My first furniture stock in Bursa Malaysia – POH HUAT

In

the first place, furniture stocks will never come into my investment

portfolio radar, maybe due to the perception of low margin, highly

competitive and slow grow prospect. But after I went through the AR of

this company report. I started to change my perception. Conventional

thinking, most of the local retail furniture shops are not doing well,

so in my opinion the furniture manufacturers also shouldn't be good

either. In certain extend, I might be right but how about the furniture

exporters that earning USD. For the past few years, there was a theme of

furniture stocks, but now already cool off. Now, to most of the

investors, furniture stock considered as sunset business, one

word“hopeless”. But if you look at this company 5 years financial

highlights, it doesn't look so dull, in fact, the company still

growing.

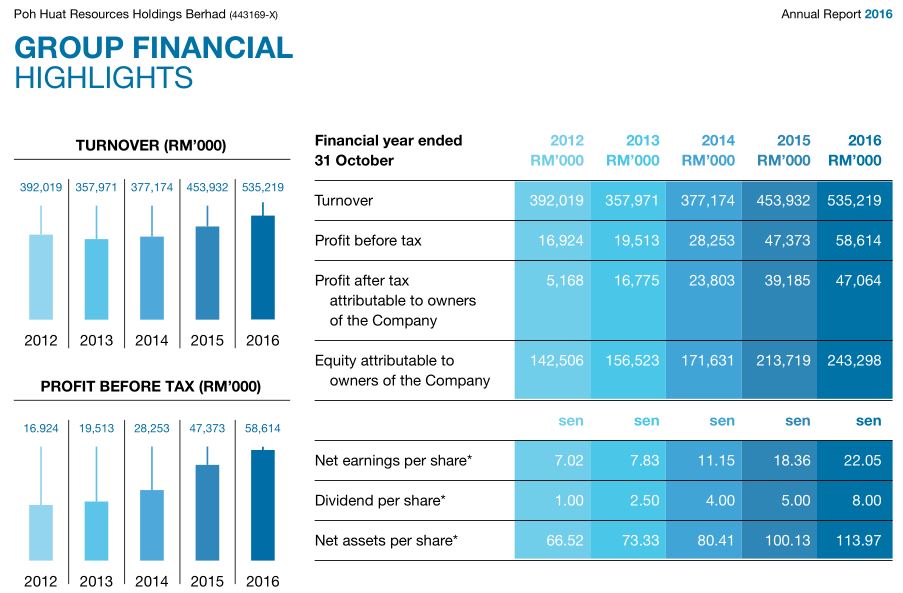

CAGR for the past 5 years

1)Turnover - 6.4% (not that impressive but pass 3 years around 12.4%)

2)PBT - 28% (very impressive)

3)PAT - 56% (very impressive)

4)EPS - 26% (very impressive)

Company background

*“The

company has its roots in Muar in the southern state of Johor, which is

the heartland of Malaysia’s furniture industry. Today, its local

manufacturing facilities have expanded to 5 factories, located on 24

acres of land, with about 800 workers. This is the company’s base for

producing, primarily, panel-based wood furniture for office and

home-office systems, made from laminated particleboards and metal parts.

The manufacturing process is relatively simple – cutting, boring,

edging and packing – and involves a high level of automation. Products

are either manufactured based on in-house designs and marketed under its

own brand names (‘AT Office Systems’ and ‘AT Home System’) or

customised to order. A typical office suite comprises of tables,

worktops, side extensions, counters, pedestals, cabinets and

workstations. The newest addition to its product range is the

panel-based bedroom sets, mainly for export to the US market. In 2003,

Poh Huat expanded its manufacturing base to Vietnam, where there is a

greater pool of skilled workers to produce higher quality (value) spray

orientated wood furniture, mostly bedroom sets. Its manufacturing bases

in Vietnam are situated in 2 locations, namely the districts of Binh

Duong and Dong Nai, near Ho Chi Minh City.”

What I like?

-the

company is focus on the US and Canada market (90%). As North America

economy on the steady recovery path, so the demand of new houses also on

the rise, this should benefit furniture exporters like Poh Huat. That's

mean the company still has plenty room to grow.

-recently

acquired a warehouse in Australia, according to the management,

Australia market quite similar to North America in term of personal

preference on furniture. We might see the contribution from this part of

world in a few years time

-a net cash company, with RM32.9m (maybe already expexted because most of the furniture stock in net cash position)

-* from latest quater report

”Shipment of furniture from our Malaysian factories increased substantially as a result of the coming on-stream of

new products, including panel based bedroom models, introduced in the

previous quarters. Contribution from its panel based bedroom models for

the US market increased to 20% from 5% previously. Shipment of furniture

from our Vietnamese operations were also higher in line with

improvement in the US economy and its efforts to ship higher value

orders to the US.”

* from research report

“To

expand its market share, the company has a two-pronged approach. On one

hand, it is moving up the value chain by producing home furniture sets

targeted at the medium and upper-medium segments of the market, which

carry better margins and are less competitive. On the other hand, it is

also moving down, to the lower-mid market segments with its panel-based

bedroom sets to encompass the home and SoHo segments. This move has

since produced tangible results, as evidenced by the increase in sales

and earnings. The company indicated that panel-based bedroom furniture

now accounts for some 20% of sales from the local plant. Utilisation

improvement has translated into better economies of scale.”

-attractive valuation with low PE, steady cash flow, strong balance sheet, ROE-20% and DY-4%

Some risks but not limited to

• depleting woods resources and increasing in wood costs (as latest governance announcement that ban rubberwood export from 1st July is a good news to the company)

•

tightening in regulation and law in countries where the Group operates

and sell to (Trump protectionist trade might pose some threat to the

company)

• subject to world economic changes since the Group operate in and sell across the globe;

• expose to foreign workers shortage problem (due to illegal foreign workers issue)

• exposure to foreign exchange fluctuation; (as export oriented, stronger USD is good for the company)

• production availability and technical changes in manufacturing processes

To me, the fair value of this company is around RM2.50

*derived from AR and some research report

FOR SHARING PURPOSE ONLY, NOT A BUY OR SELL CALL ON THE COMPANY