Koon Yew Yin 15 Dec 2020

Why should JP Morgan have downgraded Top Glove and Hartalega when there is a continuous increasing demand for medical gloves due to Covid 19 pandemic.

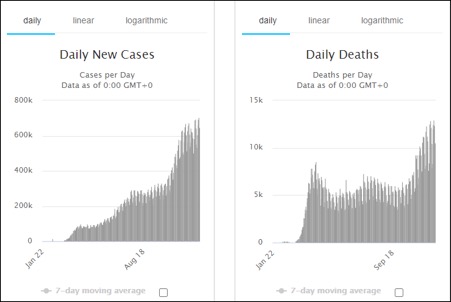

Currently there are 73.14 million Covid 19 cases and 1.65 million deaths in the world.

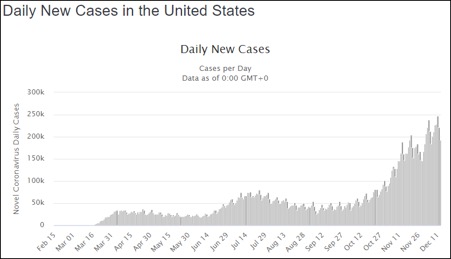

Currently there are 16.88 million Covid 19 cases and 307,635 deaths in the USA. All these numbers are still spiking high and higher.

Many scientists predicted that it will take at least 1 or more years to completely stop the spread on the coronavirus despite the start of vaccination in UK and US. To be effective at least 70 % of the people in the world must be vaccinated. It will take a long time to produce so much of vaccines. Moreover, more medical staff will be employed and all of them will have to wear gloves for safety to inject vaccines. As a result, there will be an additional demand for gloves.

Vaccine will increase the demand for gloves.

On 12 December JP Morgan downgraded Top Glove share price to Rm 3.50, nearly 50% of its current market price of Rm 6.90. Top Glove just reported EPS 29.64 for its quarter ending November. Its previous quarter EPS was 5.32 sen, an increase of 5.7 time. Comparing to its corresponding quarter last year, it has gained 20 times.

It gave a fair value of RM8.50 for Hartalega, down 38% from its last traded price of RM13.72.

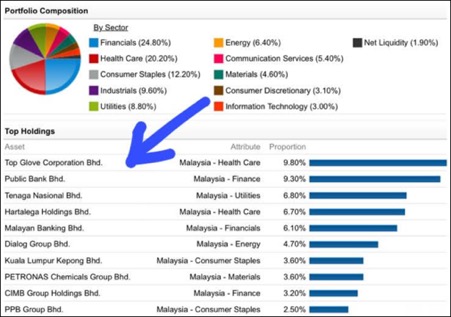

The table below shows that Top Glove is JP Morgan’s largest holding. Its 4th largest holding is Hartalega. Why should it downgrade Top Glove and Hartalega?

Obviously, JP Morgan wants to depress their share prices so that it can buy them at cheaper prices.

Due to Covid 19 pandemic the demand for medical gloves far exceeds supply and all the glove makers can easily increase their selling prices to make more and more profit. That is why Top Glove can report such an unprecedented profit. Until the pandemic is completely under control, the demand for medical gloves will continue to exceed supply and all the glove makers will continue to increase their selling prices to make more and more profit.

JP Morgan is not an ordinary investor. It started banking and investing businesses in 1871 in New York.

Securities Commission should examine the validity of JP Morgan’s reasons for downgrading Top Glove and Hartalega.

SC should also find out whether JP Morgan or its collaborators sold Top Glove and Hartalega at much higher prices before it downgraded them.

Since JP Morgan said that these 2 glove stocks are no good, whether JP Morgan or its collaborators will sell all their current holdings in Top Glove and Hartalega.

SC should also watch closely whether JP Morgan or its collaborators will buy Top Glove and Hartalega when the share prices are cheaper.

http://koonyewyin.com/2020/12/15/security-commission-should-investigate-jp-morgan/