The future earnings of JAKS is guaranteed with their IPP project in Vietnam, but I don’t suggest you to invest into it. WHY?!

Things you should know before discussing JAKS.

- IPP

- Right issue

- Private placement

- TyKoon

- The Boss

- The Star

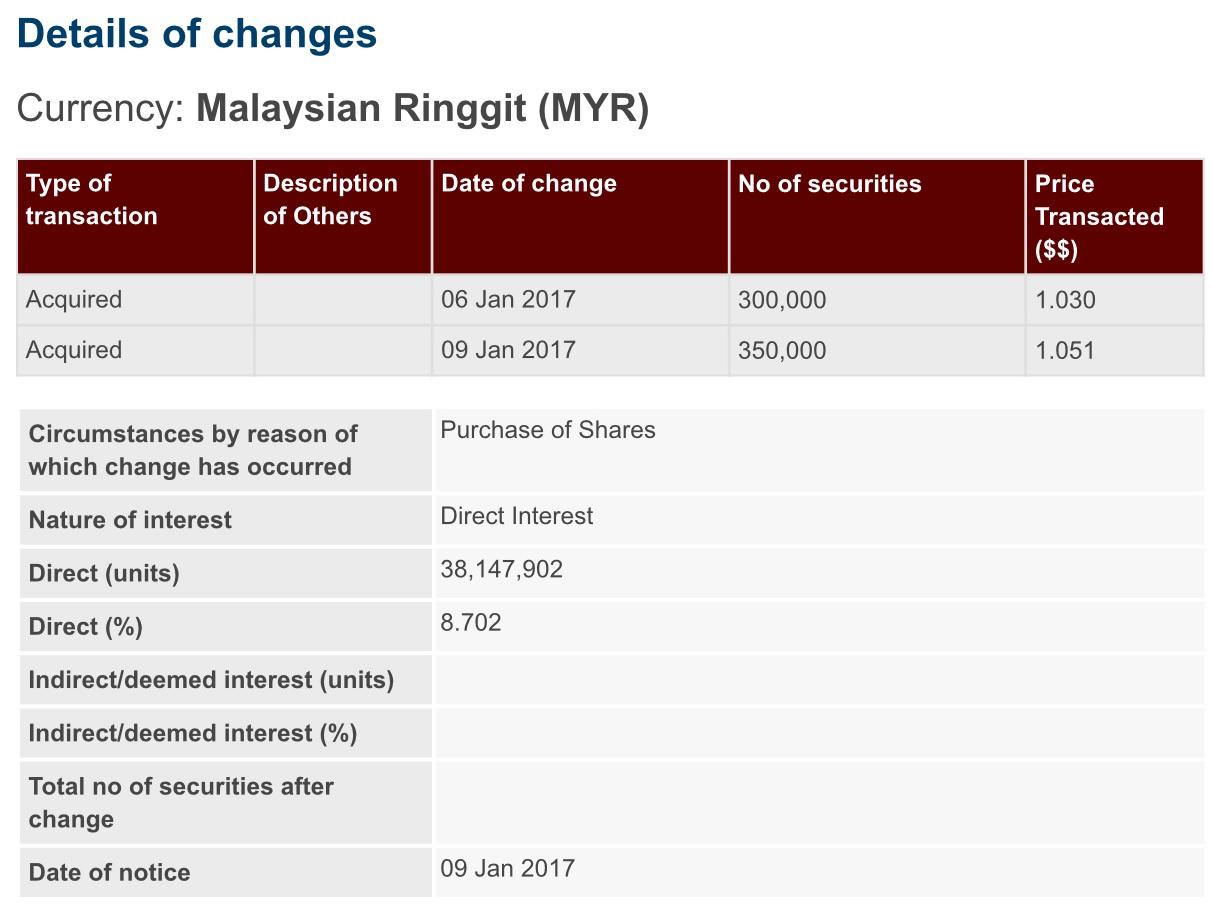

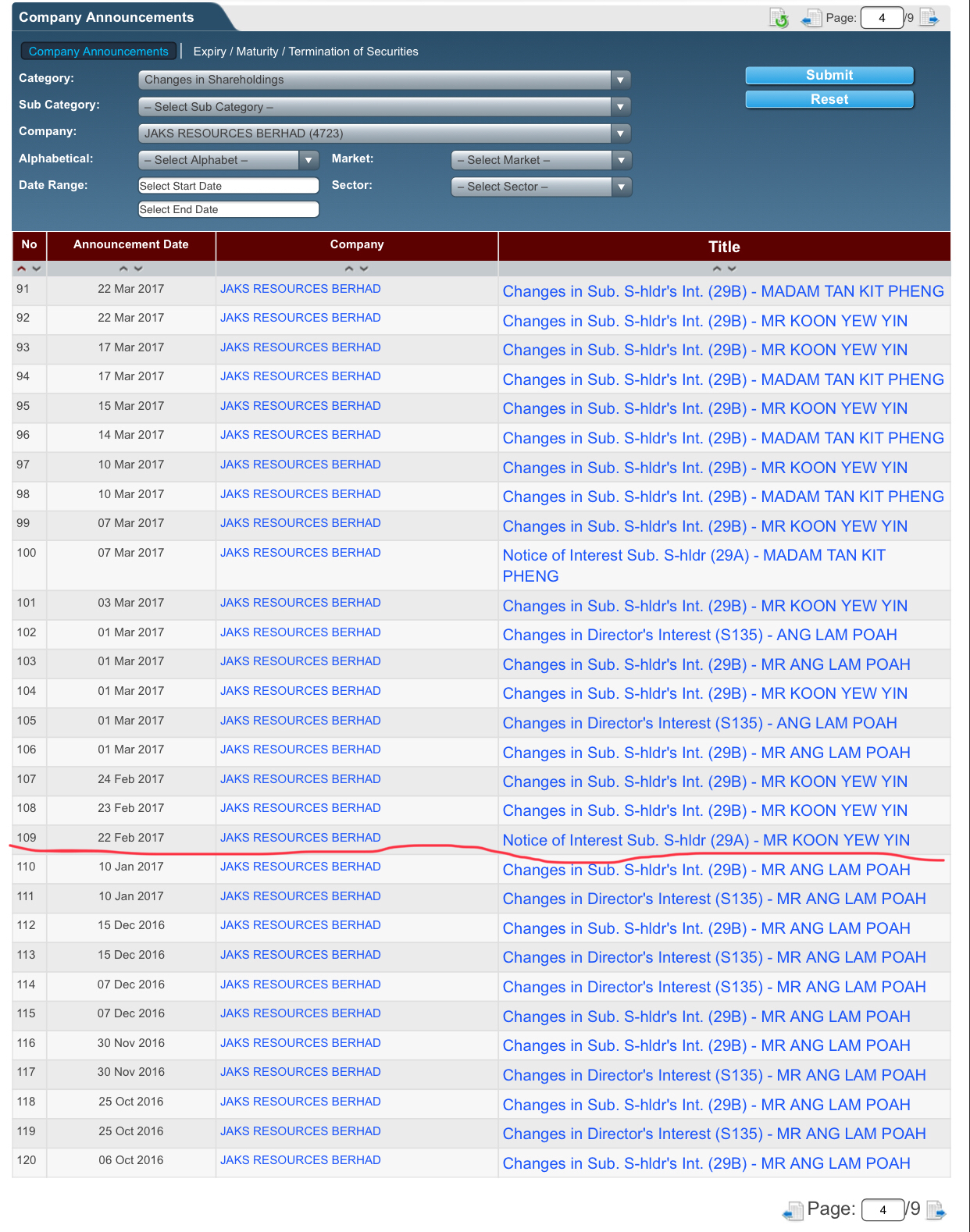

Starting in 2017, TyKoon started to accumulate JAKS because of IPP in Vietnam, within one and half month (Jan’17-Feb’17), share price has increased ~40% (from 1.0-1.4), mainly was accumulated by TyKoon. He believed in its future growth.

http://www.klsescreener.com/v2/news/view/196441

However, this subscription speed and amount is too fast and huge to seek The Boss attention!

Within one month, their shares in hand are 38.15mil & 39.96mil respectively. TyKoon became the largest shareholder in the company.

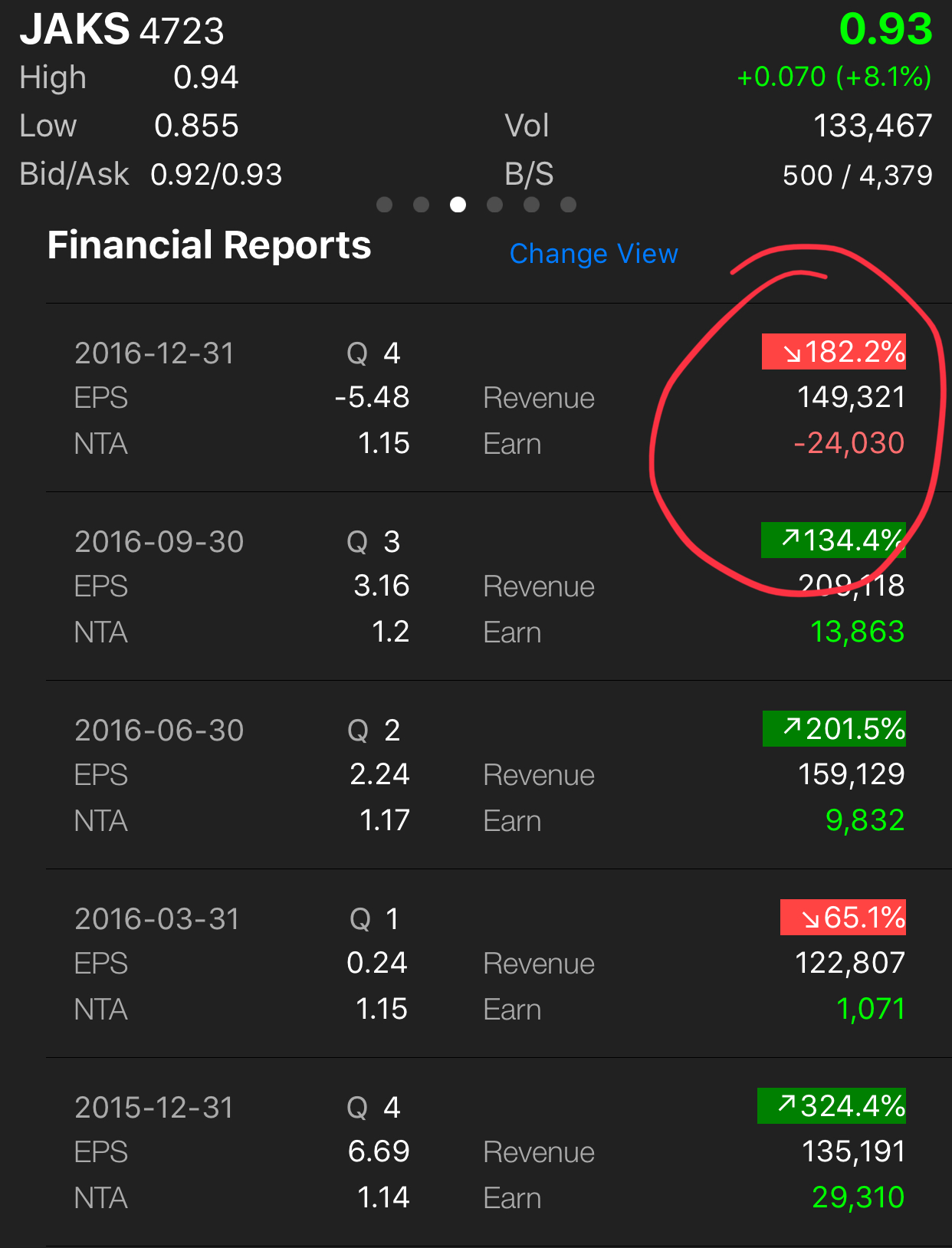

In 27 Feb 2017, Q4 2016 financial result recorded a negative earning -24mil and BOD announced Private Placement to proxy for increasing their shareholding. Share price tumble from 1.40 to 1.0. TyKoon took this opportunity to increase his holding by buying more share.

http://www.klsescreener.com/v2/news/view/198645

The Boss twice did the share placements when he found out TyKoon had bought too much at a specific high price. During the two Private Placement, TyKoon has proposed to BOD that he is interested to get the PP. However, The Boss and team don’t allow him to do that. The reason behind is they want to dilute TyKoon’s shareholding. With these two PPs, if TyKoon want to continue this game, he has to keep buying the share to maintain his holding percentage. The cost for the PP is -10% cheaper than the 5days average’s share price. No matter how TyKoon buy, The Boss and proxy still will get the lower share and dump it to TyKoon and he ordered to dump the proxy’s holdings to arbitrage for some profits and make the fixed price for right issue and share placement at much more cheaper level.

And when The Boss get the source that TyKoon has buying all the way up to a certain level, they will create panic selling, with announcement of bad news (The Star), or bad quarterly result or selling their proxies’ holdings.

Refer back to the graph, The Boss and proxy will not selling their holding before AGM and EGM. They need to maintain the majority holding to prevent something they cannot control, for example TyKoon requested to join BOD and they will not allowed this to happen. The Boss always manipulate JAKS by adjusting the profits from Q to Q and leak out wrong figure to the institution and professionals. The Boss always want a really fluctuating price moving rather than one way growing up, so that he can sell at the peak and buy at the bottom.

Once after event, The Boss and proxy will dump their shares and they can always make money from this because PP is cheaper. The main purpose of PP is to use the least economic cost to dilute TyKoon’s holding, so that TyKoon can win any vote in the AGM and EGM. Why did TyKoon not welcome? Even TyKoon is the largest shareholder, but he was kept in the dark. There must be something that they want to hide and do not want TyKoon and public to know. From The Edge, they did borrowed RM 500mil. But where did they spend this RM500mil? What asset and where they used?

An advise for those who invested or planning to invest in JAKS, prepare healthy cash flow and margin in your account. It is not a secret in the stock market industry about The Boss is a cleaver person. He is the only person that can fool TyKoon upside down. As can see from the chart below, TyKoon’s cost of buying is all above 1.0 and highest is >1.6. But base on recent margin call and TyKoon has force sell his margin at below 1.0. If you do a calculation, you will know how much TyKoon loss. And who will benefit from this?

|

TyKoon

|

|

|

|

|

16/2/17

|

23,881,900

|

1.00

|

23,881,900

|

|

23/2/17

|

16,074,600

|

1.33

|

21,379,218

|

|

28/2/17

|

3,537,000

|

1.3

|

4,598,100

|

|

3/3/17

|

7,864,800

|

1.08

|

8,493,984

|

|

7/3/17

|

3,283,200

|

1.22

|

4,005,504

|

|

10/3/17

|

3,344,600

|

1.27

|

4,247,642

|

|

15/3/17

|

17,490,300

|

1.33

|

23,262,099

|

|

17/3/17

|

4,171,100

|

1.5

|

6,256,650

|

|

28/3/17

|

5,735,500

|

1.46

|

8,373,830

|

|

30/3/17

|

1,704,500

|

1.47

|

2,505,615

|

|

11/4/17

|

2,538,500

|

1.64

|

4,163,140

|

|

13/4/17

|

3,036,300

|

1.67

|

5,070,621

|

|

thereafter |

23,000,000

|

1.6

|

36,800,000

|

https://klse.i3investor.com/blogs/whatyoumustknowaboutjaks/174256.jsp