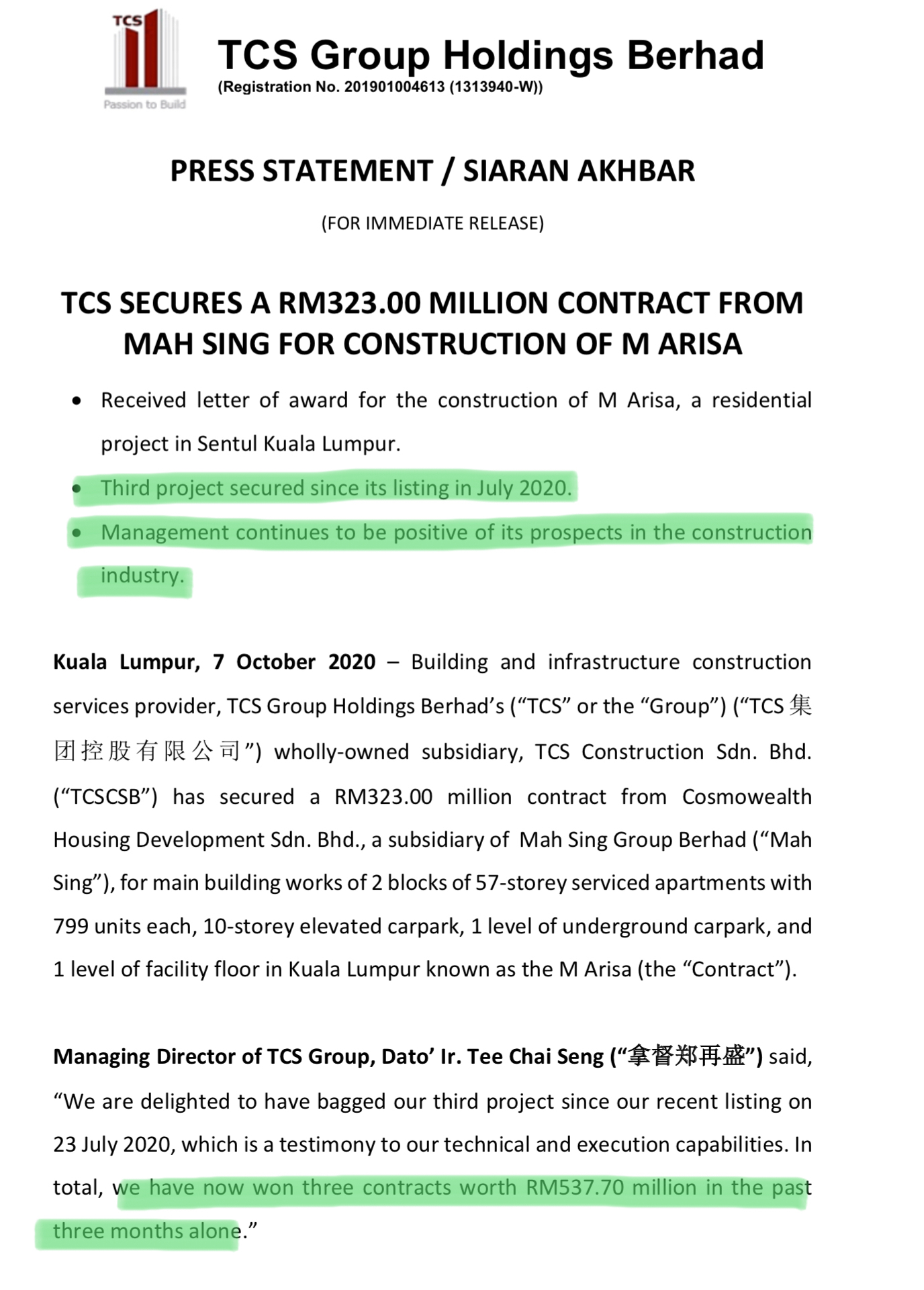

In less than 3 months since listing in July 2020, TCS Group Holdings Bhd (0221) successfully secured 3 new projects worth RM538m, DOUBLING UP its order book to RM898m.

TCS (0221) is primarily involved in the provision of construction services for buildings, infrastructure, civil and structural works in Malaysia with track record of completing its construction projects ahead of schedule.

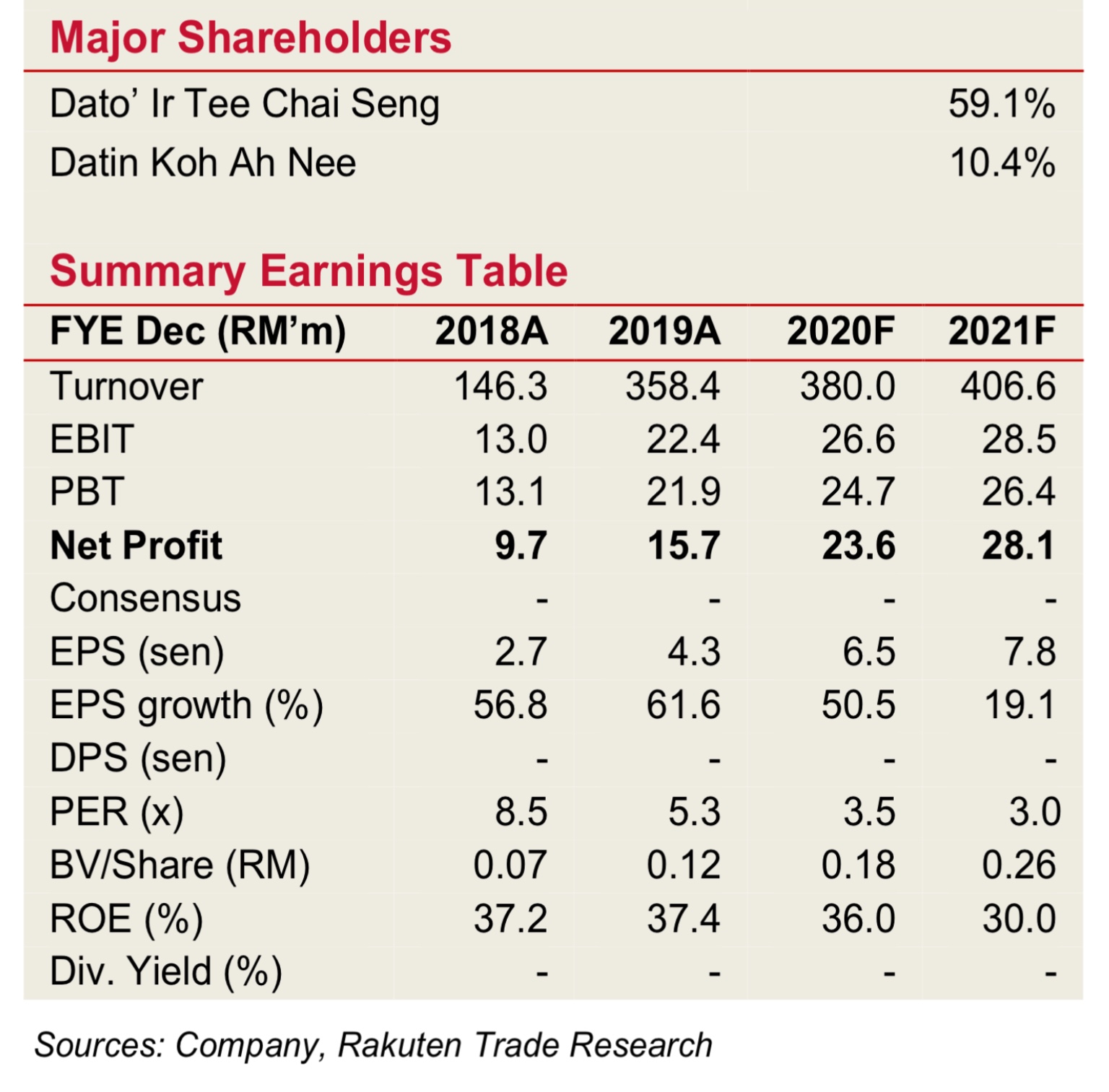

Managing Director (MD) and major shareholder, Dato’ Ir Tee Chai Seng has been operating in the Malaysian construction industry for >35 years.

He acquired TCS in 1998 and started as a subcontractor carrying out civil and structural works in townships. TCS expanded into building construction undertaking works for major property developers such as IJM Corporation, SP Setia, Tropicana and UM Land.

Post listing, balance sheet continues to be net cash position rising from RM18.5m to RM39.5m. This is a plus point because construction companies typically are in net debt position.

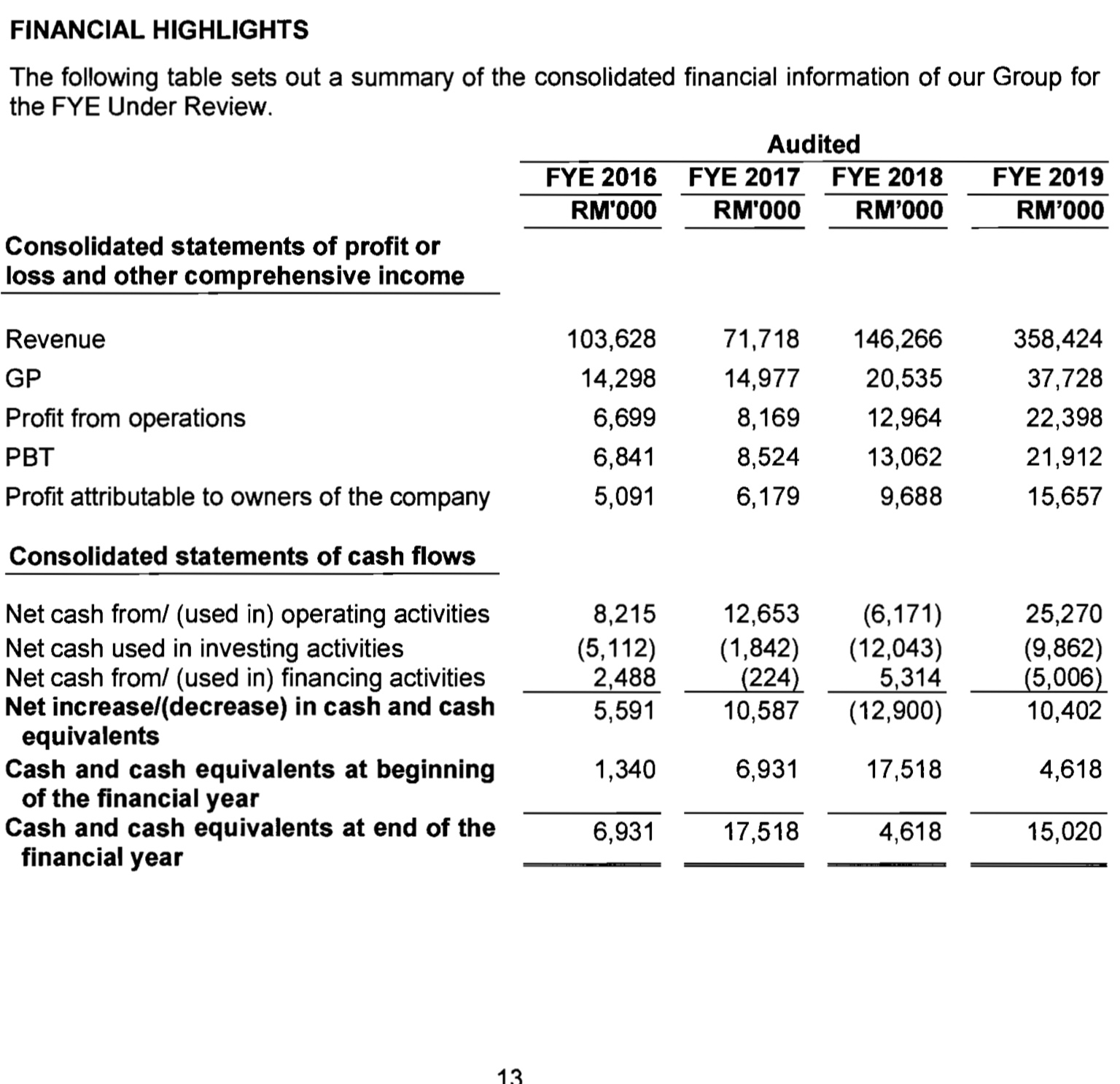

TCS has achieved CAGR of 51% in revenue between 2017 and 2019 on the back of rising orderbook.

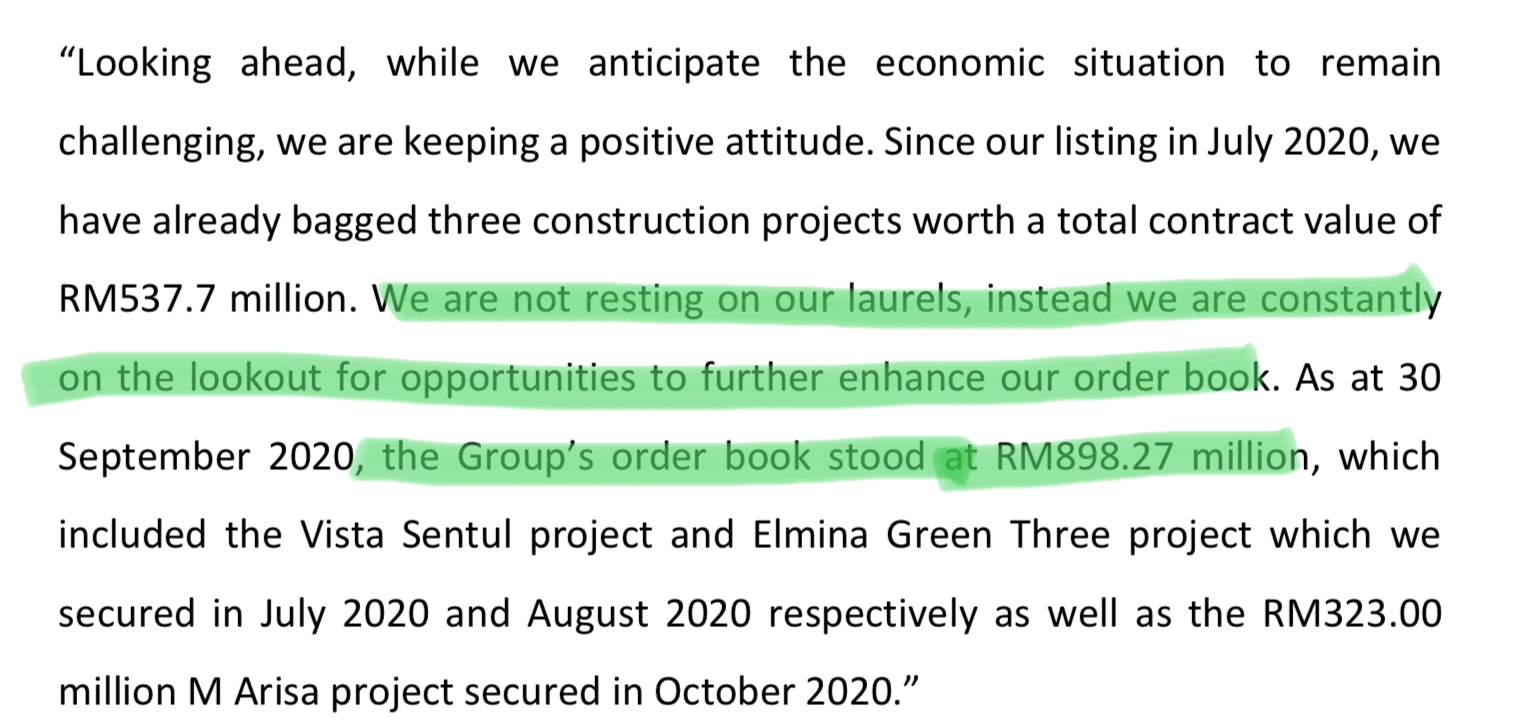

As at 30 September 2020, unbilled order book stands at RM898m with earnings visibility for 3 years. Despite RECORD HIGH order book, TCS are not resting, instead constantly look out for opportunities to enhance its orderbook.

CATALYSTS

- Growing orderbook since July 2020 after listing having secured RM537.7 million new projects with a total outstanding orderbook of RM898.27m with earnings visibility for 3 years.

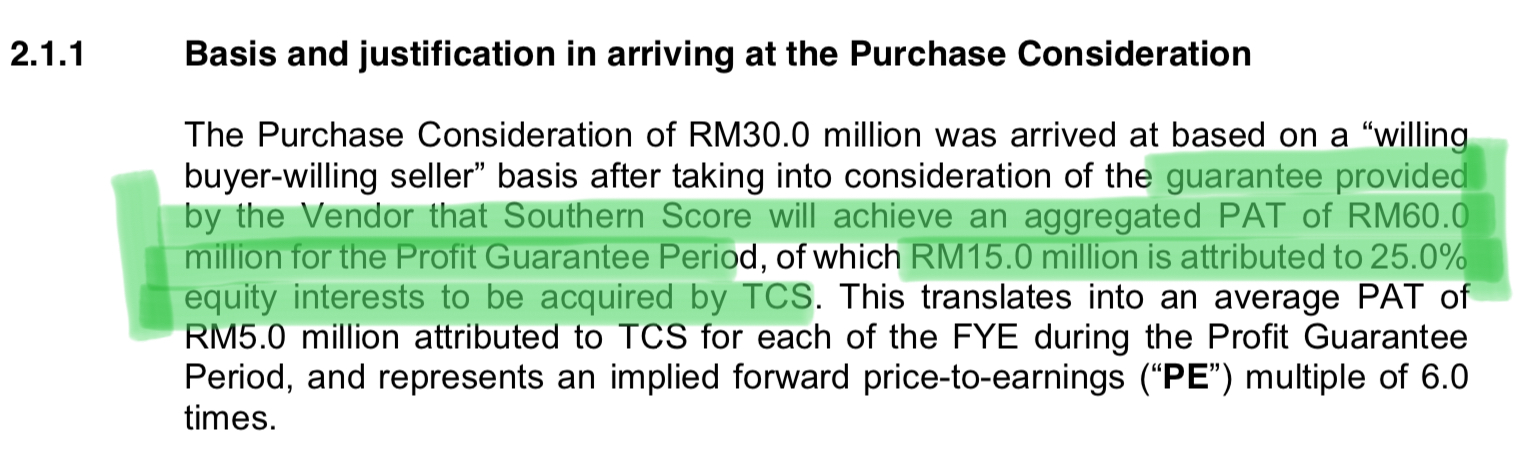

- Proposed strategic acquisition of 25% stake in Southern Score Sdn Bhd (existing client in property development) for RM30 million via issuance of 60 million new shares at RM0.50. It comes with an aggregate profit of RM60 million over 3 years (RM5 million for TCS based on 25% stake).

- Corporate exercise sweetener of one free warrant for every two shares

- Tender book of over RM2 billion, with order book expected grow to over RM1 billion

VALUATION

RAKUTEN Research forecasts FY21 net profit of RM28.1m. This is before adding in RM5m profit guarantee by Southern Score (3 years profit guarantee total RM15m).

Total net profit is RM33.1m.

If you assume a reasonable 10 times PE multiple, TCS is potentially worth RM0.92 (70% upside to current price).

Cheaper than a pack of nasi lemak.

Disclaimer: All information here reflects the author’s personal views/thoughts and should not be considered as investment advice.

Appendix

TCS Group Holdings Bhd - Construction Partner for Growth

TCS Group Holdings Bhd (“TCS”), is an established building and infrastructure construction services provider supported by strong orderbook of RM463.8m, providing earnings visibility over the next 3 years. TCS is set to debut on the ACE Market today, we recommend BUY with a target price of RM0.70 based on 9x PER FY21 as per closest industry players.

Incorporated in 1998, TCS is primarily involved in the provision of construction services for buildings, infrastructure, civil and structural works in Malaysia with track record of completing its construction projects ahead of schedule. Over the years, revenue growth was mainly centred on residential projects, as the segment contributed 77.9% to sales as compared to 22.1% from the commercial projects in FY2019. Project scope covers terrace houses, bungalows, apartments, condominiums, shop offices, shopping complex, high-rise and purpose-build buildings and other infrastructure works. TCS has achieved CAGR of 51% in revenue between 2017 and 2019 on the back of rising orderbook.

The group has established relationships with key clients notably IJM Land Group, Worldwide Holdings and Tropicana Group. As at 30 Apr 2020, unbilled order book stands at RM463.8m with visibility until FY23. Major on-going projects are located at Putrajaya (48.2%) and Kuala Lumpur (34.2%), including projects such as Putrajaya Sentral, Tropicana Urban Homes and Setia City Residences.

Bulk of the IPO proceeds (62.8% or RM13m) is earmarked for the purchase of new construction machinery and equipment, in line with the plans to expand its infrastructure construction segment as the segment contribution remains marginal for now. We believe this expansion will put the group in a better position, as we expect works resumption within the construction sector especially for infrastructure projects. RM4.2m of the funds will be used for working capital and RM3.5m is allocated for listing expenses.

The group has tender book worth of RM2.13bn, with historical success rate of 20%-30%. Post listing, balance sheet continues to be net cash position rising from RM18.5m to RM39.5m. There is no fixed dividend policy at this juncture. Moving forward, we expect the resumption of construction activities by the government especially in the infrastructure sector and TCS is in a strong position to ride on the expected recovery in the construction sector.

Source: Rakuten Research

TCS — Growing orderbook in construction

Target price: RM0.70

—

Growing orderbook since July 2020 after listing having secured RM537.7

million new projects with a total outstanding orderbook of RM898.27m

with earnings visibility for 3 years.

—

Proposed strategic acquisition of 25% stake in Southern Score Sdn Bhd

(existing client in property development) for RM30 million via issuance

of 60 million new shares at RM0.50. It comes with an aggregate profit of

RM60 million over 3 years (RM5 million for TCS based on 25% stake).

— Corporate exercise sweetener of one free warrant for every two shares

— Tenderbook of over RM2 billion, with order book expected grow to over RM1 billion

— Target price of RM0.70 based on 9 times price of earnings ratio FY21

Source: Rakuten Research

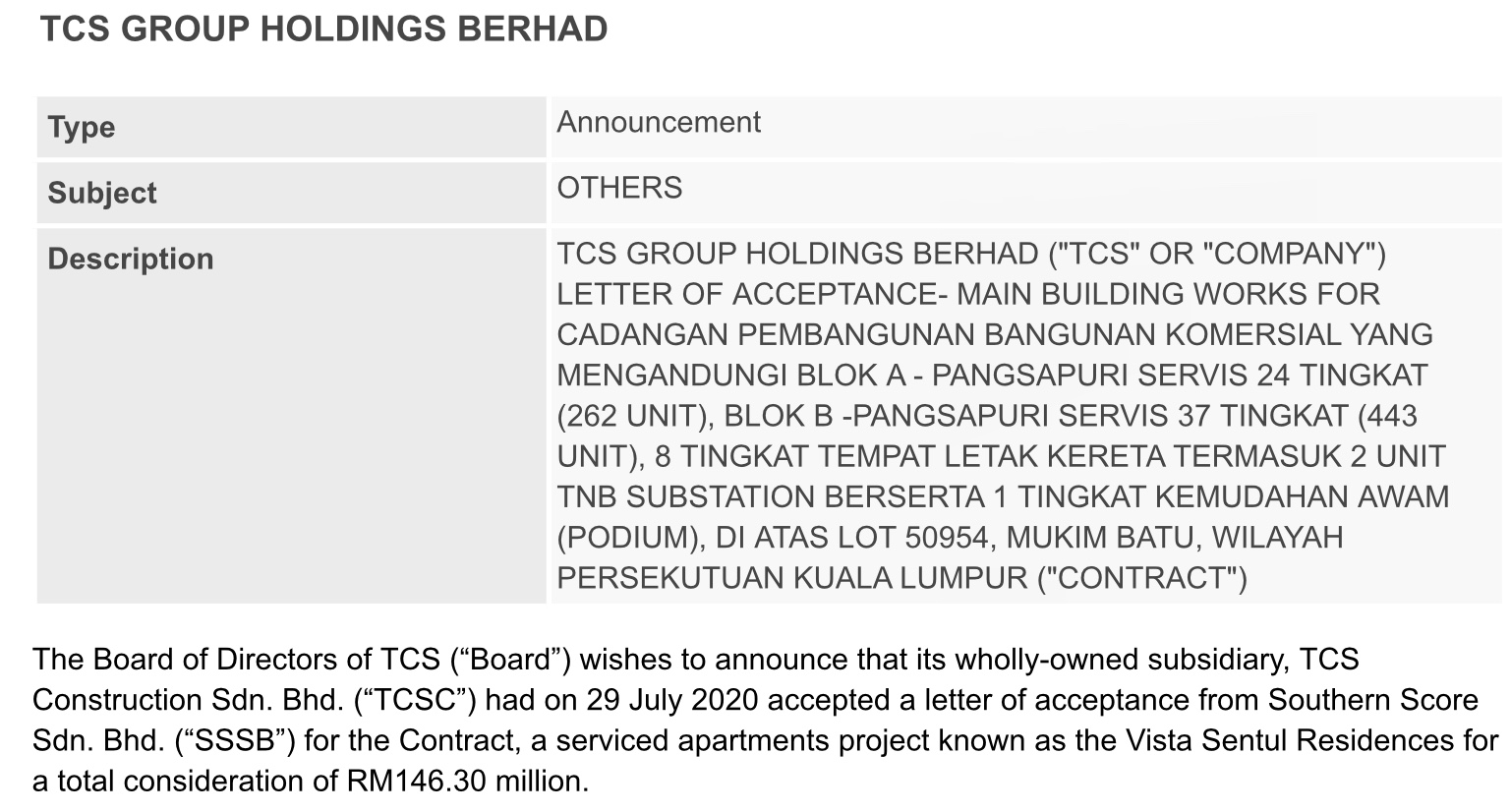

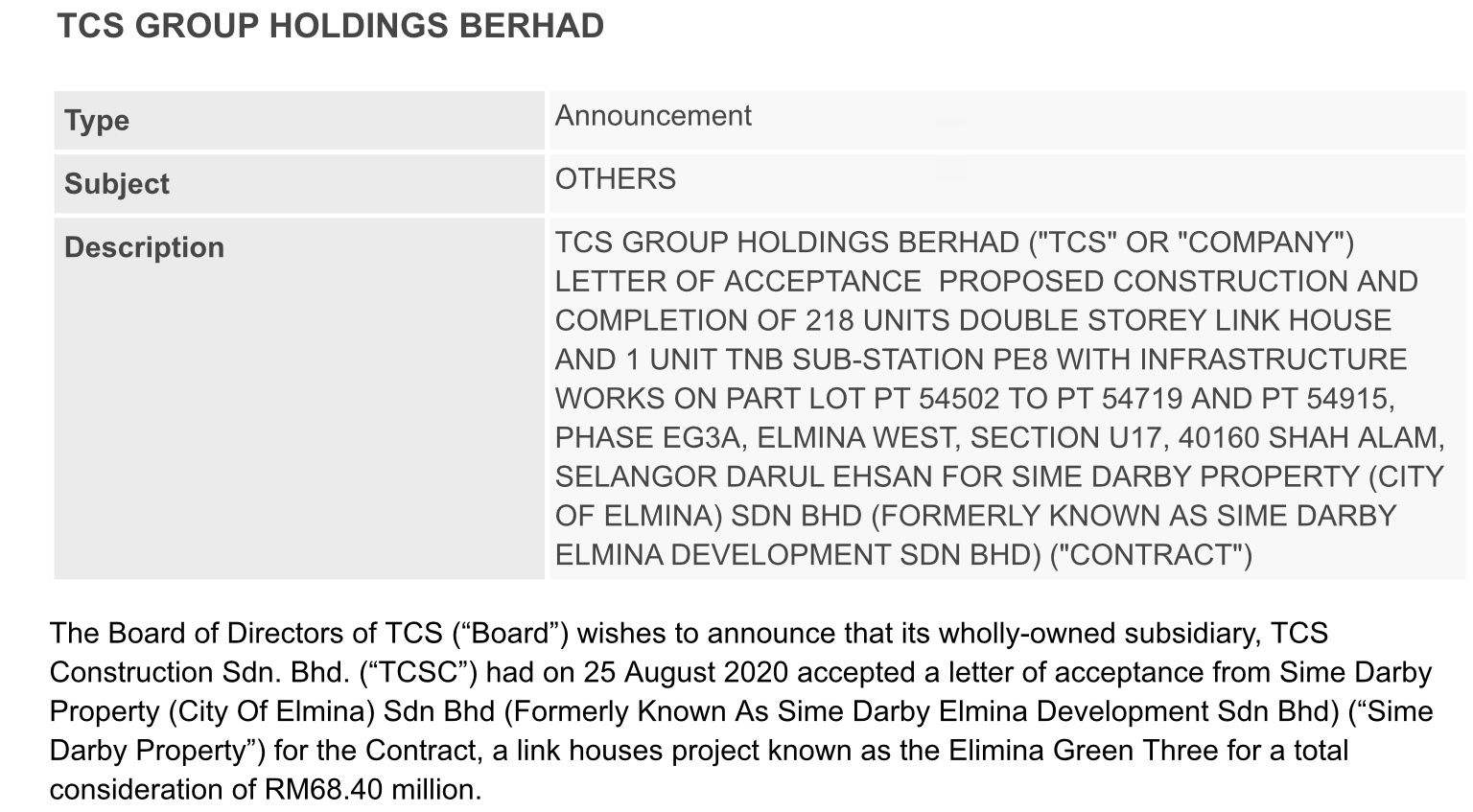

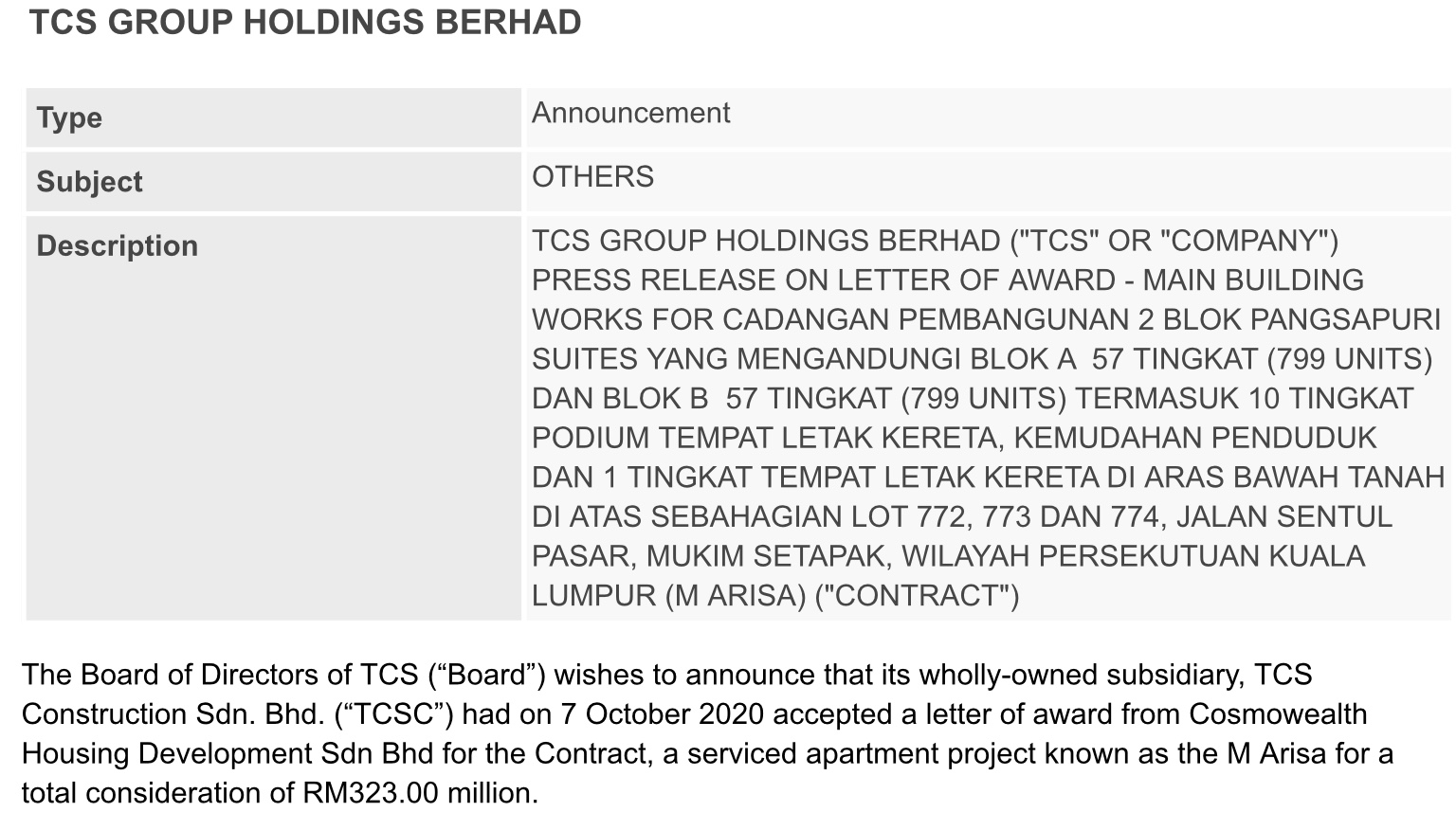

Projects secured last 3 months

1.

2.

3.

https://klse.i3investor.com/blogs/Chongkh888/2020-12-12-story-h1537561398-FIRST_STOCK_WITH_100_UPSIDE_POTENTIAL_BY_CHONGKH888.jsp