Random thoughts on the markets

Look at this chart.

S & P 500 is valued @ 21x PE ratio. Except the extreme bubble or of

the chart during 2009 crisis, it is certainly at top of the valuation

range. The median is 15 x. I always believe in reversion to mean.

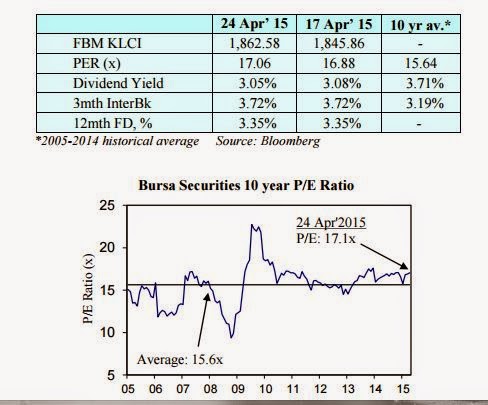

KLCI is selling for 17 PE ratio. Again it is above the long term

valuation and also at the top of trading range. Corporate earnings have

been dissapointing.

My only market that I used to be bullish while the rest of the world keep saying China was about to implode due to property bubble, crashing economy and shadow banking. As time goes by, my convictions were proven right. China is heading towards managed landing. China stock market is getting very pricey, close to 20x PE.

What is really worrisome the stock market is fuel by high school drop out and "da ma".

I don't think I am looking for the end of the world scenario but we certainly need a deep 20-30% corrections before the bull run can continue.

Please note that the cheap money is here to stay forever, is an illusion. Look the US unemployment is approaching full employment. It's close to 2006/2007 level.

Yet the interest rate stays ZERO?

No, it will not stay for long, at least not what 10 year treasury traders think. It starts to trend up.

To those who still swimming out there, just be careful. Just like Warren Buffett said: "A bull market is like sex. It feels best just before it ends."

A Malaysian Turtle Investing Diary...By Amateur for Amateur