Due to the historical record high price of CPO, all plantation companies have been reporting increased profit and will continue to report increased profit for the next few quarters. As a result, all plantation stock prices have been going up higher and higher. Investors should study the comparison based on historical PE and Market cap per planted hectare to know which are the better stocks to buy.

Comparison based on historical PE

|

Name |

Price Rm |

Latest EPS |

Latest EPS X4 |

Price ÷EPS X4 |

|

Subur |

2.20 |

16.15 |

64.6 |

3.4 |

|

Cepat |

1.14 |

7.74 |

31.0 |

3.4 |

|

SOP |

6.32 |

36.44 |

Rm1.56 |

4.1 |

|

Jaya Tiasa |

1.09 |

5.28 |

21.12 |

5.2 |

|

Sarawak Pl |

2.90 |

11.66 |

46.6 |

6.2 |

|

Hap Seng |

2.49 |

11.79 |

47.2 |

6.3 |

|

Ta Ann |

5.59 |

21.8 |

82.2 |

6.4 |

Comparison based on Market cap ÷ planted Hectare

|

Name |

Price Rm |

Market Cap Million |

Hectare |

MC÷Ha |

|

Subur |

2.20 |

460 |

44,000 |

10.5 |

|

Jaya Tiasa |

1.09 |

1,062 |

70,000 |

15.2 |

|

SarawakPl |

2.90 |

812 |

35,000 |

23.0 |

|

Cepat |

1.14 |

360 |

10,000 |

36.0 |

|

SOP |

6.20 |

3,580 |

88,000 |

40.6 |

|

Ta Ann |

5.94 |

2,642 |

50,000 |

52.8 |

|

Hap Seng |

3.05 |

2,392 |

35,000 |

67.0 |

The CPO price chart below shows that CPO price started to go up from Rm 2,500 per ton about 2 years ago to peak at above Rm 7,000 per ton. CPO price has been around Rm 2,500 per ton for many years.

Due to the Ukraine -Russia conflict all food prices have gone up. Moreover, the Indonesian Government export restriction to reserve 20% to help local consumers, CPO high price will remain.

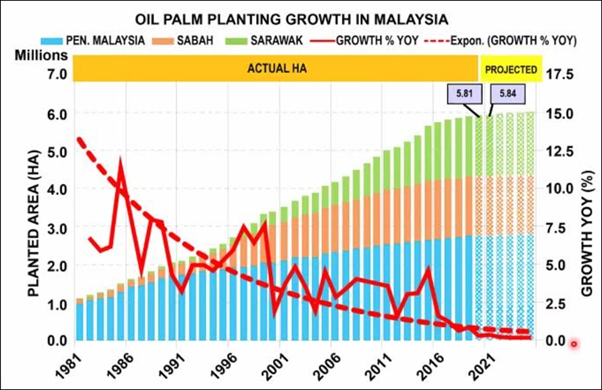

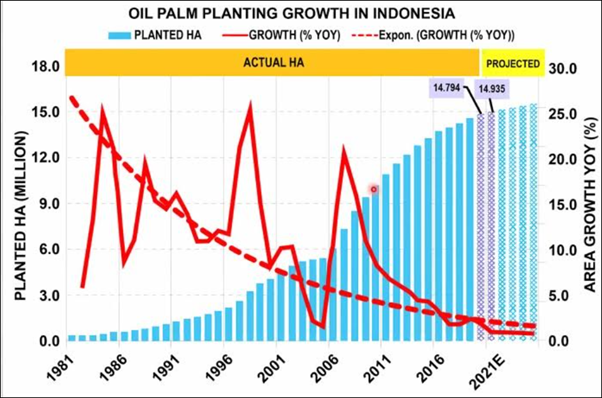

Investors should study the 2 charts below.

As agricultural land becomes limited, oil palm replanting is key to boosting palm oil yield across Indonesia and Malaysia. It is important replant to sustain supply because Indonesia and Malaysia produce about 85% of the world’s palm oil need.

Due to land shortage, plantation companies with larger planted acreage is a very important consideration for investors.