Author: ajim102 | Publish date: Sat, 26 Aug 2017, 11:09 AM

Cocoaland Berhad's share

price had gone up from RM1.86 to RM2.93 in one year's time (from

23/8/16-23/8/17) a 58% increase.An excellent result for a company in

which business is manufacturing

and trading of candies, beverages and other related food stuffs. But

what drives the rise in share price of Cocoland?does it comes from the

business performance or is it just an effect from current bull market?

“Growth is never by mere chance; it is the result of forces working together.”

Lets look into the company's performance to see whether the rise in

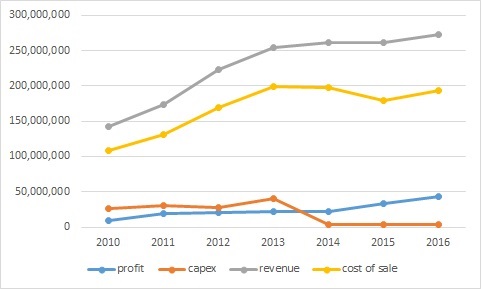

share price is justified by the business performance or not. Figure 1

shows the trend in revenue,cost of sales,profit and capex for Cocoaland

Bhd from 2010-2017. I decided to take 2010 as the base year because in

2010, Fraser & Neave Holdings Bhd (F&N) becomes the 2nd largest

shareholder in cocoland (and still the 2nd largest shareholder as per

latest annual report)

Figure 1

We can clearly see that revenue is on an upward trend rising

exponentially from for the first 4 years and stagnate for the next 3

year but increase back in 2016.Cost of sale is rising in tandem with

revenue for the first 4 years but starts to fall afterwards. This trend

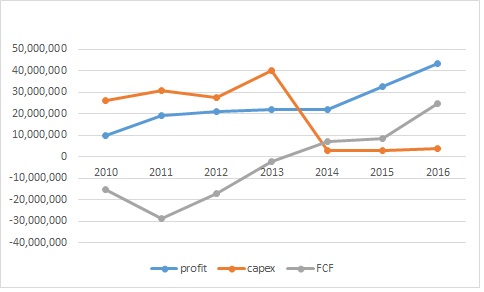

can also be seen in profit and capex, figure 2 shows a clearer picture

of the relationship between capex, profit and its free cash flow

Figure 2

We know that prior to 2013,Cocoaland Bhd had been spending a lot on

capex to expand its production line in rawang thus its free cash flow

(FCF) is in the negative territory.But since then we can see that capex

drops significantly,profit and FCF start to rise as the company's

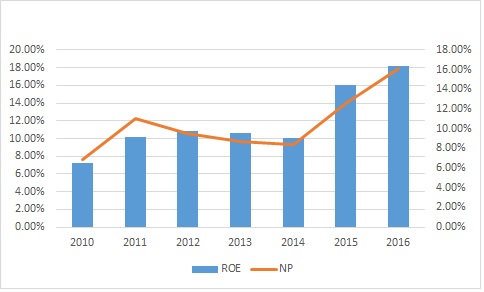

investment starts to bear its fruit. Similar improvement can be

observed with Return on Equity (ROE) and net profit margin (NP)

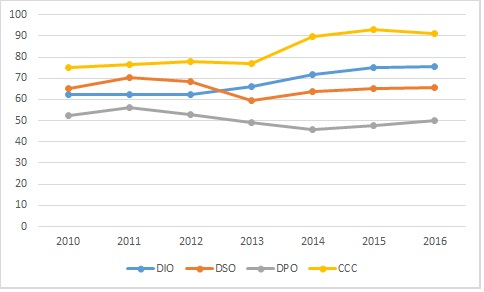

Cash Conversion Cycle (CCC) is a metric used to gauge the effectiveness

of a company's management and, consequently, the overall health of that

company. The calculation measures how fast a company can convert cash

on hand into inventory and accounts payable, through sales and accounts

receivable, and then back into cash (Investopedia) , the lower the days

the better.

CCC = DIO + DSO - DPO

Days Inventory Outstanding (DIO) refers to the number of days it takes

to sell an entire inventory. A smaller DIO is preferred. Days Sales

Outstanding (DSO) refers to the number of days needed to collect on

sales, or accounts receivable. A smaller DSO is also preferred. Days

Payable Outstanding (DPO) refers to the company's payment of its own

bills, or accounts payable. By maximizing this number, the company holds

onto cash longer, increasing its investment potential. Thus, a longer

DPO is preferred (Investopedia)

I know we are supposed to look at a company's CCC in comparison with

its peer but lets look at the trend over the years as shown below.

Cocoaland Bhd's CCC has been increasing from 80 days prior 2013 to 90

days. Is it a bad omen for Cocoaland Bhd? A sign of dark days ahead? Not

so fast folks, it is normal for a company to extend credit to their

customer especially during its expansion/growth phase, the percentage of

impairment of account receivable is very low with an average of 6% for

the past 7 years.It shows that the management is very cautious in

extending credit term to its customer. The increase in ROE, Net profit

and FCF further justify the increase of Cash Conversion Cycle.

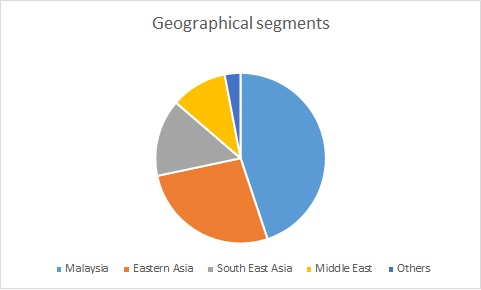

| Geographical segments | |

| Malaysia | 44% |

| Eastern Asia | 27% |

| South East Asia | 15% |

| Middle East | 11% |

| Others | 3% |

| 100% |

Back in 2010, Cocoaland's revenue comes only from Malaysia and China

but had since then diversify its revenue steam from various region and

is planning to penetrate more market in coming years. This shows that

the management is hard at work in expanding the business to capture more

market overseas,this shows tht cocoaland is a good consumer stock with

worldwide presence

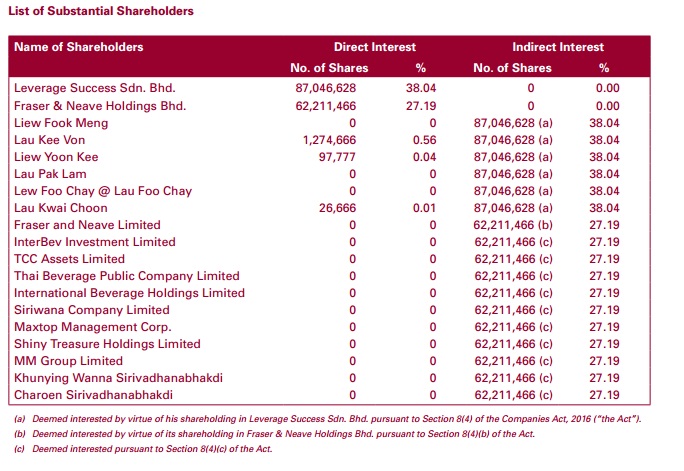

Leverage Success Sdn Bhd a company controlled by the company's director

which in turns control 38.04% of Cocoaland Berhad and Frazer &

Neave Holding Bhd. controls 27.19, this shows that the management holds

substantial interest in the company and with F&N as second largest

shareholder it will definitely brings strategic synergy to Cocoaland

because F&N being in the consumer industry itself will not simply

invest its money for the sake of capital appreciation or dividend

income.The effect of this synergy can been seen in the development and

improvement of Cocoaland's business over the years

From my opinion the appreciation in Cocoaland Bhd's share price is

justified by the business performance and furthermore current

utilization rate is only at 55% and the company is planning to boost it

to 80% in the next 3 years,there is a lot of room for growth which is

what we want to see in a growth stock, the ability to generate more

revenue.

Beside growth,the company had been paying dividen constantly with an

average of 50% payout ratio and average dividend yield of 4% while

maintaining clean balance sheet (net cash) and healthy cash flows. This

is a hallmark of a good management team.

Action speaks louder than word.Refer back to figure 2 (Profit vs Capex

vs FCF) and you will understand the quality of the company. Revenue,

profit and FCF is picking up, cost of sales is going down despite high

volatility in its raw material price,high CAPEX spending is over and now

its time to focus on growing the company forward.

ROE is at 19%,ROIC at 20%,Net profit margin 16%, FCF yield 5%, 30sen

cash per share (net cash position) Cocoaland Bhd is on its way toward a

steady and consistent growth. Cocoland is suitable for investor with a

long term horizon (more than 1 year) not for those who seek instant

gratification on their stock picks.

Disclaimer : This article is only for sharing purpose but any feedback is most welcome

For further reading i strongly suggest looking at Donkey Stock earlier post

https://klse.i3investor.com/blogs/donkeystocks/113053.jsp

And recent news for Cocoaland Berhad:

http://www.theedgemarkets.com/article/cocoaland-focus-more-overseas-markets

http://www.theedgemarkets.com/article/cocoaland-focus-more-overseas-markets

http://klse.i3investor.com/blogs/antifragileinvesting/130938.jsp