Despite

the worsening virus situation, bleak economic outlook, and the working

class worrying a retrenchment, you may be surprised to hear that the

interest in purchasing a new car or a new property in reaching a new

high.

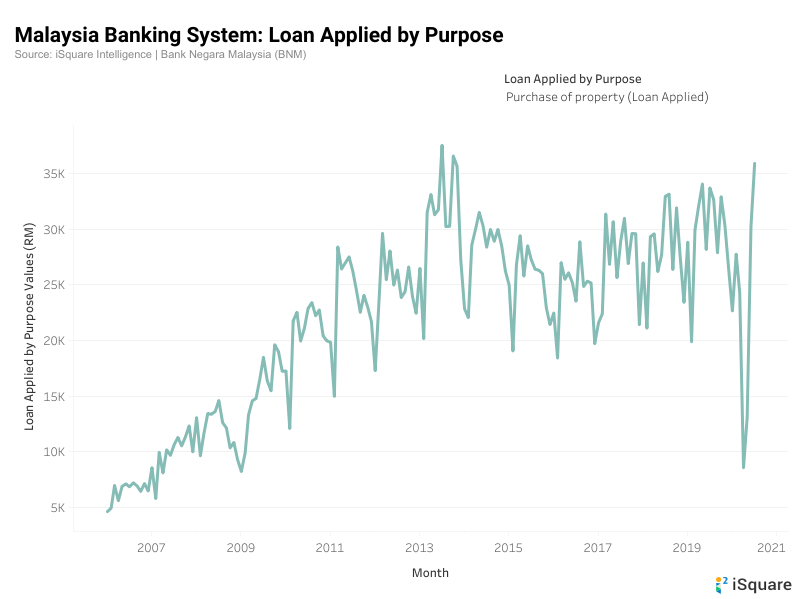

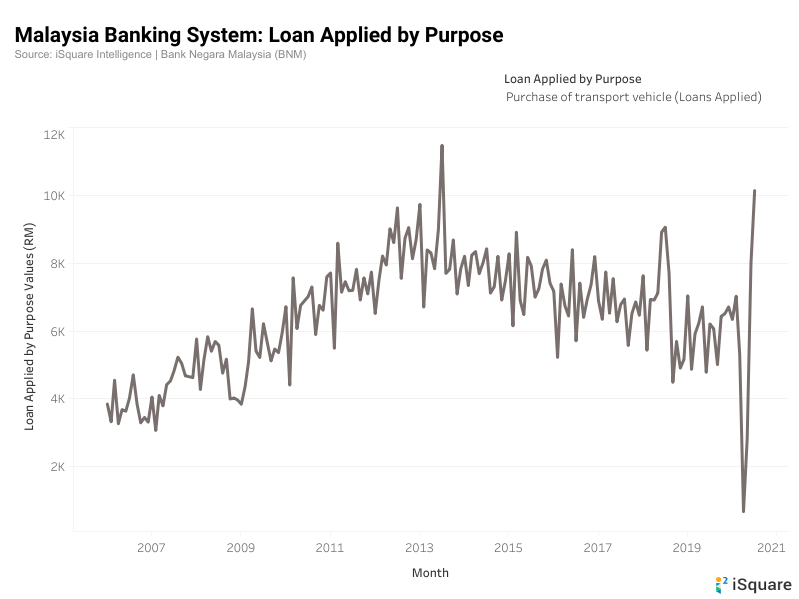

From the chart created by iSquare Intelligence show

that the numbers of loan applied for the purpose of purchasing property

and for the purpose of purchasing a car is reaching a high that we had

not seen since the year 2013. Loan applied is an indicator to determine

public sentiment. A higher number of loan applied means that the public

is more confident in the future and is comfortable to take up a loan to

make such a purchase.

One of the reasons could be the “K-Shape recovery” that

we are facing. Another reason could be the wealth effect that leads to

public spending more due to the recent rhetoric rise in the local stock

market.

End of the day, with interest rate charting new low and Central banks

flushing out tonnes of money, buying a property by taking up a loan is

one of the easiest ways to hedge against inflation and to protect your

wealth from being eroded.

https://klse.i3investor.com/blogs/isquare/2020-10-06-story-h1514480097-Interest_in_property_purchase_are_back_to_2013_level.jsp