Hengyuan: Background

The controlling shareholder of Hengyuan Refining Bhd is Shandong Hengyuan Petrochemical Company Ltd. which is a state-owned enterprise, based in Linyi County, Shandong Province, China.

The completion of the acquisition of a 51.0% equity stake in HRC via MHIL in December 2016, marks the dawn of a new era for HRC. The natural synergy within the Group, which is equipped with the latest production technologies and know-how, will only serve to further enhance HRC’s profitability and continue to strengthen its position as a leading regional refinery products supplier.

The share price of Hengyuan started to climb soon after Shandong Hengyuan Petrochemical Company of China took control. The price has been climbing higher and higher to close at Rm 14.40 on 22nd Dec 2017, an increase of 480% within 12 months. Many investors have been waiting to buy when the price is under correction. Unfortunately, the corrections are usually very mild.

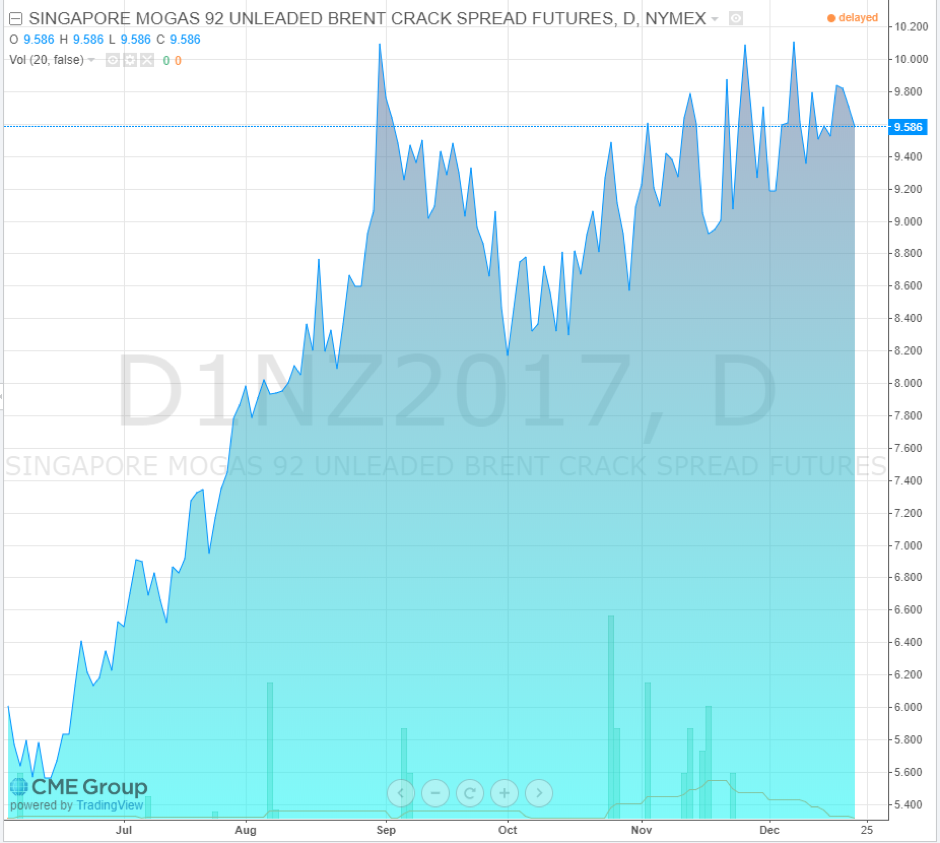

Based on the unusually high volume traded daily, I believe many institutional investors from China are buying aggressively. They are so bullish because they can see that its 1st half year EPS was Rm 1.20. Its 3rd quarter EPS was Rm 1.21 and they expect its 4th quarter EPS to be more than its 3rd quarter because its crack spread or profit margin has been better during the 4th quarter. See Crack Spread chart below.

Hengyuan’s profit essentially depends on its margin of profit or crack spread.

Crack spread is a term used on the oil industry and futures trading for the differential between the price of crude oil and petroleum products extracted from it. The spread approximates the profit margin that an oil refinery can expect to make by "cracking" the long-chain hydrocarbons of crude oil into useful shorter-chain petroleum products.

In the futures markets, the "crack spread" is a specific spread trade involving simultaneously buying and selling contracts in crude oil and one or more derivative products, typically gasoline and heating oil. Oil refineries may trade a crack spread to hedge the price risk of their operations, while speculators attempt to profit from changes in the oil/gasoline price differential.

Factors affecting the crack spread

One of the most important factors affecting the crack spread is the relative proportion of various petroleum products produced by a refinery. Refineries produce many products from crude oil, including gasoline, kerosene, diesel, heating oil, aviation fuel, asphalt and others. To some degree, the proportion of each product produced can be varied in order to suit the demands of the local market. Regional differences in the demand for each refined product depend upon the relative demand for fuel for heating, cooking or transportation purposes. Within a region, there can also be seasonal differences in demand for heating fuel versus transportation fuel.

Based on the comments on i3investor, I notice many are not sure when to buy and when to sell. Let me tell you my method which I have been practicing so successfully in buying Latitude, Lii Hen, and VS Industry before.

Now Hengyuan is a good example.

When to buy?

Among all the selection criteria such as NTA, Cash flow, return on equity, etc, the most important is profit or EPS growth which is the most powerful catalyst to move share prices. I will start to buy a little when I see the company reported an increased profit in one quarter. When the company continues to show an increased profit, I will buy more aggressively. When the company reports increased profit for the 3rd quarter, the share price would have risen and I can buy some more using the increased margin finance.

When do I sell?

I will start to sell a little when the company reports reduced profit for one quarter. If the company continues to report another reduced profit, I will sell aggressively. Sometimes, the company can recover to report a better profit, especially the product sale is subject to seasonal changes. In that case, I will buy back the shares which I sold earlier even at a higher price than what I sold.

Readers must bear in mind that since Hengyuan is reporting increasing profit, it will be stupid to sell now. In fact, if you have not bought it before, you should buy because it is selling so cheaply in terms of P/E ratio.

Can you find another share with similar quality selling at such low P/E?

http://klse.i3investor.com/blogs/koonyewyinblog/142353.jsp