THIS STEEL STOCK IS POISED TO SURGE FURTHER !!!

Hello to all readers out there. Recently, a lot of steel stocks surged worldwide due to the rise in steel commodity prices, on the back of economic recovery caused by COVID19 vaccine progress.

Having said the above, the stock which I'd like to talk about today is K SENG SENG CORPORATION BERHAD (KSSC - Stock Code 5192, Main Market, Industrial Products & Services)

BASIC INFORMATION ABOUT KSSC

KSSC was founded in 1985 and listed on BSKL in 2009, with core business in:

i) Manufacturing of Stainless Steel Products

ii) Trading of Stainless Steel Products

Market Capitalization : RM 60 (as at writing)

Shares Float : 96 million

Website : https://www.kssc.com.my/

1. A SUPERB QUARTER RESULT WHEN OTHERS DOING BADLY !!!

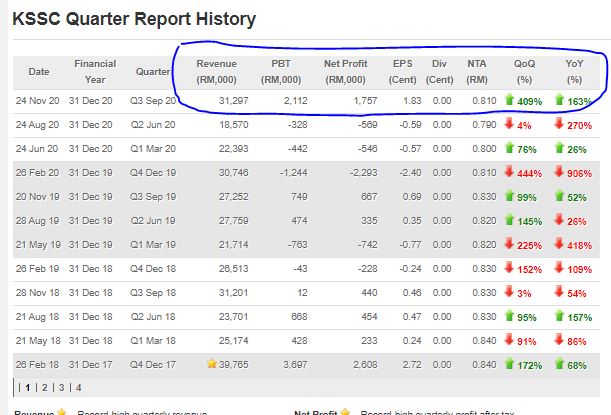

Refer below latest quarter result in Nov 2020. While others are doing bad, KSSC had posted a 3 YEARS HIGH REVENUE & NET PROFIT !!!

Revenue was RM 31.3 mil with net profit of RM 1.7 mil (EPS 1.83c).

With such a good result posted (not even as the steel prices go up), I opine that following quarters should also be performing similar/better.

Taking an estimate of 10-12c EPS per year, the long term target based on 10-12 PE ratio is around RM 1.00 - 1.40.

Also, we note that the NTA also stood strong at 81c per share.

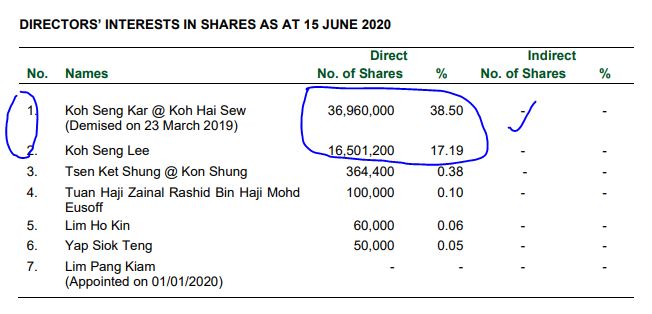

2. SUPER LOW FLOAT IN THE MARKET AS DIRECTORS HOLDING

55.69% OF TOTAL SHARES !!!

The total float shares of KSSC stood at 96 mil units. As of the latest annual shareholding report, top 2 directors hold total of 55.69% of total float.

This leaves a public float of about 42.5 million shares, which is very small for the grabbing.

As there were no sellings by major shareholders sighted in the recent term, I opine that the path upwards for KSSC will be met with very little resistance.

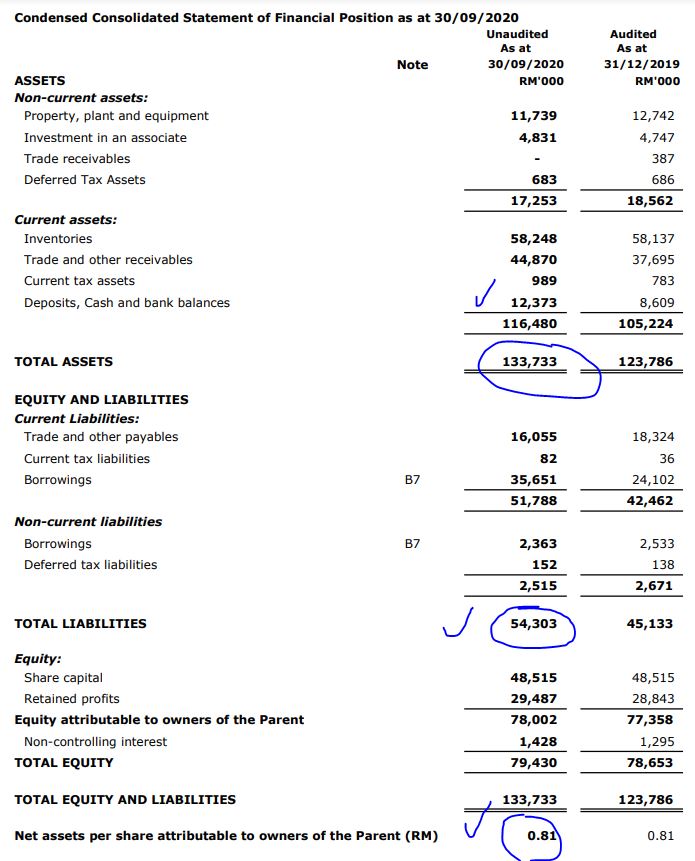

3. HEALTHY NET ASSETS OVER LIABILITIES !!!

Below the Assets Versus Liabilities summary as of latest QR. We note the following:

i) Total Assets stood at RM 133.7 mil (81c per share)

ii) Total Liabilities stood at RM 54.3 mil

iii) Hence the company is a net asset company as Assets exceed Liabilities by RM 79.4 mil

iv) Also to be noted, net cash in bank improved to RM 12.3 mil from last year RM 8.6 mil

4. TECHNICAL ANALYSIS - BUY AND ACCUMULATE AT SUPPORT FOR

STEEL STOCKS RALLY IN 2021

Refer below the basic price and volume chart with key EMAs for KSSC daily chart :

A few observations on the daily chart:

i. The stock is currently resting at a support price of 60-63c

ii. Refer Circle, volumes recently surged into this stock as steel stocks gained significant buying interest over the board

iii. The recent high for this stock was 95c in August 2020

iv. The stock is trading above all key EMAs, indicating a long and short term bullish trend

v. Should buyers be interested in this stock, we might see an upmove back to test the R1 resistance around 80-83c, then R2 resistance at 90-95c, before moving further upwards

CONCLUSION

Considering all the above, I opine that current price for KSSC is attractive due to below:

i) Superb QR earnings as other companies report bad results. Future potential better results as steel prices improve

ii) Very low public float shares in the market

iii) Net assets versus liabilites and strong cash position

iv) Strong volumes surging into this stock as steel counters worldwide garner improved buying interest

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-12-05-story-h1537418178-THIS_STEEL_STOCK_IS_POISED_TO_SURGE_FURTHER.jsp