FBMKLCI had been performing quite well for the past few weeks. Lets take a look at the monthly chart.

|

| FBMKLCI Monthly Chart |

When we look at the monthly chart, actually we can see a head and shoulder pattern. This head and shoulder pattern is a bearish pattern. The neckline is also the support, stands at 1670.

The difference between the neckline (1670) and the highest point (1896)

is 226. So from the neckline, the index is expected to break to 1444. (Luckily it did not go down to 你死死死 number; if so, we can collect a lot of fundamentally stock~ haha) I look at the support of 1670 as very important,

after few months of hovering around there, finally in March 2016, we

are breaking through, hopefully in April, we can firmly stand above the

support line.

If you like my way of analysis and you haven't join me in my facebook, appreciate if you could like my FB page, https://www.facebook.com/gainvestor10sai/?fref=ts

From the monthly chart, we can observe for the past few months, it is

considered very volatile. Look at how big is the gap between the highest

and the lowest point, averagely ranges around 50-80 points per month.

Next, lets look at the FBMKLCI Daily Chart.

|

| FBMKLCI Daily Chart |

From Daily Chart, we can see that there is a double bottom and

next the chart break through from the double bottom. Again, for the past

few days, our index had been above 1670. Notice the SMA50 and SMA200?

The gap is getting narrower and narrower. If SMA50 has crossed over SMA200, and preferably, the whole candle is above the SMA50, then, we can say that the bull is totally in charge of our FBMKLCI. Now let's wait for another few weeks...

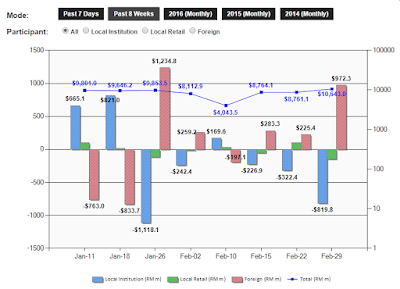

1. Foreign Investors

|

| Participation of Local Institution, Local Retail and Foreign Institution[1] |

Foreign investors / institutions had been active for the past few weeks. They had been buying.

This might be the reason why our index keeps going up. Foreign investor

had been in net buying mode, they had actually bought in RM1,181.2

million for the past 8 weeks[1].

In terms of FBMKLCI chart, it seems to me will continue to go up, and

the foreign net buy will continue for the next few weeks. The foreign

investors are investing back in our country~

2. Sectors to Focus

Next, lets try to figure out where the foreign investors are investing.

First of all, of course they are investing in our 30 blue chips, which

directly will push up our index. Next, in my opinion, the foreign

investors are investing in our plantation sector.

|

| Plantation Index Daily Chart |

If you look at the plantation index, basically there is a support at around 7822. The chart is in an uptrend mode forming an ascending triangle. The plantation is in bullish mode as the SMA50 had crossed over SMA200.

The MACD looks healthy too. When we talk about plantation sector,

normally we will be related to the crude palm oil. Let's look at the

crude palm oil futures.

|

| FCPO prices [2] |

For the futures of crude palm oil, we can see all of them are going up[2].

Things are getting promising for palm oil industries in Malaysia. So in

my opinion, the plantation sector is in bullish mode and especially

those companies who are involved in palm oil industries are in high

advantage. In The Edge Financial Daily, CPO is forecasted to go as high

as RM3,200 per tonne in the first half of 2016[3]. The reason is because of El Nino phenomenon, which is also the hot weather nowadays. (My housemates keep on complaining hot these few days.)

According to Godrej International Ltd director Dorab Mistry, the demand

for palm oil is expected to improve in April and June, but will be much

depending on the palm oil production and stocks in March and April.

|

| Close up with Oil Palm |

Well, for famous plantation palm oil stocks, such as KLK, IOI, FGV and

others. If we were to invest in plantation stocks, first we must make

sure that the fundamental analysis is good. For example, the revenue and net profit is growing, the PE, EPS are well checked also. For the technical analysis,

at least the SMA50 had golden crossed the SMA200. Combine with the

candlestick pattern to make a better decision. I had yet to venture into

the plantation sector.

And another additional information to check, the age of the planted oil

palm tree. The oil palm tree has an average productive life-span of

about 25 to 30 years. In each productive year, an oil palm tree may

produce between 8 to 12 bunches of fruit. Each bunch weighs between 10

and 25 kg and contains between 1,000 and 3,000 fruitlets[4].

As the market now seems to stable and looking for a new direction. Is

the BULL is in charge and plantation set to flourish now? For me, yes.

What says you?

Let's Ride the Wind and Gainvest

Gainvestor 10sai

12 March 2016

3.13am

3.13am

Sources:

[1]: http://www.malaysiastock.biz/Market-Statistic.aspx?m=w

[2]: Crude Palm Oil Futures (FCPO): http://www.bursamalaysia.com/market/derivatives/prices#/?contract_code=FCPO

[3]: The Edge Financial Daily dated 10 March 2016

[4]: http://www.simedarby.com/upload/Palm_Oil_Facts_and_Figures.pdf

[2]: Crude Palm Oil Futures (FCPO): http://www.bursamalaysia.com/market/derivatives/prices#/?contract_code=FCPO

[3]: The Edge Financial Daily dated 10 March 2016

[4]: http://www.simedarby.com/upload/Palm_Oil_Facts_and_Figures.pdf

http://gainvestor10sai.blogspot.my/2016/03/fbmklci-bull-in-charge-now-and.html