Will data centre boom be a new catalyst for plantation sector?

This article first appeared in Capital, The Edge Malaysia Weekly on June 10, 2024 - June 16, 2024

FASTER and bigger returns could be in store for land rich planters that are capitalising on the current data centre boom by using agricultural land for solar farms, say analysts. Their observation comes amid tepid growth in the plantation sector but rising interest in data centres in Malaysia.

Heavyweights in the plantation sector may well be the latest beneficiaries of the data centre boom as the burgeoning sector’s renewable energy (RE) requirements could pave the way for planters to earn multiples in operating profit compared to oil palm.

“Plantation companies should strike while the iron is hot. This is a golden opportunity for them to tap into a new earnings stream. It’s all about the value to be realised on the land, and we do know that plantation companies hold substantial amounts of agricultural land that can be easily converted into solar farms,” TA Investment Management Bhd chief investment officer Choo Swee Kee tells The Edge.

The rental rate of solar farms is understood to be much more than the average return from planting oil palm, with Maybank Investment Bank Research estimating in a June 3 report that Large Scale Solar (LSS) projects could allow planters to generate up to 54 times more operating profit per mature hectare compared to planting the crop.

SD Guthrie Bhd (KL:SDG) (formerly Sime Darby Plantation Bhd) is the only planter to have publicly stated its RE ambitions.

In search of “less productive land for solar projects and more productive land for oil palm cultivation”, the company, which owns 240,309ha of land in Peninsular Malaysia, said last month that it planned to further its involvement in LSS projects via land lease and equity shareholding to own assets that can generate up to 1gw of power. Such an undertaking would require an investment of up to RM2.5 billion over the next three to five years and it believes it has the potential to deliver an 8% to 9% return on investment on a project basis.

SD Guthrie has leased sites for the LSS1, LSS4 and Corporate Green Power Programme and is bidding for three more sites under the upcoming LSS5 programme.

Maybank IB Research sees Kuala Lumpur Kepong Bhd (KL:KLK), IOI Corp Bhd (KL:IOICORP), Genting Plantations Bhd (KL:GENP), TH Plantations Bhd (KL:THPLANT) and United Plantation Bhd (KL:UTDPLT) as other potential beneficiaries of the LSS5 project as their Johor estates are near the presumed location of the national electricity grid in the state.

Further details on the LSS5 have yet to be disclosed to the market, which is eager for information on the much-awaited third party access (TPA) to the national electricity grid as well as how RE producers can export energy, particularly to Singapore.

“Some planters have been leasing their land to RE players of LSS farms at a rental rate of two to three times the average return of oil palm on a per mature hectare basis. Such moves have helped planters gain immediate rental returns as opposed to the typical seven-year gestation period for oil palm to generate their maiden profit after replanting. The leasing of less productive land or that due for replanting, therefore, makes financial sense as it also helps to defer the huge capex (capital expenditure) otherwise required for replanting, that is about RM20,000 to RM30,000 per hectare over three years,” the research house explained.

It estimated that the average oil palm operating profit per mature hectare in FY2023 to be RM5,027 after averaging RM4,444 over the last 10 years.

“According to recent guidance by SD Guthrie, which is keen to venture into RE with a 1gw capacity target in five years, every megawatt (mw) of solar capacity will cost RM2.5 million and require between 1.5ha and 1.7ha of land use. SD Guthrie expects an 8% to 13% return from this RE project,” Maybank IB Research noted.

“Based on our back-of-the-envelope calculation, 1gw of RE capacity may bring in recurring income of RM134 million to RM266 million per annum, using just 1,500ha to 1,700ha of land. This translates into 24 times to 54 times higher returns compared to the sector’s average oil palm operating profit of RM4,444 per hectare achieved in the past 10 years. Viewed differently, each mw of investment may bring in RM134,000 to RM266,000 in net profit,” it added.

However, Fortress Capital Asset Management (M) Sdn Bhd founder and CEO Datuk Thomas Yong cautions that the demand for land use for solar projects under the LSS may not be significant compared with the overall land ownership of listed plantation players. Hence, only a small fraction of plantation land is involved. In essence, the bigger game lies in being an RE producer.

The Bursa Malaysia Plantation Index had risen 1.49% year to date to 7,500.86 points in early May but sank to 7,137.12 points last week.

Yong is neutral on the outlook for the sector in the second half of the year, although he projects that earnings of plantation companies are likely to improve on the back of higher fresh fruit brunch output as well as stable to higher margins from improved cost structure amid uncertainties stemming from geopolitical tensions as well as demand from major economies such as China.

Data centre play expected to boost developers’ earnings growth

Property developers were quick to jump on the data centre bandwagon, particularly those with land bank near proposed data centre sites.

“As the supply chain of the data centre ecosystem starts with landowners, we are seeing many property developers with land bank as the first to benefit. With more data centre operator applications expected to come on stream over the next 10 years, the likeliest to land such deals are the [landowners] in the right locations. There could be joint venture models too where the landowner will benefit over the long term,” Areca Capital Sdn Bhd CEO Danny Wong tells The Edge.

In recent months, UEM Sunrise Bhd (KL:UEMS), Mah Sing Group Bhd (KL:MAHSING) and Sunway Construction Group Bhd (KL:SUNCON) have announced partnerships with companies offering data centre solutions, indicating such opportunities in the fast growing industrial segment.

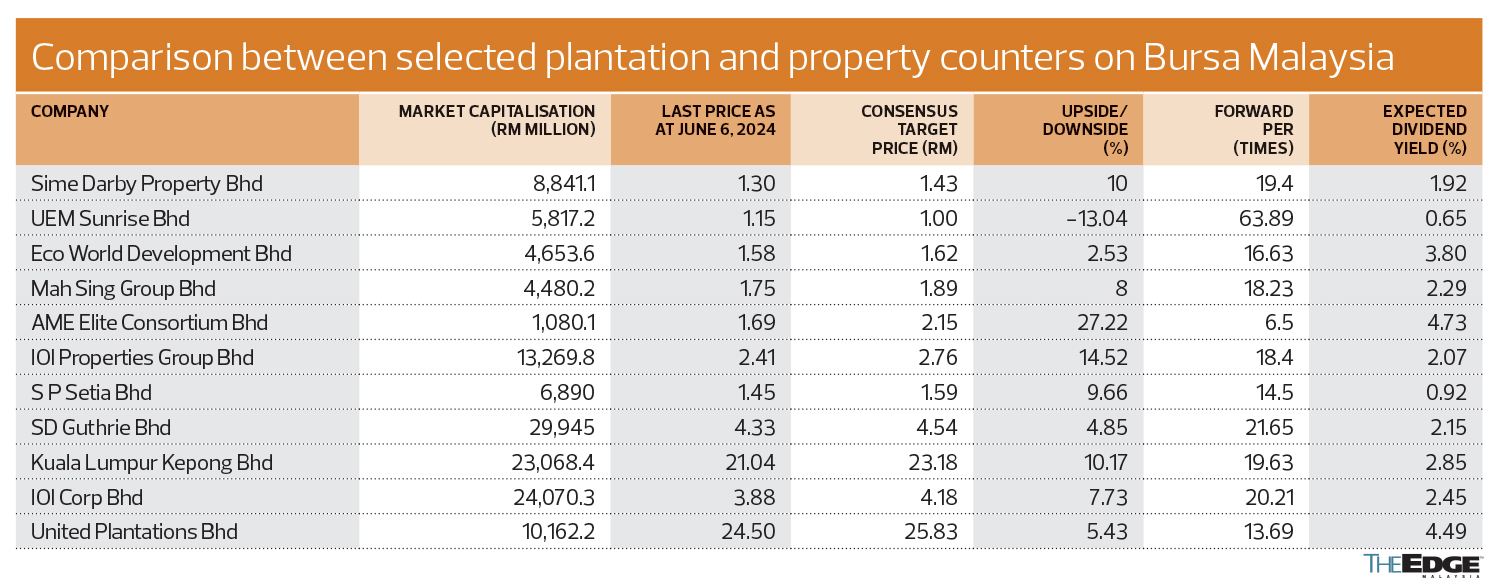

“These are property developers with sizeable land bank in Johor and the Klang Valley, as well as strong balance sheets. UEM Sunrise, Sime Darby Property Bhd (KL:SIMEPROP), S P Setia Bhd (KL:SPSETIA), Mah Sing Group, Eco World Development Group Bhd (KL:ECOWLD) and AME Elite Consortium Bhd (KL:AME) are potential developers that may benefit from the demand for data centres, given the location, amenities and infrastructure of their existing land bank. As data centres have to be distant from residential and commercial property areas due to strict security reasons, developers may choose to have data centres set up in their existing industrial parks,” says RHB Research senior analyst Loong Kok Wen.

The data centre play aside, she favours companies in the so-called Johor play.

“We are positive on these companies even without the data centre factor,” she says, adding that UEM Sunrise, Eco World Development and AME Elite have featured strongly in the Johor thematic play given the multi-year growth story of Iskandar Malaysia.

Sime Darby Property “is seeing very strong property sales and [now] has strategic exposure to the industrial segment”, she notes.

Loong observes that the data centre segment in Malaysia has benefited from the US-China trade tensions, with companies seeking to better manage their geopolitical risks.

Fortress Capital’s Yong believes that apart from selling land, property developers can benefit from serving as project managers for the development of data centres, with jobs ranging from construction to managing the data centres. The developer can also participate in joint ventures as the asset owner, with the intention of commanding recurring revenue in the future.

“However, some of these [prospects] may not materialise [so soon] and may require high upfront investment costs. Investors need to bear in mind that the demand for data centres will only pick up gradually,” he cautions.

Noting renewed interest in the property sector, Yong points to the development of infrastructure projects to improve interconnectivity in the country as well as favourable government policies such as the Malaysia My Second Home programme, as potentially attracting foreign participation in the sector.

“The affordable home segment is likely to continue to attract demand from young families in urban areas. We think residential property in Penang and industrial property in Johor may continue to perform well in the second half of the year due to favourable policies and inflow of foreign direct investment,” he says.

Apart from construction, utility, RE and property stocks, technology and technology-related counters have also benefited from the data centre boom.

Areca Capital’s Wong points to the growing interest in data centres as the government continues to actively pitch Malaysia as an ideal location for such land- and energy-intensive investments.

“The demand has continued to increase, with data from Knight Frank’s Data Centre Research Report Malaysia April 2023 revealing a total of more than 900mw of IT capacity for key data centres in Greater Kuala Lumpur (211mw) and Johor (712mw) in 2022. Tenaga Nasional Bhd (KL:TENAGA) estimates more than 5,000mw of potential maximum demand by 2035, with the many data centre applications requiring a total of more than 10gw. Although not all the projects are expected to be implemented, I must say the mega trend is here to stay for years to come,” he says.

“Next, of course, is the capex on data centre construction. Construction companies/contractors, consultancies, power cables, substations, infrastructure (for example, power supply, grid, transfer switch), mech engineering, ventilation and cooling systems, fittings and air conditioning … many will benefit even before the data centre starts operations.

“Even the later parts of the supply chain like UPS (uninterruptible power supply), hardware and servers, transceivers, HDD (hard disk drive) components and so on are highly connected to the strong demand of the data centre theme. These drive the upstream and downstream components.

“With strong demand and the potential of a much higher total addressable market of data centres, the power supply will be the next topic. With environmental, social and corporate governance criteria closely watched, RE is the best alternative, putting the huge land bank of plantation estates in focus.

“With much higher potential profits and better ESG play, it makes sense for a planter to diversify into RE, much like plantation land going to housing and industrial development. With that, I believe the laggard plantation sector will catch up with this hot theme.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

http://www.theedgemarkets.com/node/714845

Singapore Investment

-

-

-

-

-

-

-

-

-

Portfolio Summary for November 20245 hours ago

-

-

-

Sudden Realizations7 hours ago

-

-

-

-

-

Portfolio (Nov 30, 2024)19 hours ago

-

-

-

What Are Pennies Made Of?22 hours ago

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Bought an Argentina stock3 days ago

-

SOLD: Keppel DC Reit3 days ago

-

-

-

-

Cory Diary : Cash Flow4 days ago

-

-

-

-

-

-

-

-

-

Public Transport in Japan6 days ago

-

-

-

-

-

-

-

-

-

-

Tesla vs OCBC and UOB1 week ago

-

SRS -> Endowus1 week ago

-

Finance Investment Movement 512 weeks ago

-

-

-

-

-

FIRE via Bitcoin Compounding2 weeks ago

-

Interest rate and the Trump trade II3 weeks ago

-

-

-

The tide is turning!3 weeks ago

-

-

-

-

Oct 2024 Portfolio4 weeks ago

-

Portfolio -- Oct 20244 weeks ago

-

Who wants to be a Millionaire?4 weeks ago

-

-

Update to my side income 20244 weeks ago

-

-

Union Square Residences5 weeks ago

-

-

-

-

-

-

-

The gold rush again1 month ago

-

-

-

-

-

-

Summary of September 20241 month ago

-

-

-

China boom?2 months ago

-

-

-

PSA Annoucement: Life of a minion2 months ago

-

STI ETF2 months ago

-

-

-

-

-

Unibet Casino Bonus Codes 20242 months ago

-

-

-

-

MSC: Mission Critical distributor3 months ago

-

500k Milestone!3 months ago

-

Random thoughts: Air Drying of car3 months ago

-

-

-

-

-

-

-

-

Monthly IBKR Update – June 20244 months ago

-

At the Half Year Mark4 months ago

-

-

-

-

-

-

-

Breakthroughs in portfolio :)6 months ago

-

-

-

-

Feb 2024 Expenditure8 months ago

-

-

The Market Is A Scam!9 months ago

-

-

-

Options Trading Journal Jan 20249 months ago

-

-

-

-

Year 2023 DIYQuant Portfolio Performance Report11 months ago

-

Monthly Summary of November 202311 months ago

-

Migration of website1 year ago

-

-

-

-

-

-

-

-

-

-

A New Light1 year ago

-

-

-

-

-

-

2022 Thoughts, Hello 2023!1 year ago

-

Series of Defaults for Maple Finance1 year ago

-

Takeaways from “Sea Change”1 year ago

-

Greed is Coming Back1 year ago

-

-

Investing is Easy2 years ago

-

-

-

-

-

-

-

-

-

What is Overemployment2 years ago

-

Terra Hill Condo (former Flynn Park)2 years ago

-

Alibaba VS Tencent: The Battle Royale2 years ago

-

-

-

-

-

-

-

-

-

Home

AME

ECOWLD

GENP

IOICORP

KLK

MAHSING

SDG

SIME

SIMEPROP

SPSETIA

SUNCON

TENAGA

THPLANT

UEMS

UTDPLT

Will data centre boom be a new catalyst for plantation sector?