I have discovered SUMATEC last two weeks. The share price has gone up since that to as high as 13sen yesterday.

Still don't believe in me? You decide yourself.

It is now starting to reflect its fundamental value of 56sen. This is based on my opinion of its FY18 DCF valuation. For short-term, I expect SUMATEC will hit 25sen.

In fact, my DCF valuation is assumed conservatively and lower than management guidance here:

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5661037

You can read my previous articles on SUMATEC here.

Part 1: https://klse.i3investor.com/blogs/themagicofmerlin/143497.jsp

Part 2: https://klse.i3investor.com/blogs/themagicofmerlin/144021.jsp

My FY18 oil price forecast is at USD60/b. So, as long as oil price can sustain at this level and above, downside risk to my valuation of 56sen will remain unchanged!

I believe SUMATEC will not go down even though oil prices make a correction this week. This is because SUMATEC still can make money at USD50/b with huge profit margin of 60%. Otherwise, it will be huge undervalued.

Plus, if oil prices do need to make a correction, it won't drop below USD60/b. As long oil prices can sustain at USD60 or above, SUMATEC is sitting on goldmine

I know SUMATEC has gone back down today... BUT for me, this is healthy correction. It is in the Wave 2 and the completion of Wave 2 was very fast after hitting Wave 2 support level of 9sen.

Now, we are waiting for Wave 3, which is the resumption of the rally. It will hit 20sen and we will see SUMATEC to reach my short-term target at Wave 5.

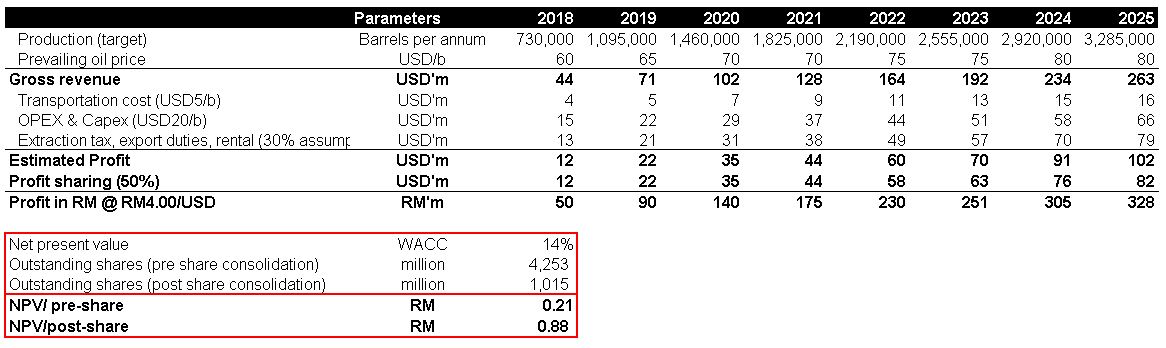

My FY18 DCF valuation

This is rakushechnoye asset, worth of 21sen pre-share consolidation.

The valuation has not taken into consideration 100% stake in Rakushechnoye field yet.

This is karaturun asset, worth of 35sen pre-share consolidation

In total, its assets in Khazakhstan is worth 56sen as of FY18 DCF valuation.

Well, it is not too late to go in now. It is still at the beginning stage of the rally. Upside is huge of more than 5-fold from current price of 9sen.

It will take some time and gradually to hit 56sen but I expect within this year as my DCF valuation is in FY18 basis.

For short-term, maybe before its 4Q results release this February, I expect it will SHOOT UP to 25sen.

To remind you again:

SUMATEC is in strong position to turnaround and poised to register strong earnings from this year and onwards.

Quarterly, its financial results has started to turnaround in 3QFY17.

Given favourable oil prices in 4Q17, its 4QFY17 earnings would be surely registered even higher.

Not

just that, its oil production would also improve in 4Q17 to average

1,000 barrel daily against average 500 barrel daily in 1H17 as guided by

the Management in its recent quarters results.

The

company expects total oil production to increase to 7,500/b daily by

end of this year. This means next year will see full year of oil

production of 7,500/b daily. Annualised it, we will get 2.74 million/b

for total oil production by the Company in FY19.

Recall that SUMATEC has

commenced an oil production enhancement program back in April 2017,

which encompasses the improvement / repairing of existing wells that

include rehabilitation and rejunevation works, drilling

of new wells for appraisal and production, construction of oilfield

surface facilities and upgrading of the central processing facilities.

The flow results of the initial wells have been encouraging and they expect total oil production to improve further.

Summary

It is time to reap the fruit of the past painful and restructuring. Things start to fall in place and favour SUMATEC now.

It is also a time to switch from upstream players like UMWOG or Sapura Energy, HIBISCUS, KNM, REACH to the BEST and still laggard upstream player, SUMATEC.

http://klse.i3investor.com/blogs/themagicofmerlin/144574.jsp

http://klse.i3investor.com/blogs/themagicofmerlin/144574.jsp