KFIMA (6491) - Fixed Deposit in this company will pay you more than 5% now

With a diverse base of readership on my KLSE share trading journal, it is my pleasure to put some fundamental picks into my investment journey as well. As you can see, I am very versatile, and will not stick to a single method of investing, because I believe investing should be a very interesting journey, and a lot of factor will influence the investment decision.

To a lot of people, fundamental picks are at times very boring. It can be boring in a sense that there might not be much hoo-haa in the corporate scene such as corporate exercises, new acquisition or any other merger exercises. It is just business as usual, and keep improving the existing business. Well, i tend to agree and disagree, that is because sometimes, a fundamentally strong company can be as interesting as a speculative company in nature.

So today, I will introduce to you a very fundamentally sound company which you can virtually treat it as your Fixed Deposit investment if you are purely looking for the annual dividend. Of course, this package will come with a little bit of share price fluctuation in the mean time. But since the fundamental is strong, i would reckon that your capital is prone to the upside swing of the appreciation.

This time around, I will be very straight forward to point out to you this company, which is Kumpulan Fima Berhad (Kfima - 6491).

I will not go through this company with you like an annual report, but good enough extract to have you make your own decision in deciding whether this company will be your next Fixed Deposit destination or not.

I will attached the latest chart of Kfima here first, then I will go through with you on 4 different views on analyzing Kfima.

As a fundamental strong company, we will first talk about dividend. I will take the past 3 years dividend history as a benchmark.

2014 - 8 cents

2015 - 8.5 cents

2016 - 9 cents

Now we are in 2017, and at the trend that we are looking, probably Kfima will be declaring 9.5 cents to 10 cents dividend for the shareholder this coming May, and payable in September 2017.

Let's assume dividend for 2017 will be 10 cents. At the current price of RM 1.88, you will be getting a yield of 5.31%, where you will need to hold for approximately 6 months. Even if Kfima is at the price of RM 2.10, a 10 cents dividend will still be yielding 4.76%. And for your information, the current FD promotion that is going around Malaysia is giving around 4% per annum. If you are IT savvy, you can opt for Hong Leong Bank Tuesday FD promotion at 4.15% for 9 mths through FPX. But for now, are you going for a 4% FD or a 5.31% FD, that's your decision again.

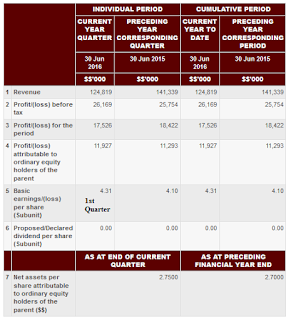

Secondly, we will look at the latest 3 quarter earning of Kfima. This is as easy as Do-Re-Mi-Fa forecast.

1st Quarter - 4.31 cents

2nd Quarter - 5.2 cents

3rd Quarter - 6.59 cents

So as you can see, the total 3 quarter cumulative earning is at 16.12 cents. According to the growth of the earning, let's assume the 4th Quarter will be 7 cents, very feasible and practical right?

If that is so, the total FYE 2017 will be ending on a high note of 25 cents in EPS, which can be value Kfima at RM 2.50 based on PER x 10.

Thirdly, we will look at some technical chart now. I will put up very simple understanding drawing, no need to see MACD, Stochastic, MA and all sort of indicator, just resistance line.

If you refer to the chart, you can obviously see that Kfima had finally awaken from it's sleep, and ready to move forward after a hibernating for 2 years. The technical chart show that Kfima is ready to break above the long term down trend resistant line, back by growing fundamental.

Lastly, Kfima will also be going to have a 10 to 1 bonus issue.

As you can see, Kfima have 282 million shares outstanding, and share premium account is having RM 29.5 million, so that is just good enough measure to give a 10 to 1 bonus issue. Yea, you might be arguing that the latest Company Acts is bla bla bla and so, but according to the latest development, corporate with share premium account are given 24 months to settle it. Since Kfima do not have any losses to write off, then it will be bonus shares. So, that will be either this year, or next year, 10 shares held for 1 bonus share.

Regardless of that, Kfima also have a very strong cash balance of almost RM 400 million, which supersede any debt obligation they are currently carrying. So in short, Kfima is net cash company, and hence, you can be certain that for the next 5 years, you will still be getting consistent dividend.

This company is really for those who are eyeing for a long haul, and growing along with the company year to year basis. But for now, I had informed you about the possible corporate exercise involving bonus issue, which is one of the sexier part of this company.

If you are going to boom your cash load on FD promotions, why not allocate some towards Kfima, for a better yield, capital appreciation and some bonus shares as well ?

KFIMA (6491) - Fixed Deposit in this company will pay you more than 5% now

http://bonescythe.blogspot.my/2017/03/fixed-deposit-in-this-company-will-pay.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+BonescytheStockWatch+(Bonescythe+Stock+Watch)