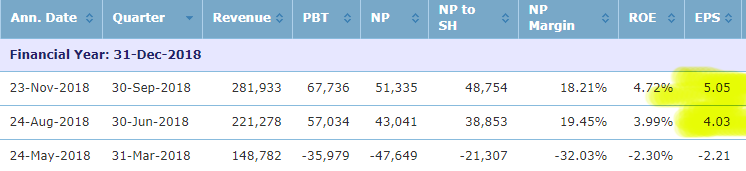

Ok, I go straight to the point. Recently, Dayang Enterprise Bhd has announced its 3rd quarter result with the earnings per share as high as 5.05 sen. And making the latest two quarter results totally have 9.08 sen of eps.

This has matched Uncle Koon's stock selection criteria which he has mentioned that the requirement is the company must show increasing profit in the last 2 consecutive quarters and with good profit growth prospect. In addition, it must be selling below P/E 12.

Frankly speaking, for now Dayang still trading at 52.8 P/E. But I believe that Dayang will record reasonable quarter result ahead with the group has won the MCM contracts from Petronas last year ago.

Above is the turnaround result from Dayang, just for your reference. Now market sentiment no good, as a newbie in stock market, with 10 years only. I think the best strategy now is dumb dumb buy low P/E counter and let the share price performing itself.

This is not recommendation or buy or sell call. Investing is fun, exciting, and dangerous if you don't do any work. You can comment as much as you like, and I'll try to learn something from your comments. Thank you and good luck.

https://klse.i3investor.com/blogs/everest2020/183848.jsp