FOCUSP (0157) FOCUS POINT HOLDINGS BHD - GUESS WHAT I FOUND AT FAMILY MART? SALES SKYROCKETS 300% THIS YEAR. A STOCK THAT MANY OVERLOOKED!

My favourite hangout place is Family Mart.

My favourite desserts at FamilyMart are Original Pudding, Hanjuku Cheese and Mochi Puff. They are so so gooood!

Little did I know these Japanese desserts are actually supplied by Komugi, a 100%-owned subsidiary of Focus Point. Until one day my girlfriend came home and tell me excitedly and show me the desserts she bought at Komugi.

Some Komugi products which also supply to Family Mart, Sushi King and others.

My favourite desserts are always sold out at Family Mart! Then I decided to dig more information about Focus Point.

I found out Focus Point is actually ONE OF THE TOP SUPPLIERS to FamilyMart! Thousand of the Japanese desserts are sold at FamilyMart EVERY DAY! YES, THOUSANDS EVERY SINGLE DAY!!

According to Hong Leong Investment Research, Monthly sales to FamilyMart had skyrocketed 300% to RM1.2m vs. RM300k last year!! And keep on growing and growing until Focus Point has to build one more central kitchen!

With capacities of Focus Point’s current central kitchen facility maxing out, a second central kitchen is in the process of being set up. At full capacity, Focus Point estimates sales from the second central kitchen will amount to RM4m per month. (more info in Appendix)

Then more I dig, the more I like Focus Point.

In November 2016, FamilyMart opened its first outlet at Kuala Lumpur, and it just blew up. And now, fast forward to the end of 2019, there are now 162 FamilyMart Malaysia outlets. The initial target of opening 300 stores by March 2022 is well within the Group’s ability based on the current track record (Source).

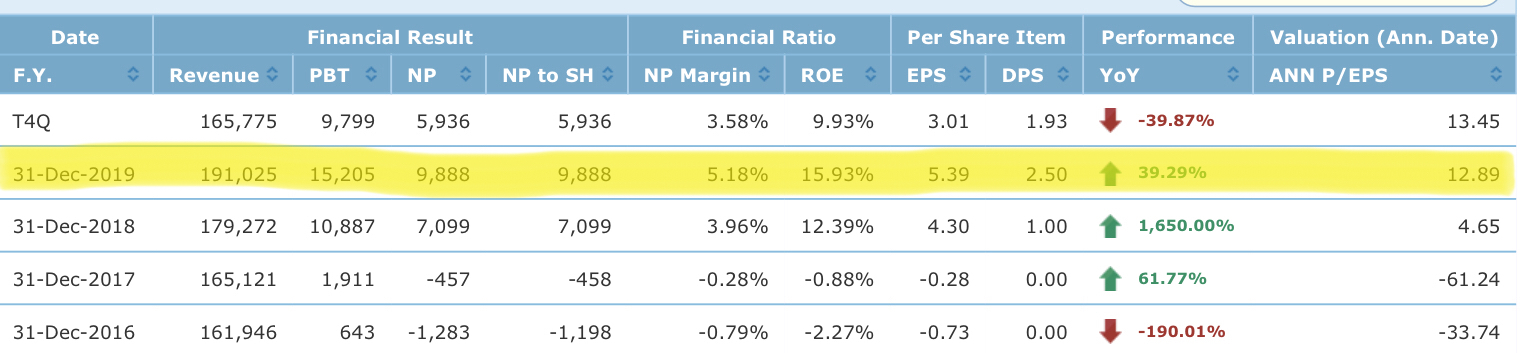

Have been shareholders of QL since they opened the first FamilyMart outlet in Malaysia. But then QL already not cheap trading at 60 times PE multiple. When I looked at Focus Point PE multiple, I got shocked like first time see my girlfriend!

Focus Point trading at 13 times PE multiple only? I rub my eyes many times until they became red.

Focus Point trading at 13 times PE multiple only! FamilyMart trading at 60 times!

If FamilyMart opens more outlets, Focus Point will sell more Japanese desserts to FamilyMart. Not only that, number of SKUs will increase!

With the growing number of retail outlets of their largest corporate client and expected increase in SKUs supplied, Focus Point estimate sales to their largest corporate client will be able to reach RM1.7m/month by 1Q21. We understand their new SKUs will be macarons and Dorayaki (a type of Japanese red bean pancake) (Figure #2-3). With capacities of Focus Point’s current central kitchen facility maxing out, a second central kitchen is in the process of being set up. At full capacity, Focus Point estimates sales from the second central kitchen will amount to RM4m per month. (more info in Appendix)

If you assume a reasonable 30 times PE multiple, Focus Point is potentially worth RM1.60 (125% upside to current price).

Cheaper than the Japanese desserts I always buy.

New SKUs

Company background. FocusP operates optometry retailers, consumer facing bakeries under the name “Komugi‟ and a central kitchen bakery which supplies products to external clients including convenience stores and cafes. In addition to this, it also operates a franchise division which franchises out their optical retailer trading names and F&B franchise. FocusP was listed on the ACE market on Aug 2010. (source: Hong Leong Investment Bank Research)

Focus Point - Stronger F&B Corporate Sales in FY21 Coming |

We recently met with Focus Point and came away feeling positive about the group’s prospects going forward. Increasing F&B corporate sales and securing a second central kitchen should see profitability of the F&B division accelerate. Furthermore, we reckon the possibility of securing new F&B corporate clients is likely given the popularity of their current product offerings. As the meeting yielded no surprises, we keep our forecasts unchanged. We maintain our TP of RM0.88 and BUY call based on an unchanged PE of 16x based on FY21 earnings.

We recently met with Focus Point and came away feeling positive about the group’s prospects going forward.

3Q20 earnings outlook. We expect Focus Point’s optical division to rebound strongly in 3Q20 due to pent up demand after relaxation of MCO rules. Additionally, we foresee better margins due to increased portion of vision glasses sales (which is a significantly higher margin product category) at the expense of sunglasses (lower margins). After reporting losses in 1H20 due to MCO restrictions on Komugi retail outlets, we expect the F&B division to return to profitability (Figure #1). In addition to reopening of Komugi outlets, growth in outlet count of Focus Point’s largest F&B corporate client have resulted in much higher sales volumes. Note that currently, monthly sales to their largest corporate F&B client amounts to RM1.2m (vs. RM300k in SPLY).

F&B expansion. With the growing number of retail outlets of their largest corporate client and expected increase in SKUs supplied, Focus Point estimate sales to their largest corporate client will be able to reach RM1.7m/month by 1Q21. We understand their new SKUs will be macarons and Dorayaki (a type of Japanese red bean pancake) (Figure #2-3). Additionally, Focus Point is on track receive HACCP and ISO certifications, which would enable the group to supply food to new clients. We understand Focus Point is already in talks with a number of interested parties which require these certifications before supply agreements can be made. With capacities of Focus Point’s current central kitchen facility maxing out, a second central kitchen is in the process of being set up. At full capacity, Focus Point estimates sales from the second central kitchen will amount to RM4m per month.

Source: Hong Leong Investment Bank Research

https://klse.i3investor.com/blogs/Chongkh888/2020-11-22-story-h1536400573-GUESS_WHAT_I_FOUND_AT_FAMILY_MART_SALES_SKYROCKETS_300_THIS_YEAR_A_STOC.jsp