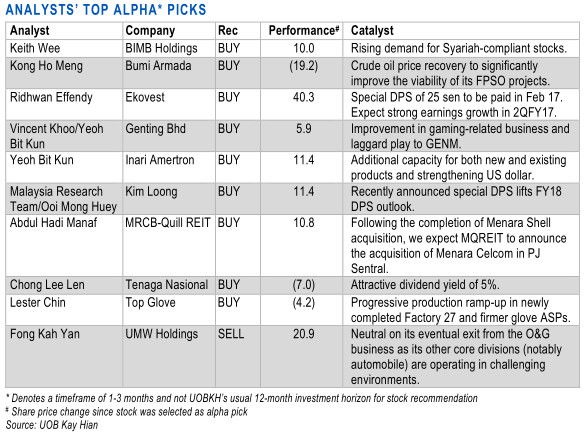

Most of our alpha picks

delivered gains in Jan 17, with our average BUY picks beating the

FBMEMAS Index’s 2.4% gain. Our line-up for Feb 17: BIMB Holdings, Bumi

Armada, Ekovest, Genting Bhd, Inari, Kim Loong, MRCB-Quill REIT, Tenaga

Nasional and Top Glove. UMW remains our sole SELL. We expect technology

and infrastructure investment themes to take the limelight in February.

WHAT’S NEW ■ Review of January picks.

Most of our BUY alpha picks gained in Jan 17 (see RHS table), led by

Ekovest, Inari and MRCB Quill. However, some US-dollar beneficiaries -

Top Glove and Kim Loong - did not deliver positive returns as we had

expected. Our sole conviction SELL call – UMW - unfortunately rebounded

strongly after announcing plans to spin off its oil & gas (O&G)

business. Nevertheless, we expect the stock to reel back, given

continuing weak fundamentals in its automotive and heavy equipment

divisions, coupled with ongoing impairments of its investments in the

O&G business.

■ Technology, infrastructure and China FDI themes to continue to deliver good investment returns. We expect continuing momentum in the outsourced assembly and test (OSAT) segment within the technology sector. Catalysts include new products as added features in mobile phones, a strong replenishment cycle for the upcoming iPhone 8, and margin expansion (thanks to the weak ringgit). We also expect a further upward re- rating in the infrastructure sector as most of the new mega infrastructure projects take off or gain momentum from 2Q17.

ACTION

■ Aligned with the focused themes are conviction BUY picks Inari and Ekovest . There is potentially 10-20% upside to our FY18 earnings forecast for Inari should all the new production lines for retinal scan components achieve full utilisation by 2H17, and further upside should it indirectly secure new orders from other mobile phone IDMs. Sunsuria (BUY) is a chief beneficiary of the China FDI theme.

■ Other notable beneficiaries include Ann Joo, Hume and Kerjaya under the infrastructure theme. We also note that within the OSAT segment, Globetronics (NOT RATED) is on course to making a strong earnings recovery as it ramps up production from 2Q17 to service rising demand for mobile devices.

■ Technology, infrastructure and China FDI themes to continue to deliver good investment returns. We expect continuing momentum in the outsourced assembly and test (OSAT) segment within the technology sector. Catalysts include new products as added features in mobile phones, a strong replenishment cycle for the upcoming iPhone 8, and margin expansion (thanks to the weak ringgit). We also expect a further upward re- rating in the infrastructure sector as most of the new mega infrastructure projects take off or gain momentum from 2Q17.

ACTION

■ Aligned with the focused themes are conviction BUY picks Inari and Ekovest . There is potentially 10-20% upside to our FY18 earnings forecast for Inari should all the new production lines for retinal scan components achieve full utilisation by 2H17, and further upside should it indirectly secure new orders from other mobile phone IDMs. Sunsuria (BUY) is a chief beneficiary of the China FDI theme.

■ Other notable beneficiaries include Ann Joo, Hume and Kerjaya under the infrastructure theme. We also note that within the OSAT segment, Globetronics (NOT RATED) is on course to making a strong earnings recovery as it ramps up production from 2Q17 to service rising demand for mobile devices.

BIMB Holdings

■ BIMB delivered a robust 3Q16 earnings growth of 17% yoy, by far the strongest among peers, supported by growth across all major lines. Net financing income was up 4.0% yoy with above-industry loan growth of 11%. Trading income soared 85.8% yoy on higher forex and securities investment gains. Takaful income recorded a solid 23% yoy growth on the back of a 16% gross premiums growth. As such, pre-provision operating profit growth expanded 24.5% yoy.

Share Price Catalyst ■ May fetch a scarcity premium, being the only Syariah-compliant full-fledged bank, which could bring 15-20% upside to our target price.

■ Takaful subsidiary continues to deliver stronger-than-expected growth, which is important, given its relatively sizeable 70% composition to the group's non-interest income.

■ Lower collective assessment provisioning arising from the potential downward adjustment in its overly conservative 1.50% collective allowance closer to the industry’s 1.20%.

Bumi Armada ■ The successful delivery of four floating projects will unlock new cash flow contributions and

potentially double future earnings growth as these projects are of long-term contract tenures (8-18 firm year periods each). The group is trading at 0.6x post-Claire impairment P/B. Despite the recent quarterly impairment-related losses, balance sheet is still well above the debt covenant threshold.

Share Price Catalyst

■ Sharp recovery in crude oil prices improving the viability of its FPSO projects.

■ Smooth delivery in 4Q16 and first oil/first gas of floating projects.

■ Recovery in OSV utilisation and rates.

Ekovest

■ We like Ekovest for its: a) unique exposure to the coveted and long-dated Duke 1 and 2 tolled highway concessions, b) deep discount to our SOTP valuation of RM5.22/share, and c) strong 3-year earnings CAGR of 69%.

Share Price Catalyst

■ Share price should continue on its positive momentum pending a special DPS of 25 sen per share, with an expected ex-date by Feb 17.

Genting Bhd ■ The combination of GENT’s cheap fundamental value and the anticipated continuous improvement in gaming-related businesses in 2017 - Genting Malaysia (GENM) had partially open its Genting Integrated Tourism Plan (GITP) amenities in end-Dec 16 and GENS’ EBITDA is expected to recover further due to easing provisions and better cost efficiency - remain as catalysts to re-rate the stock.

Share Price Catalyst

■ Laggard play to GENM. GENT’s share price should sympathetically move up as GENM’s

share price momentum is expected to build up ahead of the opening of major GITP amenities. GENT and GENM are trading at 8.2x and 9.7x 2017F EV/EBITDA respectively.

■ Any positive development on TauRX’s dialogue with regulatory authorities European Medicines Agency (EMA) and US Food and Drug Administration (FDA). Inari Amertron (Yeoh Bit Kun)

■ Inari’s multi-pronged expansion is expected to lead to strong yoy earnings growth of 21%

and 23% in FY17-18. Key highlights are: a) kick-start of new contract for iris scanning components; b) ramp-up in utilisation of new plant for switch testing jobs (data centre application), and c) organic growth from the radio-frequency business.

Share Price Catalyst

■ Assuming things go smoothly, Inari’s new contract for iris scanning components (for smart devices’ security function purpose) could raise our FY18-19 earnings forecasts by 9% and 16% respectively.

■ Benefitting from the US dollar strength. Every 1% increase in our base RM4.00/US$ assumption would result in Inari’s net profit rising about 2% in FY17.

Kim Loong ■ Earnings growth is supported by: a) a recovery in fresh fruit bunch production, and b) good milling margins from a recovery in the oil extraction rate (OER), and c) extra income from value-add by-products.

■ Kim Loong announced a special dividend of 5 sen during its 3QFY17 results. We are expecting a final dividend of 6 sen, bringing FY17 dividend to 18 sen, implying a yield of 5.2% and payout ratio of 75%. For FY18, we forecast a similar dividend payout ratio of 75% which translates into an attractive yield of 7.2%.

Share Price Catalyst

■ Better-than-expected FFB yield and OER.

■ Current CPO prices are well above our forecast for 2016.

MRCB-Quill REIT ■ Completion of Menara Shell acquisition is proof that MQREIT is committed to its shareholders, evidenced by the expansion of its asset size following MRCB’s entry as co-sponsor for the REIT on Mar 15. To recap, MRCB intends to inject at least one property every year into MQREIT.

Share Price Catalyst

■ Yield-hungry investors to bid up MRCB-Quill’s valuation, given that its dividend yield is among the highest in the sector.

■ Healthy acquisition pipeline to boost growth. MQREIT’s next acquisition will be Menara Celcom in PJ Sentral (scheduled for completion in 2017).

Tenaga Nasional

■ TNB will benefit from a positive risk-reward profile under the IBR framework. The framework,

we opine, remains intact and would drive a sustained re-rating of TNB closer to market valuation in the long run.

Share Price Catalyst

■ Positive outcome from more active capital management (announced in Dec 16) suggests an attractive dividend yield of 5%.

Top Glove

■ Normalising industry supply-demand dynamics and sustained strength of the US dollar could imply further upside to upcoming quarterly earnings and offer some trading opportunities

over the next two quarters.

Share Price Catalyst

■ Progressive production ramp-up at the newly-completed Factory 27 and firmer glove ASPs arising from the recent price revisions should see margin expansion and firmer earnings for 2QFY17.

■ Near-term valuation re-rating potential, given Top Glove's position as the prime beneficiary

of the strengthening US dollar within the sector.

UMW Holdings ■ Although UMW’s eventual exit from its loss-making O&G businesses may see the group’s

earnings recover, we are neutral on the development as its other core divisions (notably automobile) is operating in challenging environments against the backdrop of weak consumer sentiment and prolonged weakness in the ringgit.

■ Maintain SELL and SOTP target price of RM4.00, implying 1x 2018 P/B. Our fair value of 50 sen for UMW O&G implies 16x EV/EBITDA based on its historical trading range. We do not see any re-rating catalysts in the near to medium term as all its core divisions (besides O&G) are operating in extremely challenging environments.

Share Price Catalyst

■ Further weakening in the ringgit and oil prices will be negative to stock price.

potentially double future earnings growth as these projects are of long-term contract tenures (8-18 firm year periods each). The group is trading at 0.6x post-Claire impairment P/B. Despite the recent quarterly impairment-related losses, balance sheet is still well above the debt covenant threshold.

Share Price Catalyst

■ Sharp recovery in crude oil prices improving the viability of its FPSO projects.

■ Smooth delivery in 4Q16 and first oil/first gas of floating projects.

■ Recovery in OSV utilisation and rates.

Ekovest

■ We like Ekovest for its: a) unique exposure to the coveted and long-dated Duke 1 and 2 tolled highway concessions, b) deep discount to our SOTP valuation of RM5.22/share, and c) strong 3-year earnings CAGR of 69%.

Share Price Catalyst

■ Share price should continue on its positive momentum pending a special DPS of 25 sen per share, with an expected ex-date by Feb 17.

Genting Bhd ■ The combination of GENT’s cheap fundamental value and the anticipated continuous improvement in gaming-related businesses in 2017 - Genting Malaysia (GENM) had partially open its Genting Integrated Tourism Plan (GITP) amenities in end-Dec 16 and GENS’ EBITDA is expected to recover further due to easing provisions and better cost efficiency - remain as catalysts to re-rate the stock.

Share Price Catalyst

■ Laggard play to GENM. GENT’s share price should sympathetically move up as GENM’s

share price momentum is expected to build up ahead of the opening of major GITP amenities. GENT and GENM are trading at 8.2x and 9.7x 2017F EV/EBITDA respectively.

■ Any positive development on TauRX’s dialogue with regulatory authorities European Medicines Agency (EMA) and US Food and Drug Administration (FDA). Inari Amertron (Yeoh Bit Kun)

■ Inari’s multi-pronged expansion is expected to lead to strong yoy earnings growth of 21%

and 23% in FY17-18. Key highlights are: a) kick-start of new contract for iris scanning components; b) ramp-up in utilisation of new plant for switch testing jobs (data centre application), and c) organic growth from the radio-frequency business.

Share Price Catalyst

■ Assuming things go smoothly, Inari’s new contract for iris scanning components (for smart devices’ security function purpose) could raise our FY18-19 earnings forecasts by 9% and 16% respectively.

■ Benefitting from the US dollar strength. Every 1% increase in our base RM4.00/US$ assumption would result in Inari’s net profit rising about 2% in FY17.

Kim Loong ■ Earnings growth is supported by: a) a recovery in fresh fruit bunch production, and b) good milling margins from a recovery in the oil extraction rate (OER), and c) extra income from value-add by-products.

■ Kim Loong announced a special dividend of 5 sen during its 3QFY17 results. We are expecting a final dividend of 6 sen, bringing FY17 dividend to 18 sen, implying a yield of 5.2% and payout ratio of 75%. For FY18, we forecast a similar dividend payout ratio of 75% which translates into an attractive yield of 7.2%.

Share Price Catalyst

■ Better-than-expected FFB yield and OER.

■ Current CPO prices are well above our forecast for 2016.

MRCB-Quill REIT ■ Completion of Menara Shell acquisition is proof that MQREIT is committed to its shareholders, evidenced by the expansion of its asset size following MRCB’s entry as co-sponsor for the REIT on Mar 15. To recap, MRCB intends to inject at least one property every year into MQREIT.

Share Price Catalyst

■ Yield-hungry investors to bid up MRCB-Quill’s valuation, given that its dividend yield is among the highest in the sector.

■ Healthy acquisition pipeline to boost growth. MQREIT’s next acquisition will be Menara Celcom in PJ Sentral (scheduled for completion in 2017).

Tenaga Nasional

■ TNB will benefit from a positive risk-reward profile under the IBR framework. The framework,

we opine, remains intact and would drive a sustained re-rating of TNB closer to market valuation in the long run.

Share Price Catalyst

■ Positive outcome from more active capital management (announced in Dec 16) suggests an attractive dividend yield of 5%.

Top Glove

■ Normalising industry supply-demand dynamics and sustained strength of the US dollar could imply further upside to upcoming quarterly earnings and offer some trading opportunities

over the next two quarters.

Share Price Catalyst

■ Progressive production ramp-up at the newly-completed Factory 27 and firmer glove ASPs arising from the recent price revisions should see margin expansion and firmer earnings for 2QFY17.

■ Near-term valuation re-rating potential, given Top Glove's position as the prime beneficiary

of the strengthening US dollar within the sector.

UMW Holdings ■ Although UMW’s eventual exit from its loss-making O&G businesses may see the group’s

earnings recover, we are neutral on the development as its other core divisions (notably automobile) is operating in challenging environments against the backdrop of weak consumer sentiment and prolonged weakness in the ringgit.

■ Maintain SELL and SOTP target price of RM4.00, implying 1x 2018 P/B. Our fair value of 50 sen for UMW O&G implies 16x EV/EBITDA based on its historical trading range. We do not see any re-rating catalysts in the near to medium term as all its core divisions (besides O&G) are operating in extremely challenging environments.

Share Price Catalyst

■ Further weakening in the ringgit and oil prices will be negative to stock price.

source: UOBKayHian Research – 6/2/2017