BNM Dec 16 Statistics: Deposit Growth Improves

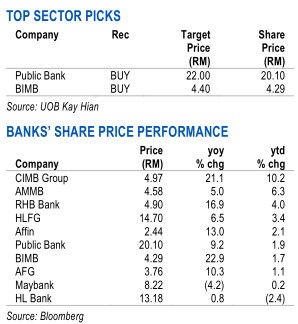

Leading loan growth indicators, such as loan approval (-12.8% yoy) and application (-8.0% yoy), in Dec 16 continued to point towards a moderating growth environment. On a brighter note, the sharp mom growth recovery in deposits should help ease competition for deposits. We continue to like Public Bank and BIMB for their high provision buffers, ahead of the MFRS9 implementation, and Maybank as an immediate-term election play. Maintain MARKET WEIGHT.

Leading loan growth indicators, such as loan approval (-12.8% yoy) and application (-8.0% yoy), in Dec 16 continued to point towards a moderating growth environment. On a brighter note, the sharp mom growth recovery in deposits should help ease competition for deposits. We continue to like Public Bank and BIMB for their high provision buffers, ahead of the MFRS9 implementation, and Maybank as an immediate-term election play. Maintain MARKET WEIGHT.

WHATS NEW

• 2016: Year of sharp deceleration in loan growth. Total loans stood at RM1,521.5b in Dec 16, bringing 2016 system loan growth to 5.3% (2015: +7.9%). Loans to working capital and non-residential property saw the largest growth deceleration in 2016, declining from 10.4% and 10.6% in 2015 to 5.6% and 6.1% respectively in 2016. This was followed by residential property loans which continued to moderate downwards to 9.2% in Dec 15 (Dec 15: +11.9%, Nov 16: +9.5%), while automobile loans continued to fall by 1.0% in Dec 16. Consumer loan growth remained weak with growth moderating to 5.3% in Dec 16 (Nov 16: +5.4%, Dec 15: +7.7%). We retain our 2017 loan growth forecast of 4.5-5.0%, judging from the continued double-digit contraction in loan approval.

• Growth momentum remained stable mom, underpinned by working capital loans. Loan growth remained fairly robust at 0.9% mom (Nov 15: +0.9%), driven by the continued surge in working capital loan growth momentum (+2.6% mom vs average mom growth run rate of 0.5%). Given that the strong loan growth emanated from the real estate and retail sectors, which continue to face challenging headwinds, the strong loan growth momentum may not be sustainable.

• Strong mom uptick in business deposits. There was a strong 2.4% mom (+RM12.9b) surge in business deposits in Dec 16 vs the full-year contraction of 0.2%. We believe this could be partially attributed to BNM’s recent foreign-currency control measures on exporters to repatriate a portion of their foreign-currency proceeds bearing fruit. More importantly, this should help alleviate funding cost pressure in the banking sector as business deposits have been a key drag on system deposit growth. Moving into 2017, we forecast sector NIM to undergo a milder compression of 5bp (2016: -9bp), given our expectation of a recovery in business deposits. This should help drive a healthier system deposit growth of 3.0% (2016: +1.5%).

• Positioning for the run-up to impending 14 th general election. Studying the share price performance trend of banks during the last three general elections, it is clear that government-linked banks tend to outperform the sector during the run-up to a general election. This was especially so in the last general election in 2013 whereby all government-linked banks outperformed the KLFInance index with the scenario reversed for non-government-linked banks. Among large-cap banks, Maybank had been among the consistent outperformers.

• Maintain MARKET WEIGHT. Credit quality will remain a key factor of earnings resilience as overall loan growth remains subdued. As it will be prudent for banks to start building up provision buffers ahead of the MFRS9 implementation in Jan 18, we believe the market will continue to favour banks with high provision buffers - Public Bank and BIMB. However, to position for a potential election-driven rally, we like Maybank. Assuming valuation stretched towards its historical 5-year mean P/B of 1.40x, a positive election-driven sentiment could drive its share price to the RM9.00 level (or 1.35x 2017F P/B).

source: UOBKayHian Research 2/2/2017