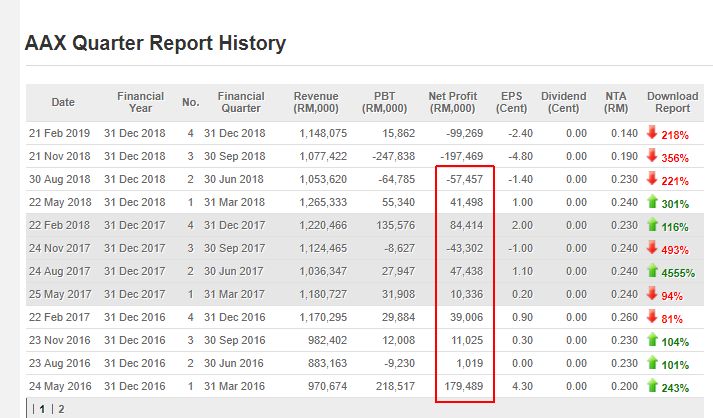

I'm hopeful, though not 100%, based on my tracking. Simply because major operating factors that affecting AAX profitability seem to be in favourable condition now. Due to the complexity of the airline business, i will try to portion them into multiple parts inside this article and toward the end of this article, i will put out a matrix for 2019.

PLEASE TAKE NOTE THAT AAX IS IN MY TRACKING LIST AND THIS ARTICLE IS NOT A BUY/ SELL CALL!

Let begin!

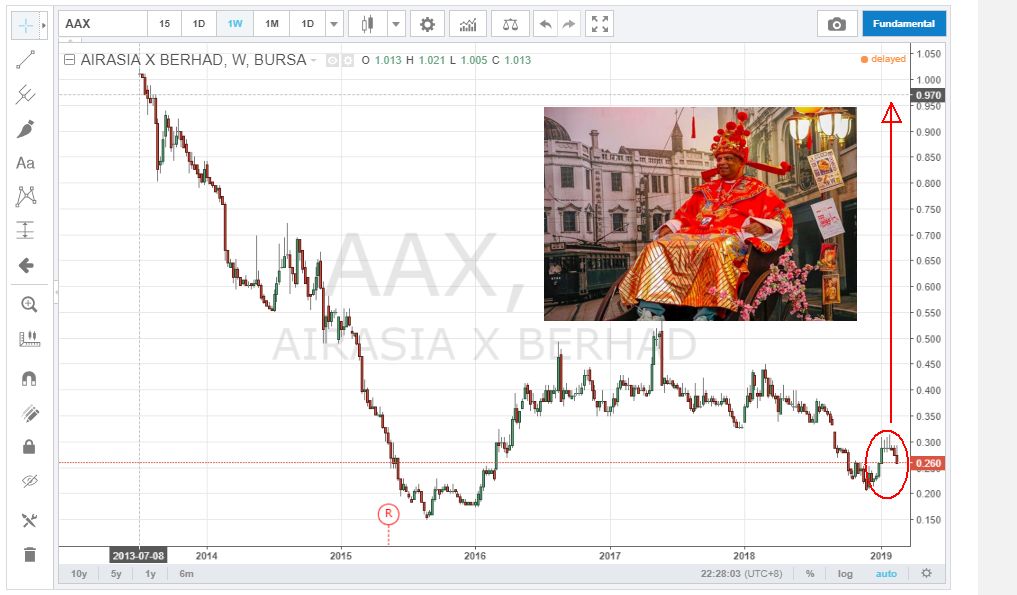

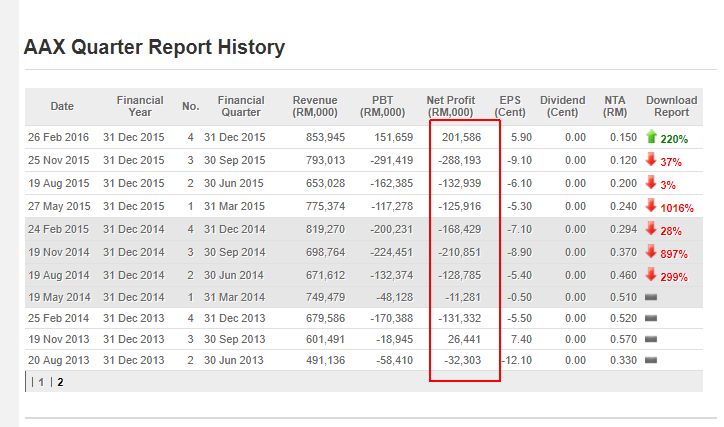

Airasia X is operating as a mid-haul low cost airline. Not long haul. The company was making years of profit before listed in Bursa Malaysia in 2013. Unfortunately, condition turn sour especially when Ringgit crash from 3.20 towards 4.00 again USD. You can see the share price performance in above chart, a real ugly one.

For AAX to be profitable, there are generally seven factors that AAX must overcome.

(A) Revenue/ ASK > Cost/ ASK

(B) Forex gain/ loss

(C) Hedging

(D) Finance income > finance cost

(E) Associate Contribution (Thai AAX)

(F) Special item (gain/loss)

(G) Deferred tax gain/loss

Of the above seven, (A) and (C) will affect the Operating Income of the airline. (B), (D), (E), (F) will affect Profit Before Tax, and (G) will ultimately affect comany profitability of that particular year/ quarter.

Let start with (B) Forex gain/ loss.

(B) Forex gain/ loss

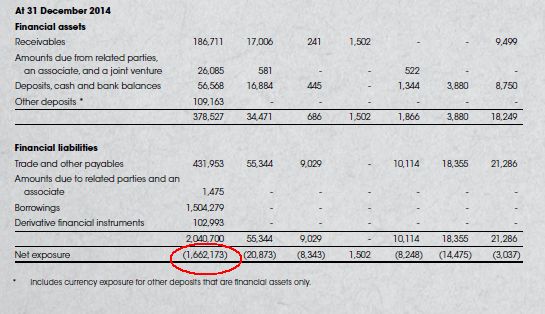

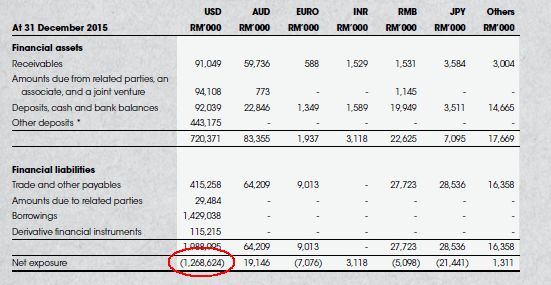

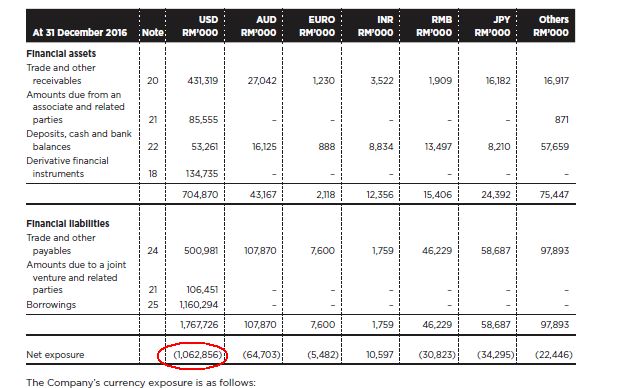

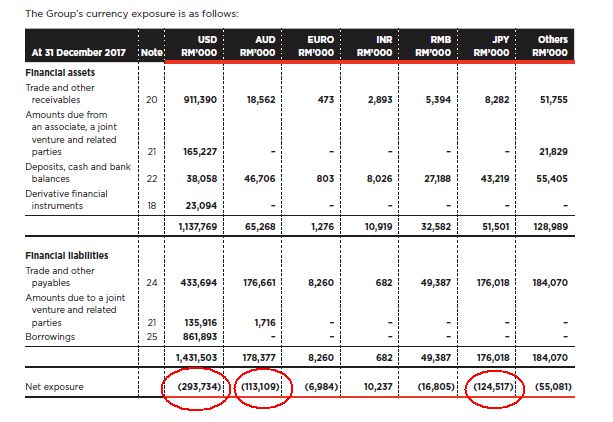

If you are a regular reader of my article, you should know that this factor really depends on "Net Exposure" of the currencies involved in AAX business. An appreciation on Ringgit will not necessary result in forex gain/ loss. For AAX, it is kind of quite consistent whereby it has constantly showed negative exposure to major 3 currency that affecting its business: USD, AUD & JPY. You may refer to below currecy exposure table for AAX for 2014, 2015, 2016 & 2017.

Key Observation:

Over the past 4 years (excluding 2018), the next exposure to foreign currency has been getting narrow and narrow. USD net exposure has reduced from (RM 1.66 bil) in 2014 to (RM0.29 bil) in 2017. One of the main reason for such tremendous improvement was due to speedy reduction of USD borrowing, from RM 1.5 bil in 2014 to RM 861 mil in 2017. [Based on latest quarter result, the net exposure should has reduced further in 2018 where AAX continue to pare down thier borrowing]

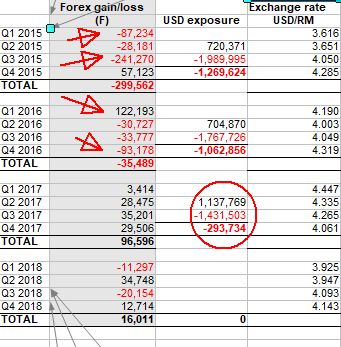

See the impact of forex gain/ loss for the past 4 years as below:

The very big impact of forex net exposure resulted in high magnitude of forex loss in early years and triggered major share price collapse from IPO to 2016).

Please see below the magnitude of the loss/ gain in hundreds of million of ringgit quarter in quarter out.

And the impact is getting smaller and smaller in recent years which also means that AAX has successfully solved the problem of Forex Net Exposure issue. See below.

(C) Hedging

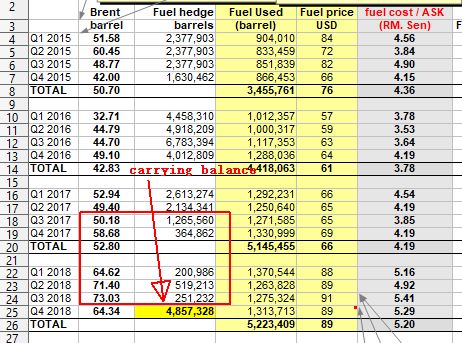

Hedging is another key factor that affecting AAX fuel/ASK and therefore Cost/ASK which include fuel/ASK. AAX has constantly hedge jet fuel via singapore Jet fuel kerosene which correlate with Brent oil very closely. (p>0.9)

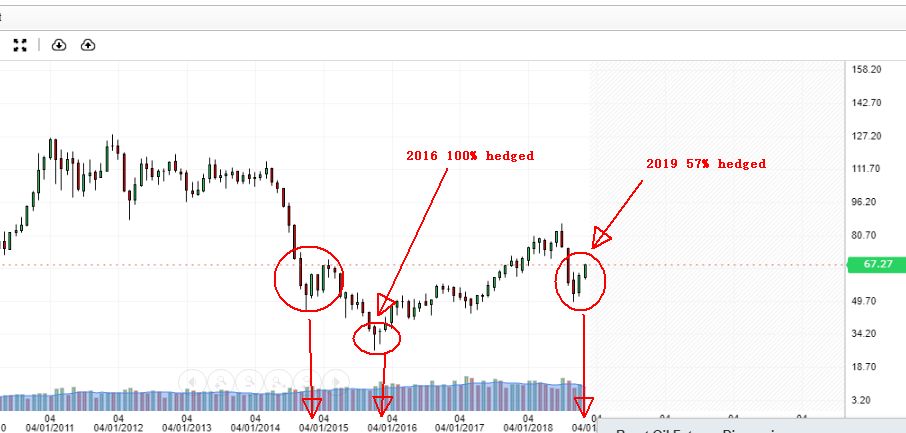

A quick look below the brent oil chart monthly chart from 2011 to 2019.

Prior to 2015 when brent traded above USD 100 per barrel, AAX was collecting fuel surcharge. Such surcharge has then ceased to be collected when oil crash in 2015. Typically airlines will not hedge oil when oil price is high but they will opt for fuel surcharge. See below AAX hedging history.

Key Observation:

AAX has constantly hedge oil from 2015 to 2017 quarter 2. Thereafter, the hedging ratio went down. Usually an airline will not hedge the oil when they think oil has peaked, or they have confident to pass through the addtional cost to customers via fuel surchage/ increase airfare. For AAX, i think they probably thought the oil has peaked in mid 2017 and they stop hedging.

Unfortunately, the oil keep going up and touch USD 80 per barrel in December 2018 before soften again to USD 50 per barrel in 1st quarter of 2019. Somebody will take responsible for this and i think this guy has left the company.

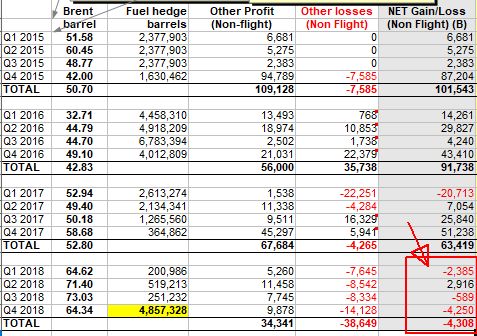

Below the impact of hedging to AAX.

Please take note that AAX has not separate the gain and loss of their hedgings contracts, but generally we can see that 2018 was the miserable year.

Fortunately, in my opinion, the recent brent oil correction has provided AAX with not just cheaper fuel in 2019 and also an opportunity to start big hedging for 2019. With the hedging in place, 2018 disaster should not be again repeat.

You can see the carrying amount of fuel hedging contract has increased to 4.9 million barrel in Q4 2018 quarter report.

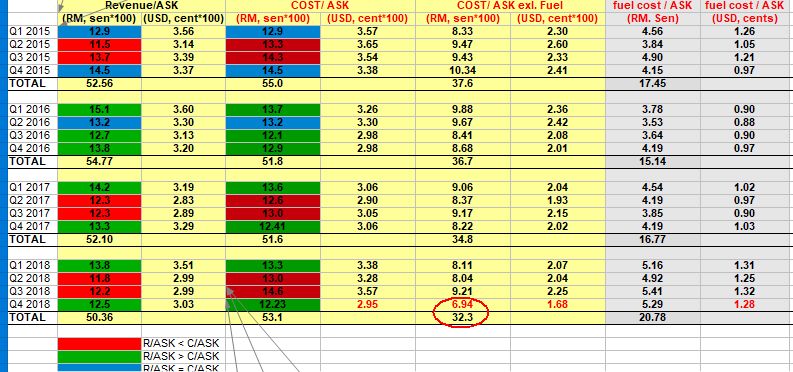

(A) Revenue/ ASK > Cost/ ASK

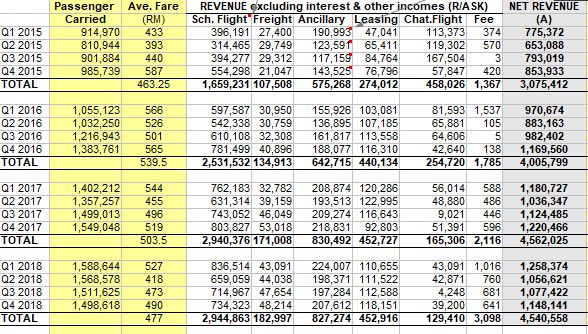

Below are the tables of Revenue vs Cost of AAX

Key Observation:

(1) The 1st reason for AAX investors to buy AAX is of course, the profitability of the company. It is not wrong. And AAX team is certainly working very hard to push for Revenue/ ASK, load factors, passenger carried, and at the same time, keep cutting Cost/ ASK. However, if you are common investors, i afraid you may be missing the big story of Airasia/AAX model - the potential of cash to be salvaged and pay out as special dividend via selling off the asset when matured. The real cash that the shareholders are receiving!!!

(2) As i said above, It is silly for AAX investors to focus on just profit and loss of the company. And neglecting another true big piece of MEAT. [The leasing arm of AAX]

AAX is duplicating the success of Airasia by adding more and more aeroplane [ via opening of more profitable routes, push load factors, increase passengers carried year over year (from 3.6 mil in 2015 to 6.2 mil in 2018). It is adding another 5 more aeroplane in 2019 and to push the ASK and trying to gain market share by offering passenger lower fare which will push up the load factor eventually when route got mature. The core market now is Australia, Korea, Japan, China & Taiwan which are popular tourist destination.] AAX want passengers, lot and lot of them. The gold mine in future.

Lease Income should grow further as AAX will start taking delivery of new Airbus 330 neo. AAX has order 100 units of these carriers AT BIG DISCOUNT and will take delivery gradually over the coming years. These are fuel efficient planes that save fuel by 25%. The receiving of new A330 neo should increase the lease incomes, and total Revenue/ASK.

Airasia sold 78 planes for RM 4.2 billion after years of effort.

I personally see AAX is duplicating what Airasia is doing and eventually the fruit to be reaped will be substatial.

The model: Buy good aeroplane at great discount to grow the passenger carried--> once it grow to certain size, you can sell the aeroplane to lessor at good price and cash out. That's how airasia special dividend derived from.

THAT's the TRUE BIG FAT MEAT. You do see how this big fat meat push Airasia share price, don't you?

THINK OF THIS, Many investor buy the same dream during the IPO at RM1.20. Now I'm buying the same dream at RM 0.30 or lower. 4 times cheaper!!! If share price drop below RM 0.20, i bought the same dream at 6 times cheaper!!!

(3) The ancillary incomes will continue growing not matter how because AAX is adding more planes, more flights and flying longer routes. Thier sweet spot now is 6 to 8 hours flight which will push up the ancillary incomes.

(4) All in all, while AAX is working hard on Operating Profit, they are also rushing for this big piece of meat. AAX is dedicated to provide low fare, to push for it operating statistic and eventually push up leasing arm and reap the fruit. Passengers win, Investors win.

I hope common investors to regain thier focus when investing in AAX. AAX is buying your time for growth, and with god wish, pay you back your time when right time finally arrive. It should not be too long because AAX is not starting from zero, it starded with the help of Airasia's passenger data gold mine.

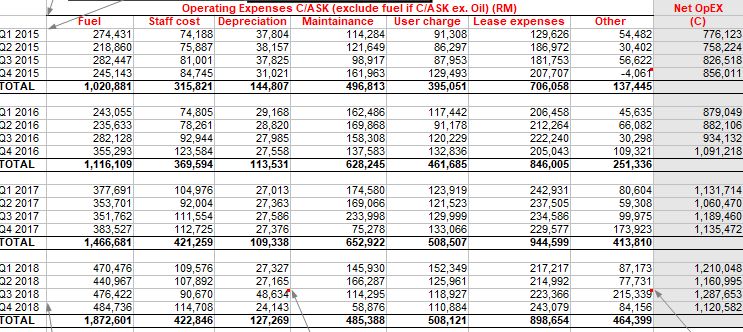

(5)On Cost/ ASK ex fuel, AAX has did wonderful job over the years in reducing the Cost/ASK (ex. fuel) as shown in below:

(6) Do pay attention on COST/ASK ex fuel, it keeps dropping.

(7) Those numbers in green means the Revenue/ ASK is greater than Cost/ASK, which gives Operating Profit.

(8) Those numbers in red means the Revenue/ ASK is smaller than Cost/ASK, which gives Operating Loss.

(9) Blue means break even.

Since hedging gain/loss is not part of the Revenue/ ASK or Cost/ ASK, hence those quarters in green are probably due to greater revenue (either higher average fare, ancillary income, and etc) and/or lower Cost in particular fuel price. Out of above 4 years data, 2016 was the best year (high Revenue/ ASK and low Cost/ASK).

Therefore, hedging is very important so that the impact of fuel can be offset by the fuel hedging gain (non-flight) as per pointed out in (C)

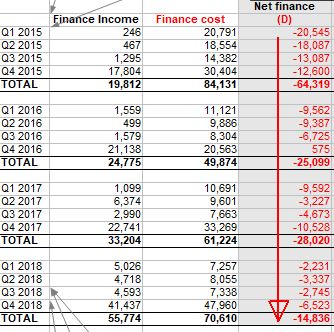

(D) Finance income > finance cost

Key Observation: As the debt goes down, the net finance cost has reduced significantly.

(E) Associate Contribution (Thai AAX)

Key Observation: The impact is not significant yet. But Thai AAX is very potential too.

(F) Special item (gain/loss) & (7) Deferred tax gain/loss

Key Observation: SPEECHLESS!!! I need expert to explain to me this part. Soo Jin Hou, Icon8888, Probability, or anyone?

CONCLUSION:

Ever since AAX listed in bursa, the fundamental has improved substantially. 2019 is probably the best year for AAX. Below i done up a matrix to summarise the challenges face by AAX in the past 4 years.

| Year | Forex | Hedging | Cost/ASK ex fuel | Finance Cost | Revenue/ASK |

| 2015 | X | O | X | X | X |

| 2016 | X | O | X | X | O |

| 2017 | X | XO | X | X | X |

| 2018 | X | X | X | X | X |

| 2019 | O | O | O | O | ??? |

(1) forex gain should be no longer important when net exposure become irrelevant

(2) hedging has been put in place again

(3) Cost/ASK ex fuel should improve further as per previous 4 years trend.

(4) Net finance cost will be lower when borrowing continue to reduce.

(5) Revenue/ASK - This segment must be work in optimum level to give positive operating profitability while ensure the leasing arm can continue to growth (Revenue/ASK depends on fare, route, ancillary income and etc which i not able to estimate)

(6) I see AAX's profitability in 2019? -a good to better- rating due to favourable condition on factors such as forex, oil hedge, cost/ask ex fuel and finance cost.

Special NOTE:

Above Asset held for sale amounting to RM 999 mil 1st appeared in the balance sheet of AAX. This should be due to AAX is disposing own aircraft (older model) to lessor and lease them back while taking delivery of A330 Neo.

Should this happen, AAX may use the proceeds to repay partial or all the debt in note 23. Assuming full repayment, AAX will become net cash company, this will save the company finance expenses in ITEM (D)

https://klse.i3investor.com/blogs/aax/194707.jsp