MASTER (7029) MASTER-PACK GROUP BHD - THE MASTER BEHIND SOLAR PACKAGING? HOW DOES IT COMPARE TO PPHB?

MASTER

(7029)

THE ‘MASTER’ BEHIND SOLAR PANEL'S CORRUGATED PACKAGING?

HOW DOES IT COMPARE TO PPHB?

#jntstudynotes

DISCLAIMER

We share study notes for sharing purpose only. Facts are compiled from publicly available resources. Study notes may involve our views and guesses, which could be inaccurate. Our valuation involves assumptions which could be inaccurate. Share prices are ultimately determined by Mr Market. There is no BUY/SELL recommendation. Share investment involves uncertainties and risks. Investors own all their investment decisions and decision outcomes.

US SOLAR CAPACITY MAY MORE THAN DOUBLE IN 5 YEARS

Mr Biden put clean energy at the heart of plans to reboot the US economy. He pledged to spend USD 2 trillion over four years on everything from solar panel installations to doubling the country’s offshore wind capacity. US solar and wind capacity could more than double in five years, if Mr Biden stuck to his campaign pledges.

Source: International Energy Agency, Nov 11, 2020

US’ FIRST SOLAR 3RD QUARTER SALES ROSE BY 70%

First Solar is a solar-panel manufacturer in US. Its sales rose 70% year-on-year in the 3rd quarter of 2020. For 2020, First Solar expects to deliver net sales in the range of $2.6 billion to $2.9 billion owing to a "strong fleet-wide production" with productive capacity averaging over 100% at all of its factories. Moreover, First Solar expects its 2nd factory in Malaysia to start up in Q1 2021.

First Solar is a solar-panel manufacturer in US. Its sales rose 70% year-on-year in the 3rd quarter of 2020. For 2020, First Solar expects to deliver net sales in the range of $2.6 billion to $2.9 billion owing to a "strong fleet-wide production" with productive capacity averaging over 100% at all of its factories. Moreover, First Solar expects its 2nd factory in Malaysia to start up in Q1 2021.

Source: Business Insider & Q3 2020 Earnings Call Transcript, The Motley Fool, Oct 28, 3030

FIRST SOLAR COULD BE MASTER’S CLIENT

In 2011 (9 years ago), First Solar recognises MASTER as one of their Top Suppliers that deserves achievement awards.

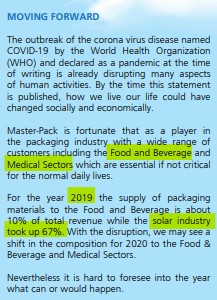

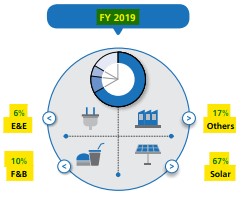

As of FY2019, solar industry makes up 67% of MASTER’S revenue.

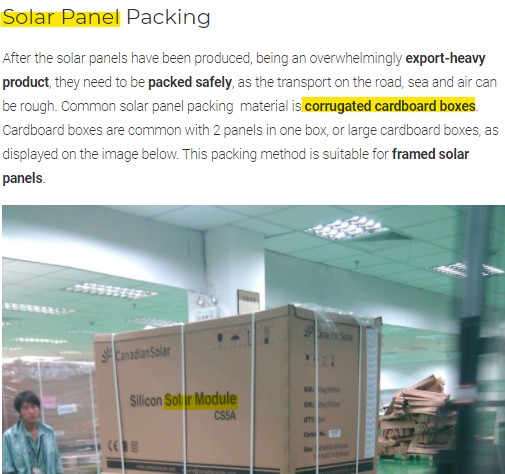

SOLAR PANELS ARE USUALLY PACKAGED IN CORRUGATED BOXES FOR SAFETY & PROTECTION

Source: Sinovoltaics

MASTER, A CORRUGATED PACKAGING MANUFACTURER WITH VALUE-ADDED SERVICES

MASTER manufactures corrugated packaging products. Value-added services include one stop packaging solution, warehousing as well as Vendor Managed Inventory.

EXTENSIVE APPLICATIONS, ALWAYS IN DEMAND

Packaging using paper is by and large very versatile. The process and techniques of corrugating can transform paper into all kinds of shapes and forms that are not only strong but attractive in design. Corrugated materials can also be made into other usable articles such as paper plates and cups and even furniture.

Always in demand:

- Food & Beverage

- Medical Sector

High-growth industry

- Solar

TEMPORARY DROP IN REVENUE (HINTING US IT WILL RECOVER?)

MASTER latest quarterly QR was released on Nov 20, 2020. The drop in revenue was due to decision of a major customer to change to a new product model and discontinue the old product model. This resulted in a temporary drop in revenue and the lower revenue resulted in the lower profit before taxation.

The key word here is temporary drop. The major customer is changing to a new product model. We are unsure, but this could mean that MASTER would need some time to receive the latest product models’ dimension and packaging requires to kickstart the new packaging manufacture. Management seems to hint that their revenue and earnings will recover. Recently, packaging stocks have rallied (the most popular one is PPHB, with limit up). MASTER was not one of them.

Has Mr Market assumed MASTER’s drop in revenue and earnings are irrecoverable? If yes, Mr Market could have mispriced MASTER’s share price.

ALMOST ALL-TIME LOW RAW MATERIAL COST

In FY19 annual report, MASTER mentioned their raw materials, wood pulp was trending downwards due to lower global demand. As of 2020, it is going down even further.

BUSINESS RISKS

Lower-than-expected order volumes, operational inefficiencies that erode profit margins, as well as forced shut down due to COVID-19.

FUNDAMENTAL INFORMATION AND PEER COMPARISON WITH PPHB

As of Nov 30 (Share price RM1.82), MASTER has market capitalization of RM99 million. At a net cash position of RM30.2 million, 31% of MASTER is cash. MASTER also has a strong current ratio of 3.81x and a decent ROE of 9.3%. However, net profit margin is less ideal – single digit of 6.53%.

|

|

PPHB |

MASTER |

WINNER |

|

NTA |

RM1.39 |

RM2.03 |

- |

|

Profit Margin |

10.4% |

6,5% |

PPHB |

|

Share Price |

RM1.11 (20% below NTA) |

RM1.82 (10% below NTA) |

PPHB |

|

PER |

10.56x |

9.6x |

MASTER |

|

ROE |

7.6% |

9.3% |

MASTER |

|

DY |

0.2 |

2.2% |

MASTER |

|

In terms of profit margin and share price premium over NTA, PPHB is a better stock than MASTER. Based on, PER (Price-to-Earnings Ratio), ROE and DY, MASTER is a better stock than PPHB. All this information reflects the past and current situation. What about the future? |

|||

VALUATION BASED ON FUTURE EARNINGS ESTIMATION

Disclaimer: Valuation is performed based on currently available information. Forecasting and guesstimating the future involves assumptions, which could be inaccurate.

In 19Q3, MASTER made a core earnings of RM6 million due to high order volumes that also results in economies of scale. Supported by potentially high order volumes and near all-time low material costs, MASTER may stand a chance to generate remarkable earnings in upcoming quarters. If MASTER can produce quarterly earnings of RM6 million for 4 quarters, its annual earnings would be RM24 million, equivalent to an EPS of 44 sen.

- At a hyper-conservative PER of 5 times, MASTER is worth RM2.20.

- At a modest PER of 8 times, MASTER could be worth RM3.52.

SHARE PRICE OBSERVATION

In the past 5 trading days, PPHB has surged from RM0.77 to RM1.22, up 58%. On the other hand, MASTER consolidated between RM1.70 and RM1.85.

Moving forward, how will MASTER’s share price move? Let’s let Mr Market decide.

SUMMARY

-

US solar capacity may more than double in 5 years.

-

US First Solar’s sales rose by 70%, driven by strong

fleet-wide production with 100% production capacity across all its

factories, and expect Malaysia’s factory to start up in 2021.

-

First Solar could be MASTER’s clients. In 2011, First Solar

recognised MASTER as one of their Top Suppliers. As of FY2019, solar

industry makes up 67% of MASTER’S revenue. Our studies also show that

solar panels are usually packaged in corrugated cardboard boxes.

-

MASTER is a corrugated packaging manufacturer with value-added services.

-

MASTER latest quarterly result showed a temporary drop in

revenue and the lower revenue resulted in the lower profit before

taxation. The key word here is temporary drop. The major customer is

changing to a new product model. We are unsure, but this could mean that

MASTER would need some time to receive the latest product models’

dimension and packaging requires to kickstart the new packaging

manufacture. Management seems to hint that their revenue and earnings

will recover.

-

Recently, packaging stocks have rallied (the most popular one

is PPHB, with limit up). MASTER was not one of them. Has Mr Market

assumed MASTER’s drop in revenue and earnings are irrecoverable? If yes,

Mr Market could have mispriced MASTER’s share price.

-

MASTER is enjoying an almost all-time low raw material cost.

-

Business risks of MASTER include

lower-than-expected order volumes, operational inefficiencies that erode

profit margins, as well as forced shut down due to COVID-19.

- Peer comparison with PPHB: In terms of profit margin and share price premium over NTA, PPHB is a better stock than MASTER. Based on, PER (Price-to-Earnings Ratio), ROE and DY, MASTER is a better stock than PPHB.

- Supported by potentially high order volumes and near all-time low material costs, MASTER may stand a chance to generate remarkable earnings in upcoming quarters. If MASTER can produce quarterly earnings of RM6 million for 4 quarters, its annual earnings would be RM24 million, equivalent to an EPS of 44 sen.

- At a hyper-conservative PER of 5 times, MASTER is worth RM2.20.

- At a modest PER of 8 times, MASTER could be worth RM3.52.

- In the past 5 trading days, PPHB has surged from RM0.77 to RM1.22, up 58%. On the other hand, MASTER consolidated between RM1.70 and RM1.85.

DISCLAIMER

We share study notes for sharing purpose only. Facts are compiled from publicly available resources. Study notes may involve our views and guesses, which could be inaccurate. Our valuation involves assumptions which could be inaccurate. Share prices are ultimately determined by Mr Market. There is no BUY/SELL recommendation. Share investment involves uncertainties and risks. Investors own all their investment decisions and decision outcomes.

https://klse.i3investor.com/blogs/jomnterry/2020-12-01-story-h1537353599-MASTER_THE_MASTER_BEHIND_SOLAR_PACKAGING_HOW_DOES_IT_COMPARE_TO_PPHB.jsp