Summary

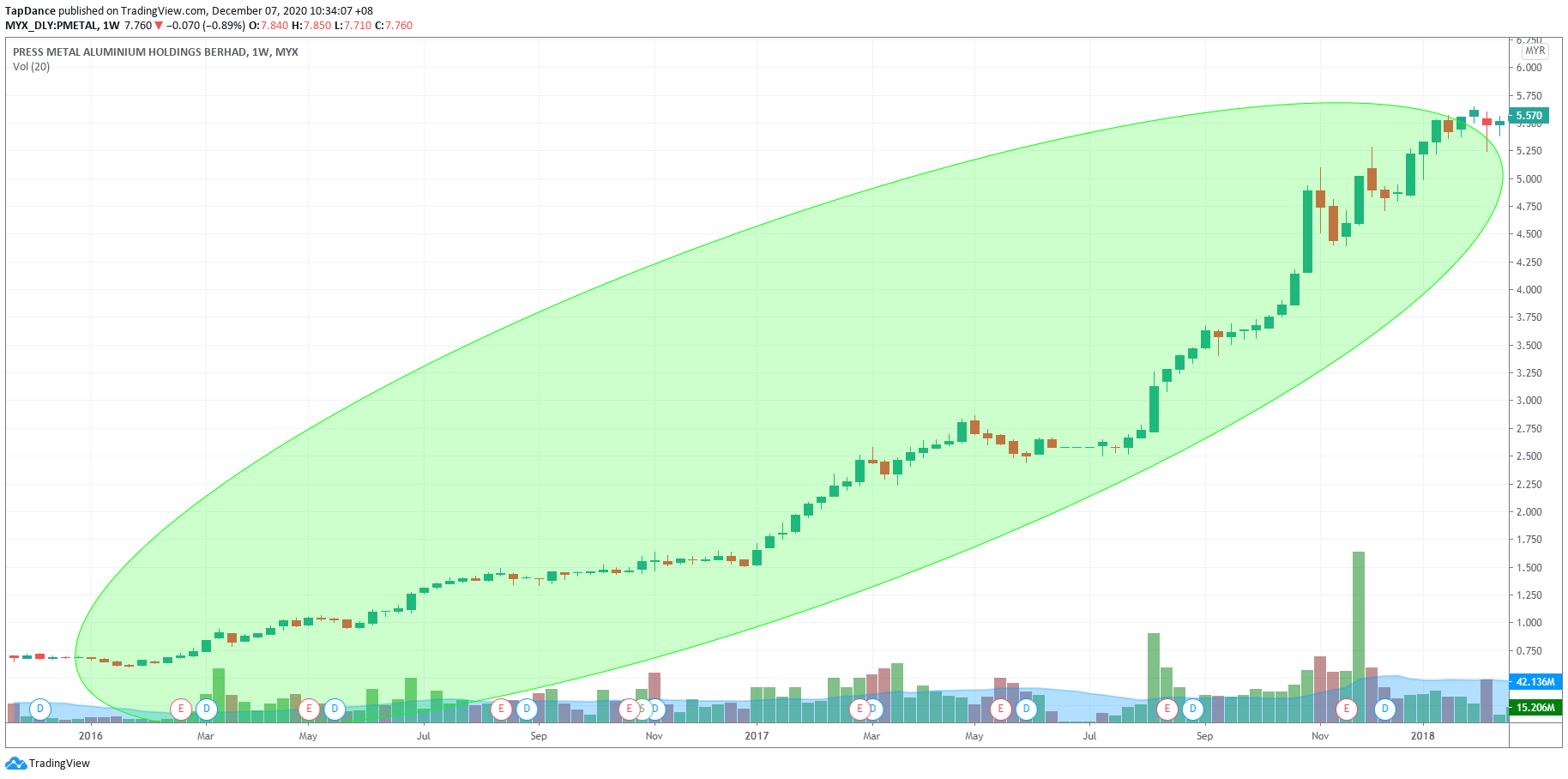

Today’s PMBT bears a striking resemblance to the 2016’s Press Metal (PM) – which has grown by +1,000% in 2 years’ time.

PMBT is banking on Silicon as an essential material for our future economy.

- Silicon is the basic material for solar industry.

- Tesla intends to replace cobalt with silicon for its batteries.

- China alters global silicon supply demand balance as it pivots on environmental friendly policies.

These factors drove silicon price to a fresh 3-year high.

Majority own and manage by the Koon family, PMBT and PM are of the same playbook. More importantly when PM started off with less resources and market recognition in the past, today’s PMBT – leverage on experience acquired and the market respect from PM – earning will ramp up swifter.

Eventually share price trajectory will follow suit.

Description

Press Metal (PM) – one of the most efficient and lowest cost aluminium producer globally is a majority shareholder of PMB Technology (PMBT). Both companies are mange by the Koon brothers. In late 2019, PMBT disposed its aluminium business (to PM) to stay focus as a silicon provider.

Silicon metal is an important element added to various grades of aluminum alloys used in performance applications such as automotive components and aerospace products.

Silicon metal also is a critical raw material in the production of silicone compounds used in numerous products including sealants, adhesives, rubber gaskets, caulking compounds, lubricants, food additives, coatings, polishes, and cosmetics, among others.

In addition, silicon metal is the base material in the production of polysilicon, a purified form of silicon used in solar cells and semi-conductors.

In summary, Silicon demand will be driven by solar and electronics in many years to come, whilst supported by its widely adopted application in various industries currently.

Growth factors

- Management and efficient Hydro power supply

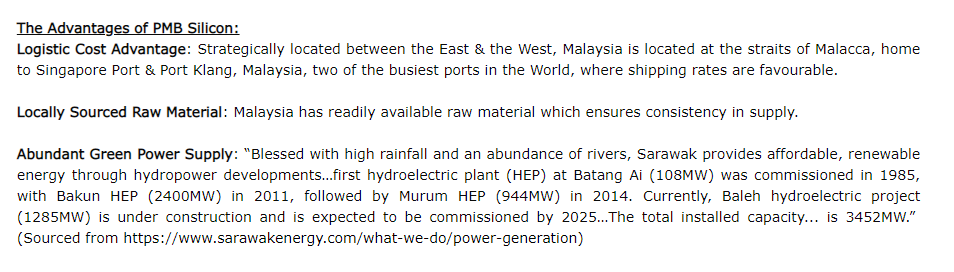

The competitive advantage of the PM series of companies lies in its lean production cost. On top of the very capable management strength, the ultra-competitive position is because of its power procurement contract with Sarawak Energy i.e. Bakun Hydropower.

Aluminium and Silicon production requires substantial amount of power. Energy cost as a single cost component weights more than 40% of the total production cost. The availability of an efficient energy sources alone determines the survival rate of the business.

By securing the ultra-competitive Bakun hydropower supply contract – which is one of the lowest in the world, PM has and PMBT will emerge as one of the lowest cost producer in the world.

Meanwhile PMBT is already position at the middle to lower quartile of the global cost curve despite starting out as a green field player only in 2019. Further improvement is on sight.

Below snapshot from the PMBT’s website confirms and mentions about its advantages:

- China supply outlook – Silicon and Aluminium price on a tear

Both silicon and aluminium price soars to their 3-year high. While global solar energy demand drove the recovery from March lows, it was actually news about China changing their environmental policies that fuels the price trend.

China produces more than 50% / 60% of the world’s aluminium / silicon. As mentioned earlier, it takes a great environmental toll to produce these materials. Now that China pivots its environmental concern policies, coal-fired power plants will be discontinued hence potentially shrinking production rates and altering supply-demand balance outlook.

Reference: https://cn.nikkei.com/politicsaeconomy/commodity/42830-2020-12-02-04-59-01.html

- Silicon as an essential material for solar and EV economy

Solar – The basic component of a solar cell is pure silicon, which also has been used as an electrical component for decades.

Polysilicon (a purer form of silicon) is in acute shortage because of vigorous solar module demand. Over 90% of the current solar cell market is based on silicon currently.

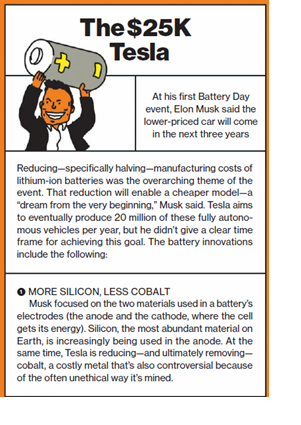

Electronic Vehicles (EV) – Elon Musk announced that Tesla will use more Silicon to replace Cobalt in producing its batteries for its future generation models.

The strategy poise to make Tesla EV a lot more affordable and is seen to be adopted by other EV battery vendors.

- Aggressive capacity expansion

PMBT is undergoing an aggressive expansion plan to meet the world’s silicon demand is impeccable.

Located in Samalaju Industrial Park in Bintulu, Sarawak, it is to double current (i.e. phase 1) production capacity of 36,000 mtpa to 72,000 mtpa (i.e. phase 2) of metallic silicon by 2020.

First phase of the silicon facility started construction back in Dec 2017, having attained full capacity (i.e. 36,000 mtpa) by 2Q19.

The second phase finished constructed in the end of 2019, and commence operation in 3Q20. Schedule was slightly delayed by the MCO.

First phase capacity is currently fully utilized. Ramp-up schedule of second phase is to produce 45,000 tons in 2020 whilst gradually increase to its full potential of 72,000 mtpa target in 2021.

Noteworthy, the co.’s corporate presentation indicates that the plant size is of 64 hectares and – is suitable for 4 phases of development.

- Trade War

Trade war distorts the global supply chain. PMBT stands to capture higher market share as a neutral Malaysian producer.

Meanwhile the company’s markets are mainly in Europe and America where there are trade barriers against the Chinese suppliers.

Valuation

Recent QR registered huge improvement in its core earnings (+150% Y/Y). Those figures will be better indicated by recent silicon price rally.

The second phase expansion effect has yet to surface hence the 30x trailing PE is not reflective of its true potential.

Market expectation is not high from a replacement cost perspective. PMBT is currently valued at 1.5x PB or 1x EV/Assets, versus PM’s 8x and 3x respectively.

PMBT must worth much more than its replacement cost as one of the world’s most cost efficient silicon provider. Based on PM’s track record, market may be incline to see PMBT overtake PM’s valuation for its smaller size and swifter growth.

Why the opportunity?

Full earning potential has yet to surface. PMBT is only at the beginning stage of an inflection point.

Illiquid. PMBT shares are closely held (read – ‘cornered’).

Low profile, absence of sell-side coverage.

Institutional investors are forbidden because of liquidity and cap size constraints

Today’s PMBT bears a striking resemblance to 2016’s PM (i.e. +1,000% in 2 years)

Playbook is basically the same – secures cost advantage on a global scale, aggressive expansion, ramp-up production, improvise cost efficiency, and repeat.

More importantly when PM started off with less resources and market recognition in the past, today’s PMBT – leveraging on experience acquired and the market respect from PM – earning will only ramp-up swifter.

Eventually share price trajectory will follow suit.

Catalyst

Solar and EV drives silicon demand

Production capacity expands by 2x in 2021

Tesla battery revolution drives more silicon for anode material

Trade war for higher market share

PM’s aura

If, better sell-side coverage

If, all 4 phases of expansion

P/S: for follow-up discussion on the idea pls visit the link

https://klse.i3investor.com/blogs/tapdance/2020-12-07-story-h1537446815-Low_Risk_High_Return_10_PMB_Technology_PMBT.jsp