See the original

Most counters had been rising quick and sharp since the dip from last

week but VS and SKPRES had yet to move following the broad market this

time around.

For obvious reasons, VS and SKPRES are makers of plastic products for

the famous brand Dyson and GBP is the biggest threat to them so far.

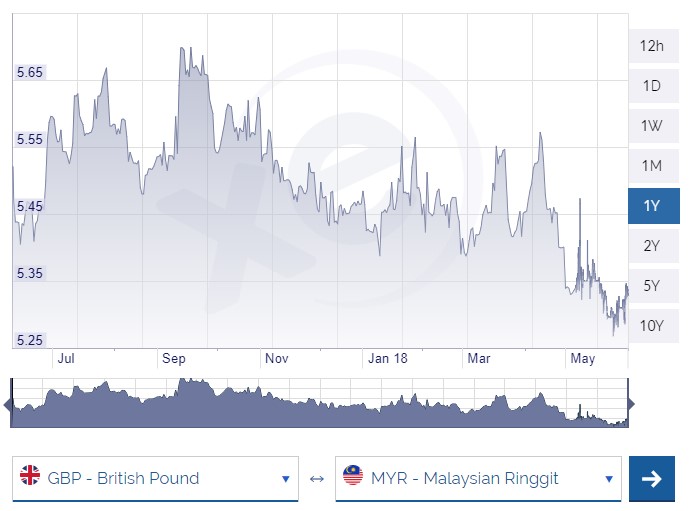

Much like stock prices spiking for exporting counters when you see the

USD strengthened three years ago, the weakening GBP had caused these two

counters to follow suit.

GBP dropped significantly due to Brexit and we felt that it would

remain weak for the time being. Nevertheless, these two counters has

value with the availability of capacity to deal with continuous order

increases.

The only doubtful factor would be a range of new products by Dyson

that might not include SK Pres and VS in their OEM supplier list. All

things remain constant, we believe that these two counters are cheaply

priced for the time being neglecting the fact that external risk could

still point downwards.

We think that it is worth to collect some if you had made profits from

this rise as it is hard to find counters which are high in value after

this rally.

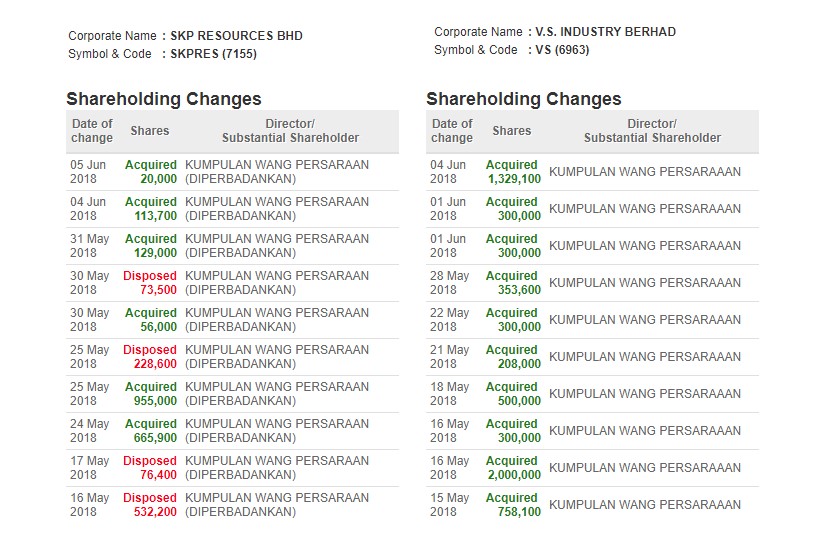

Looking at institutional transactions, they had began collecting these

two counters in anticipation for a better GBP strengthening in the

coming months or so.

Net-off, both counters see addition by KWAP but VS seems to be more

aggressively bought by them so far. You be the judge on which to buy. We

like both!

Chart wise, both trades similar as well and we are on the lower side of things than what it was starting this year alone.

SKPRES down 50% YTD

VS down 29.5% YTD

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

Make the next post easily visible from your Facebook!

You can visit us at http://omightycap.wordpress.com