Malaysian businesses are more optimistic than consumers

● MIER’s Business Conditions Index +13.6 points QoQ to 106.4—it is the

first time that the index has emerged above the 100-point mark in five

quarters. The rising optimism is premised on (1) sales trending higher,

(2) a pick-up in output activities, (3) higher local and overseas orders

and (4) investments going up.

● MIER’s Consumer Sentiment Index remains weak (still below the 1998 AFC low), although the index +5.6 points QoQ to 78.5.

● Although we are now more constructive on the Malaysian stock market, there will be some short-term headwinds. (1) Consumer sentiment is still very fragile, and the 1MDB issue will not help. (2) 2Q result season will remain poor, although 2Q16 sales will see a

boost YoY. (3) An 11% hike in Minimum Wage.

● Malaysia’s valuations are not cheap relative to the region—its 2016 PE of 18.3x is in line with the average in the region

● MIER’s Consumer Sentiment Index remains weak (still below the 1998 AFC low), although the index +5.6 points QoQ to 78.5.

● Although we are now more constructive on the Malaysian stock market, there will be some short-term headwinds. (1) Consumer sentiment is still very fragile, and the 1MDB issue will not help. (2) 2Q result season will remain poor, although 2Q16 sales will see a

boost YoY. (3) An 11% hike in Minimum Wage.

● Malaysia’s valuations are not cheap relative to the region—its 2016 PE of 18.3x is in line with the average in the region

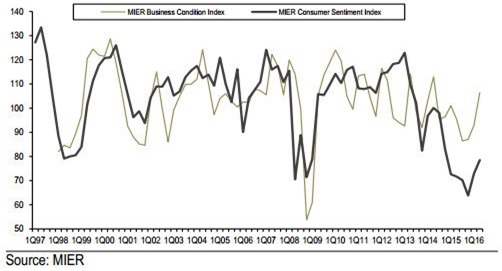

Figure 1: MIER Consumer Sentiment and Business Confidence Index

Businesses are more optimistic than consumers

MIER’s Business Conditions Index +13.6 points QoQ to 106.4—it is the first time that the index has emerged above the 100-point mark in five quarters. The rising optimism is premised on (1) sales trending higher, (2) a pick-up in output activities, (3) higher local and overseas orders and (4) investments going up.

The rollout of high-impact development projects such as the Mass Rapid Transit, the Light Rail Transit expansion and the Pan-Borneo Highway should have a positive impact and will support manufacturing activities. MIER believes that the recovery in local orders adds to signals that domestic demand conditions are turning the corner.

However, MIER expects MYR to weaken further and hover at 4.15 against the USD by year-end. Executive Director Prof Dr Zakariah said “1MDB remains to be a matter of concern in affecting sentiment.” MIER has maintained its GDP growth forecast for Malaysia at 4.2% this year (CS 2016 = 4.1%, CS 2017 = 4.5%).

MIER’s Consumer Sentiment Index remains weak (below the 100-point level) although the index +5.6 points QoQ to 78.5. This level is still below the Asian Financial Crisis low but is above the Global Financial Crisis low. The survey concludes that (1) household incomes are fairly stable, (2) job and financial expectations are up cautiously and (3) worries over higher prices continue to grow

MIER’s Business Conditions Index +13.6 points QoQ to 106.4—it is the first time that the index has emerged above the 100-point mark in five quarters. The rising optimism is premised on (1) sales trending higher, (2) a pick-up in output activities, (3) higher local and overseas orders and (4) investments going up.

The rollout of high-impact development projects such as the Mass Rapid Transit, the Light Rail Transit expansion and the Pan-Borneo Highway should have a positive impact and will support manufacturing activities. MIER believes that the recovery in local orders adds to signals that domestic demand conditions are turning the corner.

However, MIER expects MYR to weaken further and hover at 4.15 against the USD by year-end. Executive Director Prof Dr Zakariah said “1MDB remains to be a matter of concern in affecting sentiment.” MIER has maintained its GDP growth forecast for Malaysia at 4.2% this year (CS 2016 = 4.1%, CS 2017 = 4.5%).

MIER’s Consumer Sentiment Index remains weak (below the 100-point level) although the index +5.6 points QoQ to 78.5. This level is still below the Asian Financial Crisis low but is above the Global Financial Crisis low. The survey concludes that (1) household incomes are fairly stable, (2) job and financial expectations are up cautiously and (3) worries over higher prices continue to grow

Short-term headwinds will plague the market

Although we are now more constructive on the Malaysian stock market compared to six months ago, there will still be some short-term headwinds faced by the market.

1) Consumer sentiment is still very fragile, and therefore the US government’s move to seize assets allegedly stolen from 1MDB amounting to over US$1 bn could worsen sentiment in 3Q [The US Department of Justice filed the claim on 20 July]

2) The result season in Malaysia has just started and will continue into August. We believe that 2Q16 result will remain uninspiring, and could disappoint QoQ, but one may potentially see an artificial boost in sales growth YoY for two main reasons:

a) 2Q15 was the first quarter with 6% GST and sales were very depressed then. Hence, 2Q15 was from a low base. b) The difference in timing of HariRaya suggests that in 2016, 2Q sales captured the bulk of the HariRaya demand (festival dates = 6 and 7 July), but in 2015, 2Q sales captured far less of the HariRaya demand (festival dates = 17 and 18 July).

3) The Minimum Wage in Malaysia was increased by 11% to RM1,000/month, and the extension of the Anti-Profiteering Act will make it difficult for corporates to pass on the increase in cost.

4) Foreign investors continue to point out that Malaysia’s valuations are not cheap relative to the region, although Malaysia’s PE and PB valuations look attractive relative to its history.

Although we are now more constructive on the Malaysian stock market compared to six months ago, there will still be some short-term headwinds faced by the market.

1) Consumer sentiment is still very fragile, and therefore the US government’s move to seize assets allegedly stolen from 1MDB amounting to over US$1 bn could worsen sentiment in 3Q [The US Department of Justice filed the claim on 20 July]

2) The result season in Malaysia has just started and will continue into August. We believe that 2Q16 result will remain uninspiring, and could disappoint QoQ, but one may potentially see an artificial boost in sales growth YoY for two main reasons:

a) 2Q15 was the first quarter with 6% GST and sales were very depressed then. Hence, 2Q15 was from a low base. b) The difference in timing of HariRaya suggests that in 2016, 2Q sales captured the bulk of the HariRaya demand (festival dates = 6 and 7 July), but in 2015, 2Q sales captured far less of the HariRaya demand (festival dates = 17 and 18 July).

3) The Minimum Wage in Malaysia was increased by 11% to RM1,000/month, and the extension of the Anti-Profiteering Act will make it difficult for corporates to pass on the increase in cost.

4) Foreign investors continue to point out that Malaysia’s valuations are not cheap relative to the region, although Malaysia’s PE and PB valuations look attractive relative to its history.

source: Credit Suisse 28/07/16

http://malaysia-bursa.blogspot.com/2016/07/malaysia-market-strategy.html