Dec 29, 2017

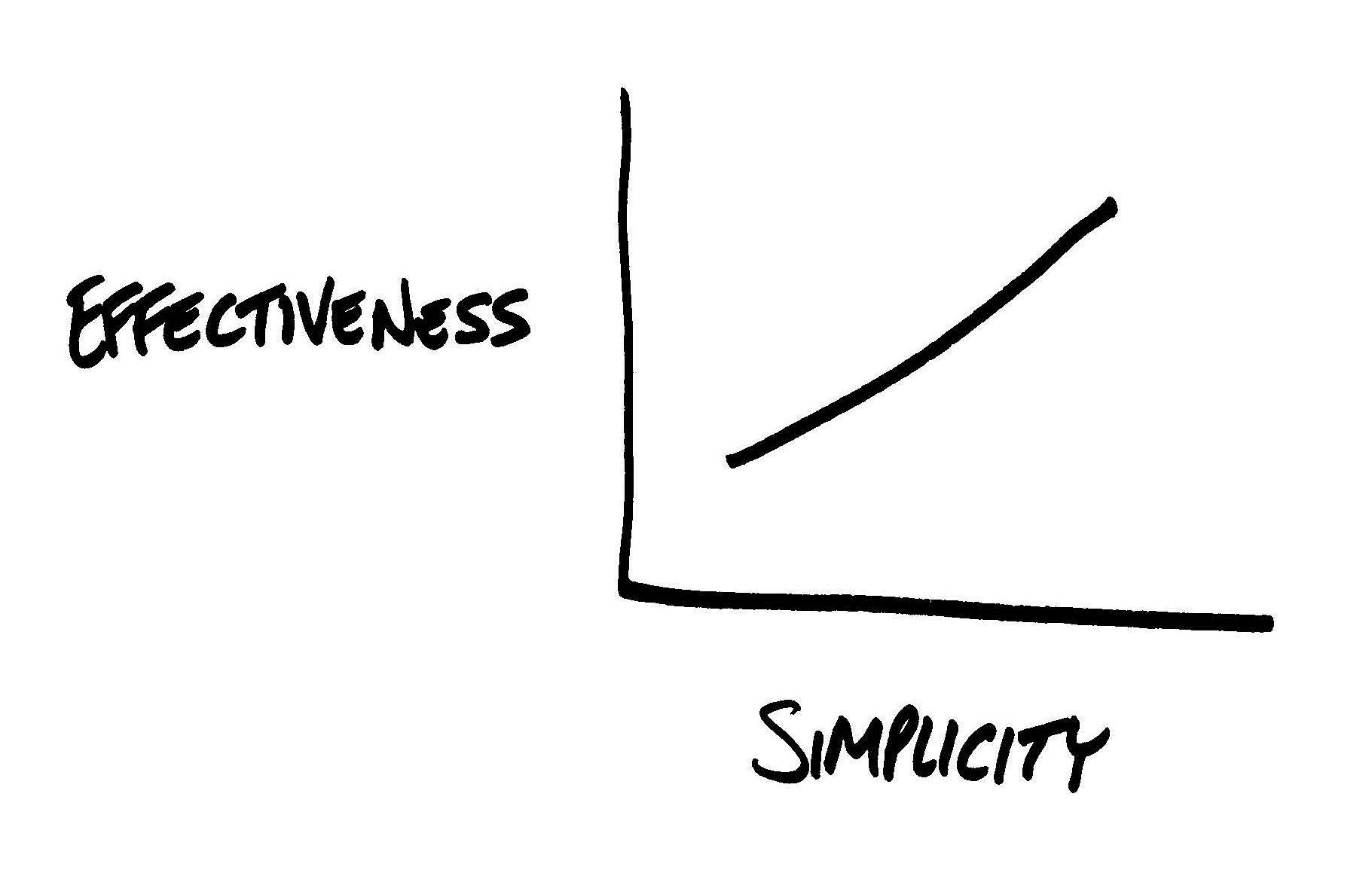

In the age old dichotomy between simplicity and complexity, the former has been shown time and time again to be the better strategy.

Some of the truly great minds of history agree:

"Everything should be made as simple as possible, but not simpler."

- Albert Einstein

"Life is really simple, but we insist on making it complicated."

- Confucius

"Truth is ever to be found in simplicity, and not in the multiplicity and confusion of things."

- Sir Issac Newton

"Simplicty is the ultimate sophistication."

- Leonardo da Vinci

We feel the same is true when analyzing businesses in order to find great stock investment opportunities.

The Impressive - But Unfriendly - World of Typical Stock Analysis

There are a lot of places out there you can find individual stock analyses. SeekingAlpha is one of the largest (here's our profile). You can also find really detailed stock analyses from multiple other sources as well.We're not here to knock on these productions. Many of these analyses are detailed, filled with charts and facts, laden with the latest market projections. For some investors, this is what they want - as much detail as humanly possible.

But there are some problems here, as well.

For one, too much detail can lead to a "forest for the trees" issue.

For example, think back to late 2012. Facebook (FB) had gone public mid-year, but had quickly declined from the high $30's to down below $20. The business media was widely touting it as a "busted IPO". Revenue growth slowed dramatically, from 88% in 2011 to 37% in 2012. The narrative was that Facebook could not do mobile, and Internet traffic was quickly moving in that direction.

Many detailed analyses of the stock at this time made this the conclusion, projecting continuing slowing revenue growth as people abandoned Facebook's desktop site and many of its sources of revenue at the time, like online games.

We all know what happened instead. Mark Zuckerberg bet the whole company on mobile, the firm succeeded spectacularly, and in the 5 years since, Facebook has generated an average revenue growth rate of 50%.

This is a good example of the "forest for the trees" problem with detailed stock analyses. Sure, at the time Facebook had some challenges. But what was missed in staring at those micro details was its still-growing user base, its under-utilization of advertising possibilities, and its even-then dominant status as the largest social network - creating an extremely strong network effect competitive advantage. Founder-led, highly invested management was also underplayed, and this management led to the company's rebound and continuing strong performance.

Another problem with long-form stock analysis is that it's just too complicated for the average person to understand. Wall Street jargon that most average investors don't know clutters the argument. And who really wants to read 10,000 word write-ups with a dozen charts and 50-row tables?

I've been analyzing and investing in individual stocks for 20 years, and to this day those long-form stock analyses put me to sleep! Sure, I'm just the writer for a small stock website. But what about Peter Lynch, one of the most famous mutual fund managers of all time? Legend is that Lynch started an egg timer when an analyst pitched him an idea, and if they could not articulate the premise of the investment in one minute or less, he deemed it not worth his time!

A Focus On What's Important

So, how do we find great, long-term investments without burying ourselves in detailed analyses?We keep it simple. We focus on what's important.

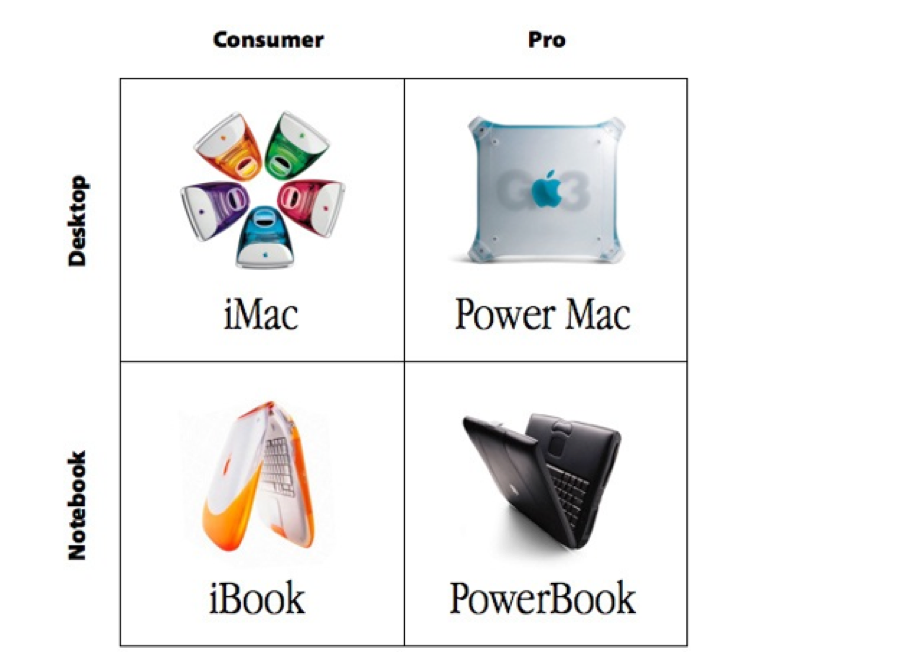

This is not a novel concept. Some of the most successful businesses in history - McDonald's (MCD), Netflix (NFLX), Coca-Cola (KO), etc. - are due to the simple models they use to appeal to consumers. Upon returning, Steve Jobs scrapped Apple's (AAPL) entire computer product line and refocused it around a simple 4-box matrix to return the company to profitability.

Simple works. Even in investing. As Warren Buffett has said: "I would rather be approximately right than precisely wrong". His purchase of See's Candies in the 1970's is one he refers to over and over. He bought the company not on a detailed, weeks-long analysis, but because he liked the business model and the fact that the company had "positive mind share" (i.e. brand power), which allow him to raise prices consistently.

So what is important in finding great companies to OWN for the LONG-TERM (3+ years)? We think there are 3 things:

1) Can the company grow its revenue at at least twice the average rate for the long-term? You can make a buck buying cheap stocks and selling them when they return to fair value. But you will rarely make 100, 200, even 1,000+% gains that way. A company has to have substantial growth potential to achieve greatness.

2) Does the company have regularly recurring revenues? Also known as: do your customers buy from you over and over again without thinking about it? Recurring revenue just makes business easier. Planning is easier, as sales and cash flows can be relied upon. Growth is easier, as replacement sales are far lower. Advertising is less expensive, because your existing customers are basically buying from you again for free. Some of the best businesses of the 20th century were essentially recurring revenue - soda, gasoline, food, cigarettes, electricity - and those of the 21st century will be even more so.

3) Does the company have strong, DURABLE competitive advantages? New technology is not a durable competitive advantage. Great management is not a durable competitive advantage. A fad product is not a durable competitive advantage. Years of research has uncovered just a few things that can help a company fight off competition over the long term: consumer brand, network effects, high switching costs, unique assets, regulatory barriers, and economies of scale. If the company cannot demonstrate one of these, we don't believe it has a durable advantage over existing or future competitors. Some companies have varying degrees of these, and some have none.

And that's it.

Everything else most stock analyses concern themselves with - minute changes in profitability, debt ratios, prospective competition, etc. - pales when compared against these 3 questions. We believe ALL of those take care of themselves, over time, in a truly great business.

As Simple As A Stop Light

MagicDiligence uses those 3 questions above to categorize every stock we review into one of 3 business model diligence ratings: RED: These are unattractive business models. They usually have limited

revenue growth potential, no structurally recurring revenues, and

limited if any durable competitive advantages. These stocks may be good

for short-term, value-oriented valuation gains (e.g. Ben Graham's "cigar

butts"), but we would not be comfortable holding them for the long

term.

RED: These are unattractive business models. They usually have limited

revenue growth potential, no structurally recurring revenues, and

limited if any durable competitive advantages. These stocks may be good

for short-term, value-oriented valuation gains (e.g. Ben Graham's "cigar

butts"), but we would not be comfortable holding them for the long

term. YELLOW: These are companies with some - but not all - of the attractive

qualities we look for. Maybe they have durable competitive advantages

in a small and stale market. Or maybe they have substantial growth

opportunity, but no recurring revenue and no durable advantages. YELLOW

stocks, over time, usually drift more towards the RED or GREEN rating,

but at the time of review their future is less clear.

YELLOW: These are companies with some - but not all - of the attractive

qualities we look for. Maybe they have durable competitive advantages

in a small and stale market. Or maybe they have substantial growth

opportunity, but no recurring revenue and no durable advantages. YELLOW

stocks, over time, usually drift more towards the RED or GREEN rating,

but at the time of review their future is less clear. GREEN: These are the companies that have substantial growth

opportunities; a high degree of predictable, recurring revenue; and

undeniably strong competitive advantages. These are the stocks we are

comfortable holding for those long-term periods, even if there are

short-term ups and downs.

GREEN: These are the companies that have substantial growth

opportunities; a high degree of predictable, recurring revenue; and

undeniably strong competitive advantages. These are the stocks we are

comfortable holding for those long-term periods, even if there are

short-term ups and downs.