Welcome back to "The Huat Project". We would like to present On Demand to Take Off this Monday - ASTRO(6399).

I am sure as Malaysians, we would know the brand ASTRO(6399). Lets study this company together.

Fundamental Analysis

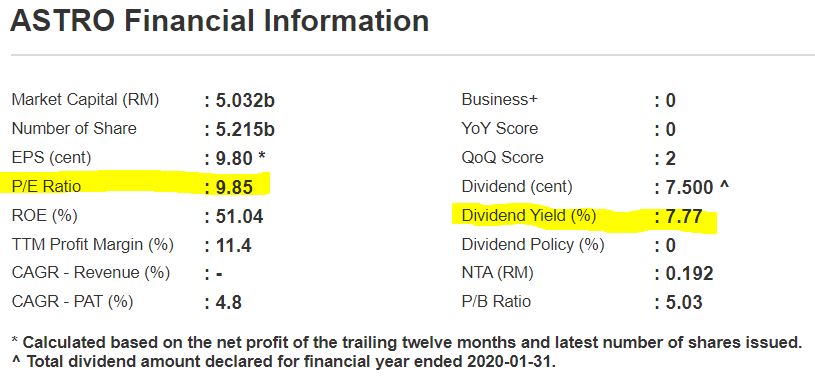

Lets look at ASTRO (6399)’s financials.

As seen above, ASTRO(6399) is currently trading at PE 9.85 compare to all other Tech stocks of PE 100. Also ASTRO(6399) has dividend yield of 7%, which is more than double, compared to banks Fixed Deposit of 3%.

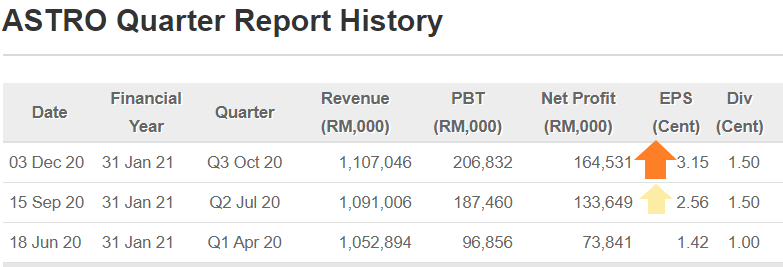

Also, ASTRO(6399) Profit After Tax (PAT) also Earnings Per Share (EPS) keep on increasing. This is due to the skillful administration from the management team.

Also, ASTRO(6399) Profit After Tax (PAT) also Earnings Per Share (EPS) keep on increasing. This is due to the skillful administration from the management team.

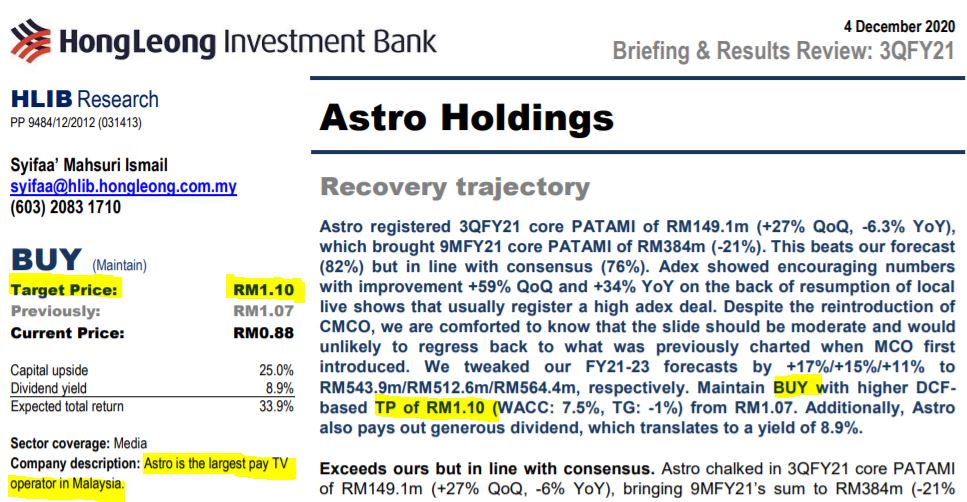

Investment Bank Analyst Opinion:

HLIB research analyst, Syifaa calls “buy” on ASTRO(6399) with target price of RM1.10

CIMB Analyst call for “add” on ASTRO(6399) with target price of RM1.18 backed by strong FCF generation is highest amongst media peers under their coverage. Also added that the ASTRO(6399) Ultra Box & SVOD would benefit the company.

(https://www.theedgemarkets.com/article/cgscimb-astro-overlooked-stock-current-valuations-considering-entering-highspeed-broadband)

(https://www.thestar.com.my/business/business-news/2021/01/07/digital-convergence-strategy-puts-astro-on-new-growth-path)

News analysis:

Credit Suisse believes that ASTRO(6399) could be privatised by its major shareholder, T Ananda Krishnan, backed by a sustainable dividend of 10 sen per share, implying about 8% yield. Thee tycoon started reversing this trend by picking up Astro stock in 2018, upping his stake to 41.3% in November 2019. (https://www.theedgemarkets.com/article/potential-privatisation-picks )

“Loud Call for ban of Android Box” https://www.thestar.com.my/news/nation/2019/02/03/loud-calls-for-android-box-ban-malaysian-filmmakers-government-needs-to-take-action-to-curb-piracy

Company Director finned RM30k for content piracy via TV media boxes.

With the local government’s support to potentially ban the Android Box, this will greatly benefit ASTRO(6399).

Technical Analysis

ASTRO(6399) broke out from the RM0.94 resistance and will potentially breakout from RM0.985 to form Cup and Handle Breakout chart pattern to retest the resistance at RM1.10. ASTRO(6399) has recently turned uptrend by forming higher highs, higher lows. WIth the RM0.94 resistance cum support, the Reward to Risk ratio is about 4 times.

Conclusion:

We strongly believe that ASTRO(6399) would trend higher in the near term, mainly due to its improving fundamentals, strong and convincing breakout, and news plays. Besides that, during MCO, ASTRO(6399) would also benefit from more view time and subscriptionship as responsible citizens stayed at home & closure of cinema which would boost ASTRO(6399)’s bottom line.

What will you do ?

DISCLAIMER: This post serves as an educational analysis and is never meant to be a buy/sell call or recommendation. Investors must always do their own due diligence before making any investment decisions. The author of this post is not liable in any way for any decisions made by any individual.

https://klse.i3investor.com/blogs/THP/2021-02-22-story-h1541199590-On_Demand_to_Take_Off_this_Monday.jsp