INTRODUCTION

OCK

(0172) (RM0.515 as of 19-02-2021) dates back to 2000 and was set up by

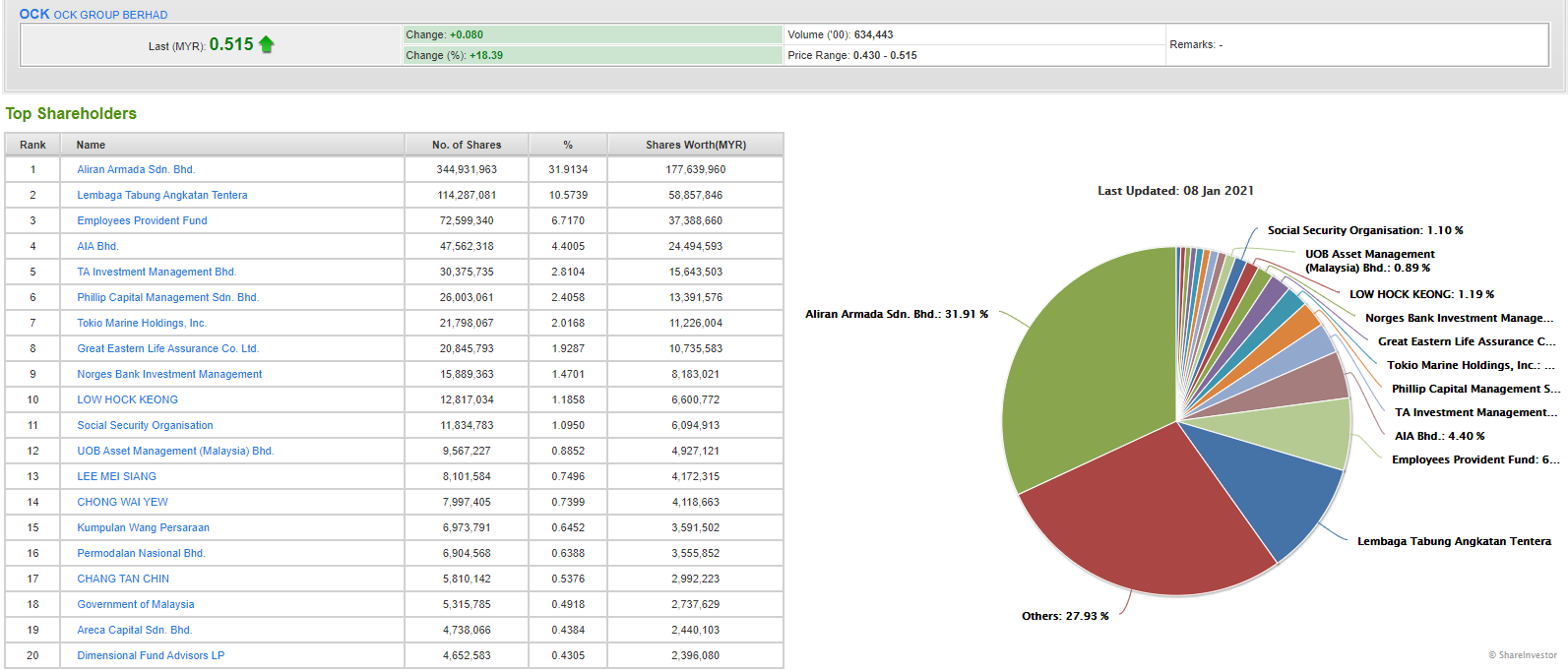

Sam Ooi Chin Khoon. He owns 31% of shares via (Aliran Armada Sdn. Bhd.).

As of 08 Jan 2021, we can see that the major shareholders of OCK are big investment funds , such as LTAT and EPF , holding 10.5% and 6.7% respectively.

Most recent acquisition is from EPF acquiring over 6.59million units.

![]()

OCK is mainly known for their exposure as a major telecommunication player, specializing in building and leasing infrastructure of telecommunications towers in Malaysia, Myanmar and Vietnam. It is a key beneficiary towards telco infrastructure and 5G rollout.

- Main revenue derives from recurring income, which contributes up to 75% of their revenue, with 54% from site leasing. They also own 17 Solar Farms with ambitions to expand towards green energy, which contributes to around 5% of their total revenue.

Outlook

- What this implies is that OCK is set up for the newly announced MyDigital Project , with allocation of RM21 billion will be invested through the National Digital Network (JENDELA) over the next five years; RM1.65 billion will be invested by telecommunications companies to strengthen connectivity to the international submarine cable network until 2023; RM15 billion will be invested to roll out 5G nationwide over a period of 10 years; and between RM12 billion and RM15 billion will be invested by cloud service provider (CSP) companies over the next five years.

- Benefit from the fast expansion of 5G & telecommunications through infrastructure, and in return also benefit from maintenance of the towers indefinitely. This means OCK benefits from the revenue of constructing infrastructure, and also the recurring income later on, which is a win-win situation.

- Benefits from the JENDELA initiatives of 1726 sites, with more unannounced with the new MyDigital Project

- Has 5G "Smart Pole" , designed to support large scale rollout of network.

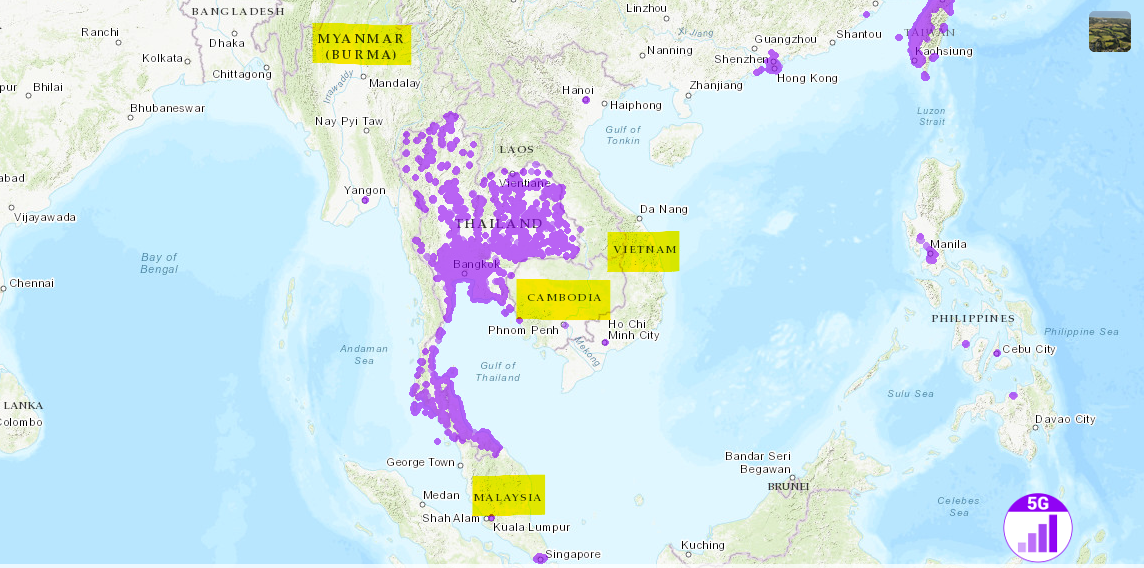

- Footprint in Malaysia, Myanmar , Vietnam , China , Cambodia

Ref: https://www.theedgemarkets.com/article/mydigital-game-changer-if-well-executed

OCK currently owns 4200 telecommunication towers

- Malaysia 500 sites

- Myanmar 1,000 sites

- Vietnam 2,700 sites

These generate up to estimated 300million in revenue per annum.

Previously, the JENDELA Project proposed over 1726 telco tower sites, and OCK plans to acquire 1100 towers in Vietnam in 2020. In hindsight this would mean nearly 50% increment of the sites they now currently own.

We can use 5G exposure chart in the aforementioned companies to get a rough idea of the demand for 5G.

As you can see, there is almost no exposure on 5G on these countries, which means very high upside if OCK were to be involved in the expansion.

Ref: https://www.nperf.com/en/map/5g

Related Countries

As mentioned before in my JAKS article: https://klse.i3investor.com/blogs/Jaks_A_Bright_Future_Ahead/2020-12-01-story-h1537354845-JAKS_A_Great_Long_Term_Choice.jsp

I am very optimistic about Vietnam due to their high GDP growth, future , and politically neutral advantage which OCK is potentially able to benefit from. They also have 2700 sites , which is more than half of its total overseas exposure.

As for Myanmar , they are currently having disputes of the coup , but this is just a minor event and will eventually subside and be resolved.

Charts:

Weekly OCK

Breakout from symmetrical triangle with significant volume. Based on Fibonacci retracement, the next points of interest will be

0.625 , 0.740 , 0.810 , 0.925 , 1.040

https://www.tradingview.com/x/TgzDwnEP/

OCK compared to Local Peers

https://www.tradingview.com/x/PRT8Y8sQ/

Weekly OCK, Bursa Index & Global Index:

Bursa Index has previously formed a flag, breaking out of a symmetrical triangle with a strong closing

VOX is much faster, breakout since 24 Aug and is uptrend ever since.

HSCI.T has indications for downtrend reversal, now resting on the downtrend resistance line, the only index which hasn’t broken out of resistance.

https://www.tradingview.com/x/HTIRy5IF/

Telecommunication stocks as of 19-02-2021 trade on an average PE of 35-50 , while OCK only has current PE of 20 as of 0.515

Basic FPE estimations based on :

Current QR

FPE 25 : RM0.620 (+20%)

FPE 30 RM0.740 (+44%)

Estimated QR of 15% improvement (7.5m) :

FPE 25 : RM0.710 (38%)

FPE 30 : RM0.850 (65%)

Average High PAT QR (10m) :

FPE 25 : RM0.95 (84%)

FPE 30 : RM1.14 (121%)

Conclusion

Pros:

- New capex cycle for 5G

- Implementation of the RM21.6bn National Fiberisation & Connectivity Plan (NFCP)

- Main telecommunications infrastructure player

- Robust and highly sustainable recurring income

- Green Energy through Solar

- Future theme (5G)

- Good management

- Undervalued

- Below NTA (0.560)

- Low PE compared to peers (PE 20 as of 0.515)

- Potential technical downtrend reversal

Cons:

- Steel/commodity prices increase will affect quarter results in the short term, as steel contributes up to 40% of OCK’s costs.

- Reliant on government contracts

- Political Instability

- Forex fluctuation due to overseas market

- Management may not be able to keep up with future advancement

- Covid-19 Pandemic

High potential upside , with peak of 2014 highest being RM1.3

With OCK's as a key player, added with the new contracts and funding, I believe it has a long and fruitful journey ahead.

Disclaimer : This is based upon personal opinion, research and publicly available data. Buy/sell at your own discretion.

https://klse.i3investor.com/blogs/ock_the_5G_battle/2021-02-22-story-h1541199613-OCK_Strategic_Positioning.jsp