My first article about Inari was written in Oct 2015 https://klse.i3investor.com/blogs/Inari/71543.jsp

The market cap of Inari was RM 2.2 bil.

Today 26 Nov 2018, @ RM 1.70 per share (RM 5.38B) , Inari is not spared and having corrected all the way from RM 2.50 per share (RM 7.9B market cap).

This nearly 31% drop in the market cap was due to various "bad news / speculation" about Apple Iphone.

As of today, nobody can judge whether those supply chain bad news/ speculation is true / false. It will never anyway, because Apple has decided not to reveal the key statistic about the unit sale of thier product.

Such move by Apple has offered tremendous opportunity for anyone who wish to be in the media headlines by creating all the negative news.

After all, it can no longer be verified, Remember?

I offered my 1st doubt when bad news about Lumentum come out. Yes, bad "NEWS"

https://klse.i3investor.com/blogs/YiStock/182096.jsp

Then, somebody has highligted more explaination for all these malignant or wicked speculation. https://appleinsider.com/articles/18/11/19/poor-news-curation-at-bloomberg-cnbc-reuters-creating-misleading-iphone-supply-chain-panic

Whatever it is, it is really up to the wisdom of individual investor to make their decision.

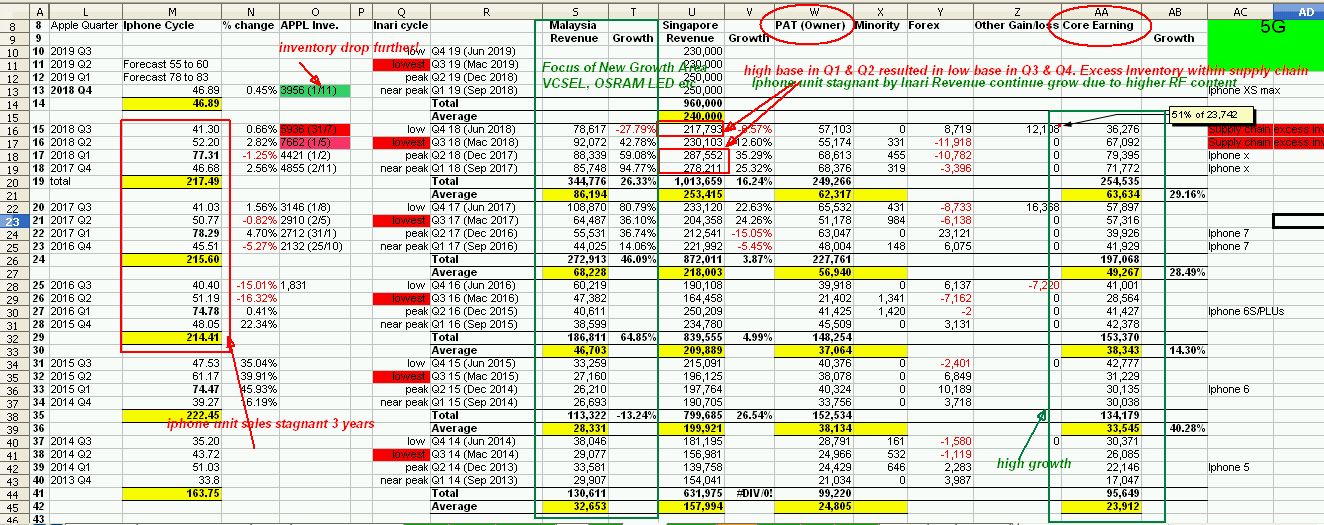

I have been holding Inari for so long, let me attached some key numbers and will probably explain more when Q result out.

To my opinion, everything looks great so far.

(1) Except lot of bad "NEWS" which offer no direct evident so far pointing Inari is slowing down.

(2) 2018 Q1 & Q2 of high base iphone X production may have been balanced by low revenue in 2018 Q3 & Q4.

(3) The Core Earning which offset Forex may offer clue Inari will be doing just fine.

(4) The new launches of Iphone XS/ Max, together with higher demand of iphone X, iphone 7, iphone

8. All needed higher RF content to run at 4G LTE.

Will Inari Slow down?

http://www.theedgemarkets.com/article/inaris-new-plants-seen-boost-earnings

I'm still positive

Cheers!

YiStock

https://klse.i3investor.com/blogs/Inari/183804.jsp