AWC (7579) - Bursting Forward

Recently, AWC Berhad had came to a small spot light when substantial shareholder, Md Shah Bin Abu Hasan had been busy upping his stake from time to time in the open market. With Dato Ahmad Kabeer Bin Mohamed Nagoor as the new driver for the company since 2013 along with 35.26% shareholding in the company, what will be brewing in AWC Berhad?

Let's have a quick look at the latest price chart of AWC.

AWC had been seen trading at the trading range of RM 0.35 prior before the volatile shake off in the equity market that had sent most of the stock down under. However, as for AWC, it had not been far too bad as it lingers at the range of RM 0.30, which is still within the trading range of between RM 0.30 and RM 0.37.

Technically outlook had saw AWC seeing a good consolidation at the range of RM 0.30 as volume starts to dry up. AWC will be looking set to pick up in momentum soon. Technically looking, AWC can be looking set to retest RM 0.37 in the coming days, before trying above RM 0.40.

AWC - Great Start Ahead

AWC core income is mostly derived from the facilities management services which is mainly from the government concessions on the maintenance of the federal government buildings. Previously, AWC had a 9 year concession to provide management and maintenance services of the federal government building in the southern zone and Sarawak.

The total budget allocated for this segment will see more than RM 6 million monthly to provide maintenance of 60 federal complex buildings nationwide. AWC is handling 23 building complexes in Sarawak alone, which includes the Bintulu Port Authority building.

Other leading corporation and clients of AWC includes OCBC Bank, Telekom Malaysia, Bangunan KWSP, KLCC, KL Tower and PPB Harta Bina. AWC services also extends to the public sector such as Ministry of Works, Public Works Department, Prime Minister's Office, and Bank Negara Malaysia.

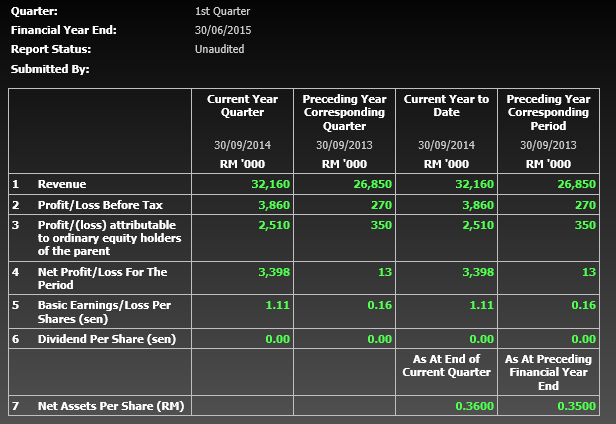

AWC had ended the FYE 2014 in a better EPS at 3.18 cents, and moving forward to 1Q FYE 2015, AWC continued to display strength with a 20% increase in revenue and 593% increase in the EPS compared to the previous corresponding quarter.

Currently, AWC had been sitting on a pile of RM 43.5million cash, equivalent to approx RM 0.19 a share on it's current cash level. While the group is currently in a net cash position at RM 40.5million, which is around RM 0.18 net cash value per share.

With the plans to expand their services to penetrate more into the private sector, AWC had seen breakthrough with the cornerstone foray into the healthcare sub-segment involving provision of biomedical and facilities engineering maintenance services in Hospital Rehabilitasi Cheras, and also secured new contracts to extend integrated facilities management services to telco stores and outlets of Celcom Axiata and the new Heriot-Watt University Malaysia campus in Putrajaya.

Another boost came for the group as AWC had secured a new 10 year concession with higher revised prices from the federal government in providing their facilities management and maintenance services is southern zone and Sarawak.

While the environment division still looks challenging, AWC believes that the STREAM will be the next "smarter environment" system that will see more country embrace the system. The automated pneumatic waste collection system under the proprietary name of STREAM had on going projects in Malaysia (Iskandar region), Singapore and Middle East.

AWC will also be looking to see more opportunity through their collaboration effort with CMSB (Cahya Mata Sawarak Berhad), which is involved in construction, property and infrastructure development in Sarawak.

Moving forward, AWC will continue to expand its services by planning to add more non-concession business to it's facilities management business segment through tenders, joint venture or even acquisition.

AWC looks great both fundamentally and technically with summarized pointers as below

- Improving revenue and earnings from past 2 quarters

- Net cash position of RM 40.5 million, or 18 cents a share (cash value is 58% of current market price at RM 0.31)

- Substantial shareholder open market buying, increasing stake to 7.77% or 17.5million shares

- New 10 year concession for facilities management services in Southern Zone and Sarawak

- Strong opportunity in Sarawak state with collaboration with CMSB

- Provider of "Smart Environment System" under the name of STREAM, an automated pneumatic waste collection system which is used in Malaysia (Iskandar Region), Singapore and Middle East currently.

- Current price of RM 0.31 is at the support price of the trading range.

AWC will be an interesting company in the coming days. With the higher anticipation of a better result for the coming quarterly result, AWC Berhad will define itself in the future.

Bone's short term TP: RM 0.40

Cheers and have a nice day

Regards,

Bone

http://bonescythe.blogspot.com/