FAVELLE FAVCO BHD Stock Code: 7229

INVESTMENT HIGHLIGHTS

•

Favelle Favco Berhad (Favco) is at the forefront of highspeed and high

capacity niche customized crane under two world renowned brands –

Favelle Favco (offshore cranes) and Krøll (tower cranes). About 89% of

the sales generated are from markets outside of Malaysia.

•

Favelle Favco Berhad (Favco) is at the forefront of highspeed and high

capacity niche customized crane under two world renowned brands –

Favelle Favco (offshore cranes) and Krøll (tower cranes). About 89% of

the sales generated are from markets outside of Malaysia.

• As at 19 August 2015, the group’s outstanding orderbook stood at

RM866m. The majority of the orderbook consists of oil and gas cranes for

the offshore oil and gas exploration and production activities. The

remainder is from the shipyard, construction and wind turbine industry.

• Since its listing in August 2006, Favco’s average PER is 8.6x. The company is trading at PER of 5.8x which is at a discount in comparison to the FBMKLCI small cap index current PER of 14.3x. FFB is also a cheaper proxy to smallto-mid cap oil and gas services companies which typically trade at PERs of 11x.

• Although we are expecting earnings to be relatively flat, we are still expecting dividend yields to continue to be excess of 4% for this financial year and the next. This assumption is premised on its net cash position and very low capital expenditure requirements (less than RM10m per annum).

• Despite the low price of oil, Favco is still receiving contracts from its tower cranes segment.

• Since its listing in August 2006, Favco’s average PER is 8.6x. The company is trading at PER of 5.8x which is at a discount in comparison to the FBMKLCI small cap index current PER of 14.3x. FFB is also a cheaper proxy to smallto-mid cap oil and gas services companies which typically trade at PERs of 11x.

• Although we are expecting earnings to be relatively flat, we are still expecting dividend yields to continue to be excess of 4% for this financial year and the next. This assumption is premised on its net cash position and very low capital expenditure requirements (less than RM10m per annum).

• Despite the low price of oil, Favco is still receiving contracts from its tower cranes segment.

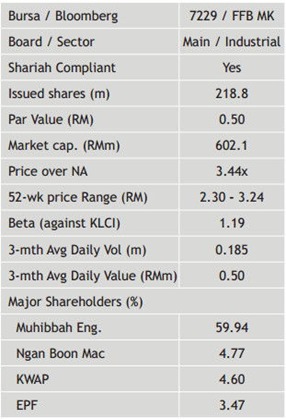

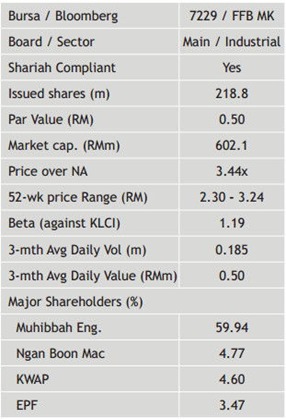

Favelle Financial Statistic

VALUATION

• We value Favco with a TP of RM2.87. Our valuation is based on EPS16 of 35.9sen pegged to PER16 of 8.0x, which reflects its average monthly rolling PER for the past three years.

source: MIDF Research – 12/01/16

FAVELLE FAVCO BERHAD

The Company is principally engaged in the design and development of lifting technologies resulting in the manufacturing rental and maintenance of lifting equipment and components.

FAVCO (7229) - Favelle Favco – Attractive Dividend Play For Oil And Gas

http://klse-online.blogspot.com/2016/01/favelle-favco-attractive-dividend-play.html

FAVCO, FAVCO (7229), 7229, EN7229, KLSE:FAVCO, Investing,